How Much Fringe Benefit Tax Do I Pay How much FBT do you pay To work out how much FBT to pay you gross up the taxable value of the benefits you ve provided This is equivalent to the gross income your

Like monetary salary the fringe benefits your company provides to your employees are taxable income In general you must deduct a prepayment of taxes and pay the employer s health The tax rate is determined by the amount of earned income you receive during the year Earned income includes pay from employment as well as pensions and benefits Your

How Much Fringe Benefit Tax Do I Pay

How Much Fringe Benefit Tax Do I Pay

https://www.darcyservices.com.au/blog/wp-content/uploads/2016/10/taxes-1032645_1280.jpg

Fringe Benefits Tax Time Connolly Associates

https://connollysbs.com.au/wp-content/uploads/2023/03/fringe-benefits-tax-time.jpg

Fringe Benefit Tax Yellow Crane

https://www.yellowcrane.com.au/wp-content/uploads/2021/06/Fringe-Benefit-Tax.jpg

Work out the FBT to pay including applying the type 1 or type 2 gross up rate and the FBT rate As an employer you must self assess the amount of fringe benefits tax FBT Fringe benefits tax FBT is paid by employers on certain benefits they provide to employees These benefits include non salary payments to employees such as gym membership payments discounted loans or

How Much Fringe Benefit Tax Do I Pay The amount of fringe benefit tax an employer pays is calculated based on the total gross up value of all taxable fringe benefits provided to Your employer pays fringe benefits tax on any fringe benefits they offer you What are fringe benefits A fringe benefit is something extra you get from your employer in addition to your wage or salary or in return for foregoing some of

Download How Much Fringe Benefit Tax Do I Pay

More picture related to How Much Fringe Benefit Tax Do I Pay

Fringe Benefits Tax FBT Mason Lloyd

https://masonlloyd.com.au/wp-content/uploads/2023/06/fringe-benefits-tax-fbt-to-pay-with-personal-income-tax-on-fringe-benefits-they-receive-vector.jpg

Fringe Benefits Tax Update

https://s3.studylib.net/store/data/008297340_1-dd435714b5c8c595a8b01d2eb8962ee2-768x994.png

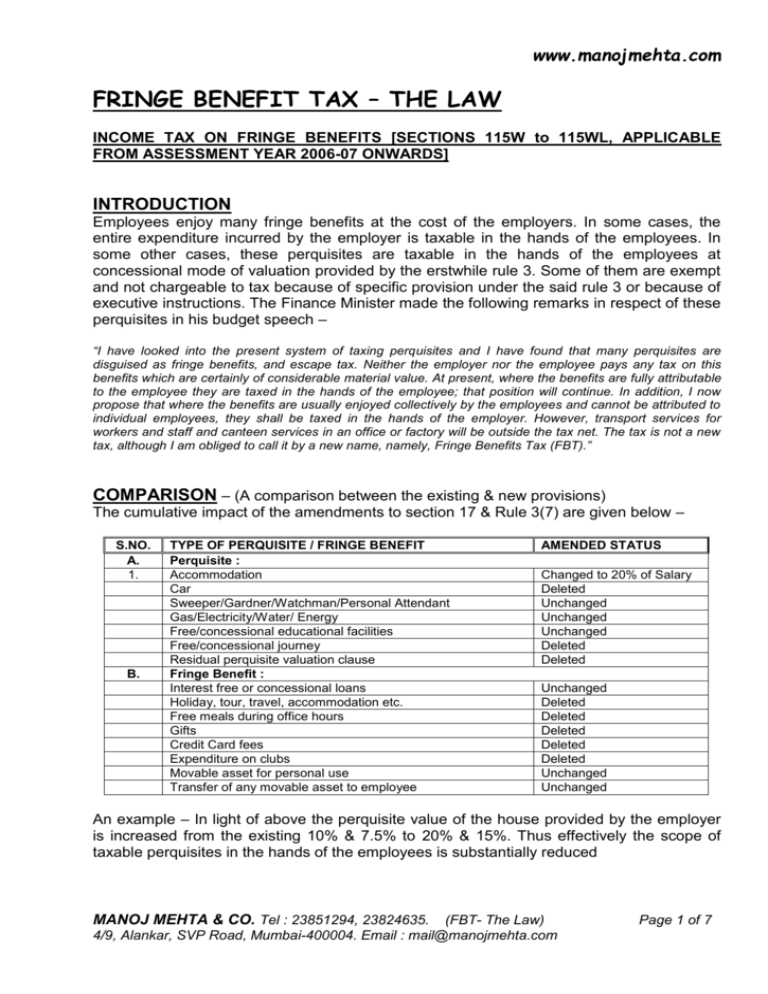

FBT Fringe Benefit Tax

https://s3.studylib.net/store/data/009022759_1-b4561ee94b8359231585ed2c36d330f2-768x994.png

