How Much Is Tax In Nebraska Find out how much you ll pay in Nebraska state income taxes given your annual income Customize using your filing status deductions exemptions and more

QuickFact The average family pays 1 361 00 in Nebraska income taxes 1 Rank 27th out of 51 Download Nebraska Tax Information Sheet Launch Nebraska Income Tax Calculator 1 Nebraska Income Tax Table Note We don t currently have Nebraska s income tax brackets for tax year 2024 SmartAsset s Nebraska paycheck calculator shows your hourly and salary income after federal state and local taxes Enter your info to see your take home pay

How Much Is Tax In Nebraska

How Much Is Tax In Nebraska

https://ne-us.icalculator.com/img/og/US/191.png

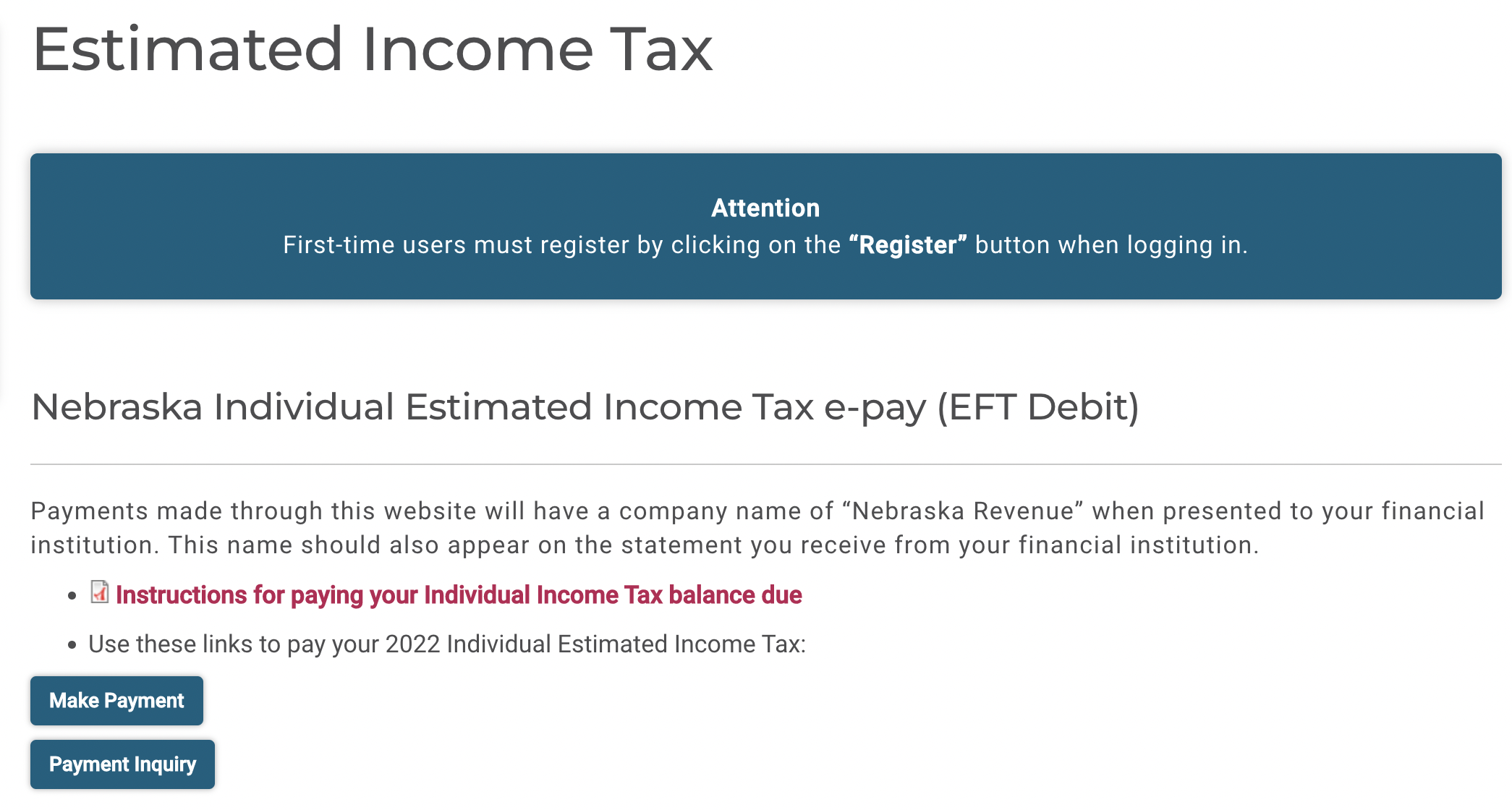

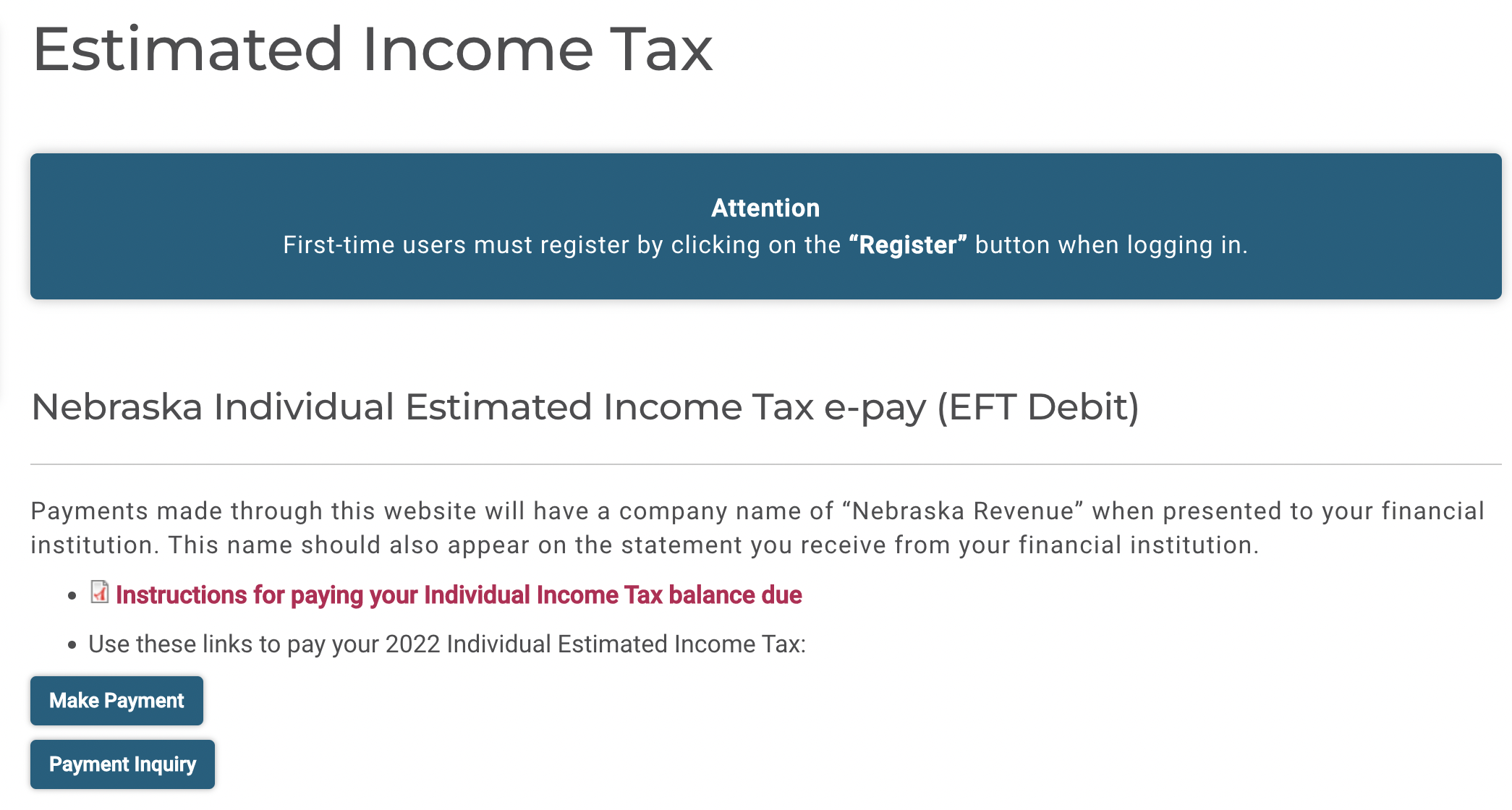

Paying State Income Tax In Nebraska Heard

https://support.joinheard.com/hc/article_attachments/5162117927831/Screen_Shot_2022-03-31_at_21.20.04.png

