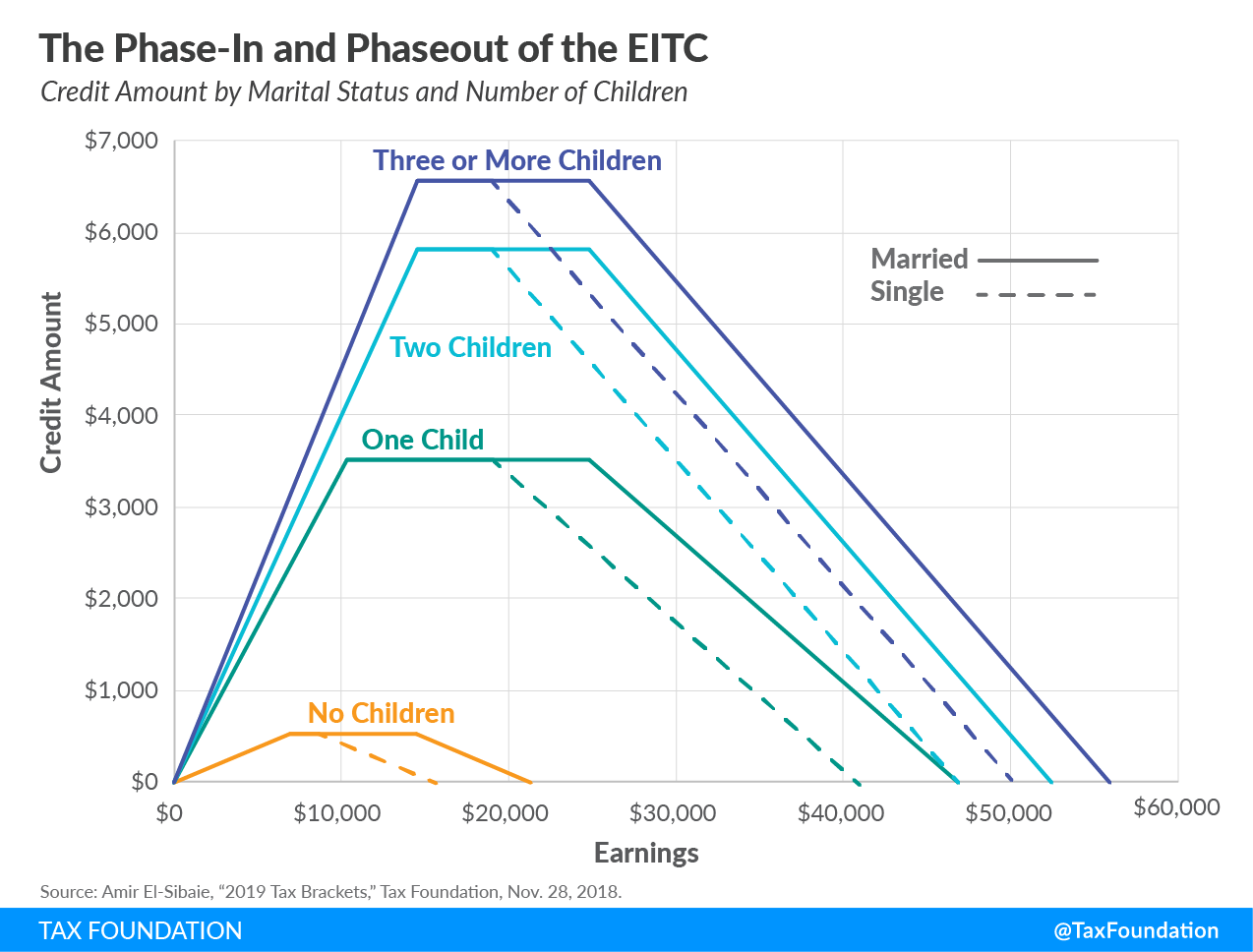

How Much Is Eitc Tax Credit Verkko 9 marrask 2023 nbsp 0183 32 For 2023 tax returns filed in 2024 the tax credit ranges from 600 to 7 430 depending on tax filing status income and number of children Taxpayers without children can qualify for a

