How Much Is Gst Rebate In Bc Payment process If you re eligible and have an annual credit amount of more than 40 you ll receive payments every July October January April Each payment is combined with the federal goods and services tax harmonized sales tax GST HST credit into one payment Generally payments are made on the fifth day of the month

The grocery rebate was introduced in the 2023 federal budget to provide targeted inflation relief to Canadians This amount is combined with the quarterly payment of the federal GST HST credit The BC climate action tax credit is GST After Rebate 21 000 1 890 19 110 Purchase Price GST GST Rebate 439 110 Keep in mind that if you are claiming the rebate in BC you must pay GST in full at the time of completion and can t include the GST amount in your mortgage To be eligible for the GST New Housing Rebate the individual must have

How Much Is Gst Rebate In Bc

How Much Is Gst Rebate In Bc

https://www.blackcanadianmedia.ca/wp-content/uploads/2022/09/gdt.png

![]()

NEW HOME GST REBATE CALCULATOR 2022 GST On Real Estate In BC

https://sp-ao.shortpixel.ai/client/to_webp,q_glossy,ret_img,w_550,h_367/https://www.merylhamdillah.com/wp-content/uploads/2019/10/pggy-calc.jpg

How Much GST HST Do I Pay And Charge Per Province

https://webtaxonline.ca/wp-content/uploads/2018/07/How-much-GST2FHST-do-I-pay_-copy.jpg

The maximum you can receive from the GST HST credit until the end of the payment period June 2024 is 496 if you re single 650 if you re married or have a common law partner 171 for each child under the age of 19 How is the GST HST credit calculated GST HST credit payments are calculated using your tax return from the previous year How much is the GST in BC The GST is a Federal tax of 5 on the purchase price of a new home or a substantially renovated home New home buyers can apply for a rebate of up to a maximum of 36 of the tax if the purchase price is 350 000 or less A partial GST rebate is available for new homes costing between 350 000 and 450 000

GST Partial Rebate Calculation Full GST Rebate of 6 300 x 450 000 400 000 100 000 3 150 GST After Rebate 20 000 3 150 16 850 Purchase Price GST GST Rebate 416 850 EXAMPLE Assuming your purchase price is 355 000 which is more than 350 000 and less than 450 000 the GST rebate would be calculated using the following formula get ready for some high school math 6 300 x 450 000 the purchase price 100 000 6 300 x 450 000 355 000 100 000 5 985 00

Download How Much Is Gst Rebate In Bc

More picture related to How Much Is Gst Rebate In Bc

GST Rebate Information For Vancouver Meetings

https://assets.simpleviewinc.com/simpleview/image/upload/c_fill,h_756,q_50,w_1920/v1/clients/vancouverbc/download_1_5__e370af99-c66a-4c06-9b19-6519ec3b0f15.jpg