How Your LLC Will Be Taxed Franchise Tax In Nebraska Create Your Own LLC

https://createyourownllc.com/wp-content/uploads/2022/08/kfqgyzoh3vk.jpg

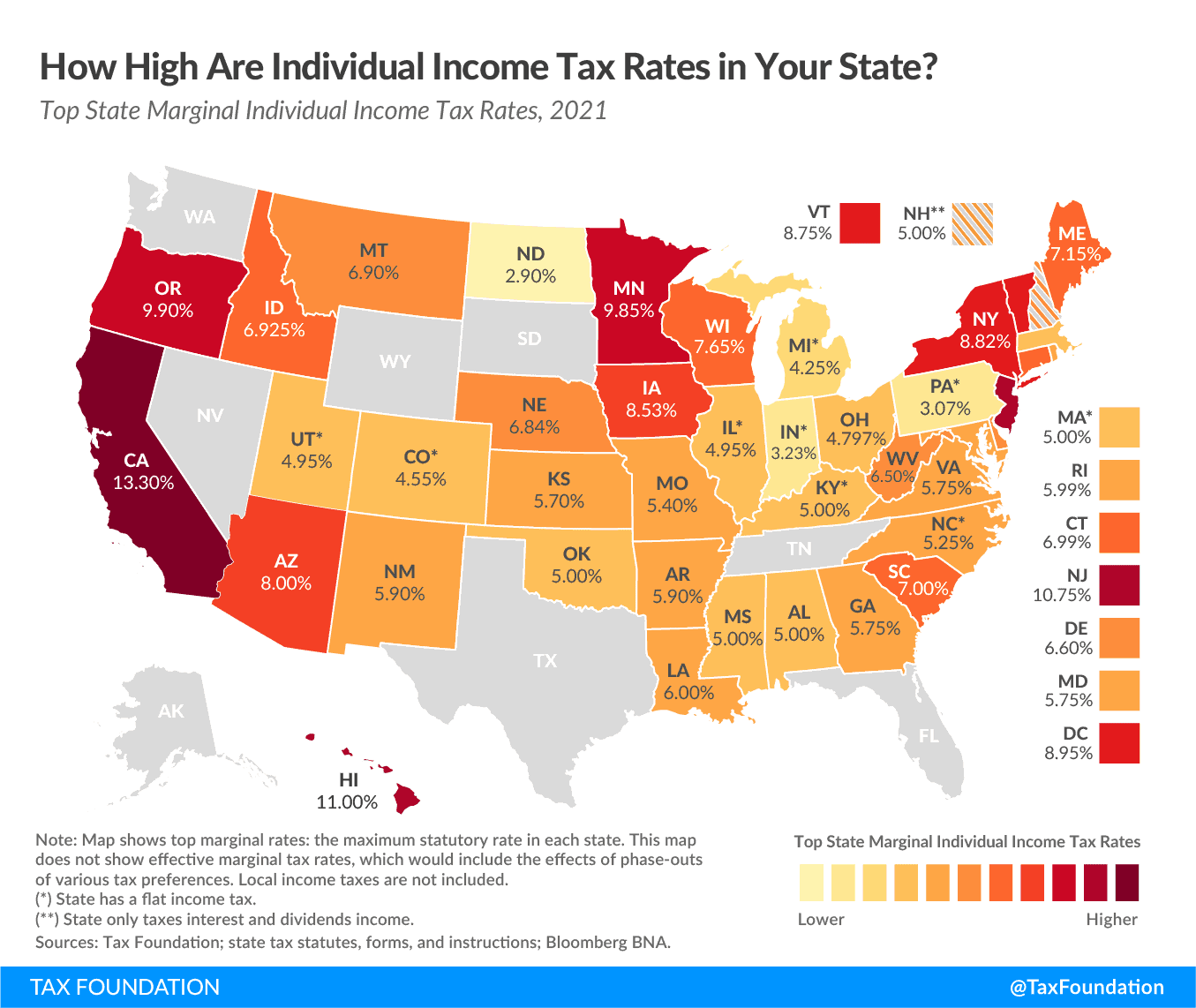

Taxes In Nebraska Nebraska Tax Rates Collections and Burdens How does Nebraska s tax code compare Nebraska has a graduated individual income tax with rates ranging from 2 46 percent to 6 64 percent Nebraska also has a 5 58 percent to 7 25 percent corporate income tax rate Over 66 460 Use the following worksheet if your Nebraska taxable income is more than the maximum amount included in the 2022 Nebraska Tax Table The tax table shown above calculates tax to the midpoint of the bracket The amounts shown below represent tax calculated on 66 460 the endpoint of the bracket

Purchase Amount Purchase Location ZIP Code or Specify Sales Tax Rate Nebraska has a 5 5 statewide sales tax rate but also has 343 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0 838 on top of the state tax You are able to use our Nebraska State Tax Calculator to calculate your total tax costs in the tax year 2024 25 Our calculator has recently been updated to include both the latest Federal Tax Rates along with the latest State Tax Rates

Download How Much Is Tax In Nebraska

More picture related to How Much Is Tax In Nebraska

