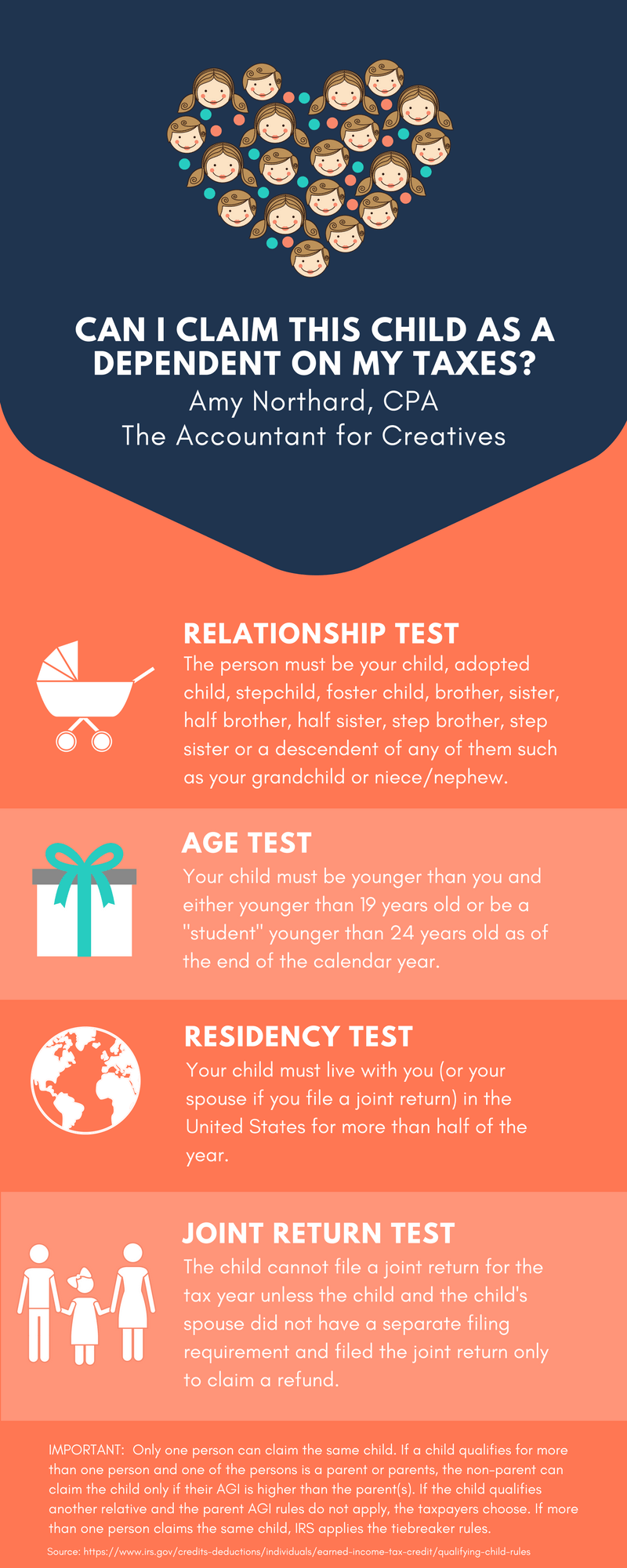

How Much Is Family Tax B The amount of Family Tax Benefit FTB Part A you get depends on your family s income Income test for FTB Part B Family Tax Benefit Part B is for single parents or carers and

How much Family Tax Benefit Part B can I receive The amount of FTB Part B you may receive depends on the age of your youngest child and your income We pay Family Tax Benefit FTB Part A for each eligible child We work out your payment rate by doing both of the following using your adjusted taxable income and an income

How Much Is Family Tax B

How Much Is Family Tax B

https://www.taxprofessionals.com/uploads/news-pictures/266-poughkeepsie-blog-post-image-20160201081101.jpg

How To Claim The Family Tax Benefit One Accountancy

https://oneaccountancy.com.au/wp-content/uploads/2022/09/Lodgment-Reminder-Family-Tax-Benefit-Recipients-e1663163157328.png