BC GST Rebate PTT Calculator For Vancouver YouTube

https://i.ytimg.com/vi/whE8VvS9ZHY/maxresdefault.jpg

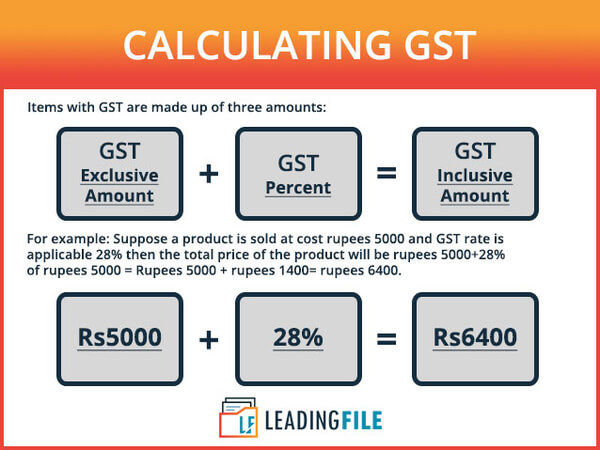

How To Calculate GST Amount Online With Formula GST Calculator

https://leadingfile.com/wp-content/uploads/2020/01/GST-calculation.jpg

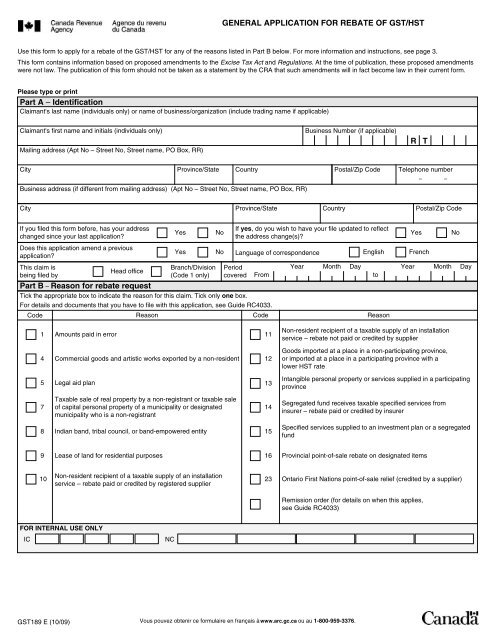

Multiply the amount from line 7 by 75 and enter the result to a maximum of 16 080 on line T This is the amount of your Ontario new housing rebate If you are entitled to claim a GST HST new housing rebate for the federal part of the HST enter the amount from line T onto the corresponding line T on Form GST191 Eligibility varies based on the offer and category being accessed For complete program details see the website The GST HST new housing rebate allows an individual to recover some of the GST or the federal part of the HST paid for a new or substantially renovated house that is for use as the individual s or their relation s primary place of

How much is the GST Rebate for New Homes in BC The GST New Housing Rebate is dependent on the purchase price of the home Maximum GST Rebate 36 Rebate of 5 GST To qualify for the Maximum Rebate the purchase price of a new or presale home must be 350 000 or less and the property must be a principal residence The credit is also adjusted depending on the number of children under 19 in the family that is registered for the Canada Child Benefit On April 5 single Canadians can expect up to 496 if they

GST New Home Rebate Calculation And Examples YouTube

https://i.ytimg.com/vi/2-0zuKt4bBk/maxresdefault.jpg

How To Complete A Canadian GST Return with Pictures WikiHow

https://www.wikihow.com/images/b/be/Complete-a-Canadian-GST-Return-Step-19-Version-2.jpg

https://www2.gov.bc.ca/gov/content/taxes/income...

Payment process If you re eligible and have an annual credit amount of more than 40 you ll receive payments every July October January April Each payment is combined with the federal goods and services tax harmonized sales tax GST HST credit into one payment Generally payments are made on the fifth day of the month

https://www.canada.ca/.../rc4210/gst-hst-credit.html

The grocery rebate was introduced in the 2023 federal budget to provide targeted inflation relief to Canadians This amount is combined with the quarterly payment of the federal GST HST credit The BC climate action tax credit is

