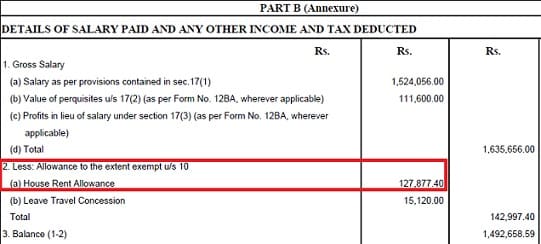

How Much Hra Can Be Claimed In Itr Verkko 7 huhtik 2022 nbsp 0183 32 Here s how to calculate the tax exempt part of HRA Basic annual salary 30 000 x 12 3 6 lakh Total HRA received 10 000 x 12 1 2 lakh Total rent paid in a year 10 000 x 12 1 2 lakh Excess of rent paid annually over 10 of basic annual salary 1 2 lakh 3 6 lakh x 10 84 000

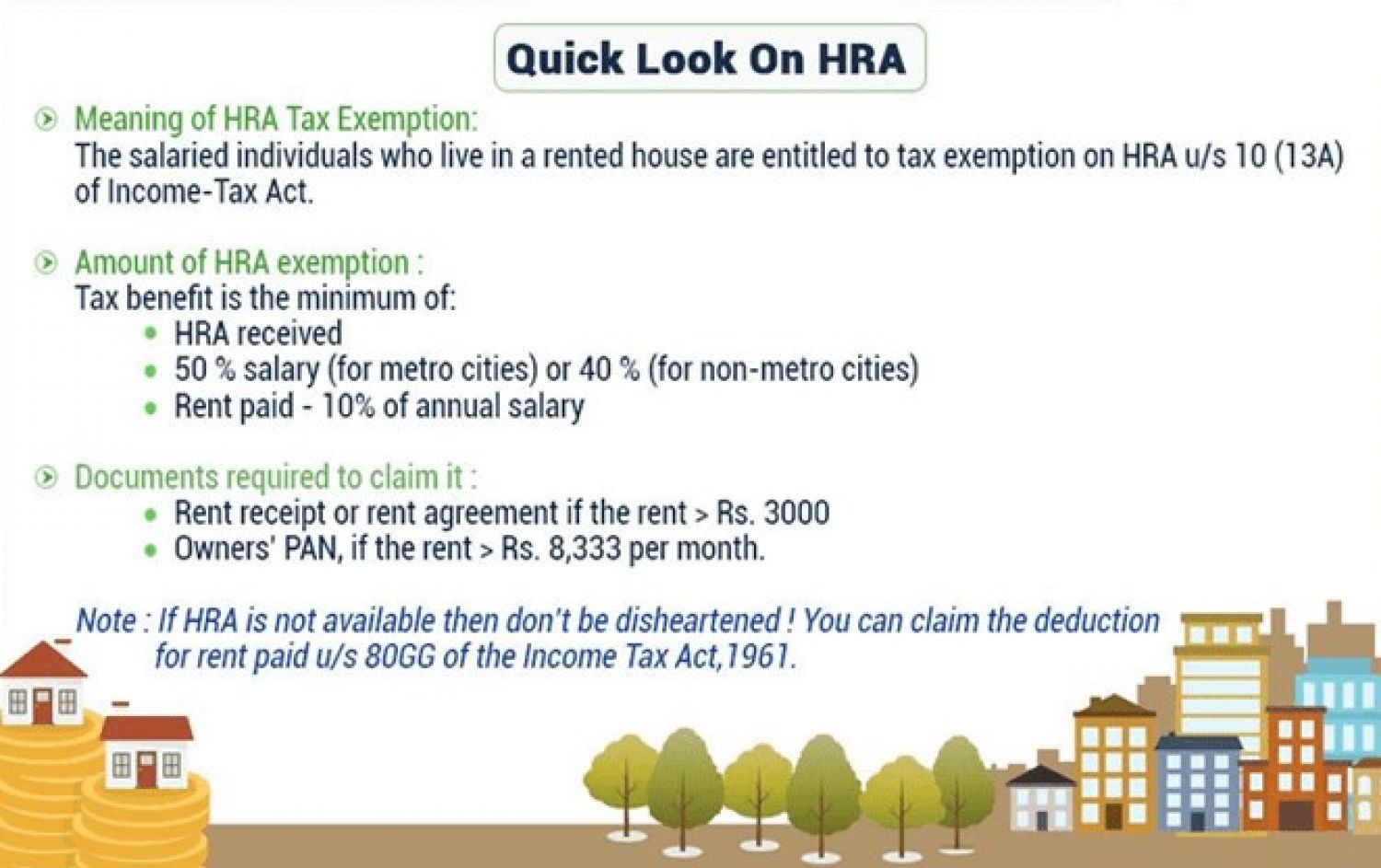

Verkko 5 toukok 2020 nbsp 0183 32 The decision of how much HRA needs to be paid is made by employer Part of Salary is apportioned to HRA 1 CONDITIONS FOR CLAIMING HRA EXEMPTION Salaried Individual only can claim HRA Self employed cannot claim HRA However Self Employed can also claim deduction of Rent paid under Section Verkko 4 elok 2023 nbsp 0183 32 Residency Requirement HRA can be claimed by Indian residents only non residents are not eligible Minimum Rent Threshold The rent must exceed 10 of the basic salary to be eligible for HRA otherwise it is not applicable HRA Calculation HRA amount is based on the employee s salary structure

How Much Hra Can Be Claimed In Itr

How Much Hra Can Be Claimed In Itr

https://d6xcmfyh68wv8.cloudfront.net/learn-content/uploads/2022/09/hra_image.jpeg

How To Claim HRA Allowance House Rent Allowance Exemption

https://carajput.com/art_imgs/how-to-claim-hra-allowance-while-filing-income-tax-return.jpg

How To Show HRA Not Accounted By The Employer In ITR

http://bemoneyaware.com/wp-content/uploads/2016/07/hra-in-form-16-section-10.jpg

