How Much Is Personal Tax Credit Personal tax credit General Personal tax credit is a tax deductions people can use to lower the tax withdrawn from their salaries by their employer People 16 years and older who are domiciled in Iceland are entitled to personal tax credit Those turning 16 get full personal tax credit for the entire year no matter when their birthday is

The amount due to you depends on when your spouse or partner died and whether you have any dependent children You receive a higher tax credit in the year of bereavement It is the same amount as the married person or civil partner credit You may claim the Widowed Parent Tax Credit for five years if you have dependent children Tax software can walk you through your expenses and losses to show the option that gives you the lowest tax Some people including nonresidents and partial year filers can t take the standard deduction Standard deduction amounts The standard deduction for 2023 is 13 850 for single or married filing separately

How Much Is Personal Tax Credit

How Much Is Personal Tax Credit

https://i.ytimg.com/vi/Hg0fOlxqHpU/maxresdefault.jpg

What Is Personal Property Tax And Why Do Businesses Need To Pay It

https://legalinquirer.com/wp-content/uploads/2023/01/What-Is-Personal-Property-Tax.jpg

Tax Credits Save You More Than Deductions Here Are The Best Ones

https://www.gannett-cdn.com/-mm-/14ee05d59f10019b9af859e1b8044dff44c16b5c/c=0-64-2118-1261&r=x1683&c=3200x1680/local/-/media/2017/03/28/USATODAY/USATODAY/636262972570306279-tax-credits.jpg

Hassle free tax filing is 50 for all tax situations no hidden costs or fees Maximum refund guaranteed Get every dollar you deserve when you file with this tax product powered by Column This earned income tax credit will get you between 600 and 7 430 in tax year 2023 depending on your tax filing status and how much you make You don t need to have children to qualify

A tax credit lowers the amount of money you must pay the IRS Not to be confused with deductions tax credits reduce your final tax bill dollar for dollar That means that if you owe Uncle Sam 5 000 a 2 000 credit would shave 2 000 off your total tax bill and you would only owe 3 000 Unlike the value of tax deductions which reduce your A tax credit reduces the income tax bill dollar for dollar that a taxpayer owes based on their tax return Some tax credits such as the Earned Income Tax Credit are refundable If a person s tax bill is less than the amount of a refundable credit they can get the difference back in their refund Keep records to show their eligibility for the

Download How Much Is Personal Tax Credit

More picture related to How Much Is Personal Tax Credit

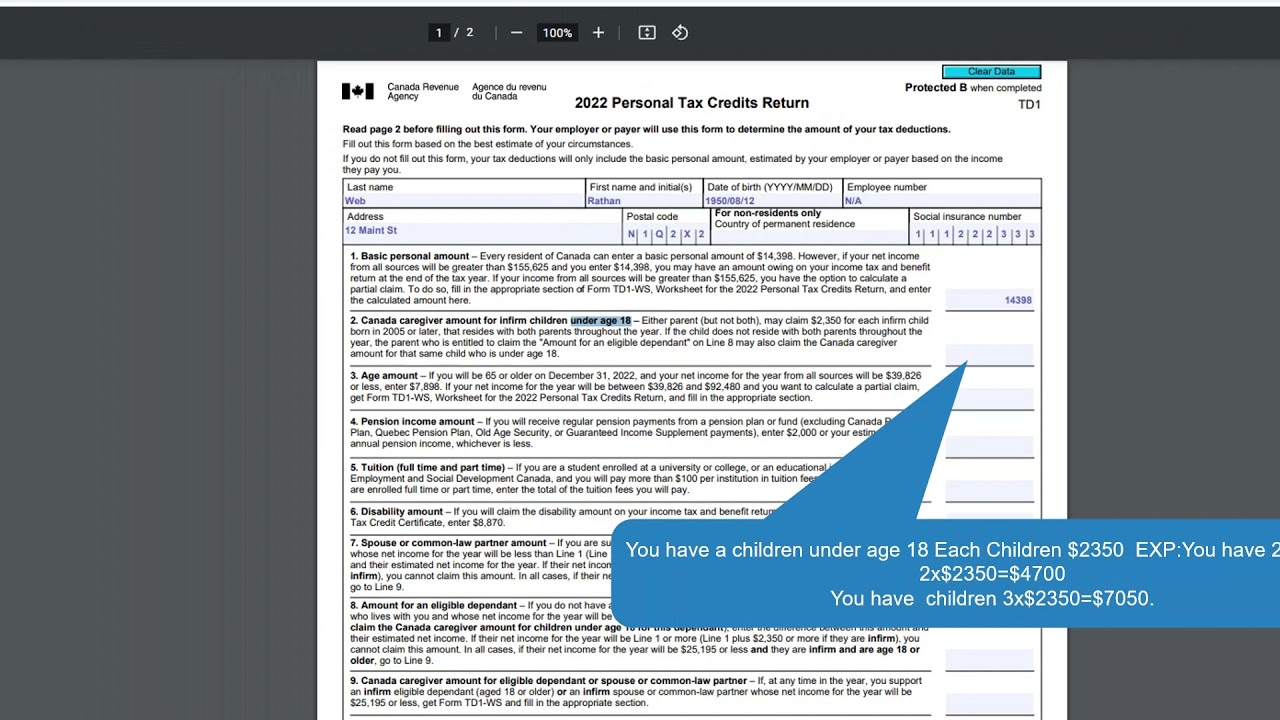

Free Digital TD1 2024 Form Personal Tax Credits Return

https://public-site.marketing.pandadoc-static.com/app/uploads/canada-personal-tax-credits-return-500x648.png