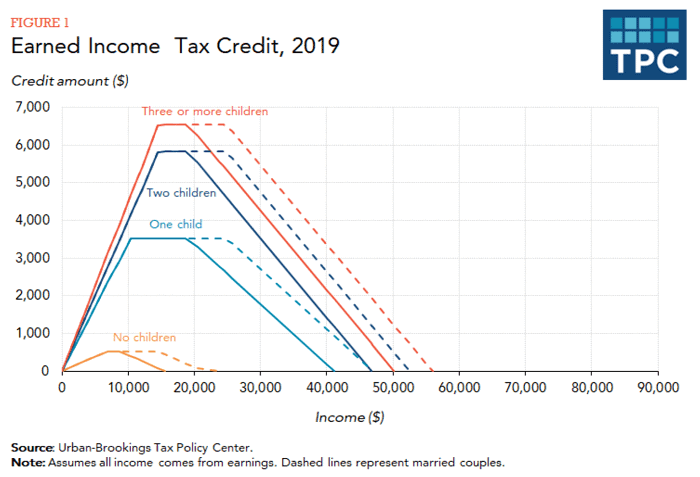

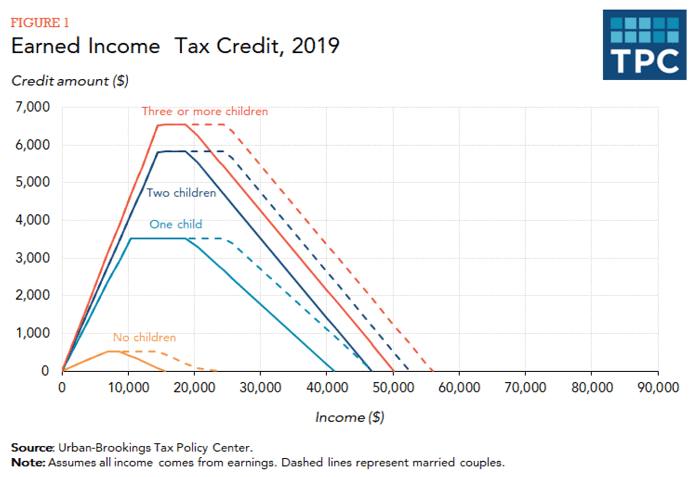

Verkko Upon enactment the EITC gave a tax credit to individuals who had at least one dependent maintained a household and had earned income of less than 8 000 during the year The tax credit was 400 for individuals with earned income of less than 4 000 Verkko 20 syysk 2023 nbsp 0183 32 If you re a low to moderate income worker find out if you qualify for the Earned Income Tax Credit EITC and how much your credit is worth The Earned Income Tax Credit EITC helps low to moderate income workers and families get a

How Much Is Eitc Tax Credit

How Much Is Eitc Tax Credit

https://i.ytimg.com/vi/Iqv37RnXnAY/maxresdefault.jpg

Earned Income Tax Credit 2020 What You Need To Know

https://youngandtheinvested.com/wp-content/uploads/earned-income-tax-credit-chart-tax-policy-center-2019.png