Verkko 26 hein 228 k 2019 nbsp 0183 32 Your monthly basic salary is Rs 50 000 and your employer is paying a monthly HRA of Rs 20 000 This would mean that your in hand receipt from your employer is Rs 70 000 per month basic plus HRA Soni explains that to claim the HRA exemption you are first required to calculate how much of the allowance is taxable Verkko 24 marrask 2023 nbsp 0183 32 Actual Rent Paid 10 of Basic Salary INR 1 90 000 2 40 000 10 5 00 000 INR 1 90 000 will be exempt from the total House Rent Allowance received and the remaining INR 60 000 2 50 000 1 90 000 will be taxable Use the HRA calculator to find taxable and tax exempt House Rent Allowance

Verkko Calculate Please enter email to continue You can claim HRA while tax filing even if you have not submitted rent receipts to your HR clearTax will help you claim this while e filing If you don t receive HRA you can now claim upto Rs 60 000 deduction under Section 80GG Click here to calculate your tax as per Budget 2023 Verkko Basic salary DA forming part of salary Commission as of turnover achieved by the employee HRA Received Rent Paid Tick if residing in metro city Tick if Yes Exempted House Rent Allowance Taxable House Rent Allowance

Download How Much Hra Can Be Claimed In Itr

More picture related to How Much Hra Can Be Claimed In Itr

HRA Calculation Formula On Salary Change How HRA Exemption Is

https://i.ytimg.com/vi/O-wluM-mvG8/maxresdefault.jpg

Is Rent Agreement Mandatory For HRA Exemption How To Claim It

https://www.edrafter.in/wp-content/uploads/2022/12/Understanding-HRA-The-Requirement-of-Rent-Agreement-To-Claim-It-768x402.jpg

All You Need To Know About HRA And Various Salary Slip Components

https://www.viralbake.com/wp-content/uploads/2022/06/All-You-Need-To-Know-About-HRA-And-Various-Salary-Slip-Components-1.jpg

