How Much Is Senior Citizen Property Tax Exemption That s right older homeowners could qualify for senior property tax exemptions that could significantly reduce their tax bills Here s what you need to know and how to determine if you

In Finland you can receive various services that provide help for everyday life and enable you to live at home If you have a municipality of residence in Finland Property Tax Exemption for Senior Citizens and People with Disabilities Washington state has two property tax relief programs for senior citizens and people

How Much Is Senior Citizen Property Tax Exemption

How Much Is Senior Citizen Property Tax Exemption

https://sarkarisuvidha.online/img/newimg/service/background/senior-citizen.jpg

Senior Citizen Discount Requirement POSTER Lazada PH

https://filebroker-cdn.lazada.com.ph/kf/Sb05870109ae446a792a5645f491229972.jpg

House Of Representatives Files Bill Of Tax Exemption For Senior

https://filipinojournal.com/wp-content/uploads/2021/03/senior_citizen_task_force_web.jpg

The tax rate is determined by the amount of earned income you receive during the year Earned income includes pay from employment as well as pensions and Certain property tax benefits are available to persons 65 or older in Florida Eligibility for property tax exemptions depends on certain requirements Information is available from

To learn about the state s most common deductions and the associated eligibility requirements of each see the links below The forms required to file the Senior citizens as well as all homeowners in Indiana can claim a tax deduction if their home serves as their primary residence The home and up to one acre of land can

Download How Much Is Senior Citizen Property Tax Exemption

More picture related to How Much Is Senior Citizen Property Tax Exemption

Jefferson County Property Tax Exemption Form ExemptForm

https://www.exemptform.com/wp-content/uploads/2022/08/fillable-short-form-property-tax-exemption-for-seniors-2017-3.png

Budget 2021 Income Tax Returns Exemption Senior Citizens Above 75 Years

https://resize.indiatvnews.com/en/resize/newbucket/1200_-/2021/02/eth6sfpu0auony6-1612164111.jpg

Senior Citizen Property Tax Exemption Second Notice Postcards Applied

https://appliedbusinesssystems.com/wp-content/uploads/2023/01/second-notice-postcard-mockSQ-min.jpg

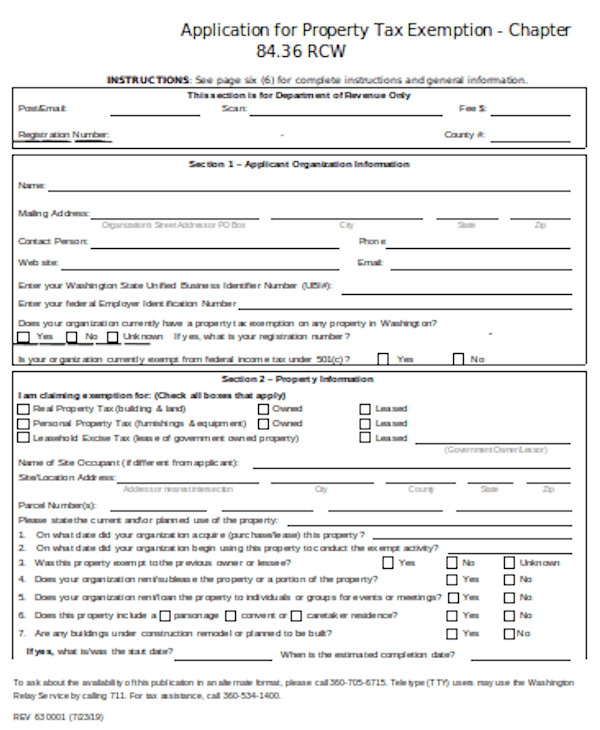

Under these options qualifying seniors may receive the exemption if their income is below 55 700 for a 20 exemption 57 500 for a 10 exemption or Property tax exemption for seniors people retired due to disability and veterans with disabilities In Washington individuals who meet certain eligibility requirements may

Your property tax savings from the Senior Exemption is calculated by multiplying the Senior Exemption savings amount 8 000 by your local tax rate Your local tax rate is Property tax exemption for seniors and people with disabilities This is a way to lower your property taxes by exempting excusing you from all extra levies like

