How Much Is Health Insurance Tax Penalty The Individual Mandate Penalty Calculator estimates your penalty for going uninsured vs how much you would pay for health

Individuals who are deemed able to afford health insurance but fail to comply are subject to penalties for each month of non compliance in the tax year In most states there is no longer a penalty for being without health insurance The ACA s federal tax penalty for not having

How Much Is Health Insurance Tax Penalty

How Much Is Health Insurance Tax Penalty

http://mediad.publicbroadcasting.net/p/shared/npr/styles/medium/nprshared/201804/605069246.jpg

Do Your Friends And Family Know About The Health Insurance Tax Penalty

https://www.godirecthis.com/wp-content/uploads/2020/02/capital-273344_1280.jpg

Can I Deduct Short Term Health Insurance From My Taxes If I m Self

https://shorttermhealthinsurance.com/wp-content/uploads/2018/10/self_employed_health_insurance_tax_deduction-960x540.jpg

Fines for not having health insurance are paid when your annual taxes are filed The following table reviews the tax penalties for individuals based on the localities 695 per adult and 347 50 per child under 18 for the year The maximum penalty per family using this method is 2 085 If you were uninsured for part of the year the penalty was 1 12 of the annual amount for each

Learn how your healthcare insurance will impact your 2021 federal tax filing What you need to know for maximum return premium tax credit and more Learn if you must pay But the GOP tax bill that was signed into law in late 2017 repealed the individual mandate penalty starting in 2019 See Part VIII Section 11081 of the text of the Tax Cuts and Jobs Act Although the law was enacted

Download How Much Is Health Insurance Tax Penalty

More picture related to How Much Is Health Insurance Tax Penalty

When Can I Deduct Health Insurance Premiums On My Taxes Forbes Advisor

https://www.forbes.com/advisor/wp-content/uploads/2022/08/tax-calculator.jpeg.jpg

Health Insurance Tax Penalty And What You Need To Know About Them

https://www.nyhealthinsurer.com/wp-content/uploads/2014/04/6757821397_ba181435ea_z.jpg

You Might Pay A Lot More Than 95 For Skipping Health Insurance WBUR News

https://media.npr.org/assets/img/2014/03/10/istock_000005279625large1_wide-dda1c42eeb961a11dfbddc5bffafca4bf6b5ae8e.jpg?s=6

Updated for Tax Year 2018 September 9 2023 9 36 AM OVERVIEW The Affordable Care Act has brought new options for health care coverage to millions of Unsurprisingly tax burdens across Europe vary significantly with workers in Western European and more developed countries paying considerably more Denmark

The federal tax penalty for not being enrolled in health insurance was eliminated in 2019 because of changes made by the Trump Administration The prior tax penalty for not The fee for not having health insurance sometimes called the Shared Responsibility Payment or mandate ended in 2018 This means you no longer pay a tax penalty for

Tax Penalties What You Need To Know

https://cdn2.hubspot.net/hubfs/3912314/Imported_Blog_Media/TaxPenalty.jpeg

Insurance Line One Blog

https://blog.insurancelineone.com/blog/image/california-tax-penalty-for-no-health-insurance-youre-not-off-the-hook

https://www.kff.org/interactive/penalty-calculator

The Individual Mandate Penalty Calculator estimates your penalty for going uninsured vs how much you would pay for health

https://www.mass.gov/technical-information-release/...

Individuals who are deemed able to afford health insurance but fail to comply are subject to penalties for each month of non compliance in the tax year

