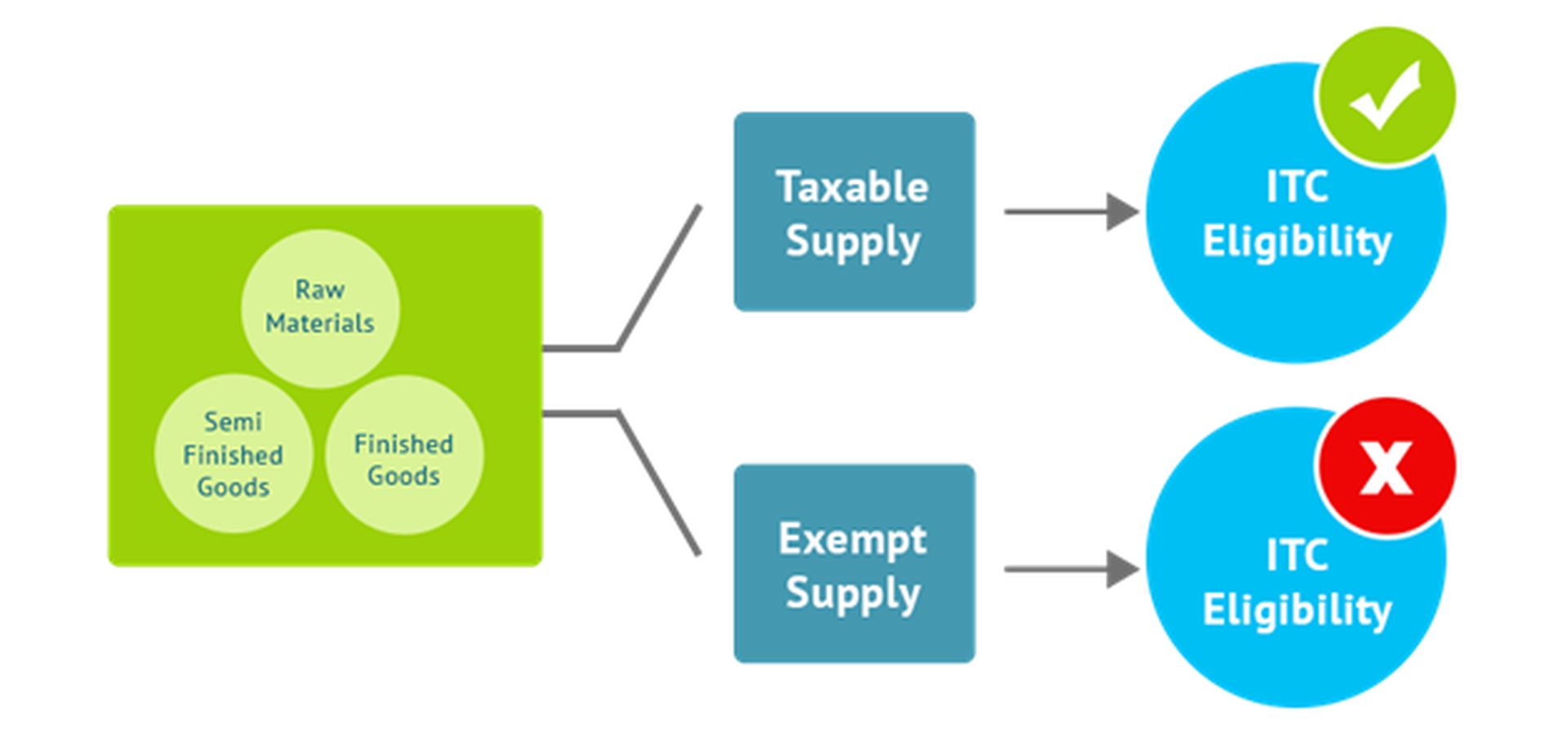

How Much Input Tax Credit Can I Claim Input Tax Credit ITC in GST allows taxable persons to claim tax paid on goods services used for business Conditions are essential to claim ITC seen in updated rules and law amendments