Gst Rebate Calculator Morrison Homes

GST New Home Rebate Calculation And Examples YouTube

Rebate Calculations 101 How Are Rebates Calculated Enable

How To Get The GST HST Rebate On New Housing In Canada New Housing

How To Qualify For GST HST NEW HOUSING REBATE On RENOVATED And OWNER

Canadian Provincial Taxes Canada Province Tax Rates GST PST HST

Canadian Provincial Taxes Canada Province Tax Rates GST PST HST

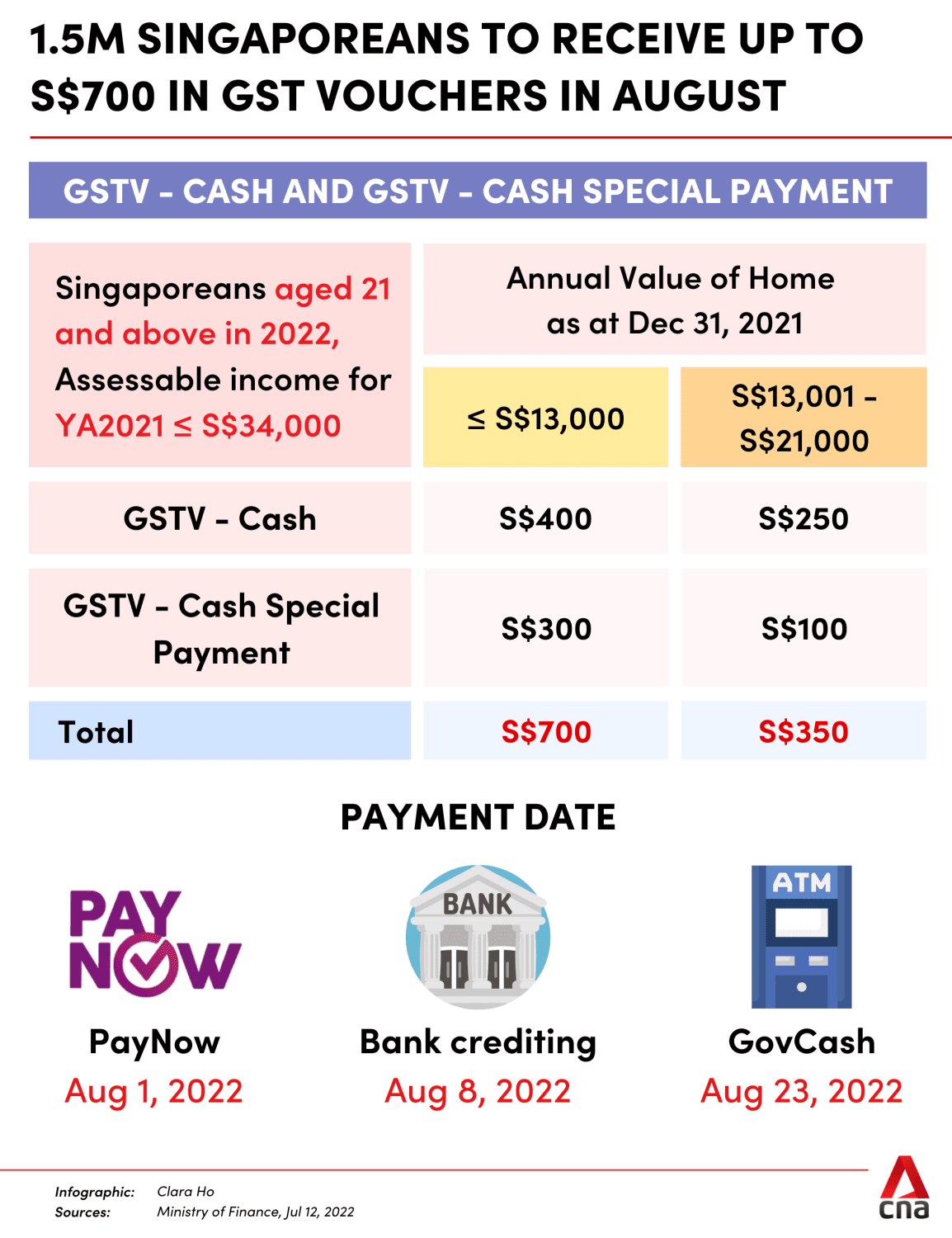

AY 2022 2023 GST Vouchers Everything You Need To Know

