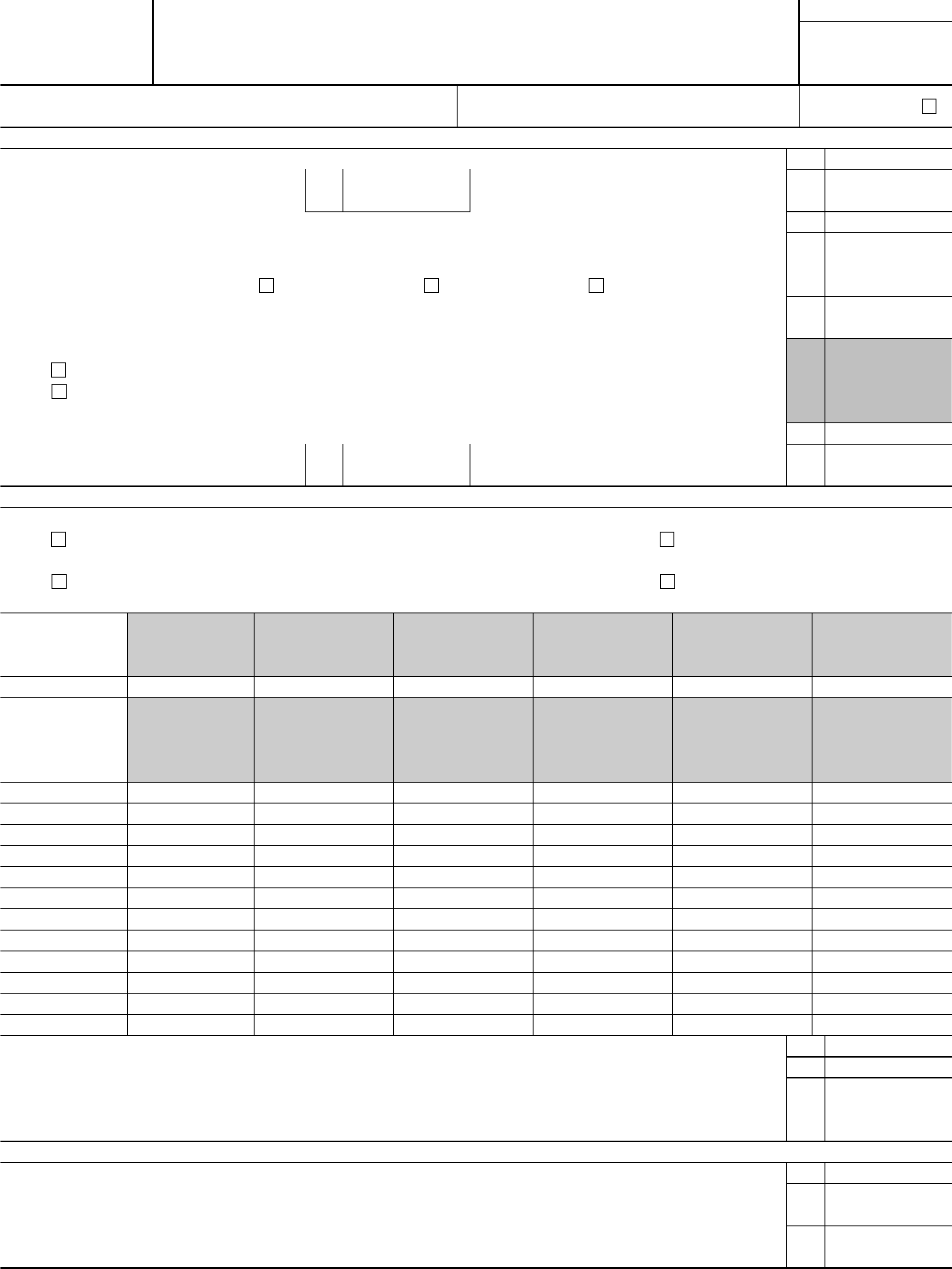

How Much Foreign Tax Credit Relief Can I Claim Self Assessment Guidance Relief for foreign tax paid Self Assessment helpsheet HS263 Use the Self Assessment helpsheet HS263 to work out tax credit relief on income that you ve