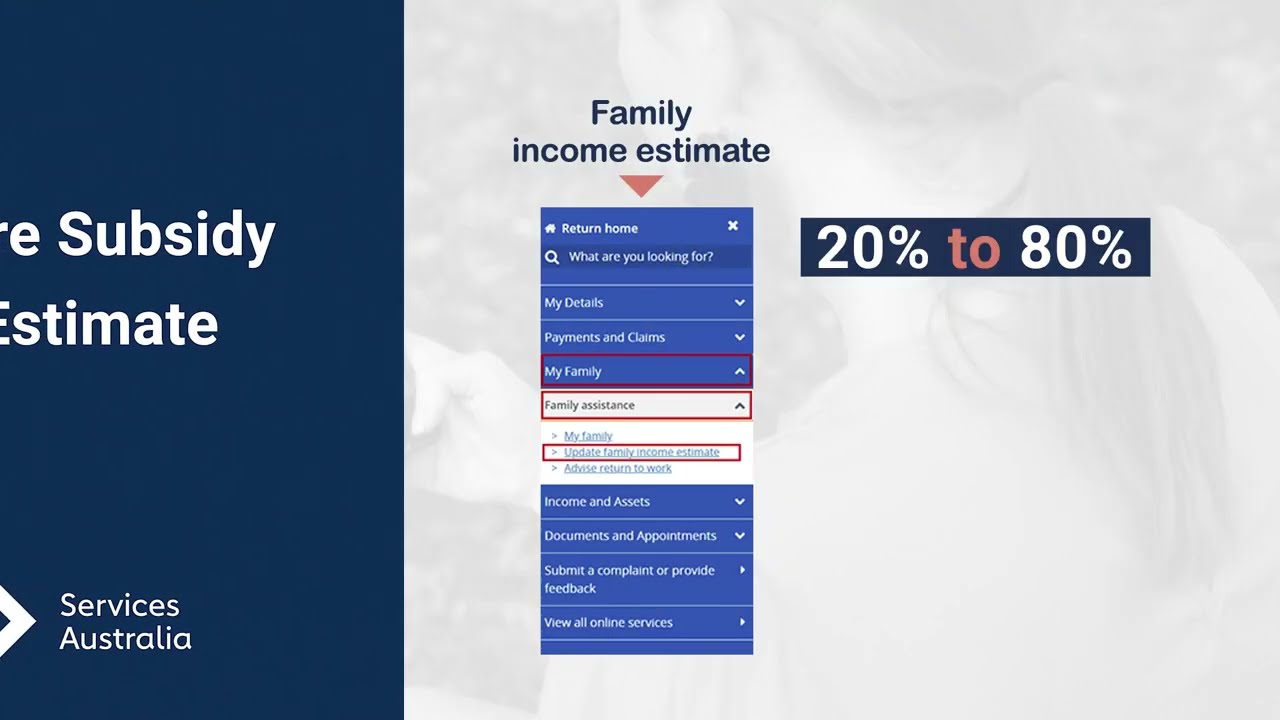

Child Care Subsidy Income Estimate YouTube

https://i.ytimg.com/vi/2AgLUdh9nOw/maxresdefault.jpg

Family Tax Benefit FTB is a payment from Services Australia Who can get it To get this you must have a dependent child or full time secondary student aged 16 Family Tax Benefit FTB is a 2 part payment for eligible families to help with the cost of raising children The Family Tax Benefit is made up of 2 parts Part A a payment

The FTB Part B supplement is part of the maximum rate and base rate of FTB Part B The current maximum FTB Part B supplement is 448 95 per family The Family Tax Benefit FTB is a payment that helps eligible families with the cost of raising children It is made up of two parts FTB Part A is paid per child and the

Download How Much Is Family Tax B

More picture related to How Much Is Family Tax B

Does The Family Tax Benefit Count As Income

https://production-content-assets.ratecity.com.au/20221118/family-taxes-zQdx3mCFx.jpg

Understanding The Family Tax Benefit TaxLeopard

https://taxleopard.com.au/wp-content/uploads/family-tax-benefit.jpeg

Single parenting payment 2 TeachingBrave

https://teachingbrave.com/wp-content/uploads/2023/04/Single-parenting-payment-2.jpg

What are the rates for the Family Tax Benefit Part A and Family Tax Benefit Part B in 2022 Find out about eligibility and how to claim FTB Part A helps with the cost of raising children It is paid to a parent guardian carer including foster carer eligible grandparent or approved care organisation To be

The maximum rate per family for Family Tax Benefit B is 161 41 per fortnight when your youngest child is aged 0 5 years old and 112 56 when your youngest child is 5 18 years of age It s important to Family Tax Benefit Part A will increase by up to 204 40 per year for families with a child under 13 years and 255 50 per year for those with a child 13

