How Much Income Is Tax Free In Germany Germany has progressive tax rates ranging as follows 2024 tax year Geometrically progressive rates start at 14 and rise to 42 The figures are adjusted on a regular basis Surcharges on income tax

Income tax rates in Germany Income tax in Germany is progressive Rates start at 14 and incrementally rise to 42 A top rate of 45 is also present for those with very high earnings The German government reviews income tax bands every year The bands for 2022 and 2023 are the following German income tax rates for 2022 The German tax free amount for singles in 2021 was 9 744 in this case Mr M ller is exempt from paying tax on the income earned Annual tax free amount in Germany basic tax free allowance Tax free income from Germany is included in the so called basic tax free allowance

How Much Income Is Tax Free In Germany

How Much Income Is Tax Free In Germany

https://i.ytimg.com/vi/x1ag5I8srTE/maxresdefault.jpg

How Much Is Tax free In Germany YouTube

https://i.ytimg.com/vi/dVrgVZGslBQ/maxresdefault.jpg

8 Reasons To Hire Someone To Help With Your Income Tax Planning Black

https://blackdiamondfs.com/wp-content/uploads/2021/08/taxfilingstatus.jpeg

The top income tax rate in Germany is 42 and applies in 2023 to incomes ranging from 62 810 to 277 826 Those earning more than 277 826 are taxed at the highest tax rate of 45 also known as the wealthy tax Approximately 4 million Germans currently pay the top tax rate Income tax in Germany If you earn money from employment or self employment you ll need to pay income tax The first 10 347 is your tax free allowance so you ll only pay tax on earnings above this amount German income tax rates are progressive starting at 14 and rising to 45 on the highest earnings

Taxable income of less than 10 908 is tax free for a single person 21 816 for a married couple Incomes from 10 909 28 816 up to 62 809 125 618 are taxes at a rate of 14 to 42 incomes from 68 810 Let s start with the basics what is the income tax in Germany based on When it comes to German tax income includes Employment earnings Money from trade and business Rental income Money made from investments All sorts of other sources of income like annuities and royalties

Download How Much Income Is Tax Free In Germany

More picture related to How Much Income Is Tax Free In Germany

How To Calculate Income Tax On Salary With Example

https://razorpay.com/learn-content/uploads/2022/02/Facebook-post-16-1024x538.png

Tax Rate Tax Free Income In Germany Explained How Much Taxes Are You

https://i.ytimg.com/vi/sj5Xi5WFiqc/maxresdefault.jpg

Tax Payment Which States Have No Income Tax Marca

https://phantom-marca.unidadeditorial.es/7f630bcfa3cc4f2b33db1ffa28dd66ab/resize/1200/f/jpg/assets/multimedia/imagenes/2023/02/05/16756118713316.jpg

If you earn money in Germany you are required to pay tax on your income The German tax system operates a progressive tax rate in which the tax rate increases with taxable income Most people will pay income tax through payroll deductions by their employer Payroll taxes and levies in Germany Income tax Einkommensteuer Lohnsteuer on wages in Germany ranges from 14 to 45 However tax is only paid on the amount that exceeds the non taxable minimum of 9 744 per year for a single person or 18 816 per year for a married couple

Basic tax free allowance The basic tax free allowance Grundfreibetrag ensures that you only pay income tax on your annual income above a certain threshold In 2021 the basic tax free allowance is 9 744 euros In the graphic below you can see how the tax free allowance Grundfreibetrag gets assigned per tax class In 2024 the allowance is 11 604 euros It increases every year Any income until that threshold is tax free in Germany Tax classes 1 4 consider the basic tax free allowance

Income Tax Number Registration Steps L Co

https://landco.my/wp-content/uploads/2022/04/Income-tax-number-steps-1-1-1024x1024.png

Federal Income Tax Brackets 2021 Vs 2022 Orangerilo

https://federalwithholdingtables.net/wp-content/uploads/2021/07/federal-income-tax-brackets-released-for-2021-has-yours-1.png

https://taxsummaries.pwc.com/germany/individual/...

Germany has progressive tax rates ranging as follows 2024 tax year Geometrically progressive rates start at 14 and rise to 42 The figures are adjusted on a regular basis Surcharges on income tax

https://www.expatica.com/de/finance/taxes/income...