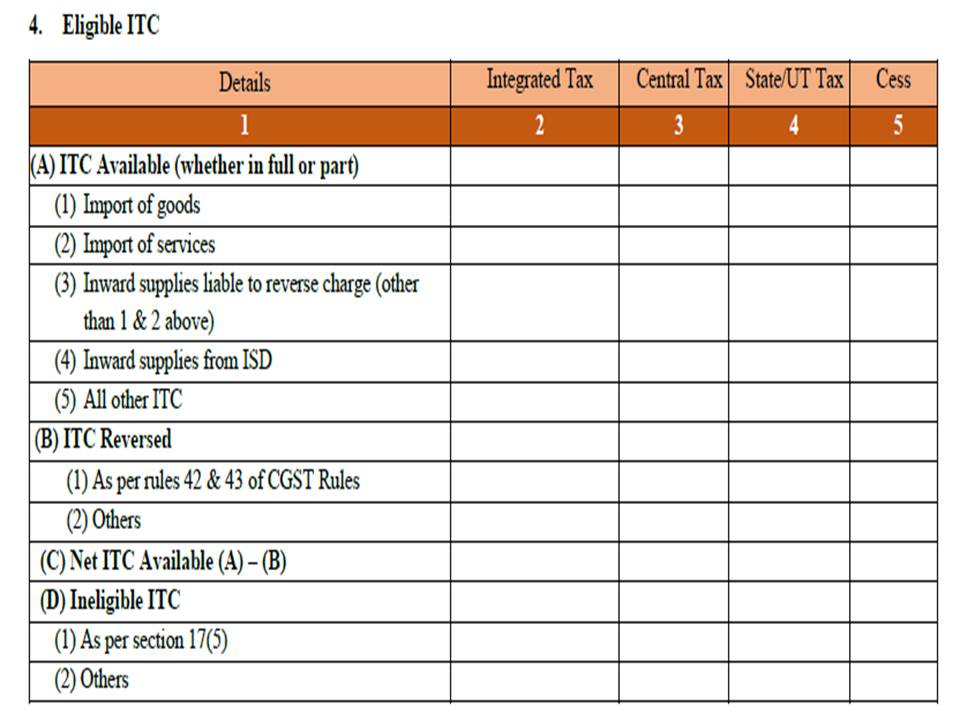

As a GST HST registrant you recover the GST HST paid or payable on your purchases and expenses related to your commercial activities by claiming input tax The following charts identify the different percentages of the amount of GST HST paid or payable you can claim as an ITC on most operating expenses that