What Is A Personal Tax Account KNNLLP

https://www.knnllp.co.uk/wp-content/uploads/2018/11/2017-11-03-608603.jpg

TD1 Personal Tax Credit JoyVancouver

https://joyvancouver.com/wp-content/uploads/2019/08/td1-768x432.jpg

Transparent pricing Hassle free tax filing is 50 for all tax situations no hidden costs or fees Maximum refund guaranteed Get every dollar you deserve when you file with this tax A nonrefundable tax credit means that a person will get the tax credit up to the amount owed For example if a person owes 2 000 in taxes and receives 3 000 in nonrefundable credits that will simply erase her tax bill If she gets 3 000 in refundable credits she will receive a 1 000 tax refund

Your BPA will be 12 298 In addition the maximum BPA will be increased to 15 000 by 2023 as follows 13 808 for the 2021 taxation year 14 398 for the 2022 taxation year and 15 000 for the 2023 taxation year and indexed for inflation for subsequent years Recently in the Budget for the 2024 tax year the Government increased the Personal Tax Credit from 1775 to 1875 Depending on your earnings nearly all workers are entitled to this tax credit Employee Tax Credit In addition to the above the Government increased the Employee Tax Credit from 1775 to 1875

What Is BBVA Immediate Cash And How Much Is The Commission American Post

https://www.americanpost.news/wp-content/uploads/2022/02/What-is-BBVA-Immediate-Cash-and-how-much-is-the.jpg

Who Gets Tax Credits Leia Aqui Who Gets Federal Tax Credits

https://cdn.newswire.com/files/x/32/c9/0bc29c33e2af4d42f581fad9e660.png

https://www.skatturinn.is/english/individuals/personal-tax-credit

Personal tax credit General Personal tax credit is a tax deductions people can use to lower the tax withdrawn from their salaries by their employer People 16 years and older who are domiciled in Iceland are entitled to personal tax credit Those turning 16 get full personal tax credit for the entire year no matter when their birthday is

https://www.revenue.ie/en/personal-tax-credits...

The amount due to you depends on when your spouse or partner died and whether you have any dependent children You receive a higher tax credit in the year of bereavement It is the same amount as the married person or civil partner credit You may claim the Widowed Parent Tax Credit for five years if you have dependent children

Personal Property Tax SDG Accountants

What Is BBVA Immediate Cash And How Much Is The Commission American Post

How Much Is Personal Data Worth Download Scientific Diagram

How To Submit Your Personal Income Tax Return

How Much Is The Down Payment For A 575 000 Home Moreira Team Mortgage

Solved Please Note That This Is Based On Philippine Tax System Please

Solved Please Note That This Is Based On Philippine Tax System Please

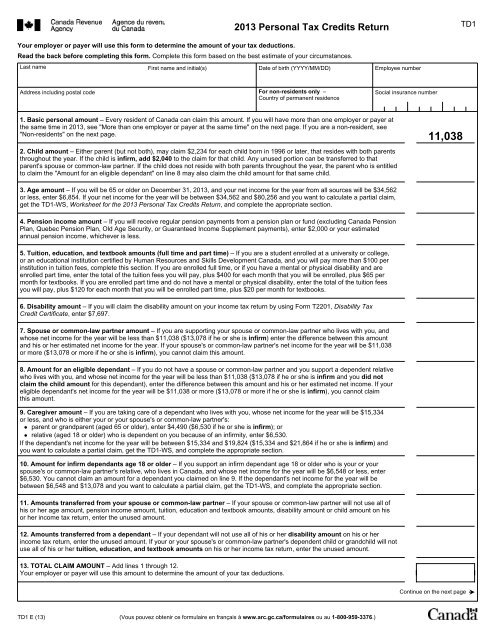

TD1 2013 Personal Tax Credits Return

Here s How Much Your Personal Information Is Selling For On The Dark

How To Prepare For Tax Year end Business Link

How Much Is Personal Tax Credit - A tax credit reduces the income tax bill dollar for dollar that a taxpayer owes based on their tax return Some tax credits such as the Earned Income Tax Credit are refundable If a person s tax bill is less than the amount of a refundable credit they can get the difference back in their refund Keep records to show their eligibility for the