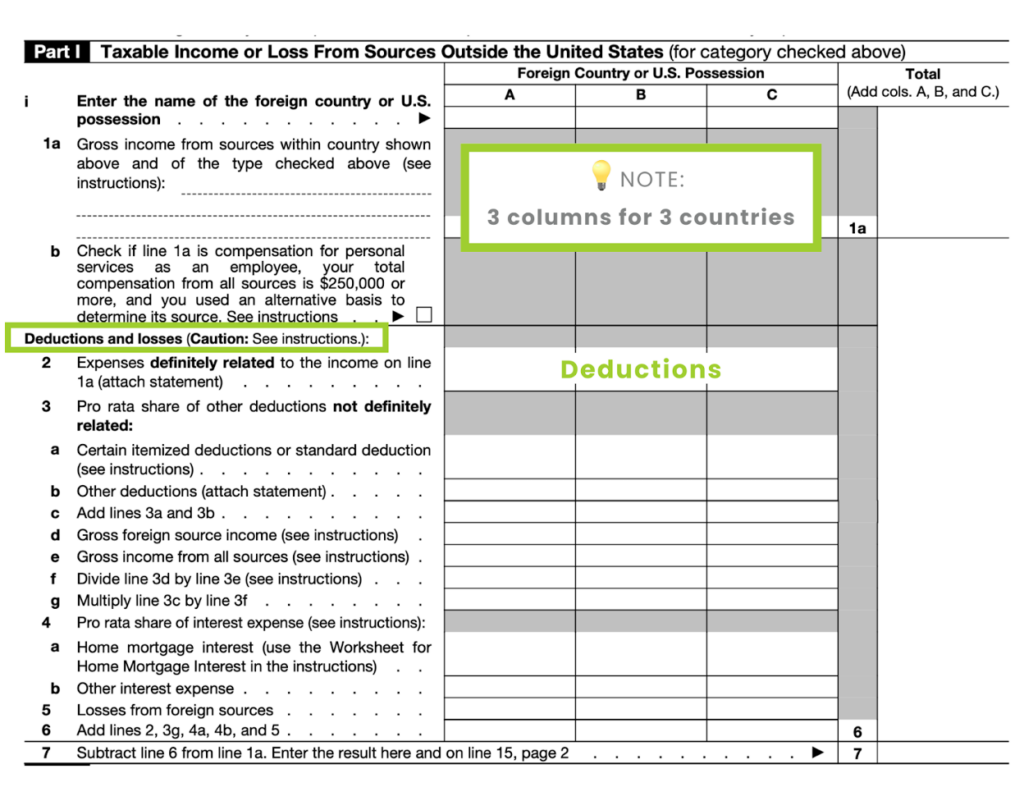

You can claim a credit only for foreign taxes that are imposed on you by a foreign country or U S possession Generally only income war profits and excess profits taxes qualify for the credit See Foreign Taxes that Qualify For The Foreign Tax Credit for more information You can choose whether to take the amount of any qualified foreign taxes paid or accrued during the year as a foreign tax credit or as an itemized deduction You can change your choice for each year s taxes To choose the foreign tax credit you generally must complete Form 1116 Foreign Tax Credit and attach it to your U S tax

How Much Foreign Tax Credit Relief Can I Claim

How Much Foreign Tax Credit Relief Can I Claim

https://www.expatustax.com/wp-content/uploads/2021/06/Foreign-Tax-Credit.jpg

Foreign Tax Credit Relief Explained YouTube

https://i.ytimg.com/vi/FWkkktgFhhE/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AH-CYAC0AWKAgwIABABGEwgVChlMA8=&rs=AOn4CLBRkaHfcSBQW1BqeB4mEIGoMtrdrA

