How Much Hst On New Home In Ontario For houses located in Ontario you may be eligible to claim the Ontario new housing rebate if you are not eligible to claim the new housing rebate for some of the federal part of the HST only because the fair market value of the housing exceeds 450 000 An Ontario new housing rebate will be available up to the applicable maximum of 24 000

For the provincial portion everyone can apply for up to 75 per cent of the HST paid to a maximum of 24 000 You can also apply for the rebates if you build your home as well It can add up to a sizeable sum If a new home costs 300 000 and there was no rebate the HST would be 13 per cent of the price or 39 000 The federal rebate is equal to 36 of the federal portion of GST HST to a maximum of 6 300 and the Ontario provincial rebate is equal to 75 of the Ontario portion of GST HST to a maximum of 24 000

How Much Hst On New Home In Ontario

How Much Hst On New Home In Ontario

https://storeys.com/media-library/image.jpg?id=50347935&width=980

Ontario Govt Helping More Ontario Students Become Doctors At Home In

https://thedesibuzz.com/wp-content/uploads/2023/04/image-29.png

Daily Routine In My New Home In Canada indianfamilyincanada2517

https://i.ytimg.com/vi/Y5hwmSIsVks/maxresdefault.jpg

Ontario New Housing Rebate The HST in Ontario is 13 in which GST is 5 and the provincial sales tax is 8 The amount of rebate you can receive for the GST Portion is 36 of the GST tax amount up to a maximum of 6 300 The only reason you are not eligible to claim a GST HST new housing rebate for some of the federal part of the HST is because the total price or fair market value of the house exceeds the applicable threshold The maximum Ontario new housing rebate amount that is available is 24 000