How Much Input Tax Credit Can I Claim

How Much Input Tax Credit Can I Claim

https://i.ytimg.com/vi/pDMQR1e2g4w/maxresdefault.jpg

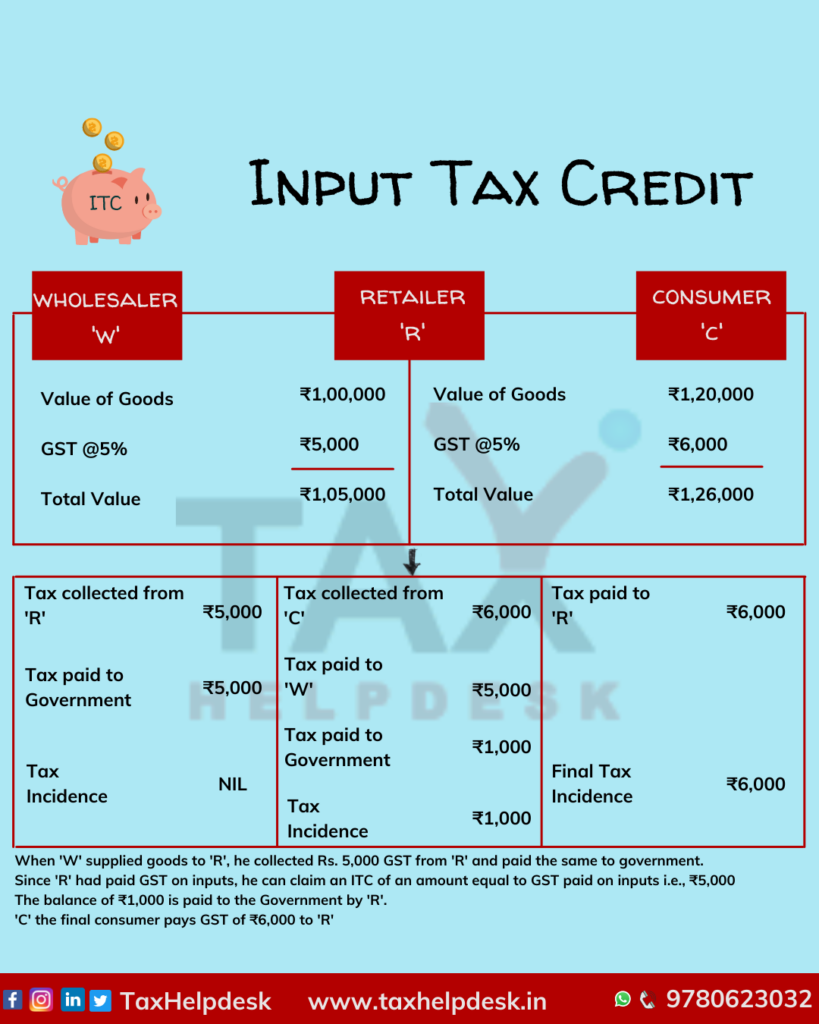

How To Claim Input Tax Credit Eligibility Requirements TaxHelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2020/10/Input-Tax-Credit-1024x493.png

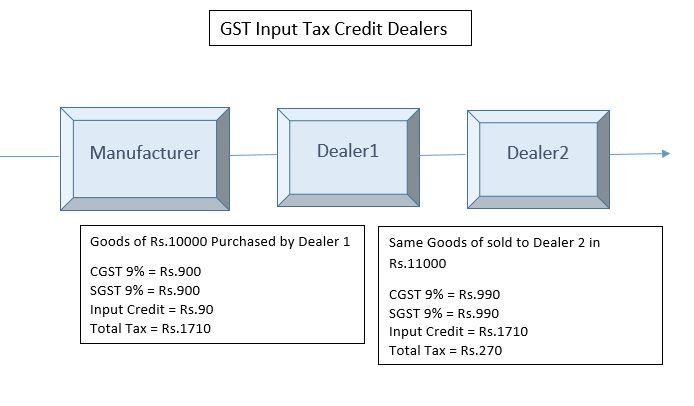

Understanding On Input Tax Credit Mechanism Under GST Administration

https://corpbiz.io/learning/wp-content/uploads/2021/02/ITC-in-GST-and-the-Persons-Eligible-to-Claim-under-Input-Tax-Credit-Mechanism.png