Verkko 16 elok 2023 nbsp 0183 32 How much HRA can be claimed The deduction available under Section 10 13A is the least of the following amounts Actual HRA received 50 of basic salary DA for those living in metro cities 40 for non metros or Actual rent paid less 10 of basic salary DA Verkko 16 helmik 2022 nbsp 0183 32 The allowable amount of HRA can be received as a refund from the TDS paid 4 What is the maximum allowable amount under section 80GG The maximum amount allowed as deduction under section 80GG is Rs 60 000 5 Can the benefit of HRA and deduction of home loan principal as well as interest be claimed

Verkko 13 jouluk 2023 nbsp 0183 32 At the time that your income tax returns are submitted you can request an HRA exemption and Claim HRA in ITR You can only do this if your employer does not submit an HRA claim on your behalf Vakilsearch s HRA calculator can be used to determine your HRA amount by Claim HRA in ITR Verkko 22 syysk 2022 nbsp 0183 32 However the maximum amount that can be claimed under this section is up to Rs 60 000 Rs 5 000 per month

House Rent Allowance Hra Tax Exemption Hra Calculation Rules Free

https://wp.sqrrl.in/wp-content/uploads/2019/08/FOR-ANAND-3-1024x796.png

How Much HRA Can Be Tax Exempted HR Spot Blog

https://lifeline.hrspot.co.in/hrspot/website_content/_Tax exempted.png

https://blog.saginfotech.com/claim-hra-filing-income-tax-return

Verkko 7 huhtik 2022 nbsp 0183 32 Here s how to calculate the tax exempt part of HRA Basic annual salary 30 000 x 12 3 6 lakh Total HRA received 10 000 x 12 1 2 lakh Total rent paid in a year 10 000 x 12 1 2 lakh Excess of rent paid annually over 10 of basic annual salary 1 2 lakh 3 6 lakh x 10 84 000

https://taxguru.in/income-tax/house-rent-allowance-hra-exemption-rules...

Verkko 5 toukok 2020 nbsp 0183 32 The decision of how much HRA needs to be paid is made by employer Part of Salary is apportioned to HRA 1 CONDITIONS FOR CLAIMING HRA EXEMPTION Salaried Individual only can claim HRA Self employed cannot claim HRA However Self Employed can also claim deduction of Rent paid under Section

Can HRA Exemption Be Claimed While Paying Rent To Relatives YouTube

House Rent Allowance Hra Tax Exemption Hra Calculation Rules Free

How Much HRA Can I Claim HOW TO CALCULATE HRA IN SALARY HEAD YouTube

Can Pg Rent Be Claimed As HRA

How Does An HRA Work

HRA Calculator By LLA LLA Newsletter

HRA Calculator By LLA LLA Newsletter

House Rent Allowance What Is HRA HRA Exemptions Deductions Tax2win

ITR Filing 2023 How To Claim Exemption On HRA In Tax Return

How To Claim HRA While Filing Your Income Tax Return ITR SAG Infotech

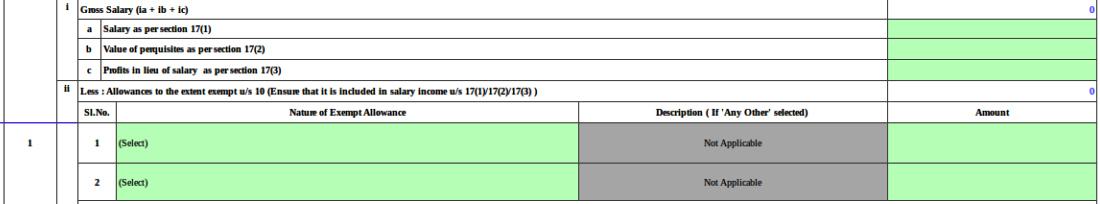

How Much Hra Can Be Claimed In Itr - Verkko 6 tammik 2023 nbsp 0183 32 The tax exempt portion of HRA can be reported under the head Allowances exempt u s 10 in the ITR1 From the drop down menu select 10 13 Allowance to meet expenditure incurred on house rent