How Much Home Loan Interest Amount Is Exempted From Income Tax The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750 000 of mortgage debt Homeowners who bought houses before

First time buyers of affordable property can claim Rs 3 50 lakhs as interest deduction by combining the benefits under Section 24 and Section 80EEA Better still if the property is jointly owned the co The best way to calculate home loan tax benefits is to use home loan tax saving calculator This automated tool makes the whole calculation process easy and hassle

How Much Home Loan Interest Amount Is Exempted From Income Tax

How Much Home Loan Interest Amount Is Exempted From Income Tax

https://www.wintwealth.com/blog/wp-content/uploads/2022/11/Exempt-Income.jpg

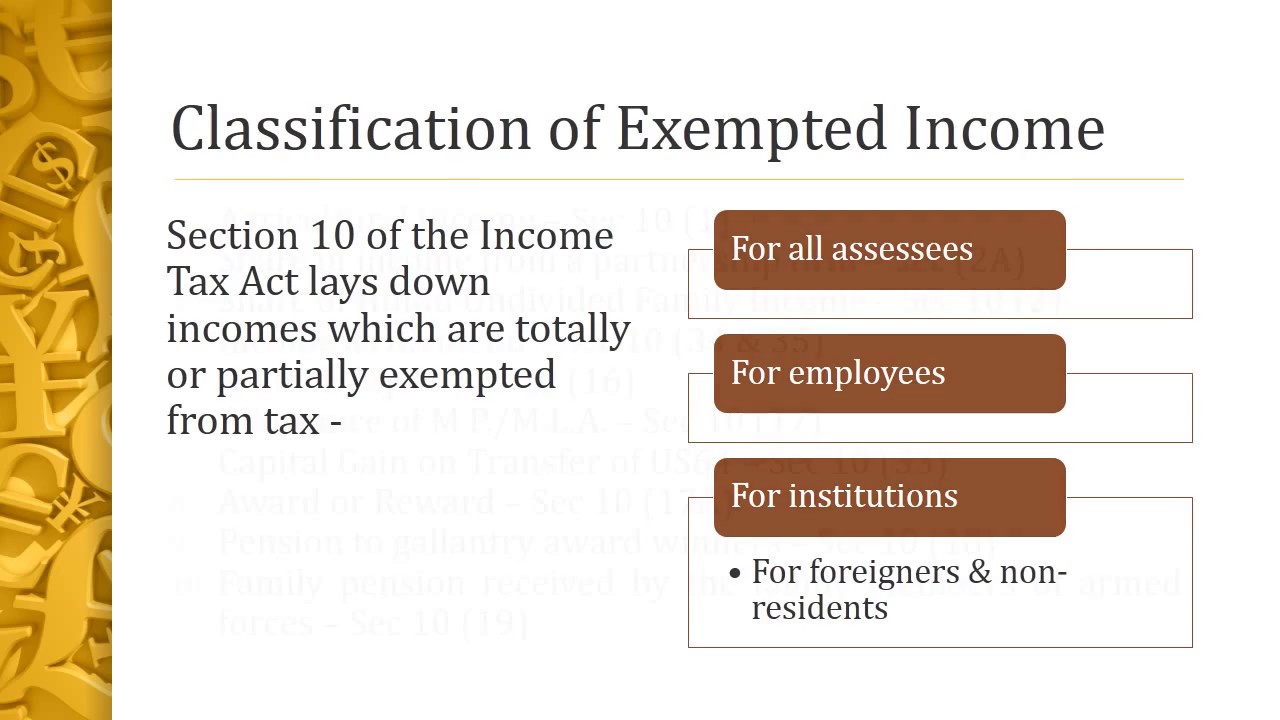

Income Exempted Under IT Act

https://eadvisors.in/wp-content/uploads/2022/06/Exempted-income-1.jpg

How Much Home Loan Can I Get Based On My Salary TESATEW

https://i.pinimg.com/originals/5d/b6/d6/5db6d60476480cbe2a94215fff245c13.jpg

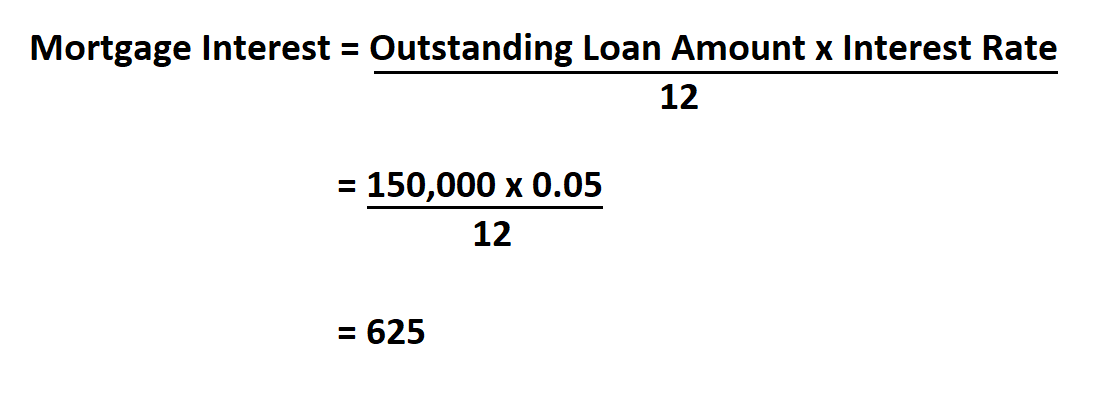

So your total mortgage interest for the year isn t going to be 12 000 it might be more like 11 357 or 12 892 In the later years of your mortgage that same 1 500 payment may put 1 000 Is home loan interest part of section 80C of the Income tax Act No section 80C of the Income tax Act does not apply to interest paid on a mortgage

