How Much Is Property Tax In Texas The median property tax in Texas is 2 275 00 per year for a home worth the median value of 125 800 00 Counties in Texas collect an average of 1 81 of a property s assesed fair market value as property tax per year Texas has one of the highest average property tax rates in the country with only thirteen states levying higher property taxes

If you need to find your property s most recent tax assessment or the actual property tax due on your property contact your county or city s property tax assessor The median property tax on a 125 800 00 house is 2 276 98 in Texas To calculate your property taxes start by typing the county and state where the property is located and then enter the home value Press calculate to see the average property tax rate along with an estimate of the monthly and yearly property tax costs

How Much Is Property Tax In Texas

How Much Is Property Tax In Texas

https://propertyownersalliance.org/wp-content/uploads/2020/10/property-taxes-by-state-2020-FV-01-1024x868-1.png

The Rise Of Residential Property Tax In Arizona Klauer Law

http://klauerlaw.com/wp-content/uploads/2015/10/tax-increase.jpg

Property Tax Definition Uses And How To Calculate TheStreet

https://s.thestreet.com/files/tsc/v2008/photos/contrib/uploads/acd49c56-5a02-11e9-a10a-7fe96a9d9db1.jpg

We publish school district tax rate and levy information in conjunction with publishing the School District Property Value Study SDPVS preliminary findings which must be certified to the commissioner of education prior to Feb 1 each year We update this information along with the city county and special district rates and levies by August How to Calculate Property Tax in Texas Every local taxing entity in Texas calculates property taxes using the same method The appraised property value is reduced by any qualifying exemptions or special appraisals divided by 100 then multiplied by the tax rate established for each entity

Texas gov s Property Tax Transparency in Texas page as collected on Aug 9 2022 Texas gov Texas gov HOUSTON If you re wondering how much you re The website provides information from your local appraisal district and local taxing units to determine a property tax estimate for properties in your county Taxpayers can see how the changes between the no new revenue rate and proposed tax rates would affect the amount of taxes they would have to pay