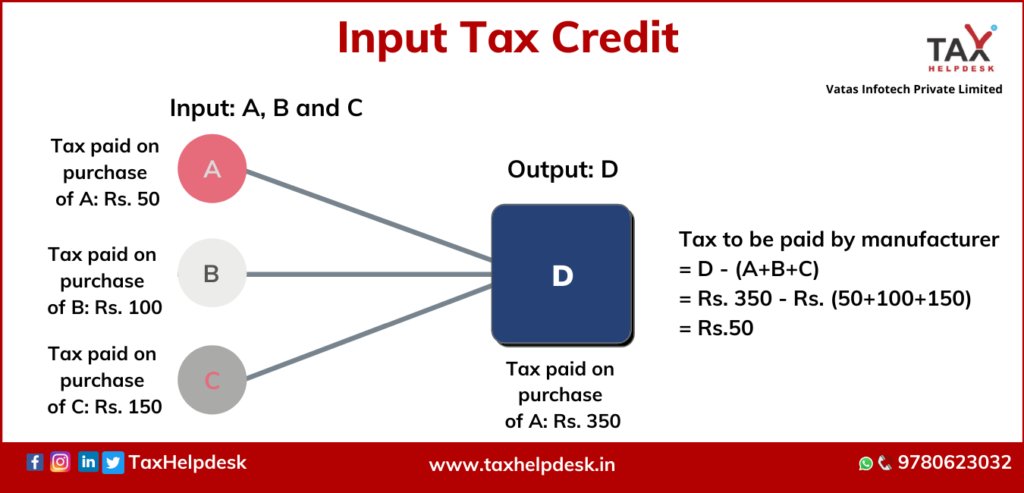

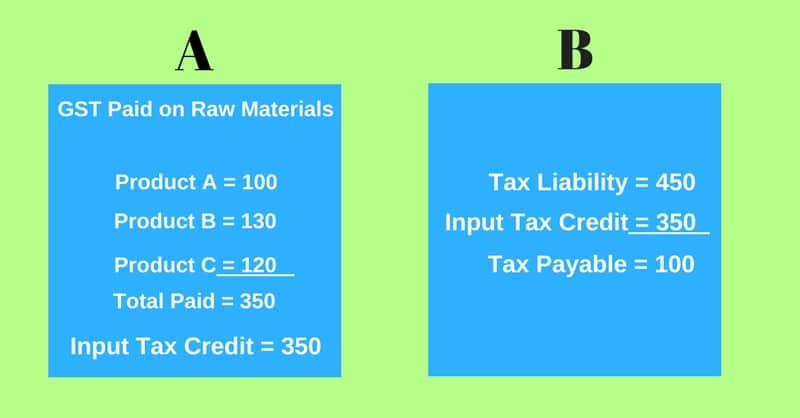

You can claim input credit of Rs 300 and deposit only Rs 150 in taxes You must have a tax invoice to claim a GST credit for purchases that cost more than A 82 50 including GST Your supplier has 28 days to provide you with a tax invoice

Reconciling your estimates of GST credits For each tax period under review you must compare your total GST credit entitlement to the amount of GST credits that Input tax credit refers to payment of tax which can be reduced if you have already paid tax on inputs Input tax credit is vital feature of GST Goods and Service Tax regime Input tax credit was introduce to eradicate

Download How Much Input Tax Credit Can I Claim

More picture related to How Much Input Tax Credit Can I Claim

Input Tax Credit Under GST A Guide On ITC Claim

https://swaritadvisors.com/learning/wp-content/uploads/2020/07/itc.jpg

Input Tax Credit Guide Under GST Calculation With Examples

https://blog.saginfotech.com/wp-content/uploads/2017/06/input-tax.jpg

All About Input Tax Credit Under GST

https://www.caclubindia.com/editor_upload/2231891_20211125160155_infographic_21.png

You can claim a credit for any GST included in the price of any goods and services you buy for your business This is called a GST credit or an input tax credit a credit for When you buy something for your business you re usually charged GST If you re registered for GST you can claim that back You do this by claiming a GST tax credit when lodging your business activity