FAQs For Statement On Standards For Tax Services No 1 Tax Return

https://images.ctfassets.net/rb9cdnjh59cm/1TSCwZdVubc6PkVgKDmdb5/ae50f39e054cdab82146f78f013c0c84/R50_1190995919.jpg?fm=webP

How Your LLC Will Be Taxed Franchise Tax In Nebraska Create Your Own LLC

https://createyourownllc.com/wp-content/uploads/2022/08/q59hmzk38eq-1-930x620.jpg

How Much Is Tax In Ontario Tax Heroes

http://static1.squarespace.com/static/6398aeddb11cd3640d8140fd/639a7b570eb37a08626d4939/649de94ecd0c575486437751/1688070686299/?format=1500w

Current Local Sales and Use Tax Rates and Other Sales and Use Tax Information Income tax calculator Nebraska Where do you work Salary rate Annual Month Biweekly Weekly Day Hour Withholding Salary 55 000 Federal Income Tax 4 868 State Income Tax 2 693 Social Security 3 410 Medicare 798 Total tax 11 769 Net pay 43 231 Marginal tax rate 36 2 Average tax rate 21 4 78 6

Motor Vehicle Fee Registration Fee Alternative Fuel Fee NOTE Some localities collect additional local fees and taxes Contact your County Treasurer s office for more information On top of the federal income tax the residents of Nebraska only need to pay the state level income tax rate ranging from 2 46 to 6 64 How much do you make after taxes in Nebraska The take home pay of a single filer with an annual salary of

