How Much Is Tax In Alabama Alabama Income Taxes The state income tax in Alabama is similar to the federal income tax with increasing rates based on income brackets However while the federal income tax has seven brackets Alabama has just three with the top rate of 5 applying to all taxable income over 3 000

What is Alabama s Individual Income Tax Rate For single persons heads of families and married persons filing separate returns 2 First 500 of taxable income 4 Next 2 500 of taxable income 5 All taxable income over 3 000 For married persons filing a joint return 2 First 1 000 of taxable income 4 Next 5 000 of taxable income Alabama has income taxes that range from 2 up to 5 slightly below the national average The Heart of Dixie has a progressive income tax rate in which the amount of tax withheld depends on which of its three tax brackets you fall under

How Much Is Tax In Alabama

How Much Is Tax In Alabama

https://www.expatustax.com/wp-content/uploads/2023/03/How-much-tax-do-you-pay-UK.jpg

OUCH Alabama Has 4th Highest Combined Sales Tax Rate In The Country

http://yellowhammernews.com/wp-content/uploads/2016/05/State-Sales-tax-rates.png

State Taxes Can Add Up Wealth Management

https://www.wealthmanagement.com/sites/wealthmanagement.com/files/uploads/2015/12/taxratechart.png

The Alabama Income Tax Alabama collects a state income tax at a maximum marginal tax rate of spread across tax brackets Like the Federal Income Tax Alabama s income tax allows couples filing jointly to pay a lower overall rate on their combined income with wider tax brackets for joint filers Alabama has a 4 00 percent state sales tax rate a max local sales tax rate of 7 50 percent and an average combined state and local sales tax rate of 9 25 percent Alabama s tax system ranks 39th overall on our 2024 State Business Tax Climate Index

After considering the 2022 deductions that we showed above your taxable income is 87 050 that is because small 100 000 12 950 87 050 100 000 12 950 87 050 Consequently considering the federal tax progressive income you pay 4 807 50 plus 22 of the amount over 41 775 which equals a total federal tax of Here s a breakdown of the Alabama income tax rates by filing status For single persons heads of families and married persons filing separate returns 2 First 500 of taxable income 4 Next 2 500 of taxable income 5 All taxable income over 3 000

Download How Much Is Tax In Alabama

More picture related to How Much Is Tax In Alabama

Why Alabama s Taxes Are Unfair Al

https://www.al.com/resizer/jcOnMqNPJXd1Ywer4M9MtaItJFg=/1280x0/smart/arc-anglerfish-arc2-prod-advancelocal.s3.amazonaws.com/public/KG56WPKKMBDEFH6X6XVUSDUPLY.PNG

Alabama s Reliance On Sales Tax Alabama News

http://www.alabamanews.net/wp-content/uploads/2018/06/Sales-02.png

Alabama Sales Tax Guide

https://blog.accountingprose.com/hs-fs/hubfs/Alabama Sales Tax FAQ.png?width=800&name=Alabama Sales Tax FAQ.png