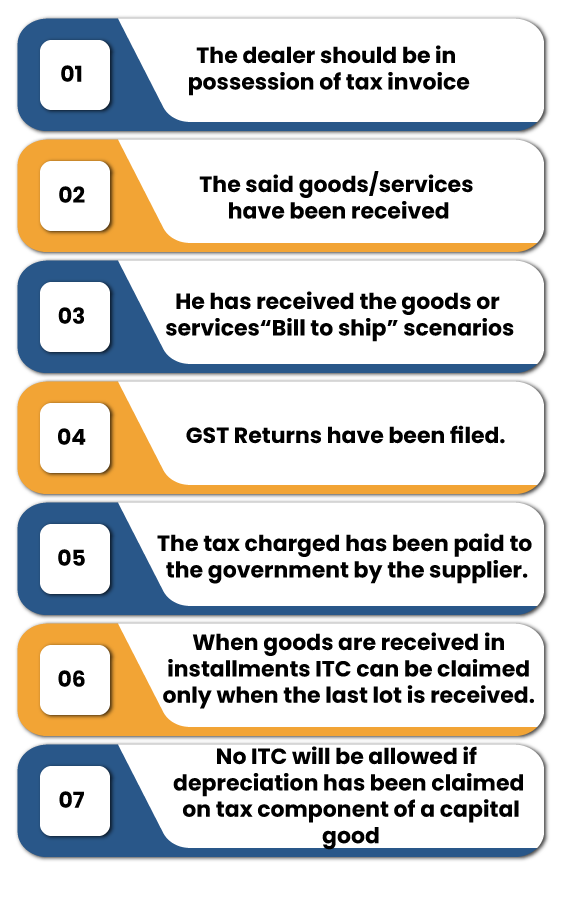

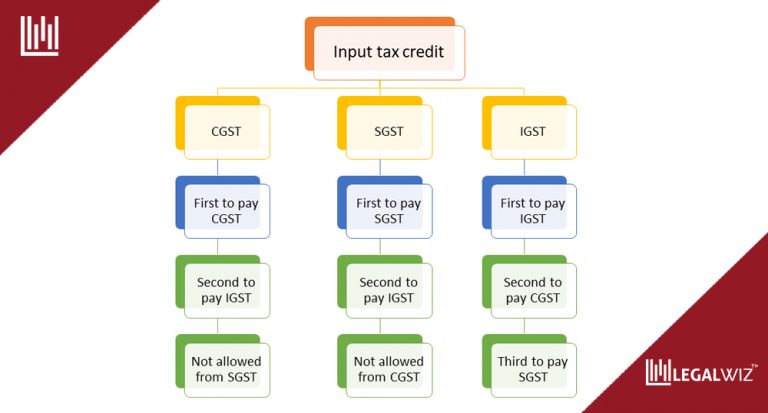

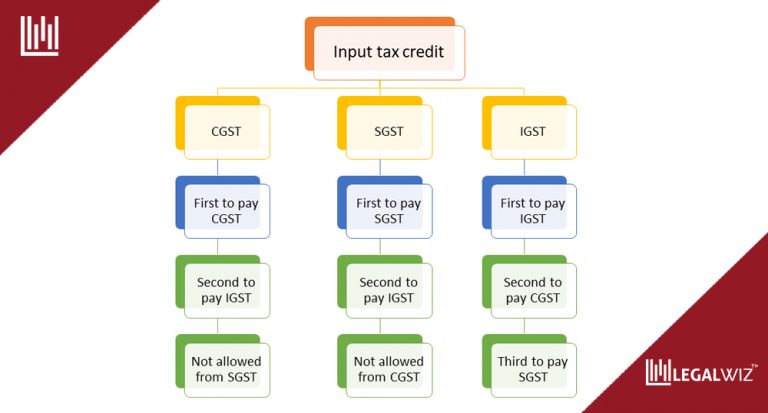

Under GST Input Tax Credit can be claimed irrespective of place of supplier thus making accessibility for sales and purchase of goods easier Let us now The recipient must file the GST returns for availing credit of eligible input tax Thus ensuring that the above conditions are met is essential enabling the recipient

What Is Input Tax Credit In GST And How To Claim It Fun Uploads

https://funuploads.com/blog/wp-content/uploads/2020/10/Input-tax-credit-768x413.jpg

Input Tax Credit ITC In GST Meaning How To Claim It And Examples

https://www.tickertape.in/blog/wp-content/uploads/2022/02/TT-23-Feb-22-Input-Tax-Credit-BB.jpg

https://cleartax.in/s/input-tax-credit-und…

Input Tax Credit ITC in GST allows taxable persons to claim tax paid on goods services used for business Conditions are essential to claim ITC seen in updated rules and law amendments

https://www.canada.ca/en/revenue-agency/services/...

As a GST HST registrant you recover the GST HST paid or payable on your purchases and expenses related to your commercial activities by claiming input tax