An employee s fringe benefit rate is everything that s paid in addition to their regular wages including payroll taxes and vacation time We ll help you figure out how to identify and calculate this rate to find an employee s To calculate the fringe benefit for salaried employees use this formula employee s total fringe benefits annual salary x 100 For hourly employees the formula is total annual

How Much Are Fringe Benefits Taxed Fringe benefits may be taxed at the employee s income tax rate or the employer may elect to withhold a flat supplemental wage Fringe benefit tax FBT is a tax payable when the following benefits are supplied to employees or shareholder employees motor vehicles available for private use low interest interest free loans

What Is Fringe Benefit Tax

https://i1.wp.com/generateaccounting.co.nz/wp-content/uploads/2013/06/FBT.jpg?fit=1000%2C664&ssl=1

.png#keepProtocol)

Fringe Benefit Tax Update 2022

https://blog.agredshaw.com.au/hubfs/Fringe Benefit Tax Update - 2022 (v2).png#keepProtocol

https://www.ato.gov.au › businesses-and...

How much FBT do you pay To work out how much FBT to pay you gross up the taxable value of the benefits you ve provided This is equivalent to the gross income your

https://www.suomi.fi › ... › fringe-benefits

Like monetary salary the fringe benefits your company provides to your employees are taxable income In general you must deduct a prepayment of taxes and pay the employer s health

