How Much Is Parent Tax Relief Married divorced or widowed parents may claim tax rebates of up to 20 000 per child As PTR is a one off rebate you may only claim PTR on a qualifying child once PTR is given to tax

For tax year 2023 the EITC is as much as 7 430 for a family with three or more children or 600 for taxpayers who don t have a qualifying child When it comes to your income tax some financial headers when linked to certain family members can fetch you much needed tax relief Here is how you can invest insure and carry out other transactions via your parents to

How Much Is Parent Tax Relief

.png?sfvrsn=d0aa2658_3)

How Much Is Parent Tax Relief

https://www.iras.gov.sg/images/default-source/assets/example-on-sharing-of-parent-relief-(staying).png?sfvrsn=d0aa2658_3

Taxpayers To Enjoy More Savings Finance PropertyGuru sg

https://cdn-cms.pgimgs.com/news/2015/03/Parent-relief-tax-claims.jpg

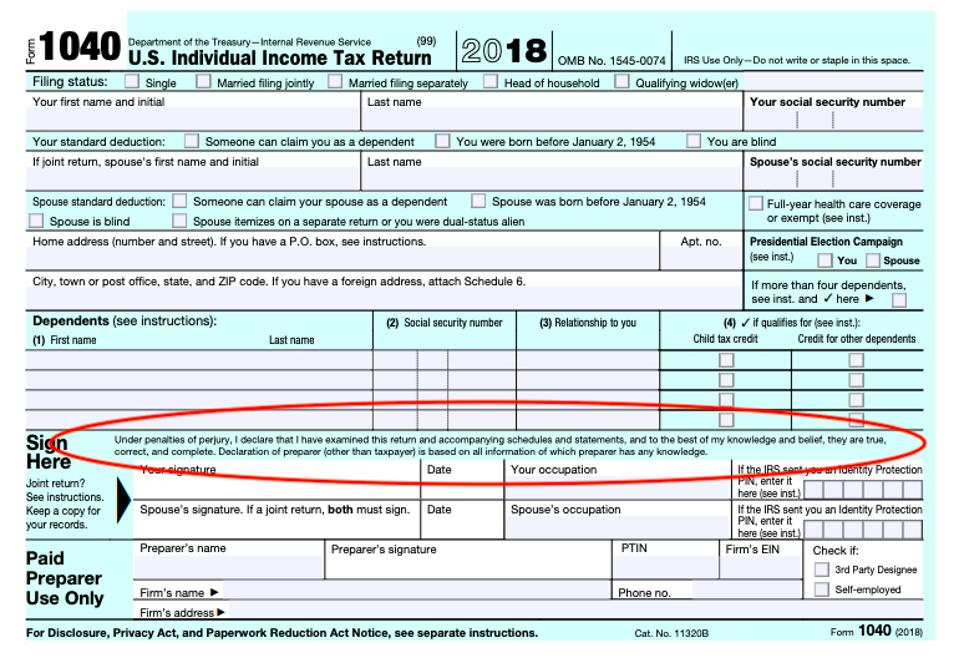

Everything You Need To Know About IRS Tax Help Services Hardluckcastle

https://anthemtaxservices.com/wp-content/uploads/2019/08/tax-debt-relief-1.jpg

You can claim tax reliefs in addition to any personal tax free allowances that you are entitled to which means you ll take home more of your income and pay less tax This guide explains which tax reliefs are available how they work and A partial child tax credit amount is available if your MAGI is up to 440 000 for joint filers or 240 000 for other statuses Child and Dependent Care Credit Whether you sent your

1 Child Tax Credit The Child Tax Credit is worth up to 2 000 for each child who was younger than 17 at the end of 2023 There s a refundable portion of the credit called the Additional Child Parent Relief Parent Relief Disability Provides tax relief of up to 14 000 per dependant to recognise individuals supporting their parents grandparents parents in law or grandparents in law in Singapore

Download How Much Is Parent Tax Relief

More picture related to How Much Is Parent Tax Relief

How Much Is Rent Vs Mortgage How Much Is The Mortgage Payment Vs

https://i.ytimg.com/vi/yvuhxq0Tvaw/maxresdefault.jpg

What Is BBVA Immediate Cash And How Much Is The Commission American Post

https://www.americanpost.news/wp-content/uploads/2022/02/What-is-BBVA-Immediate-Cash-and-how-much-is-the.jpg

Tax Preparation Specialist Issues Tax Relief Guidance For Employees Who

https://www.wealthandfinance-news.com/wp-content/uploads/2019/03/tax-relief.png

Tax season has started and one of the most popular tax breaks for parents is the child tax credit or CTC Created as part of the Taxpayer Relief Act of 1997 the child tax WASHINGTON Today Congressman Blake Moore introduced the Family First Act to support working American families with an updated and enhanced Child Tax Credit

Updated for tax year 2024 There s no doubting it having kids is expensive Between paying for diapers daycare and many other baby supplies new parents can quickly To claim the 500 credit for other dependents you ll need to provide a taxpayer identification number for each non CTC qualifying child or dependent but it can be an Individual Taxpayer

Parent Tax Help New Parent Taxes 101 Medium

https://cdn-images-1.medium.com/fit/t/1600/480/1*0jPAWzp2mc288OciuQ7sMw.png

New Mexico Printable Irs Tax Forms Printable Forms Free Online

https://specials-images.forbesimg.com/imageserve/5c6079eba7ea432d0765a91d/960x0.jpg?fit=scale

.png?sfvrsn=d0aa2658_3?w=186)

https://www.iras.gov.sg › ... › tax-reliefs › parenthood-tax-rebate-(ptr)

Married divorced or widowed parents may claim tax rebates of up to 20 000 per child As PTR is a one off rebate you may only claim PTR on a qualifying child once PTR is given to tax

https://www.irs.gov › newsroom › tax-help-for-new-parents

For tax year 2023 the EITC is as much as 7 430 for a family with three or more children or 600 for taxpayers who don t have a qualifying child

Learn How To Generate Tax Debt Relief Leads At Broker Calls

Parent Tax Help New Parent Taxes 101 Medium

How Much Is The Down Payment For A 575 000 Home Moreira Team Mortgage

Income Tax Relief Programs Services USA Tax Settlement

Everything You Should Claim As Income Tax Relief Malaysia 2022 Ya 2021

4 Tax Relief Options Halt

4 Tax Relief Options Halt

List Of Personal Tax Relief And Incentives In Malaysia 2023

Tax Debt Relief Your Options Keep Asking

12 Reasons To Speak To A Tax Relief Specialist About Your Back Taxes

How Much Is Parent Tax Relief - The Tax Cuts and Jobs Act of 2017 sunsets in 2025 and a new overhaul is expected The Trump administration hopes to make key tax policy changes for both individuals