Most homeowners can deduct all of their mortgage interest The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on Standard deduction rates are as follows Single taxpayers and married taxpayers who file separate returns 12 950 for tax year 2022 Married taxpayers who

Download How Much Home Loan Interest Amount Is Exempted From Income Tax

More picture related to How Much Home Loan Interest Amount Is Exempted From Income Tax

All You Need To Know On Exempted Income In Income Tax Ebizfiling

https://ebizfiling.com/wp-content/uploads/2022/04/income-exempted.png

Provident Funds Types Income Tax Implications

https://www.relakhs.com/wp-content/uploads/2015/05/Types-of-Provident-Funds-Tax-Implications-EPF-PPF-RPF-SPF-768x416.jpg

Are Home Loans Based On Gross Income Loan Walls

https://lh6.googleusercontent.com/proxy/_odrhf0n2pCwkstjyqNmCkFptpHwk-_ZBbKsoNPT5Lo_kBiePniVdjMj-xWQmaxFKjT49EQx0g_P9H1s_buM7McGKOydcNlI-pIRPpwEzrHlpccx1AgMHzTKjgQ1a43LQPSvDQaURtQEhRh61VM=w1200-h630-p-k-no-nu

For example if you are single and have a mortgage on your main home for 800 000 plus a mortgage on your summer home for 400 000 you would only be able Amount limit The deduction is up to Rs 50 000 It is over and above the Rs 2 lakh limit under Section 24 of the Income Tax Act Read more about the deduction of Rs

You can avail deduction on the interest paid on your home loan under section 24 b of the Income Tax Act For a self occupied house the maximum tax deduction of Rs 2 lakh Only homeowners whose mortgage debt is 750 000 or less can deduct their mortgage interest If you are married filing separately you can only deduct

Exempted Income Under Income Tax Act

https://image.slidesharecdn.com/exemptedincomeunderincometaxact-170113052519/95/exempted-income-under-income-tax-act-1-638.jpg?cb=1484285341

How Much Home Loan Can You Get Based On Your Salary In Malaysia

https://s.yimg.com/uu/api/res/1.2/lRk4NCkWNVk2w1sIm2Pf6w--~B/aD00MzM7dz03NzA7YXBwaWQ9eXRhY2h5b24-/https://media.zenfs.com/en/propertyguru_my_775/32ced232ce096ce8b8d0a248d05d70b0

https://www.nerdwallet.com/article/taxes/mortgage-interest-rate-deduction

The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750 000 of mortgage debt Homeowners who bought houses before

https://housing.com/news/home-loans-guide …

First time buyers of affordable property can claim Rs 3 50 lakhs as interest deduction by combining the benefits under Section 24 and Section 80EEA Better still if the property is jointly owned the co

7 Factors That Influence Your Home Mortgage Interest Rate Complete

Exempted Income Under Income Tax Act

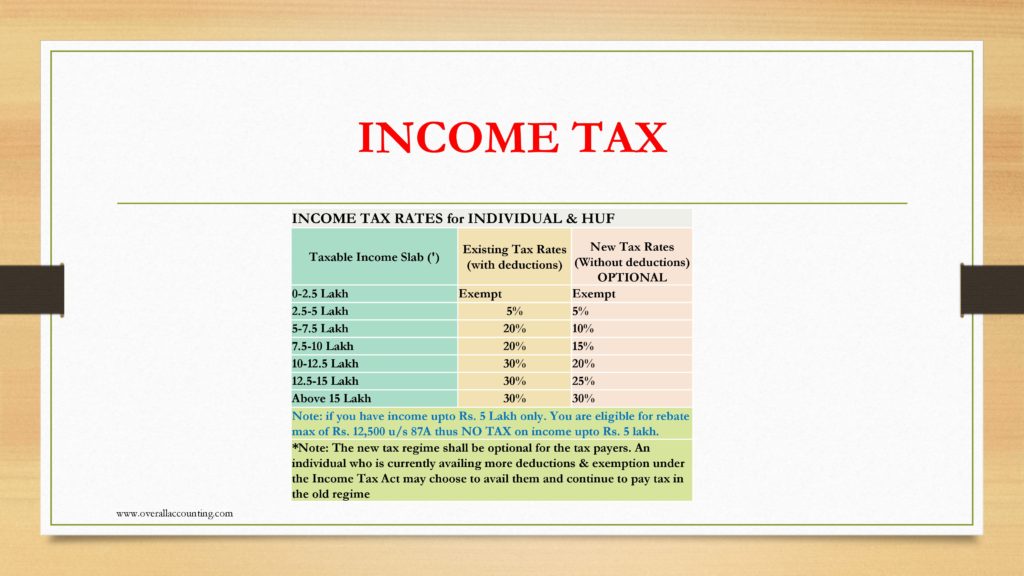

ITR Related Provisions Overall Accounting

Exempted Income INCOME EXEMPTED FROM TAX IN INDIA Income Tax Ppt

Section 10 Of Income Tax Act Deductions And Allowances

TEST BANK INCOME TAXATION cpar

TEST BANK INCOME TAXATION cpar

How To Calculate Percentage Growth Over 5 Years Haiper

Calculate How Much Home Loan You Can Afford

Service Tax Not Applicable Letter Income Tax Return

How Much Home Loan Interest Amount Is Exempted From Income Tax - The maximum deduction on interest paid for self occupied houses is Rs 2 lakh This rule has been in effect from 2018 19 onwards However if your property is a let out then