How Much Is Tax Per Dollar In Alabama For single persons heads of families and married persons filing separate returns 2 First 500 of taxable income 4 Next 2 500 of taxable income 5 All taxable income over 3 000 For married persons filing a joint return 2 First 1 000 of taxable income 4 Next 5 000 of taxable income 5 All taxable income over 6 000

The Alabama standard deduction varies depending on filing status and income At a certain point the deduction descends steadily for increasing income levels until it reaches its minimum amount at either 15 000 or 30 000 as is reflected in the table below 25 999 26 499 26 499 26 999 26 999 27 499 27 499 27 999 27 999 Alabama has income taxes that range from 2 up to 5 slightly below the national average The Heart of Dixie has a progressive income tax rate in which the amount of tax withheld depends on which of its three tax brackets you fall under

How Much Is Tax Per Dollar In Alabama

How Much Is Tax Per Dollar In Alabama

https://www.wealthmanagement.com/sites/wealthmanagement.com/files/uploads/2015/12/taxratechart.png

Family Dollar Just Launched A Recall In 6 States Due To Rodent

https://commissionerlorrainecochranjohnson.com/wp-content/uploads/2022/02/image-1024x682.jpg

Report Dollar Goes Further In Alabama Than 47 States

https://assets.caboosecms.com/posts/4502_huge.jpg?1559057676

Obtain the Alabama state income tax Because of your AGI your standard deduction is 4000 and a couple exemption of 3000 Hence your taxable income becomes 73 000 The state income tax is 220 plus 5 of the amount over 6000 which equals 3570 Supposing you live in Bessemer the local income tax is 1 of your AGI The Tax tables below include the tax rates thresholds and allowances included in the Alabama Tax Calculator 2021 Alabama provides a standard Personal Exemption tax deduction of 1 500 00 in 2021 per qualifying filer and 1 000 00 per qualifying dependent s this is used to reduce the amount of income that is subject to tax in 2021