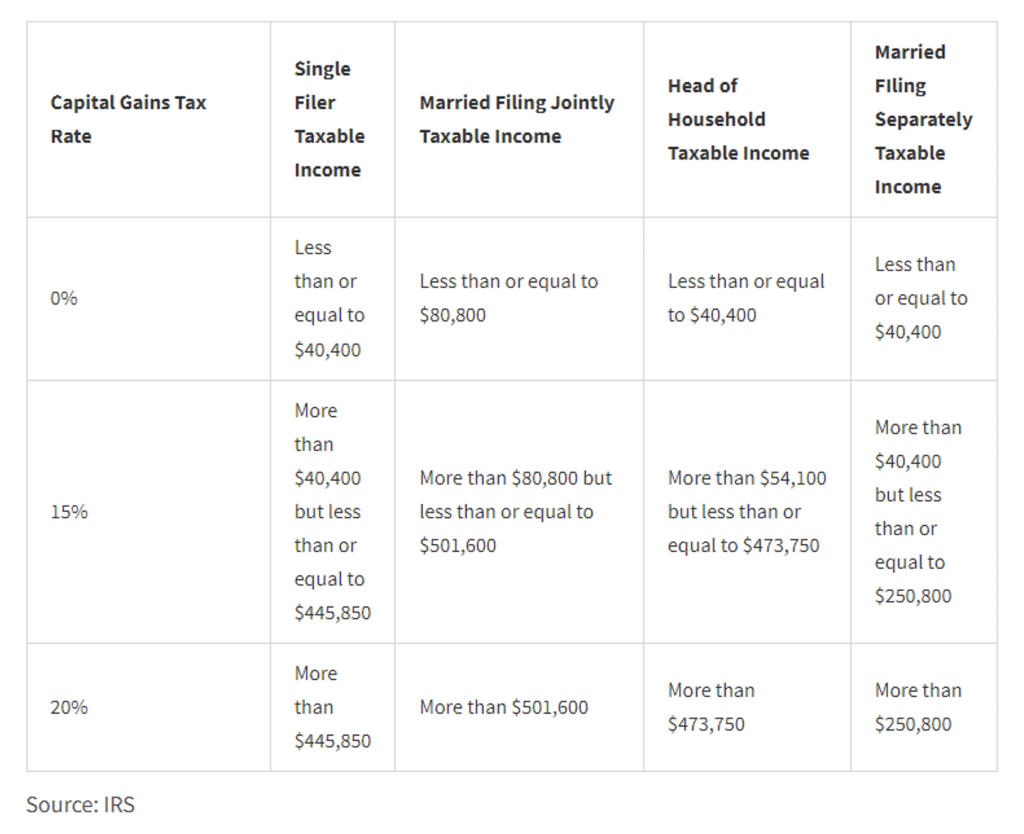

11 MMajor Tax Changes For 2022 Pearson Co CPAs

https://www.pearsoncocpa.com/wp-content/uploads/2022/05/Screen-Shot-2022-05-17-at-11.23.12-PM-1024x834.png

Verkko 18 jouluk 2023 nbsp 0183 32 The earned income tax credit EITC is a refundable tax credit that helps certain U S taxpayers with low earnings by reducing the amount of tax owed on a dollar for dollar basis Verkko 27 marrask 2023 nbsp 0183 32 For tax year 2023 meaning the return you file in 2024 you may qualify for the credit if your income is less than about 63 400 Eligible workers with dependents may see a boost in their EITC

Verkko 11 jouluk 2023 nbsp 0183 32 Income Limits and Amount of EITC for additional tax years See the earned income and adjusted gross income AGI limits maximum credit for the current year previous years and the upcoming tax year Page Last Verkko The key is that those who qualify for the EITC must file a tax return to claim the credit This year due to changes that apply to the 2021 tax year the EITC is worth as much as 6 728 for a family with three or more qualifying children with valid social security numbers or up to 1 502 for taxpayers eligible for the self only EITC

Download How Much Is Eitc Tax Credit

More picture related to How Much Is Eitc Tax Credit

See The EIC Earned Income Credit Table Income Tax Return Income

https://i.pinimg.com/originals/aa/af/be/aaafbed0a4b639f5c32ede742b5dd17b.png

Applied Sciences Free Full Text Machine Learning Based On

https://pub.mdpi-res.com/applsci/applsci-11-10004/article_deploy/html/images/applsci-11-10004-g001.png?1635247744

.png)

News Events Project EITC Outreach Financial Planning Housing

https://www.fcs.uga.edu/images/uploads/images/EITC_Logo_(1).png

Verkko Resources Use these additional resources to stay informed about refundable credits and how to claim them Where s My Refund Get the status of your refund News and Updates for Paid Preparers Learn the rules to properly prepare refundable credit claims Divorced and Separated Parents Help divorced or separated parents claim the EITC Verkko How to Claim the Earned Income Tax Credit EITC Internal Revenue Service How to Claim the Earned Income Tax Credit EITC To claim the Earned Income Tax Credit EITC you must qualify and file a federal tax return Your Refund If you claim the EITC your refund may be delayed

Verkko 17 maalisk 2023 nbsp 0183 32 View previous year statistics of tax returns by state with the Earned Income Tax Credit EITC 2020 EITC Tax Returns by State Processed in 2021 As of December 2021 25 million workers and families received about 60 billion in EITC The average amount of EITC received nationwide was about 2 411 Verkko 24 maalisk 2022 nbsp 0183 32 For taxes filed in 2022 the maximum credit workers can claim ranges from 1 502 to 6 728 But even if you don t have a child you can still qualify for the credit

What Families Need To Know About The CTC In 2022 CLASP

https://www.clasp.org/wp-content/uploads/2022/04/CTC20_f202220Infographic_final_crop.png