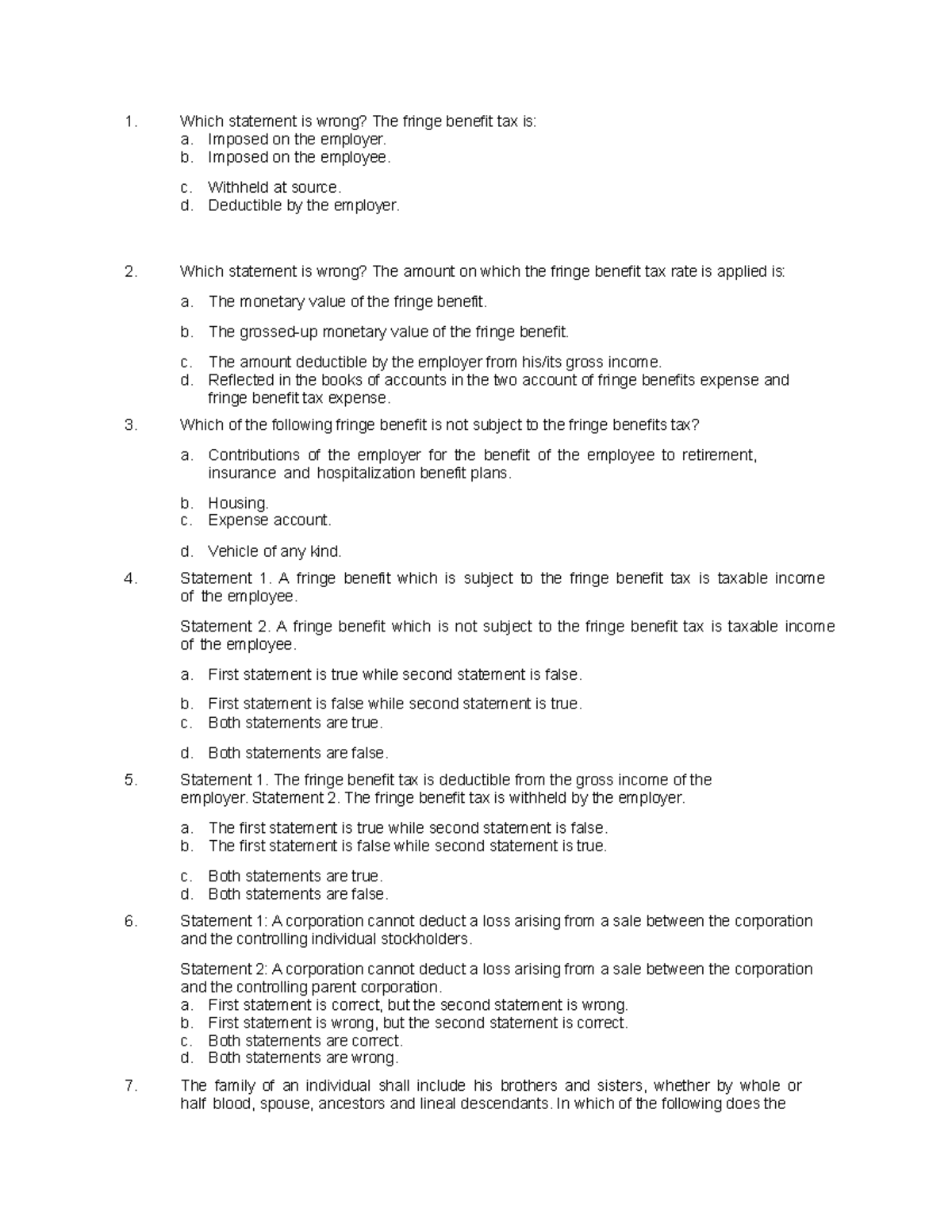

Taxation Reviewer 7 Which Statement Is Wrong The Fringe Benefit Tax

What Is Fringe Benefit Tax

How Does Fringe Benefits Tax Work Pherrus

Fringe Benefit Tax Bartleby

Activity 4 MATERIALS The Fringe Benefit Tax By Nature Is A A Tax

7 Lessons I Learned From An Accidental Millionaire

7 Lessons I Learned From An Accidental Millionaire

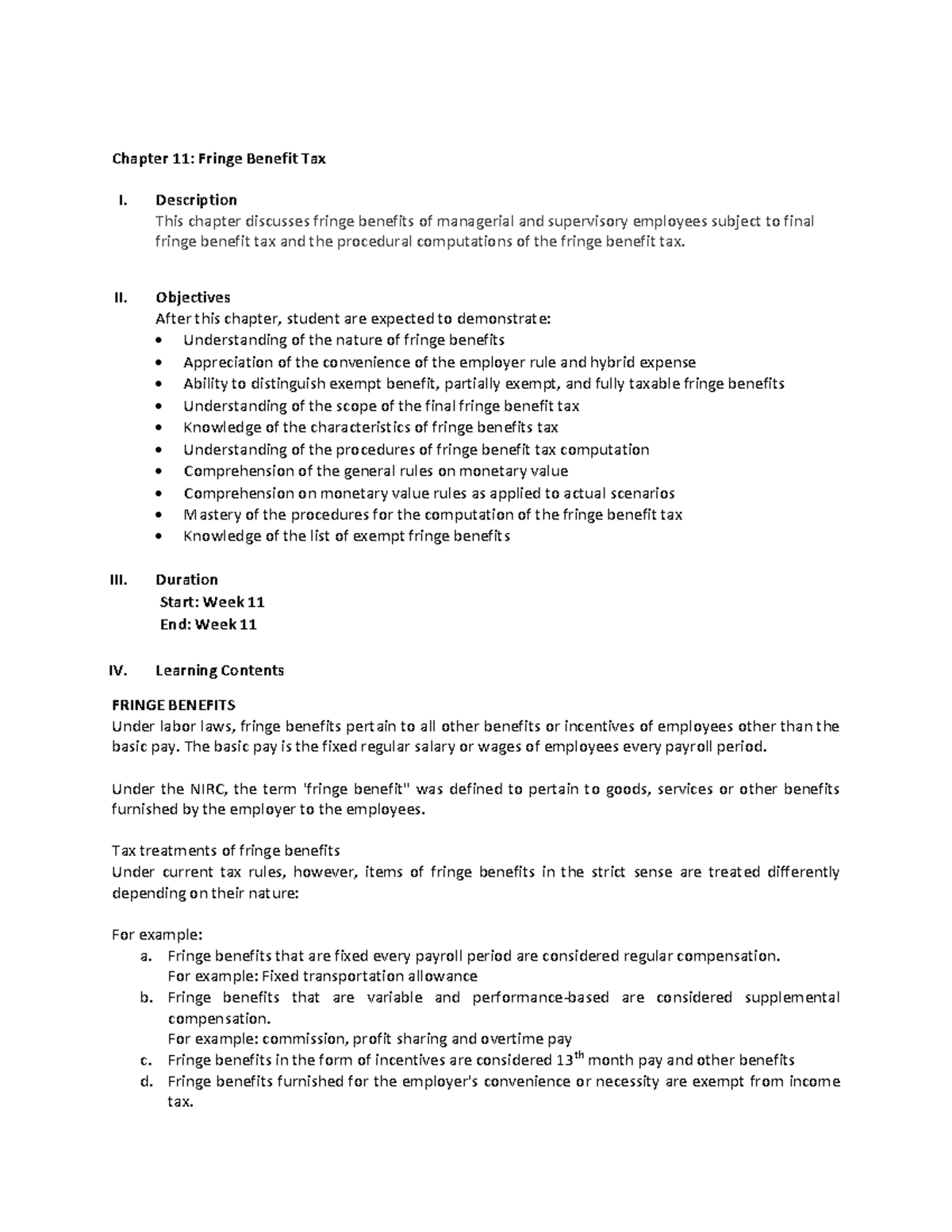

Chapter 11 Taxation Chapter 11 Fringe Benefit Tax I Description

How Much Money Does The Government Collect Per Person

Fringe Benefits Tax And Business Fiskl Advisory

How Much Fringe Benefit Tax Do I Pay - Fringe Benefit Tax is a special tax on benefits that employers provide to their employees beyond their standard wages or salaries Think of it as the tax on those extra goodies you receive at