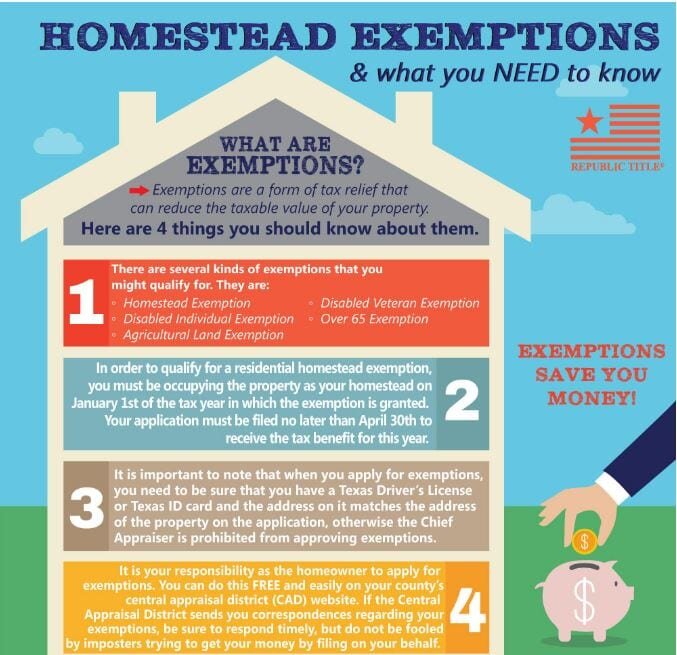

How Much Is Homestead Exemption In Georgia A homestead exemption can give you tax breaks on what you pay in property taxes A homestead exemption reduces the amount of property taxes homeowners owe on their legal residence You must file with the county or city where your home is located

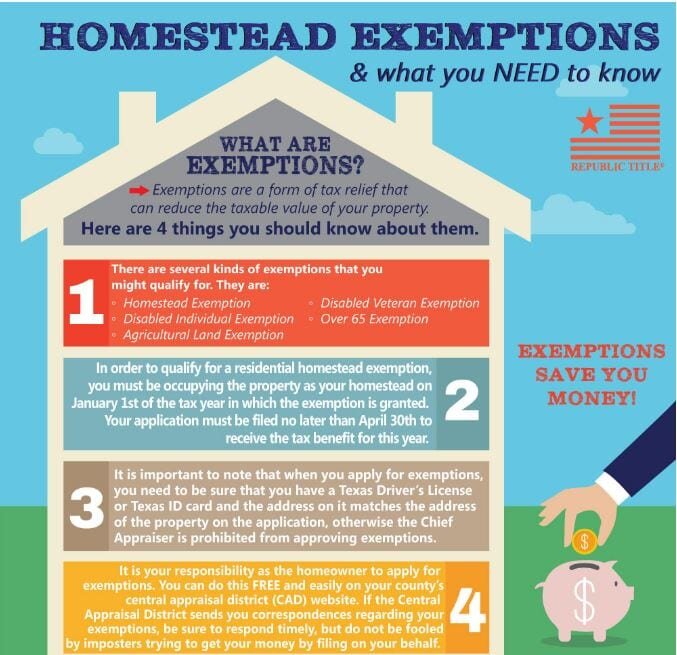

While all homeowners are able to apply for a standard homestead exemption here is a list of several different exemptions available for which you may qualify Individuals 65 Years of Age and Older May Claim a 4 000 Exemption For example the homestead exemption is available on owner occupied primary residences It reduces the assessed value of a home by 10 000 for county taxes 4 000 for school taxes and 7 000 for recreation taxes

How Much Is Homestead Exemption In Georgia

How Much Is Homestead Exemption In Georgia

https://uptownsuites.com/wp-content/uploads/Downtown-Homestead-scaled.jpg

Here s How To File Homestead Exemption In Georgia SPOTLIGHT South

https://spotlightsouthcobbnews.com/wp-content/uploads/2023/02/Untitled-design-19-1.png

-1920w.jpg)

Florida Homestead Exemption What You Should Know

https://lirp.cdn-website.com/17d53756/dms3rep/multi/opt/Homestead+exemption+(2)-1920w.jpg