What Can I Claim Against My Tax Preda

https://preda.com.au/wp-content/uploads/2020/10/GettyImages-1174914377c-1024x660.jpg

U S citizens and resident aliens who pay income taxes imposed by a foreign country or U S possession can claim the credit The credit can reduce your U S tax liability and help How the foreign earned income exclusion works In general the foreign earned income exclusion allows you to treat up to 120 000 of your income in 2023 taxes due in 2024 as not taxable by

How Much Tax Credit Can You Claim There are some general principles you need to consider when evaluating the tax credit you can claim For instance you should not exceed the credit amount for overseas tax from the lesser of tax to be paid on the gain It also should not cross the limit of the UK tax on parts taxed twice of the gain In a Nutshell If you re an American taxpayer earning money abroad you could owe income taxes to two countries the U S and the country where you earned the income If you qualify for the foreign tax credit claiming it could allow you to cut your federal income tax bill by at least some of the amount of tax you paid to a foreign country

Download How Much Foreign Tax Credit Relief Can I Claim

More picture related to How Much Foreign Tax Credit Relief Can I Claim

Form 1118 Foreign Tax Credit Corporations 2014 Free Download

https://www.formsbirds.com/formhtml/a48b0ecbc6a9c3da67eb/6d43f7bc4894e1dd94ba9b6ec1/bga.png

What Is The Foreign Tax Credit Commons credit portal

https://i4.ytimg.com/vi/5VSmmake6x8/sddefault.jpg

Calculating The Credit How Foreign Tax Credits Work HowStuffWorks

https://resize.hswstatic.com/w_1200/gif/foreign-tax-credit-orig.jpg

Let s go back to January 2022 That s when the IRS and Treasury released final foreign tax credit regs that substantially changed the rules for determining whether a foreign tax is creditable You can usually claim Foreign Tax Credit Relief when you report your overseas income in your tax return How much relief you get depends on the UK s double taxation agreement with the

Article ID 2698 Last updated 07 Feb 2024 Foreign Tax Credit Relief FTCR can be claimed if an individual has paid foreign tax on a source of income which is also chargeable to UK tax You must be living resident in the UK Isle of Man or Channel Islands if you want to claim Foreign Tax Credit Relief You can claim the lower of You must reduce your foreign taxes available for the credit by the amount of those taxes paid or accrued on income that is excluded from U S income under the foreign earned income exclusion or the foreign housing exclusion

Premium Tax Credit Form Edit Fill Sign Online Handypdf

https://handypdf.com/resources/formfile/htmls/10000/premium-tax-credit-form/bg1.png

Foreign Tax Credit Processing Of Tax Returns HLS 2234 Harvard

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/d18218b6267fdbd1e87d7cd894b93d27/thumb_1200_1553.png

https://www.gov.uk/government/publications/...

Self Assessment Guidance Relief for foreign tax paid Self Assessment helpsheet HS263 Use the Self Assessment helpsheet HS263 to work out tax credit relief on income that you ve

https://www.irs.gov/individuals/international-taxpayers/foreign-tax-credit

You can claim a credit only for foreign taxes that are imposed on you by a foreign country or U S possession Generally only income war profits and excess profits taxes qualify for the credit See Foreign Taxes that Qualify For The Foreign Tax Credit for more information