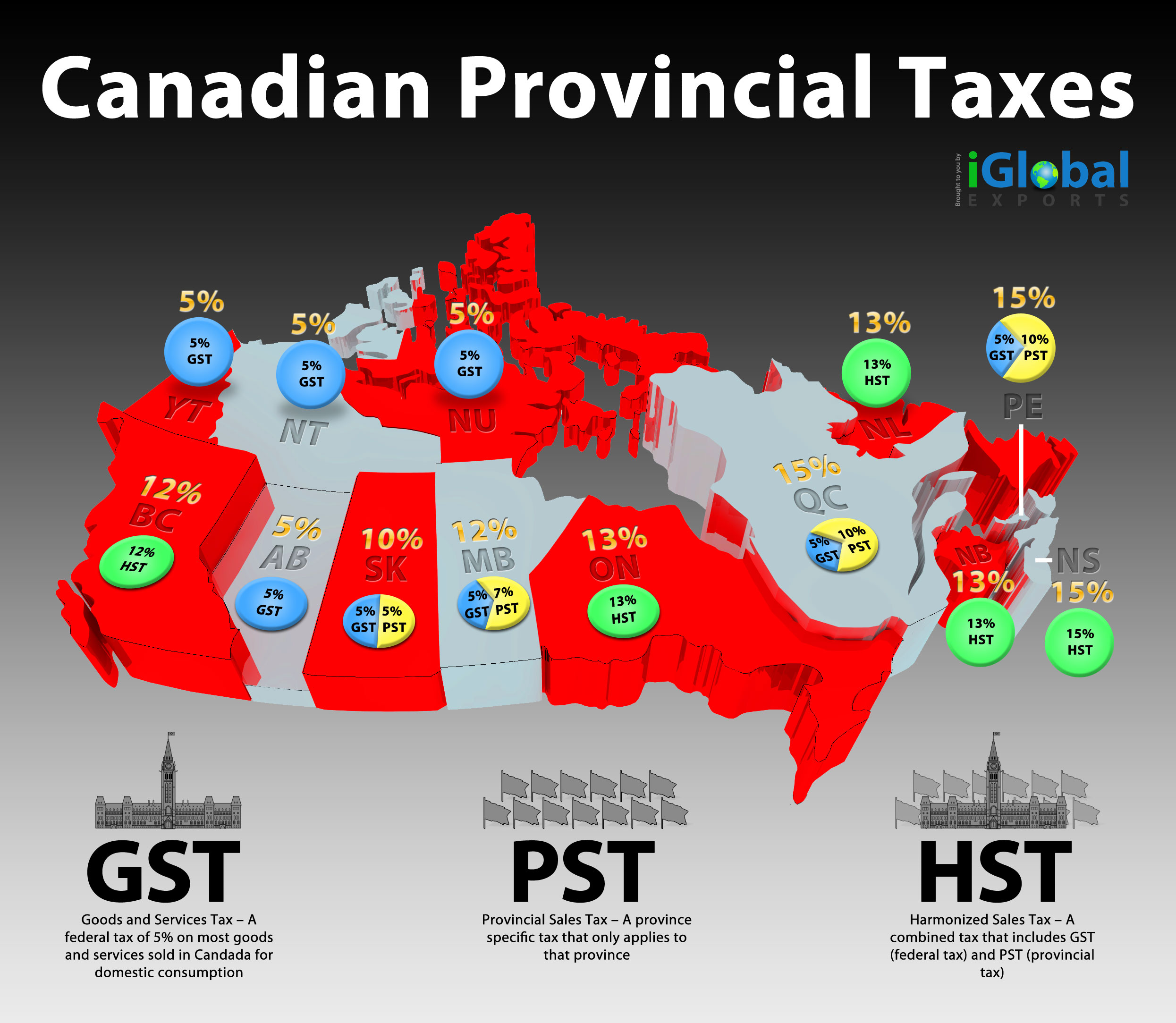

How much is the HST rebate Harmonized Sales Tax in Ontario adds up to 13 of a new home s purchase price a total of 5 GST and 8 PST The rebate program allows for new homebuyers to receive a significant portion of the HST back but there are maximum amount limits for the rebate GST HST and PST rates Province GST and HST PST Alberta 5 0 British Columbia 5 7 Manitoba 5 7 New Brunswick 15 N A Newfoundland and Labrador 15 N A Northwest Territories 5 0 Nova Scotia 15 N A Nunavut 5 0 Ontario 13 N A Quebec 5 9 975 Prince Edward Island 15 N A

Download How Much Hst On New Home In Ontario

More picture related to How Much Hst On New Home In Ontario

How Much Does It Cost To Buy A Home In Ontario Closing Costs

https://i.ytimg.com/vi/XVciTXjpSWw/maxresdefault.jpg

How Much HST Do You Pay On A New Home Sproule Associates

https://my-rebate.ca/wp-content/uploads/2021/11/image1-2-768x512.jpeg

How Much Does It Cost To Renovate A Whole House In Ontario

https://www.renovation-services-ontario.ca/wp-content/uploads/2023/04/How-much-does-it-cost-to-renovate-a-whole-house-in-Ontario-1536x864.jpg

500 000 purchase price x 5 GST in BC GST on new home purchase 25 000 If you bought a brand new condo of the same price in Toronto your HST would be calculated as 500 000 purchase price x 13 HST in ON HST on new home purchase 65 000 The HST amounts to 13 of the new property s purchase price The way the HST is charged on a new property depends on whether you are buying the house for personal use or rental Either way the rebate is applicable in both cases

Harmonized Sales Tax HST was implemented in Ontario in 2010 which raised the tax on new homes to 13 HST To help homeowners deal with the growing cost of buying a new home Canada Revenue Agency CRA introduced the HST rebate program to reimburse buyers for a portion of the additional new home tax The HST rebate can add up to a sizeable sum and mean upwards of a 30 000 difference to your bottom line To make it a little easier to understand the ins and outs of the HST rebate in Ontario for a new condo or house TheRedPin has broken down the facts around the rebate program

High Profile Podcast Finds New Home In Mid Missouri MIDPLAINS NEWS

https://einpresswire.images.worldnow.com/images/24769560_G.jpg?lastEditedDate=1689448220000

Ontario Scraps Its Portion Of HST On Purpose built Rentals

https://toronto.citynews.ca/wp-content/blogs.dir/sites/10/2023/11/01/housing-ontario-nov-1.jpg

https://www. canada.ca /.../new-housing-rebate.html

For houses located in Ontario you may be eligible to claim the Ontario new housing rebate if you are not eligible to claim the new housing rebate for some of the federal part of the HST only because the fair market value of the housing exceeds 450 000 An Ontario new housing rebate will be available up to the applicable maximum of 24 000

https:// buildersontario.com /hst-homes-ontario

For the provincial portion everyone can apply for up to 75 per cent of the HST paid to a maximum of 24 000 You can also apply for the rebates if you build your home as well It can add up to a sizeable sum If a new home costs 300 000 and there was no rebate the HST would be 13 per cent of the price or 39 000

Provincial Taxation In The Ur III State Cuneiform Monographs

High Profile Podcast Finds New Home In Mid Missouri MIDPLAINS NEWS

HST On New Construction In Ontario

Province Helping More Ontario Students Become Doctors At Home In

This Contemporary California Estate Features A Guest House

Buying A Home In Ontario Canada YouTube

Buying A Home In Ontario Canada YouTube

Ontario Is Removing HST On New Purpose Built Rentals

How To Choose An Ideal Housing Society For Your New Home

The Number Of Young Adults In Ontario Who Have Actually Bought A Home

How Much Hst On New Home In Ontario - Real Estate If you have done any of the following listed below you may be qualified for an HST rebate of up to 30 000 in Ontario Purchased a new condo Purchased a newly constructed home Contracted someone to build a house Converted a non residential property into a home Built a house Added a major addition to a home