How Much Gift Is Tax Free In India Web the list of prescribed occasion on which gift is not charged to tax and hence gift received from friends will be charged to tax However nothing will be charged to tax if the

Web Provisions on Taxation on Gifts This table below offers a glimpse of the gifts that come under the purview of gift tax in India 2022 Example Suppose the stamp duty is Rs Web 10 Jan 2023 nbsp 0183 32 For instance if you receive gifts or cash of up to Rs 50 000 in a financial year you do not have to pay any gift tax on it Similarly if you receive presents from

How Much Gift Is Tax Free In India

How Much Gift Is Tax Free In India

https://i.ytimg.com/vi/mO036He-RM4/maxresdefault.jpg

Gift Tax Free How Much Of A Cash Gift Is Tax Free In Canada Smart

https://smartwills.ca/wp-content/uploads/2022/07/JulyBlogImage2.png

How Much Rent Is Tax Free In India YouTube

https://i.ytimg.com/vi/NrwuQxy2fDM/maxresdefault.jpg

Web 3 Juli 2023 nbsp 0183 32 Gifts up to Rs 50 000 per annum are exempt from tax in India In addition gifts from certain relatives such as parents spouse Web The Income Tax Act states that gifts whose value exceeds Rs 50 000 are subject to gift tax in the hands of the recipient Gifting is one of the many ways to express love and

Web 4 Dez 2023 nbsp 0183 32 Gifts received in India are taxable if the monetary value of all gifts received without consideration by the recipient exceeds INR 50 000 The whole amount would be Web 30 Nov 2020 nbsp 0183 32 It is Rs 5 lakh for super senior citizens who are aged above 80 years If both of your parents do not have a high income then you can avoid tax by gifting money

Download How Much Gift Is Tax Free In India

More picture related to How Much Gift Is Tax Free In India

Tax Free 6 Income

https://www.indiareviews.com/wp-content/uploads/2022/07/tax-free-income-in-india.jpg

Payroll Tax Estimator GeorgeAnmoal

https://www.patriotsoftware.com/wp-content/uploads/2021/08/how_much_employer_pays_payroll_tax-01.png

Crypto Gift Taxes A Definitive Guide BitcoinTaxes

https://bitcoin.tax/blog/wp-content/uploads/2022/08/No-crypto-gift-taxes.png

Web 7 Feb 2020 nbsp 0183 32 The Gift Tax Act levied taxes on a quot donor based quot mechanism Accordingly any gifts valued above the exemption limit of 30 000 were taxed in the hands of the Web 21 M 228 rz 2023 nbsp 0183 32 If the gift giver and receiver are not relatives the maximum tax free amount of transfer is Rs 50 000 If the gift amount exceeds that then the whole amount not just the excess becomes taxable as per the

Web Provisions on Taxation on Gifts This table below offers a glimpse of the gifts that come under the purview of gift tax in India 2022 Example Suppose the stamp duty is Rs 200000 and the consideration is Rs 75000 In such a case the taxable amount will be stamp duty minus the consideration value i e Rs 1 25 lakhs Web 26 Dez 2022 nbsp 0183 32 Gifts from RIs to NRI friends or acquaintances are taxable if the value exceeds INR 50 000 The amount is added to the receiver s total taxable income and taxed per their income tax bracket Per the

Toll Tax Free

https://www.vachamarathi.com/wp-content/uploads/2023/01/Toll-Tax-Free.jpg

An Invoice Form With The Words Tech Guruplus On It

https://i.pinimg.com/736x/ee/b1/58/eeb15847e84d8f938d15fc47461df756.jpg

https://incometaxindia.gov.in/Tutorials/18. Tax treatment of gi…

Web the list of prescribed occasion on which gift is not charged to tax and hence gift received from friends will be charged to tax However nothing will be charged to tax if the

https://groww.in/p/tax/tax-on-gifts-in-india

Web Provisions on Taxation on Gifts This table below offers a glimpse of the gifts that come under the purview of gift tax in India 2022 Example Suppose the stamp duty is Rs