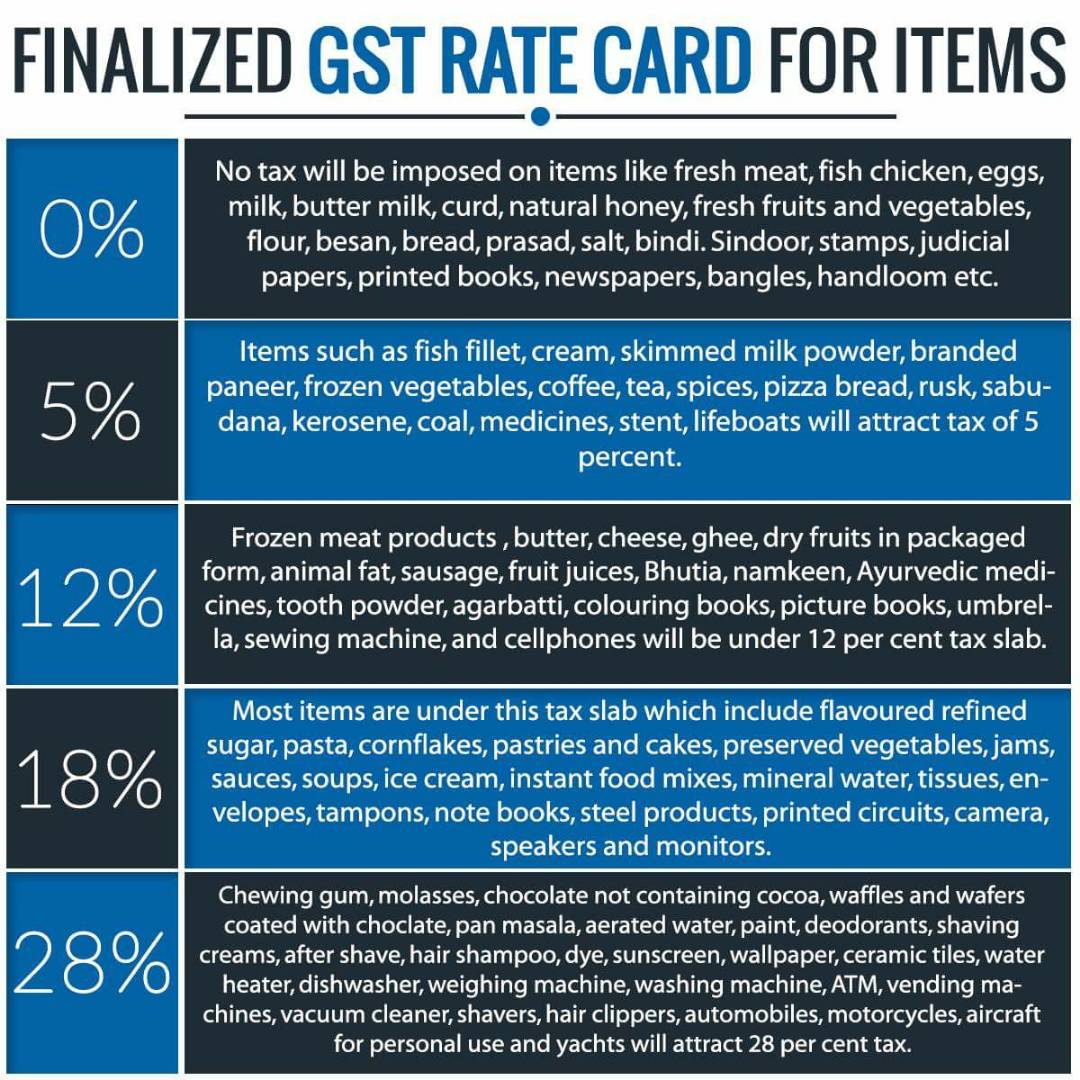

GST TAX RATE CHART FOR FY 2017 2018 AY 2018 2019 GOODS AND SERVICE

GST HST Rebate Form Asset Services Inc

How Much Is Gst Rebate In Bc - How much is the GST in BC The GST is a Federal tax of 5 on the purchase price of a new home or a substantially renovated home New home buyers can apply for a rebate of up to a maximum of 36 of the tax if the purchase price is 350 000 or less A partial GST rebate is available for new homes costing between 350 000 and 450 000