Petition GET RID OF NEW JERSEY STATE HEALTH INSURANCE TAX PENALTY

Tax Penalties What You Need To Know

2018 Tax Reform Changes To Health Insurance Tax Penalty YouTube

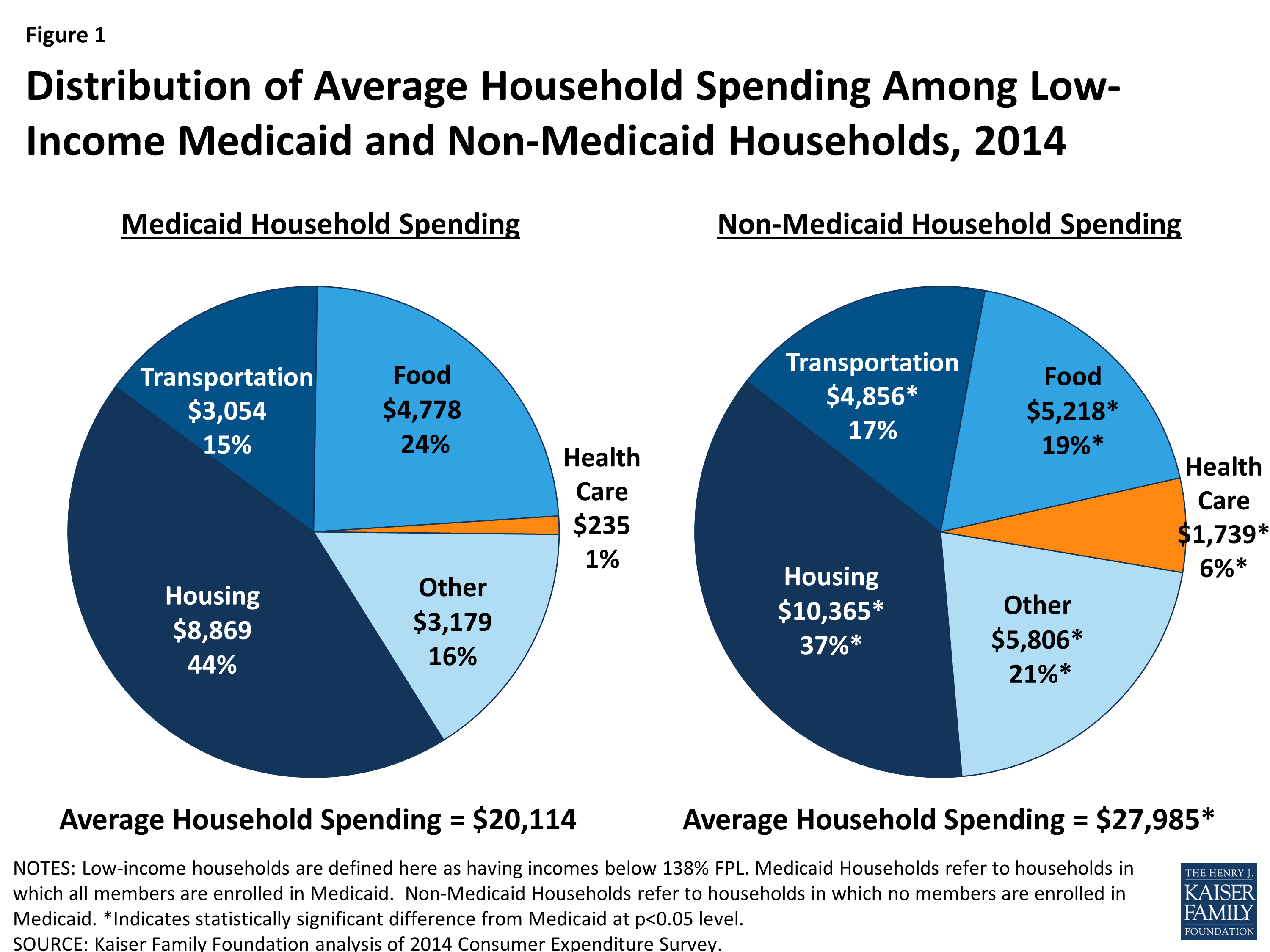

Health Care Spending Among Low Income Households With And Without

What Is The Average Cost Of Health Insurance Per Month

What Happened To The IRS Health Insurance Penalty In 2019

What Happened To The IRS Health Insurance Penalty In 2019