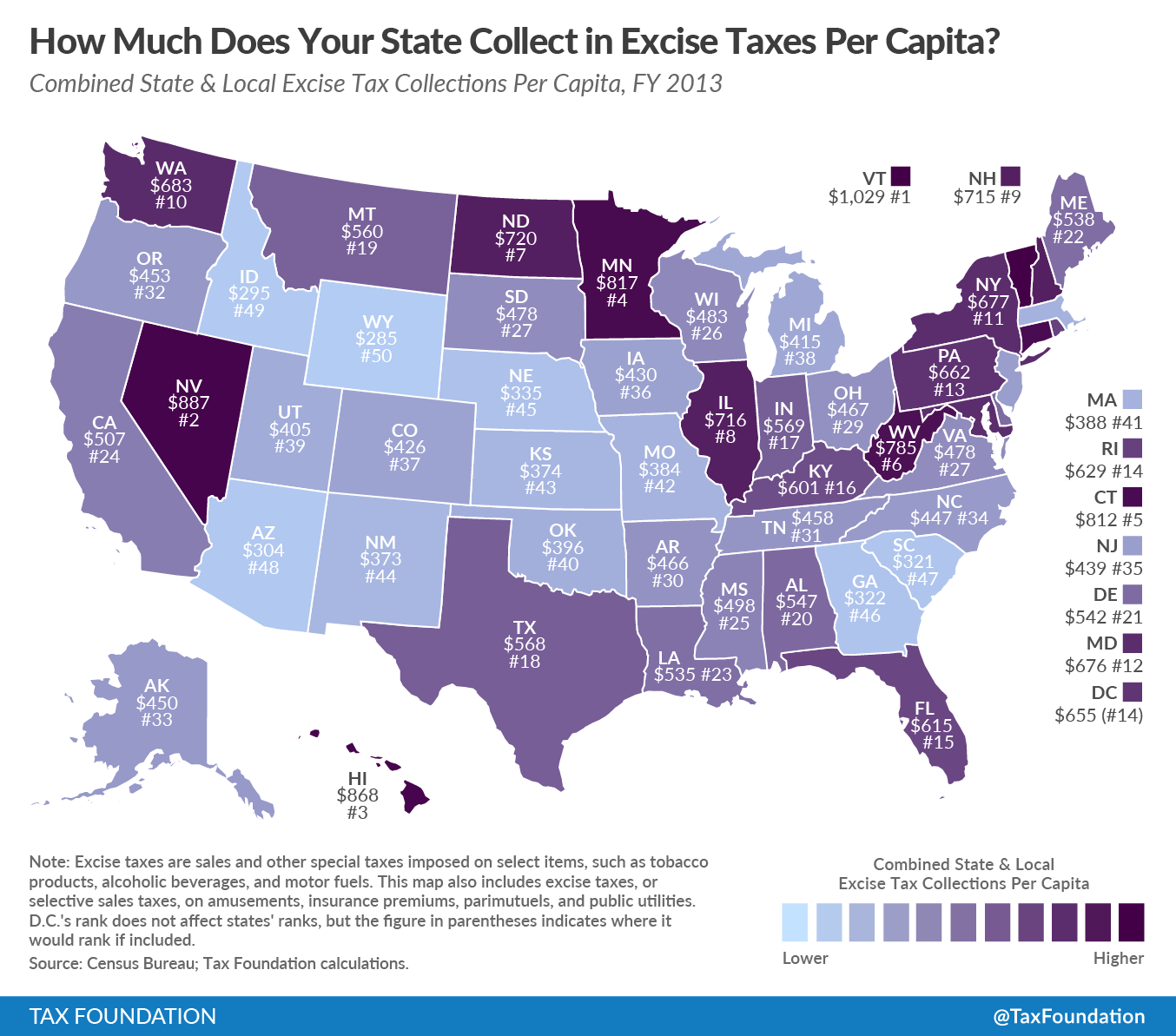

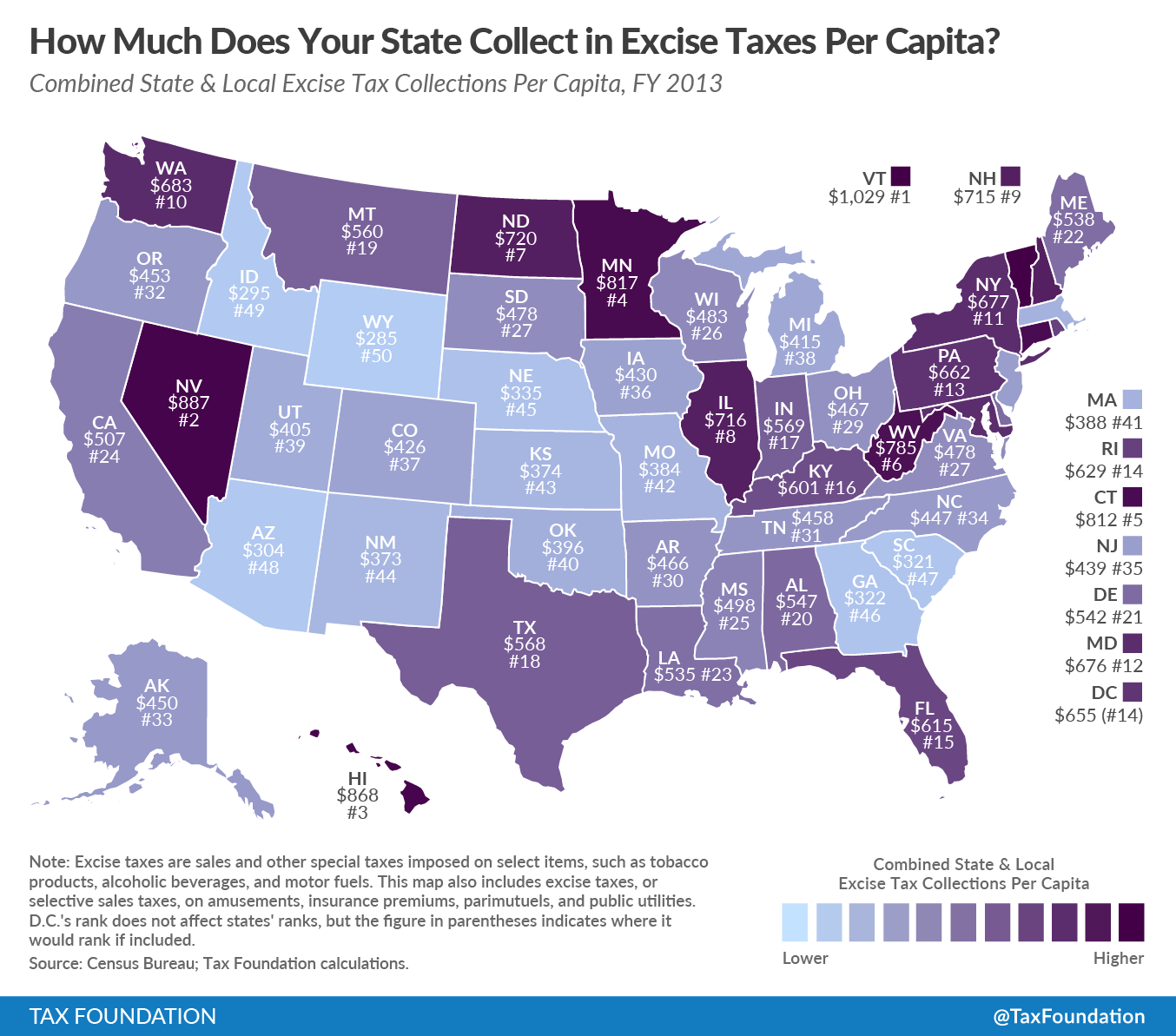

How Much Is Tax In The Us TaxesTalk

https://www.taxestalk.net/wp-content/uploads/how-much-does-your-state-collect-in-excise-taxes-per-capita-tax.png