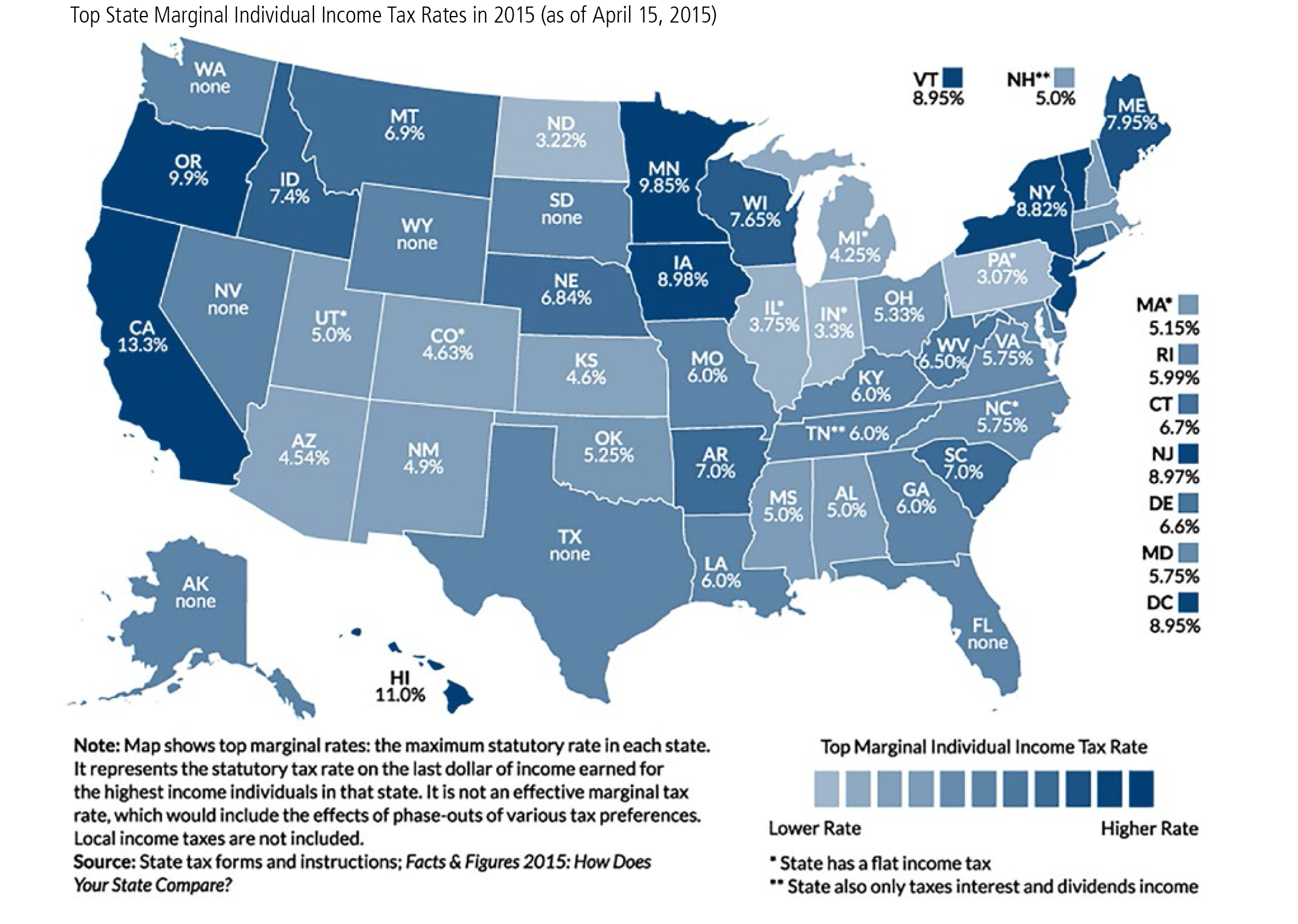

Alabama has a graduated individual income tax with rates ranging from 2 00 percent to 5 00 percent There are also jurisdictions that collect local income taxes Alabama has a 6 50 percent corporate income tax rate Alabama has a 4 00 percent state sales tax rate a max local sales tax rate of 7 50 percent and an average combined state and Quick Alabama tax facts State income tax 2 to 5 Local occupational tax 0 5 to 2 State sales tax 4 Property tax an average rate of approximately 0 42 Gas tax 0 24 per gallon on gasoline and 0 25 per gallon on diesel fuel Tobacco tax 0 675 per pack of 20 cigarettes Insurance premium tax 1 to 4

Download How Much Is Tax Per Dollar In Alabama

More picture related to How Much Is Tax Per Dollar In Alabama

What Is BBVA Immediate Cash And How Much Is The Commission American Post

https://www.americanpost.news/wp-content/uploads/2022/02/What-is-BBVA-Immediate-Cash-and-how-much-is-the.jpg

How High Are Property Taxes In Your State American Property Owners

https://propertyownersalliance.org/wp-content/uploads/2020/10/property-taxes-by-state-2020-FV-01-1024x868-1.png