Nevada Insurance Enrollment Explains Why Those Without Health Insurance

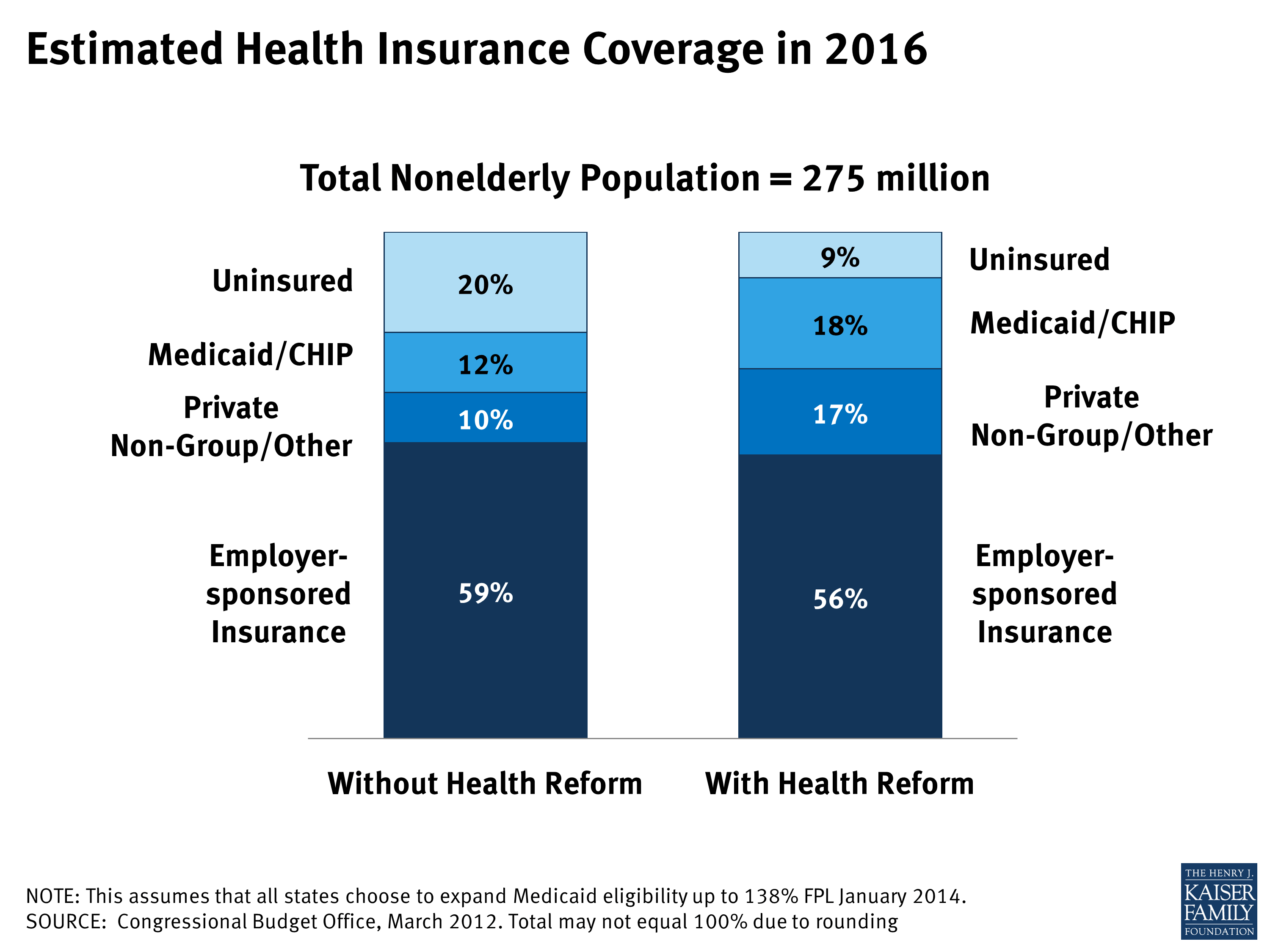

Estimated Health Insurance Coverage In 2016 KFF

December 07 2017

How Much Is Health Insurance Tax Penalty - 695 per adult and 347 50 per child under 18 for the year The maximum penalty per family using this method is 2 085 If you were uninsured for part of the year the penalty was 1 12 of the annual amount for each