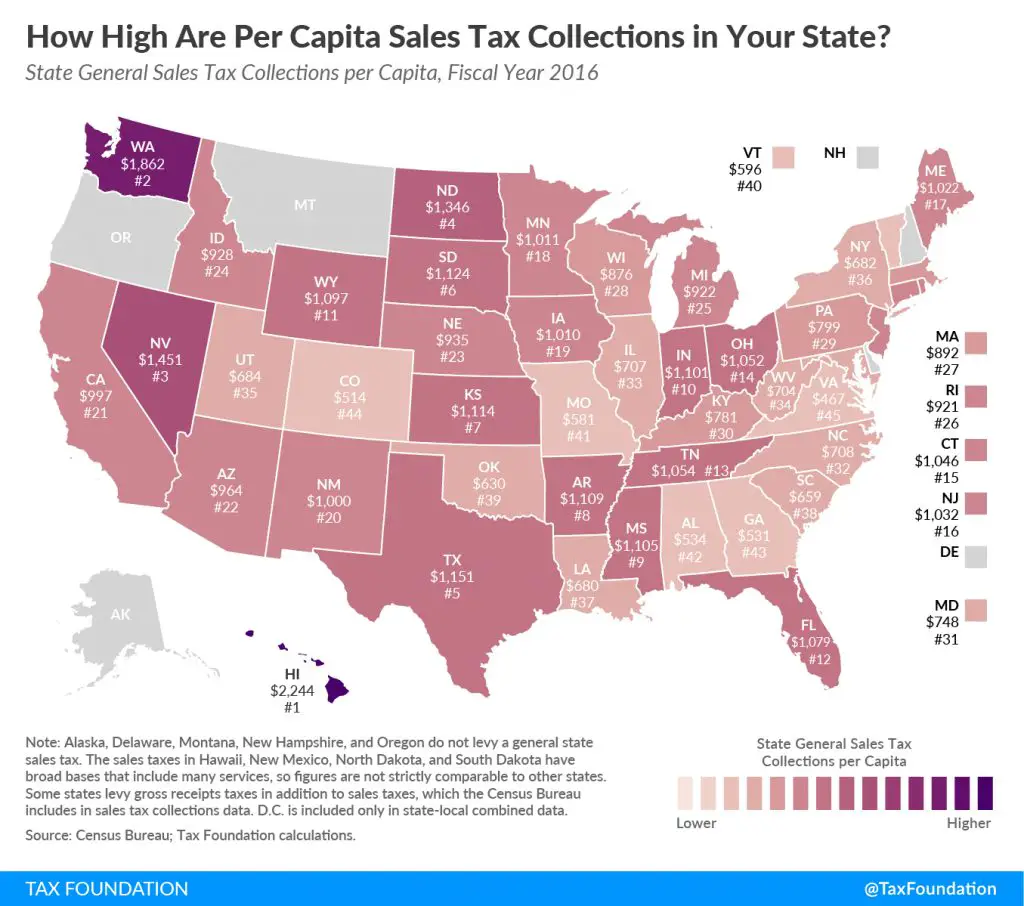

Sales Tax Nebraska Nebraska Local Sales Tax Rates

https://www.salestaxsolutions.us/wp-content/uploads/2023/03/Nebraska-sales-tax.png

https://smartasset.com/taxes/nebraska-tax-calculator

Find out how much you ll pay in Nebraska state income taxes given your annual income Customize using your filing status deductions exemptions and more

https://www.tax-rates.org/nebraska/income-tax

QuickFact The average family pays 1 361 00 in Nebraska income taxes 1 Rank 27th out of 51 Download Nebraska Tax Information Sheet Launch Nebraska Income Tax Calculator 1 Nebraska Income Tax Table Note We don t currently have Nebraska s income tax brackets for tax year 2024

Paying State Income Tax In Nebraska Heard

How Much Is Tax In The Us TaxesTalk

Does Texas Have Property Tax TaxesTalk

Fillable Nebraska State Income Tax Forms Printable Forms Free Online

TAX HACKS The 9 States With No Income Tax and The Hidden Catch In Each

Nebraska Sales Tax Calculator Step By Step Business

Nebraska Sales Tax Calculator Step By Step Business

How Much Are Taxes In Brookfield For Businesses Icsid

How Much Is Tax In The Us TaxesTalk

How Much Is Tax In Georgia TaxesTalk

How Much Is Tax In Nebraska - You are able to use our Nebraska State Tax Calculator to calculate your total tax costs in the tax year 2024 25 Our calculator has recently been updated to include both the latest Federal Tax Rates along with the latest State Tax Rates