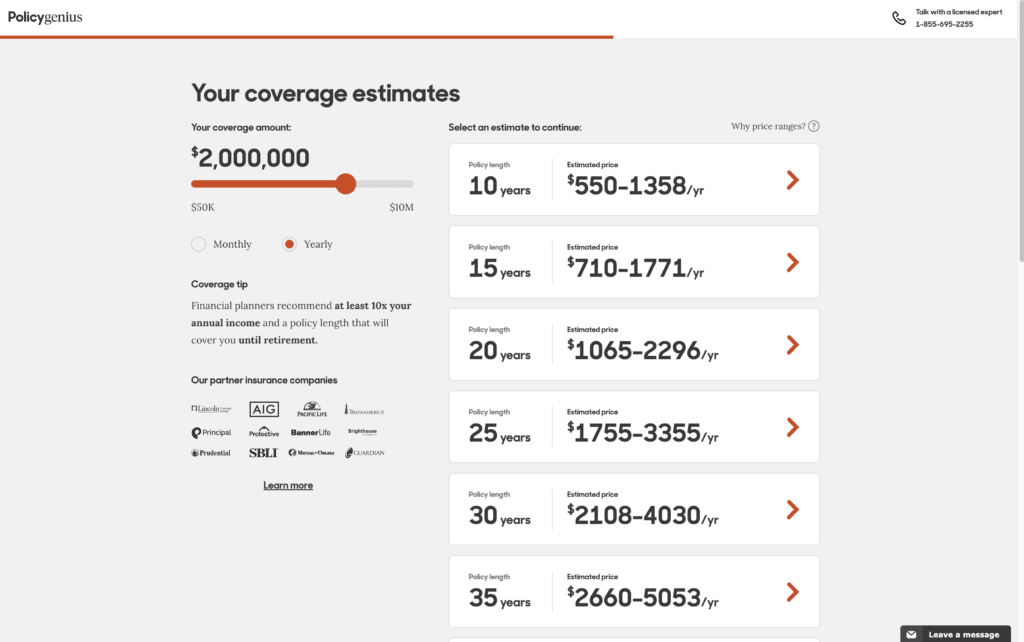

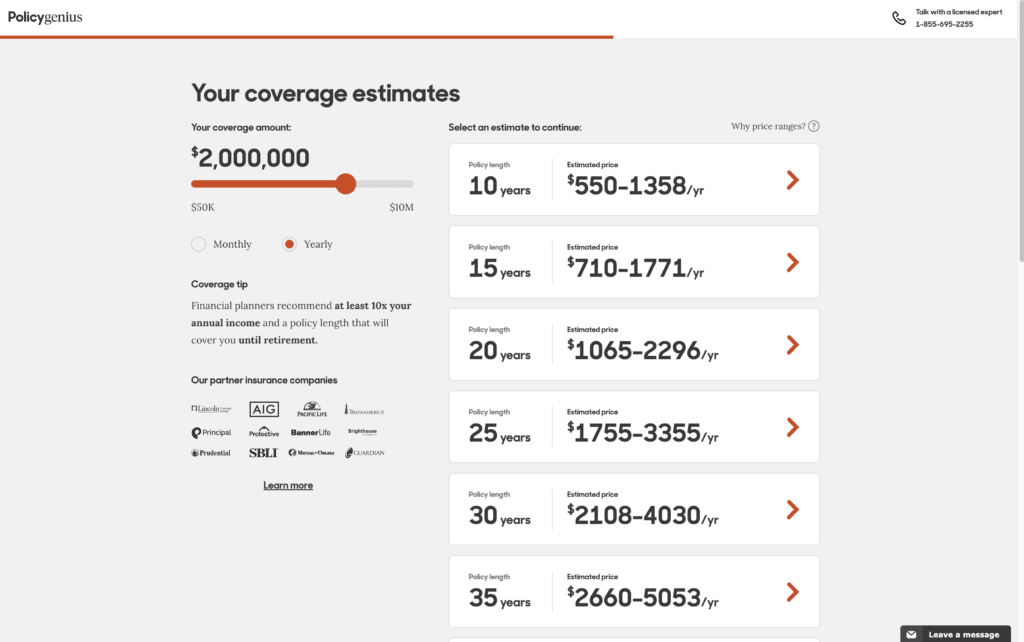

How Much Is 2 Million Life Insurance

https://www.goodfinancialcents.com/wp-content/uploads/2022/04/Cost-of-2-Million-Life-Insurane-with-Policy-Genius-Annual-pay-1024x642.png

.jpg)

What Are Working For Families Tax Credits CareforKids co nz

https://www.careforkids.co.nz/articles/assets/2018-04-10-10-47-28-shutterstock_357403964-(1).jpg

https://www.servicesaustralia.gov.au/how-much...

The amount of Family Tax Benefit FTB Part A you get depends on your family s income Income test for FTB Part B Family Tax Benefit Part B is for single parents or carers and

https://www.careforkids.com.au/blog/family-tax...

How much Family Tax Benefit Part B can I receive The amount of FTB Part B you may receive depends on the age of your youngest child and your income

New Family Tax Credits What You Need To Know Catalyst Kids

How Much Is 2 Million Life Insurance

How Much Is Family Tax Benefit

Claim For An Annual Lump Sum Payment Of Family Tax Benefit

What Is Family Tax Recovery Canadian Tax Refunds

Family Tax Benefit PART A PART B Care For Kids

Family Tax Benefit PART A PART B Care For Kids

Family Tax Credit For Other Dependents H R Block

5 Things You Should Know About The Child And Dependent Care Tax Credit

Family Tax Benefits FTB Payment Rates Toddle

How Much Is Family Tax B - Family Tax Benefit FTB is a payment that helps eligible families with the cost of raising children It is made up of two parts FTB Part A is paid per child and the