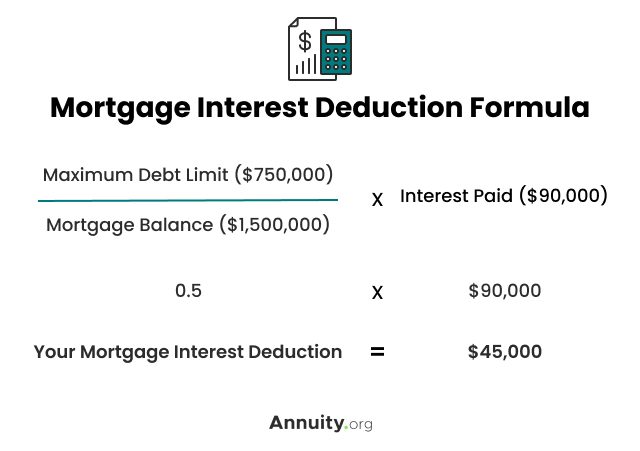

How Much Home Interest Is Tax Deductible The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on home loans up to 750 000 For taxpayers who use married filing separate status

If you got an 800 000 mortgage to buy a house in 2017 and you pay 25 000 in interest on that loan during 2024 you probably can deduct all 25 000 of that mortgage interest on your 2024 Key Takeaways The home mortgage interest deduction HMID allows itemizing homeowners to deduct mortgage interest paid on up to 750 000 of their loan principal The Tax Cuts and Jobs Act

How Much Home Interest Is Tax Deductible

How Much Home Interest Is Tax Deductible

https://assets.themortgagereports.com/wp-content/uploads/2021/11/Investment-Property-Mortagage-Closing-Cost-Credit.jpg

Mortgage Interest Tax Relief Calculator DermotHilary

https://www.annuity.org/wp-content/uploads/mortgage-interest-deduction-formula-640x0-c-default.jpg

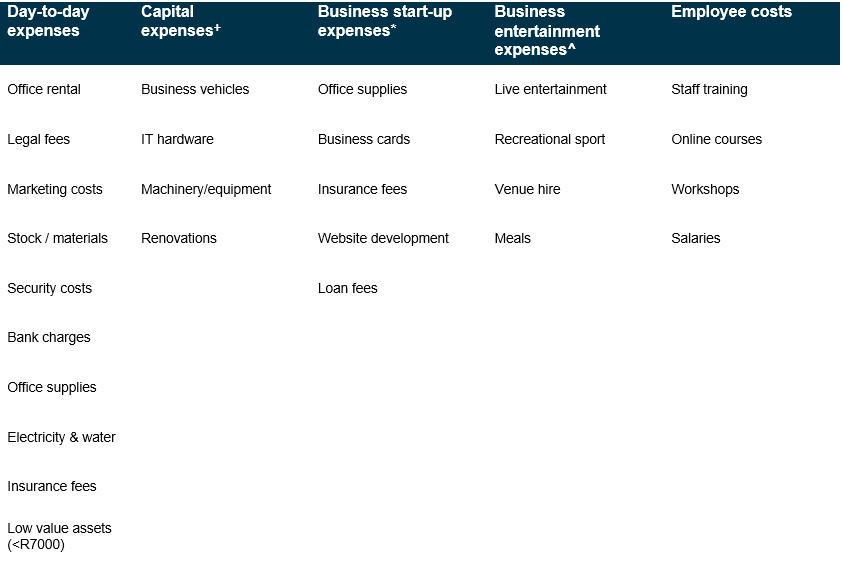

Lower Your Taxes 10 Deductible Expenses In The Philippines

https://una-acctg.com/wp-content/uploads/2022/12/Lower-Your-Taxes-10-Deductible-Expenses-in-the-Philippines-scaled.jpg

Updated December 06 2023 Reviewed by Janet Berry Johnson Fact checked by David Rubin Part of the Series Tax Deductions and Credits Guide What Is Tax Deductible Interest Instead of single or married filing jointly taxpayers deducting mortgage interest on the first 1 million 500 000 for married filing separately of their mortgage they can now only deduct

In other words if you have a mortgage for 800 000 you can only deduct the interest on 750 000 Home equity debt is included in this new limit The TCJA applies through the 2025 tax year The Key Takeaways You can usually deduct the interest you pay on a mortgage for your main home or a second home but there are some restrictions The maximum amount of debt eligible for the deduction was 1 million prior to 2018 and is now limited to 750 000