Income tax rates in Germany Income tax in Germany is progressive Rates start at 14 and incrementally rise to 42 A top rate of 45 is also present for those with very high earnings The German government reviews income tax bands every year The bands for 2022 and 2023 are the following German income tax rates for 2022

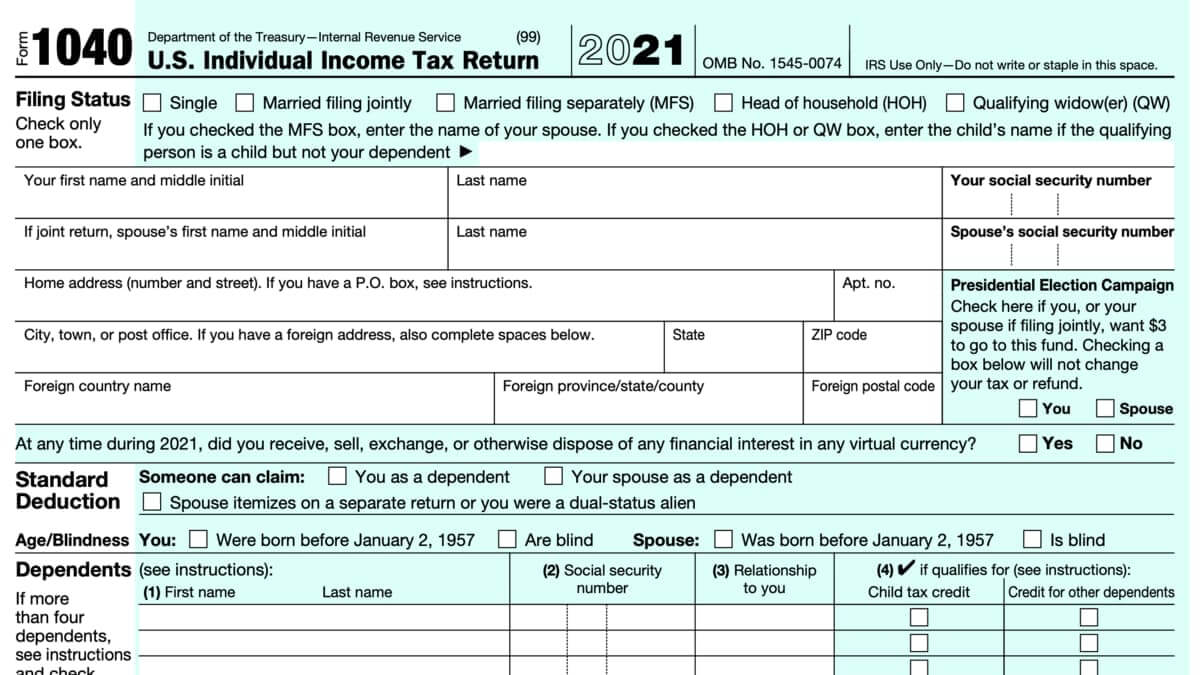

1040 Form 2022

Income Tax Number Registration Steps L Co

Budget 2022 Different Types Of Taxable Incomes Income Tax Slab Rates

Annual Federal Withholding Calculator KerstinKeisha

Life Of Tax How Much Tax Is Paid Over A Lifetime Self

What is taxable income Financial Wellness Starts Here

What is taxable income Financial Wellness Starts Here

From withholding Tax To adjusted Gross Income Tax Season Terms For

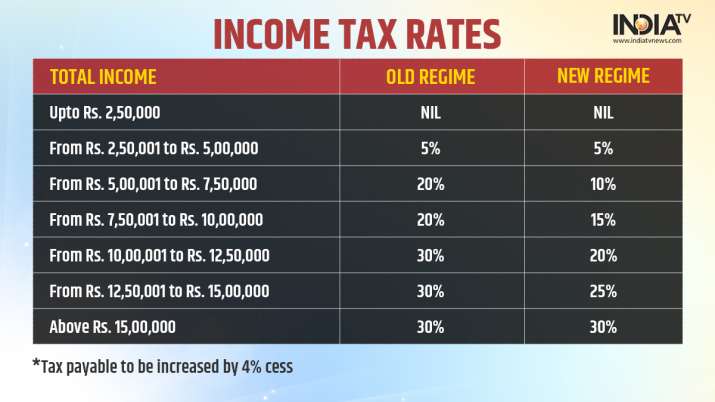

Income Tax Rates For Fy 2021 22 How To Choose Between Old Regime And

PDF Checklist German Income Tax Return Mst tax PDF FileChecklist

How Much Income Is Tax Free In Germany - The top income tax rate in Germany is 42 and applies in 2023 to incomes ranging from 62 810 to 277 826 Those earning more than 277 826 are taxed at the highest tax rate of 45 also known as the wealthy tax Approximately 4 million Germans currently pay the top tax rate