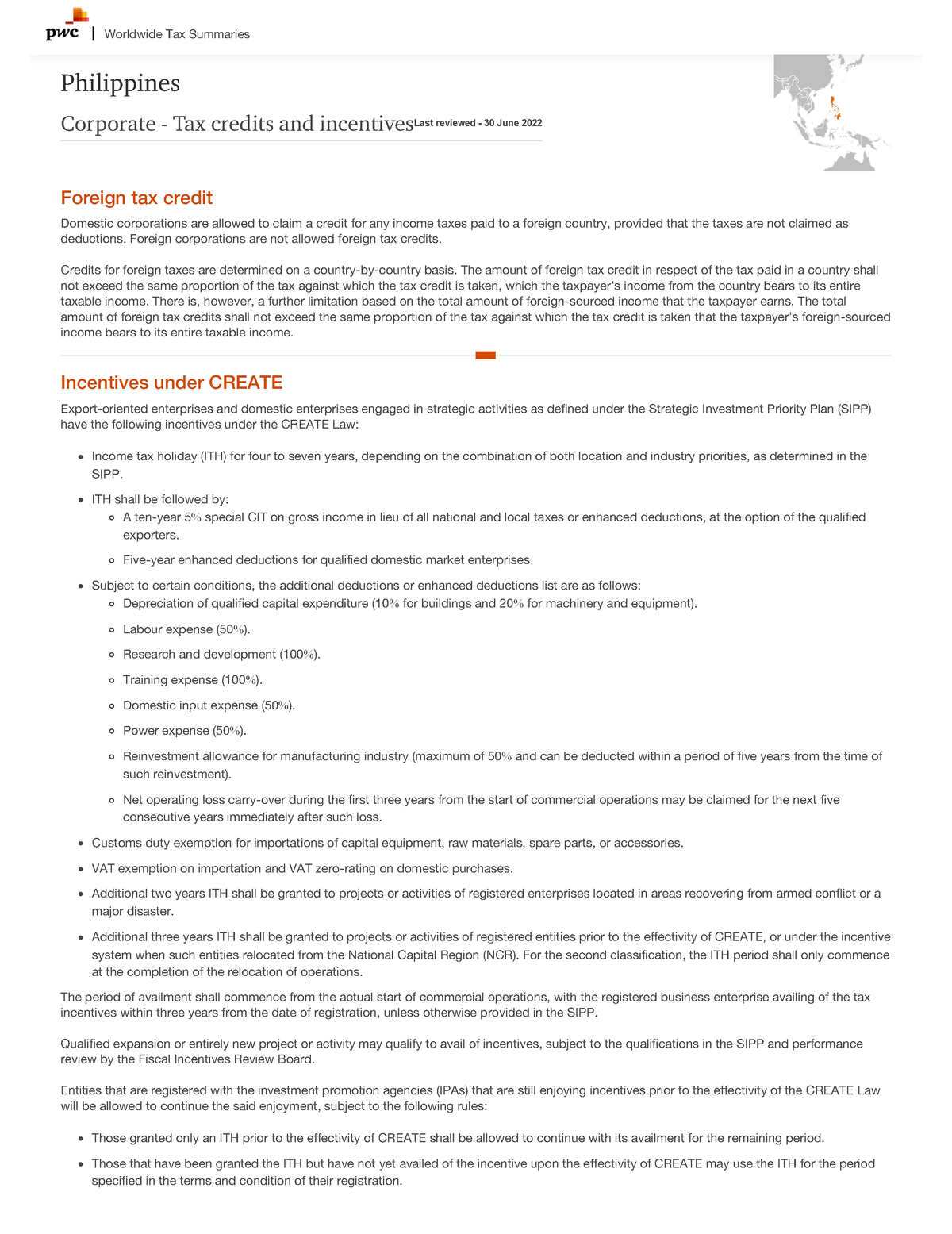

Philippines Corporate Tax Credits And Incentives Worldwide Tax

Premium Tax Credit Form Edit Fill Sign Online Handypdf

How Do I Claim Foreign Tax Credit In USA Leia Aqui Can A US Citizen

Businesses Receiving A Compulsory Purchase Order What Can I Claim For

San Francisco Foreign Tax Credit Attorney SF Tax Counsel

The Tax Implications Of Investing In Foreign Securities

The Tax Implications Of Investing In Foreign Securities

What Self Employed Expenses Can I Claim For Simple Taxes

Form 1116 Instructions For Expats Claiming The Foreign Tax Credit

Foreign Tax Credit How To Claim Tax Credit On Foreign Income

How Much Foreign Tax Credit Relief Can I Claim - Guidance Apply to operate foreign tax credit relief Find out how to apply for authority to give an employee foreign tax credit relief if you re a UK employer and you send an