Senior Citizen Tax Exemption 2020 Proposition 60 90 110 YouTube

https://i.ytimg.com/vi/XI26oShFHO4/maxresdefault.jpg

Top 64 Imagen Illinois Senior Citizen Property Tax Exemption Ecover mx

https://www.pdffiller.com/preview/484/420/484420915/large.png

https://www.realtor.com/advice/finance/…

That s right older homeowners could qualify for senior property tax exemptions that could significantly reduce their tax bills Here s what you need to know and how to determine if you

https://www.infofinland.fi/en/family/elderly

In Finland you can receive various services that provide help for everyday life and enable you to live at home If you have a municipality of residence in Finland

Top 47 Imagen Cook County Senior Citizen Exemption Ecover mx

Senior Citizen Tax Exemption 2020 Proposition 60 90 110 YouTube

Top 77 Imagen How To Apply For Senior Citizen Property Tax Exemption

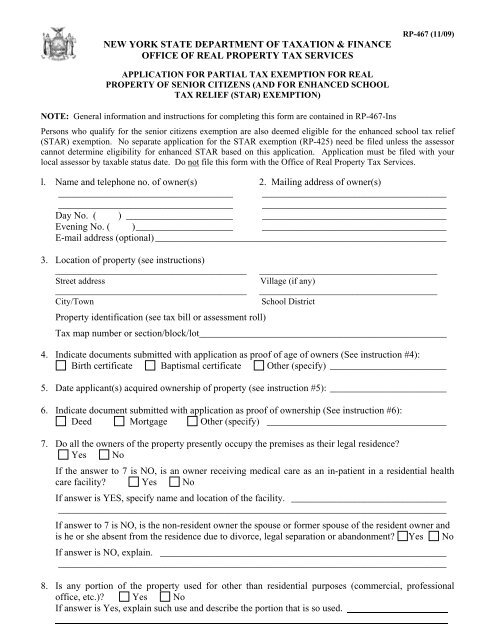

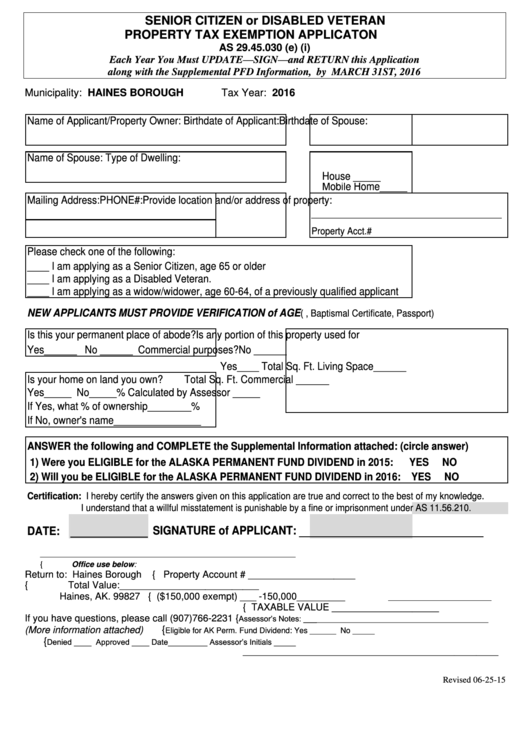

Senior Citizen Or Disabled Veteran Property Tax Exemption Applicaton

Senior Citizen Or Disabled Veteran Property Tax Exemption Applicaton

Senior Citizen Property Tax Exemption New York State ZDOLLZ

Senior Citizen Property Tax Exemption New York State ZDOLLZ

What Is A Senior Citizen Homestead Exemption PRORFETY

County Legislature Increases Senior Citizen Tax Exemption Rodney J

What Is A Senior Citizen Tax Exemption PROFRTY

How Much Is Senior Citizen Property Tax Exemption - Federal programs Old Age Security OAS Guaranteed Income Supplement GIS and Spouse s AllowanceIf you are age 65 or older and have lived in Canada for 10