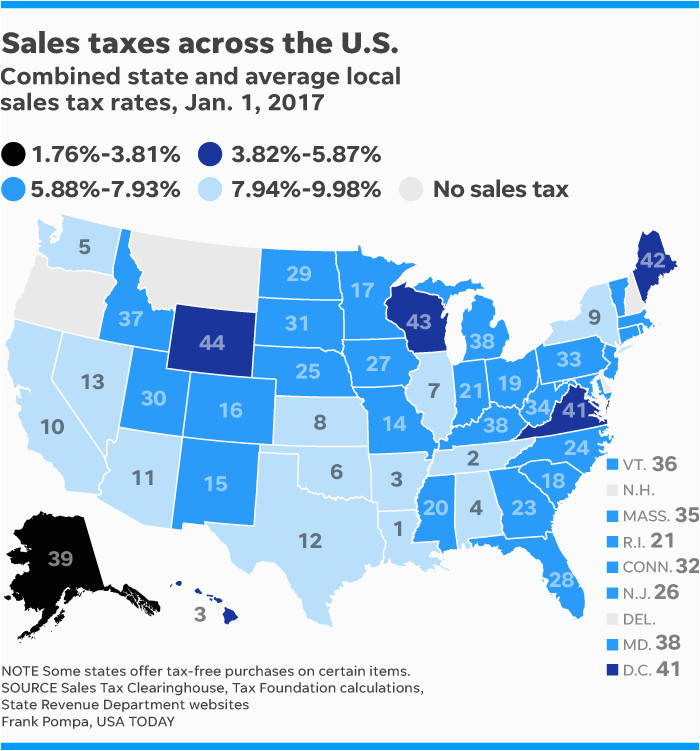

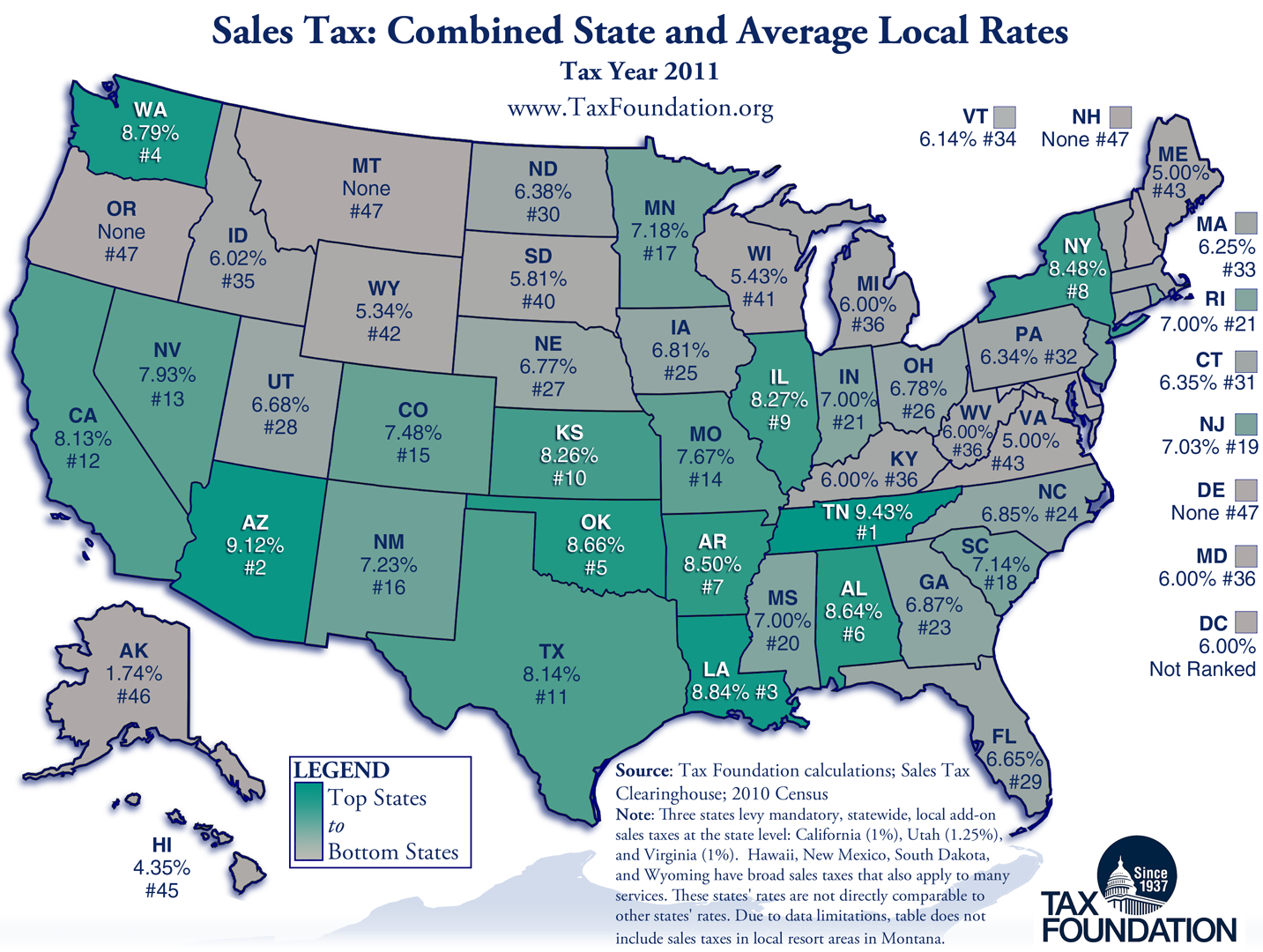

OUCH Alabama Has 4th Highest Combined Sales Tax Rate In The Country

http://yellowhammernews.com/wp-content/uploads/2016/05/State-Sales-tax-rates.png

Income tax calculator Alabama Find out how much your salary is after tax Enter your gross income Per Where do you work Salary rate Annual Month Weekly Day Hour Withholding Salary 55 000 Federal Income Tax 4 868 State Income Tax 2 267 Social Security 3 410 Medicare 798 Total tax 11 342 Net pay 43 658 Marginal tax Alabama has three income tax brackets but most people pay the highest rate of 5 since it applies to income over 6 000 for married couples filing jointly and income over 3 000 for all other

Alabama Paycheck Calculator Easily estimate take home pay after income tax so you can have an idea of what to possibly expect when planning your budget Last reviewed on January 28 2023 Optional Criteria See values per Year Month Biweekly Week Day Hour Results Income Before Tax Take Home Pay Total Tax Average Tax Rate The Tax tables below include the tax rates thresholds and allowances included in the Alabama Tax Calculator 2023 Alabama provides a standard Personal Exemption tax deduction of 1 500 00 in 2023 per qualifying filer and 1 000 00 per qualifying dependent s this is used to reduce the amount of income that is subject to tax in 2023

How Much Is The Down Payment For A 575 000 Home Moreira Team Mortgage

https://moreirateam.com/wp-content/uploads/down-payment-for-a-575000-dollar-house.jpg

QoD Top 3 Expenses Govt Paid For With Our Tax Dollars In 2019 Blog