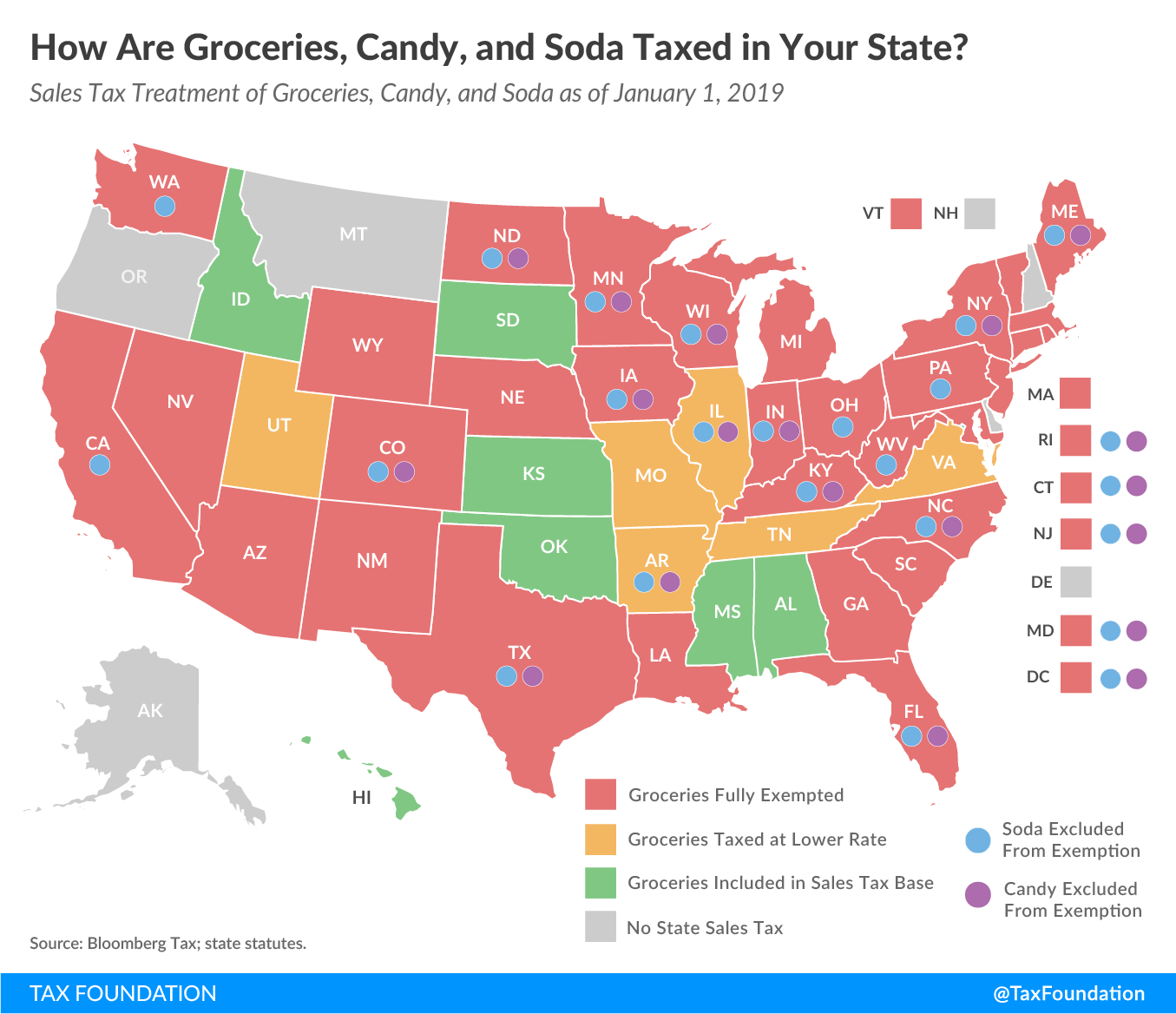

Localities can add as much as 7 5 to that and the average combined rate is 9 237 according to the Tax Foundation Unlike many states Alabama taxes groceries but prescription drugs are tax Alabama collects income taxes from its residents at the following rates For single people heads of families and married people filing separate returns 2 on the first 500 of taxable income 4

Summary If you make 55 000 a year living in the region of Alabama USA you will be taxed 11 342 That means that your net pay will be 43 658 per year or 3 638 per month Your average tax rate is 20 6 and your marginal tax rate is 33 6 This marginal tax rate means that your immediate additional income will be taxed at this rate The state income tax rate in Alabama is progressive and ranges from 2 to 5 while federal income tax rates range from 10 to 37 depending on your income This paycheck calculator can help estimate your take home pay and your average income tax rate How many income tax brackets are there in Alabama The state income tax

Alabama Tax Sales Everything You Need To Know YouTube

https://i.ytimg.com/vi/Ake4BYvVal0/maxresdefault.jpg

Alabama State Tax Guide Kiplinger

https://cdn.mos.cms.futurecdn.net/tDzYFf3QAWvmaoYt58HJKo.jpg

https://smartasset.com/taxes/alabama-tax-calculator

Alabama Income Taxes The state income tax in Alabama is similar to the federal income tax with increasing rates based on income brackets However while the federal income tax has seven brackets Alabama has just three with the top rate of 5 applying to all taxable income over 3 000

https://www.revenue.alabama.gov/faqs/what-is...

What is Alabama s Individual Income Tax Rate For single persons heads of families and married persons filing separate returns 2 First 500 of taxable income 4 Next 2 500 of taxable income 5 All taxable income over 3 000 For married persons filing a joint return 2 First 1 000 of taxable income 4 Next 5 000 of taxable income

Happy Tax Day Forbes Says Alabama Is The 10th Best State For Taxes

Alabama Tax Sales Everything You Need To Know YouTube

Alabama Gas Tax How Did Your Legislator Vote Al

Alabama Grocery Tax Reduction Starts September 1 Rocketcitynow

Ca Tax Brackets Chart Jokeragri

What Is BBVA Immediate Cash And How Much Is The Commission American Post

What Is BBVA Immediate Cash And How Much Is The Commission American Post

San Antonio Fl Sales Tax Rate Leon Langley

How Are Groceries Candy And Soda Taxed In Your State

How Much Is The Down Payment For A 575 000 Home Moreira Team Mortgage

How Much Is Tax In Alabama - You are able to use our Alabama State Tax Calculator to calculate your total tax costs in the tax year 2023 24 Our calculator has recently been updated to include both the latest Federal Tax Rates along with the latest State Tax Rates It has been specially developed to provide users not only with the amount of tax they will be paying but