Input Tax Credit Know How Does It Work

What Is Input Tax Credit In GST And How To Claim It Fun Uploads

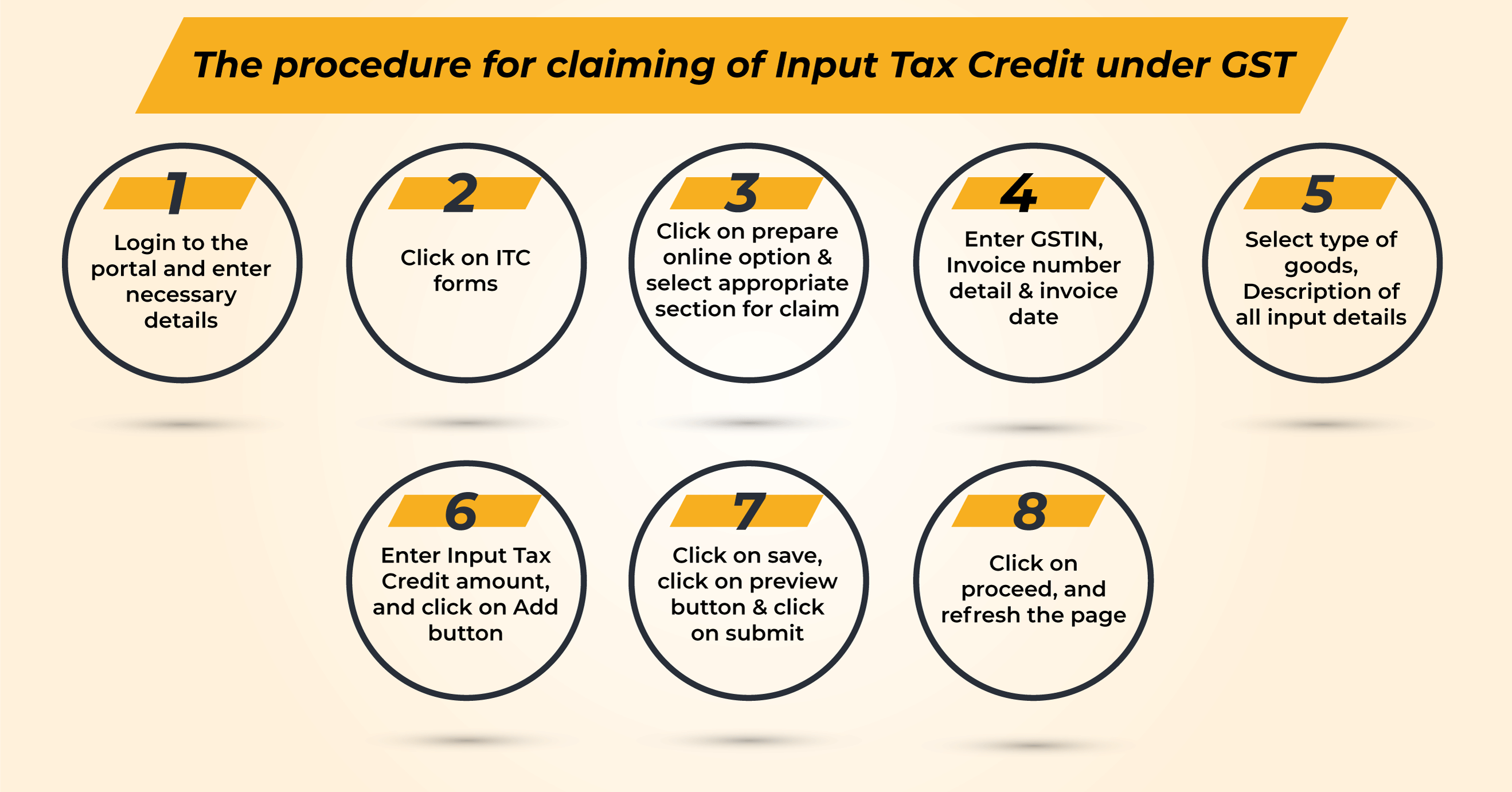

Input Tax Credit ITC Under GST How To Claim It

What Is Input Tax Credit In GST YourSelfQuotes

What GST Input Tax Credit How To Claim It

What Is Input Tax Credit ITC Under GST Accoxi

What Is Input Tax Credit ITC Under GST Accoxi

What Is The Concept Of Input Tax Credit And Who Can Claim It

How To Claim Input Tax Credit For Your Business Travel AtYourPrice

What Is Input Tax Credit Or ITC Under GST ExcelDataPro

How Much Input Tax Credit Can I Claim - Any business that has correctly paid their GST HST can claim for input tax credits But within the business only the named recipient of the supply can be entitled to