Download How Much Home Interest Is Tax Deductible

More picture related to How Much Home Interest Is Tax Deductible

Is Savings Account Interest Tax Deductible

https://s.yimg.com/uu/api/res/1.2/evO7M0dUmFwjNGktKceIXQ--~B/aD0xNDYzO3c9MjA0OTtzbT0xO2FwcGlkPXl0YWNoeW9u/http://media.zenfs.com/en-US/homerun/motleyfool.com/cbdf5e307d50f0dbe4cdc22816aa633e

Investment Expenses What s Tax Deductible Retirement Plan Services

https://workplace.schwab.com/resource-center/insights/sites/g/files/eyrktu871/files/Example-1.png

Ergeon How Your Fence Can Be Tax Deductible

https://assets-global.website-files.com/5ad551c41ca0c52724be6c55/6059e280542a77693a187cdc_Tax deductible.jpg

For heads of households the standard deduction is 20 800 With the standard deduction you can reduce your taxable income by a standard amount When you itemize deductions including tax breaks for homeowners you forgo the standard deduction Updated on January 4 2023 Reviewed by Michelle P Scott In This Article View All Photo monkeybusinessimages Getty Images The home mortgage interest tax deduction is reported on Schedule A of Form 1040 along with your other itemized deductions Before claiming it know the limitations

The maximum amount you can deduct is 750 000 for individuals or 375 000 for married couples filing separately If you took out your home loan before Dec 16 2017 the maximum you can deduct goes up to 1 million for individuals and 500 000 for married couples filing separately How much mortgage interest can be deducted If the mortgage was taken out before Oct 13 1987 there is no cap or no upper limit

Interest Rates Mortgage Interest Rates Real Estate Advice Real

https://i.pinimg.com/originals/1f/17/0f/1f170ff96695d3d07b8bcfa0b3bd4b4c.jpg

Tax Deductions The New Rules INFOGRAPHIC Alloy Silverstein

https://alloysilverstein.com/wp-content/uploads/2019/03/Tax-Reform-Deductible-vs-Non-Deductible-Infographic-2019.png

https://www. bankrate.com /mortgages/mortgage-tax...

The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on home loans up to 750 000 For taxpayers who use married filing separate status

https://www. nerdwallet.com /article/taxes/mortgage...

If you got an 800 000 mortgage to buy a house in 2017 and you pay 25 000 in interest on that loan during 2024 you probably can deduct all 25 000 of that mortgage interest on your 2024

Tax Deductible Bricks R Us

Interest Rates Mortgage Interest Rates Real Estate Advice Real

Is Home Equity Loan Interest Tax Deductible For Rental Property

Can Home Equity Loan Be Tax Deductible In Canada

Is Interest Rate Tax deductible Jan 04 2022 Johor Bahru JB

Investment Expenses What s Tax Deductible Charles Schwab

Investment Expenses What s Tax Deductible Charles Schwab

Solved Please Note That This Is Based On Philippine Tax System Please

Tax deductible Expenses For Small Businesses On Accounting

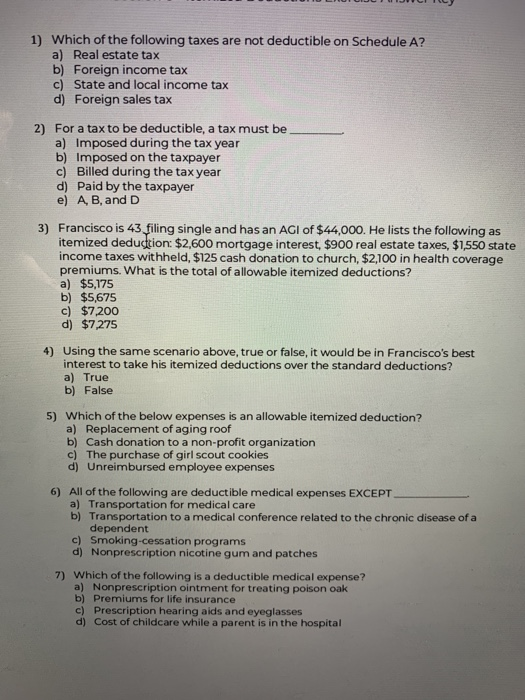

Solved 1 Which Of The Following Taxes Are Not Deductible On Chegg

How Much Home Interest Is Tax Deductible - You can deduct the interest you paid on the first 750 000 of your mortgage during the relevant tax year For married couples filing separately that limit is 375 000 according to the Internal