NYS Can Help Low income Working Families With Children By Increasing

http://fiscalpolicy.org/wp-content/uploads/2014/05/EITC-table.png

https://www.nerdwallet.com/.../taxes/can-you-take-earned-income-tax-cr…

Verkko 9 marrask 2023 nbsp 0183 32 For 2023 tax returns filed in 2024 the tax credit ranges from 600 to 7 430 depending on tax filing status income and number of children Taxpayers without children can qualify for a

https://en.wikipedia.org/wiki/Earned_income_tax_credit

Verkko Upon enactment the EITC gave a tax credit to individuals who had at least one dependent maintained a household and had earned income of less than 8 000 during the year The tax credit was 400 for individuals with earned income of less than 4 000

The Earned Income Tax Credit EITC Refund Schedule For 2022 2023

What Families Need To Know About The CTC In 2022 CLASP

Irs Tax Brackets 2024 Calculator Evvie Wallis

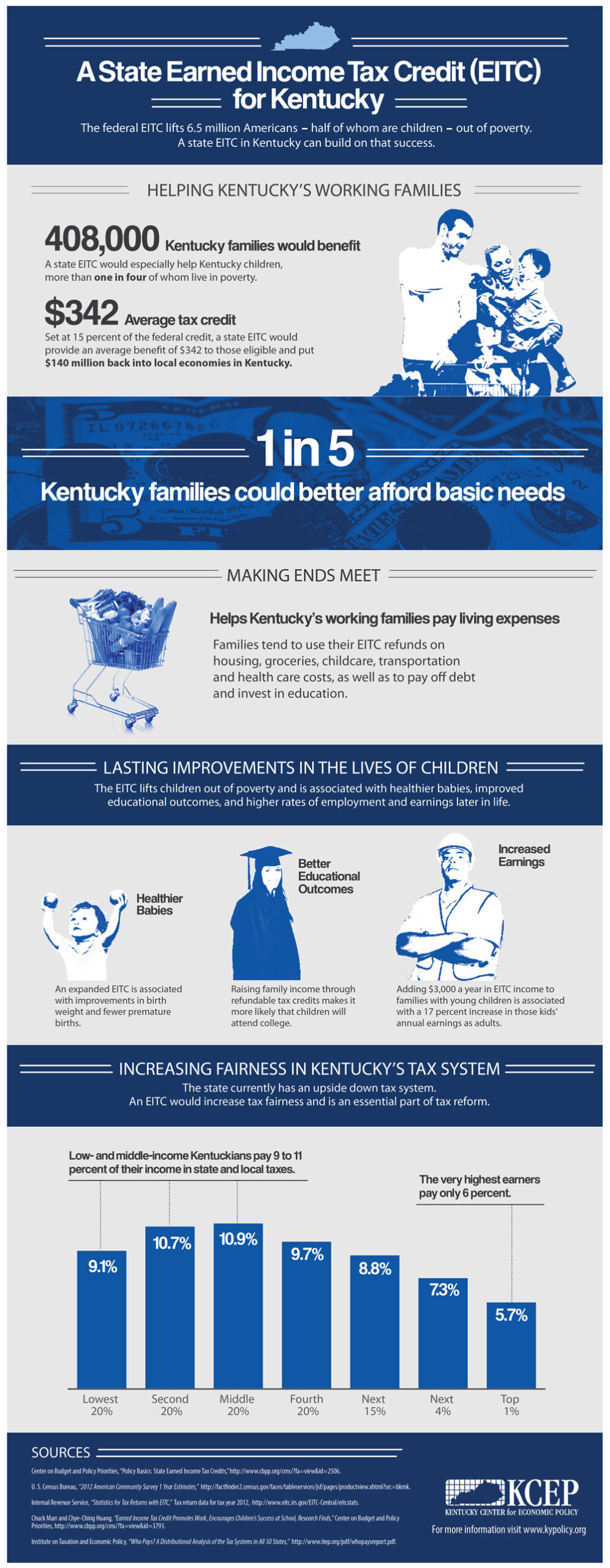

Infographic A State Earned Income Tax Credit EITC For Kentucky

What Is The Earned Income Tax Credit

New 2023 Tax Brackets Top FAQs Of Tax Jan 2023

New 2023 Tax Brackets Top FAQs Of Tax Jan 2023

Treasury Audit Highlights The Need For Clearer Eligibility Guidelines

What Is The Earned Income Tax Credit Tax Policy Center

What Is The Earned Income Tax Credit EITC Tax Policy Center

How Much Is Eitc Tax Credit - Verkko The key is that those who qualify for the EITC must file a tax return to claim the credit This year due to changes that apply to the 2021 tax year the EITC is worth as much as 6 728 for a family with three or more qualifying children with valid social security numbers or up to 1 502 for taxpayers eligible for the self only EITC