Can You File Your Taxes With Your Last Pay Stub This Is What To Know

Toll Tax Free

20 Tax Free Incomes In India Finlaw Blog

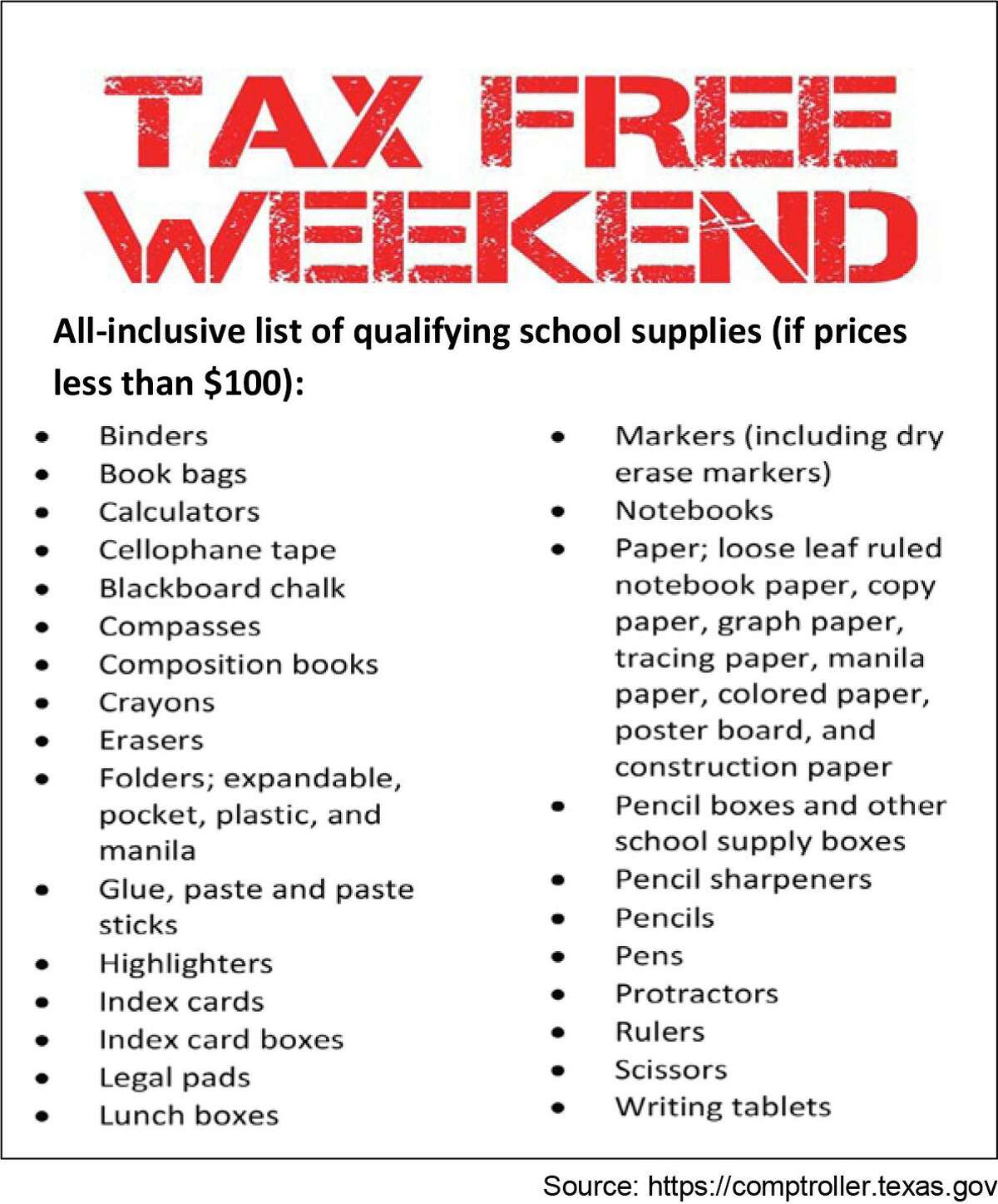

Texas Tax free Weekend Here Are The Rules For How To Save Money

2023 Income Tax On Gift Rules In Hindi

2023 Income Tax On Gift Rules In Hindi

Income Tax On Gifts Received From Relatives Friends YouTube

Share More Than 143 Gift Card Income Tax Super Hot Kidsdream edu vn

Making The Income Tax Fair Zenconomics

How Much Gift Is Tax Free In India - Web 3 Juli 2023 nbsp 0183 32 Gifts up to Rs 50 000 per annum are exempt from tax in India In addition gifts from certain relatives such as parents spouse