https://d3f7q2msm2165u.cloudfront.net/aaa-content/user/files/QoD/taxes.jpg

https://www.revenue.alabama.gov/faqs/what-is...

For single persons heads of families and married persons filing separate returns 2 First 500 of taxable income 4 Next 2 500 of taxable income 5 All taxable income over 3 000 For married persons filing a joint return 2 First 1 000 of taxable income 4 Next 5 000 of taxable income 5 All taxable income over 6 000

https://smartasset.com/taxes/alabama-tax-calculator

The Alabama standard deduction varies depending on filing status and income At a certain point the deduction descends steadily for increasing income levels until it reaches its minimum amount at either 15 000 or 30 000 as is reflected in the table below 25 999 26 499 26 499 26 999 26 999 27 499 27 499 27 999 27 999

California Sales Tax Map Secretmuseum

How Much Is The Down Payment For A 575 000 Home Moreira Team Mortgage

Tax Day 2017 Where Your Tax Dollar Goes

Ranking State And Local Sales Taxes Tax Foundation Texas Sales Tax

How Much Is Tax On 40 000 Salary YouTube

How Much Is The Percentage From Medicare

How Much Is The Percentage From Medicare

US Property Tax Comparison By State Armstrong Economics

Happy Tax Day Forbes Says Alabama Is The 10th Best State For Taxes

In 1 Chart How Much The Rich Pay In Taxes 19FortyFive

How Much Is Tax Per Dollar In Alabama - Quick Alabama tax facts State income tax 2 to 5 Local occupational tax 0 5 to 2 State sales tax 4 Property tax an average rate of approximately 0 42 Gas tax 0 24 per gallon on gasoline and 0 25 per gallon on diesel fuel Tobacco tax 0 675 per pack of 20 cigarettes Insurance premium tax 1 to 4