Download How Much Is Property Tax In Texas

More picture related to How Much Is Property Tax In Texas

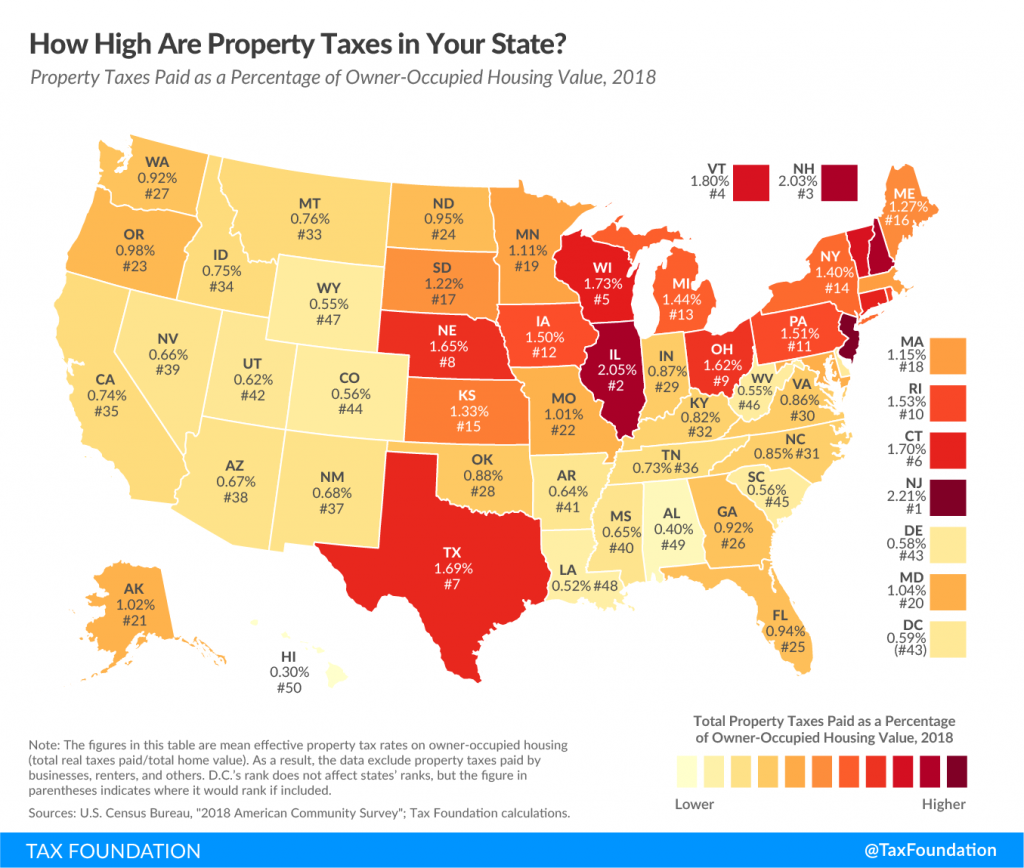

How High Are Property Taxes In Your State

http://dailysignal.com/wp-content/uploads/property_taxes-01.png

Taxes Are Surprisingly Similar In Texas And California Mother Jones

https://www.motherjones.com/wp-content/uploads/2019/11/blog_tx_taxes.jpg

KY State Legislature Makes Changes To Property Tax In House Bill 6

https://deandorton.com/wp-content/uploads/2022/05/Property-Tax-1.jpg

Translation Texas has no state property tax Local governments set tax rates and collect property taxes to provide many local services including schools streets roads police and fire protection Texas law requires property values used in determining taxes to be equal and uniform It establishes the process for local officials to follow in Texans paid an estimated 73 2 billion in property taxes in 2021 which went to school districts cities counties and other taxing entities that then use the revenue to fund everything from

According to a 2022 study on property taxes by WalletHub an average American single family household has a median value of 217 500 and its residents spend about 2 471 on property taxes each year In comparison an equivalent average household in Texas would pay about 3 907 or over 58 more News Governor Abbott Signs Largest Property Tax Cut In Texas History August 9 2023 Austin Texas Press Release Governor Greg Abbott today ceremonially signed legislation delivering the largest property tax cut in Texas history 18 billion passed during Special Session 2 of the 88th Legislature in New Caney

These States Have The Highest Property Tax Rates

https://www.thestreet.com/.image/c_limit%2Ccs_srgb%2Cq_auto:good%2Cw_700/MTkzMTM5Mzg2MDIyNDM4MjQ0/table-property-taxes-101922.png

How To Register File Taxes Online In Texas

https://uploads-ssl.webflow.com/5f50dfefde2d2df9368da112/60d9d21925a9056169cad7f5_6BNxCHP4_L0nE3u2cfKQF-bPTFEy-uSwozcR9rmQql1Lg4H2svZl8BfAahg9--nzGVq2K51Qk0B-Opnfz11da0Vdo8WvDdVFfxhIfr1s2PEOyKRh9XYKgnI9FvCQYA_M3ohhjqS6.png

https://www.tax-rates.org/texas/property-tax

The median property tax in Texas is 2 275 00 per year for a home worth the median value of 125 800 00 Counties in Texas collect an average of 1 81 of a property s assesed fair market value as property tax per year Texas has one of the highest average property tax rates in the country with only thirteen states levying higher property taxes

https://www.propertytax101.org/texas/taxcalculator

If you need to find your property s most recent tax assessment or the actual property tax due on your property contact your county or city s property tax assessor The median property tax on a 125 800 00 house is 2 276 98 in Texas

State And Local Public Finance Taxing Professional Services Beating

These States Have The Highest Property Tax Rates

Download Property Tax Receipt Property Tax Payment Online Tamil

In depth Look At The Property Tax Reform Delano News

Texas Has The Fifth Highest Property Taxes In The Nation But Do We Get

To What Extent Does Your State Rely On Property Taxes Hawaii Free Press

To What Extent Does Your State Rely On Property Taxes Hawaii Free Press

Pinas For Good Real Property Tax 2019 100 Increase

The United States Of Sales Tax In One Map The Washington Post

What If I Do Not Pay My Texas Property Taxes Property Tax Loan Pros

How Much Is Property Tax In Texas - The website provides information from your local appraisal district and local taxing units to determine a property tax estimate for properties in your county Taxpayers can see how the changes between the no new revenue rate and proposed tax rates would affect the amount of taxes they would have to pay