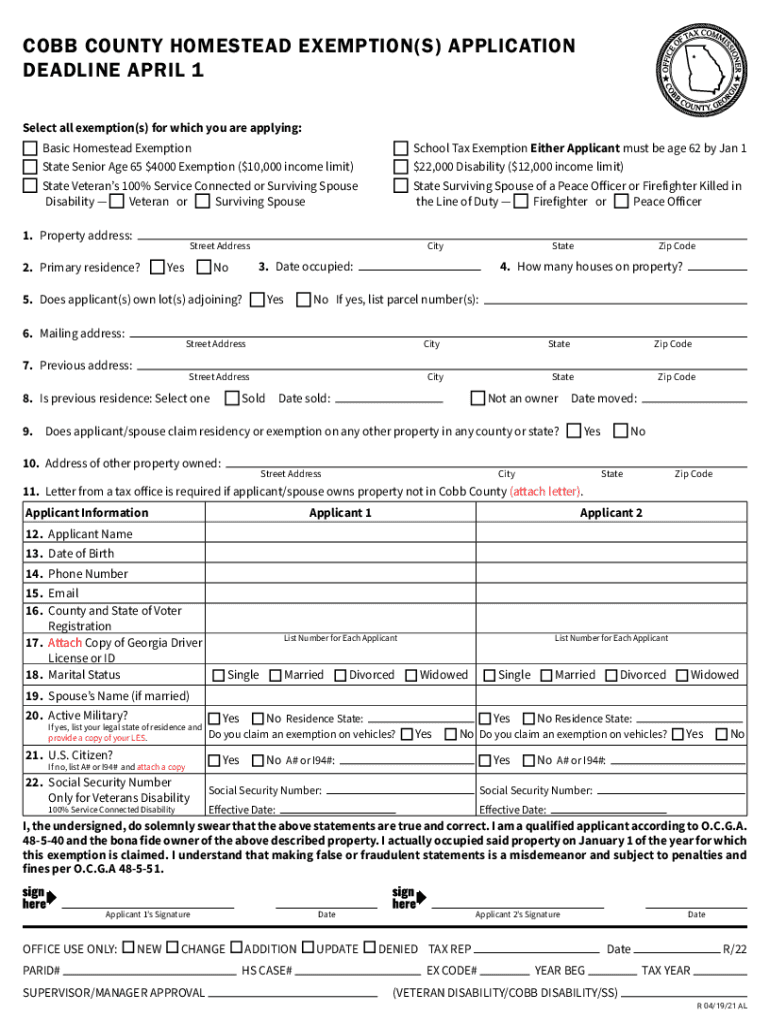

Standard Homestead Exemption From Georgia Property Tax The home of each Georgia resident that is owner occupied as a primary residence may be granted a 2 000 exemption from most county and school taxes The 2 000 is deducted from the 40 assessed value of the homestead The 2020 Basic Homestead Exemption is worth 273 60 In addition you are automatically eligible for a 10 000 exemption in the school general tax category When applying you must provide proof of Georgia residency

H3 Senior or Disability Exemption This has a household income limit of 10 000 Georgia Net Income Exempts the recipient s from all school taxes and maintains the exemption of 10 000 for County levies except bonds Basic homestead exemption of 40 000 plus city assessment freeze if applicable Senior Exemption age 65 and meeting county requirements receive 160 000 plus city assessment freeze if applicable

Download How Much Is Homestead Exemption In Georgia

More picture related to How Much Is Homestead Exemption In Georgia

Homestead Exemption

http://bakerpa.com/images/house3-min.png

Georgia Property Tax Relief For Seniors Carin Bloom

https://boa.chathamcountyga.gov/images/Chatham County Homestead Poster.jpg

How Do I Register For Florida Homestead Tax Exemption W Video

https://www.yourwaypointe.com/wp-content/uploads/2017/07/Florida-Homestead-Tax-Exemption.jpg

While all homeowners may qualify for a basic homestead exemption there are also many different exemptions available for seniors and people with full medical or veterans disabilities and their surviving spouses In Fulton County the BASE VALUE typically increases from one year to the next by 3 or the CPI whichever is less The City of Atlanta s BASE VALUE however increases yearly at 2 6 per the details of the legislation regarding this exemption

In the State of Georgia there are special benefits conferred to properties that qualify as homesteads Only homeowners can receive the benefits of a homestead property and these benefits are only available if the home is the owner s legal residence as of January 1 of the taxable year Georgia has several homestead exemptions that lower homeowner property taxes Nearly every home in Georgia is taxed on 40 percent of fair market value and the standard homestead exemption subtracts 2 000 from that A separate exemption protects 21 500 in home equity from sale in bankruptcy

Georgia Homestead Exemption Don t Miss This If You Bought A Home Last

https://i.ytimg.com/vi/TYCH0rKBu1Q/maxresdefault.jpg

How To File Homestead Exemption In Georgia Homesteading House Styles

https://i.pinimg.com/736x/78/f9/09/78f90942d16488272001f9bd92396315--homesteads-georgia.jpg

https://georgia.gov/apply-homestead-exemption

A homestead exemption can give you tax breaks on what you pay in property taxes A homestead exemption reduces the amount of property taxes homeowners owe on their legal residence You must file with the county or city where your home is located

https://www.homegeorgia.com/blog/how-to-apply-for...

While all homeowners are able to apply for a standard homestead exemption here is a list of several different exemptions available for which you may qualify Individuals 65 Years of Age and Older May Claim a 4 000 Exemption

Homestead Exemption Information And Tips For Fulton Forsyth Cherokee

Georgia Homestead Exemption Don t Miss This If You Bought A Home Last

How To File For Florida Homestead Exemption Smart Title

Cobb Homestead Exemptions 2021 2024 Form Fill Out And Sign Printable

What Is A Homestead Exemption Protecting The Value Of Your Home

Homestead Exemptions What You Need To Know Rachael V Peterson

Homestead Exemptions What You Need To Know Rachael V Peterson

Where To Submit Homestead Exemption In Cherokee County Ga About

Apply For Georgia Homestead Exemption OLD FOURTH WARD Homes For Sale

How Much Is The Homestead Exemption In Houston Square Deal Blog

How Much Is Homestead Exemption In Georgia - The 2020 Basic Homestead Exemption is worth 273 60 In addition you are automatically eligible for a 10 000 exemption in the school general tax category When applying you must provide proof of Georgia residency