How Much Is The Carbon Tax Rebate In Bc On Monday B C raised its carbon tax by 23 per cent to 80 a tonne from 65 a tonne an amount that the B C NDP government said represents an increase of about three cents a litre

Changes to income thresholds in the 2023 B C budget boosted what a single person can receive to a maximum of 447 per year For a family of four the maximum amount is 893 50 The new Individuals receiving 447 this year will collect 504 a year starting in July 2024 Approximately 65 of people in B C receive money back through the tax credit The credit will increase annually with the goal of 80 of individuals and families receiving the credit by 2030

How Much Is The Carbon Tax Rebate In Bc

How Much Is The Carbon Tax Rebate In Bc

https://accufile.ca/blog_images/how-to-claim-the-carbon-tax-rebate-climate-action-incentive-1000x700.jpg

America Should Adopt A Carbon Tax Now As I See It Pennlive

https://www.pennlive.com/resizer/pWIs_Tu_EqTIEGJNCPrkl_0j7m4=/1280x0/smart/advancelocal-adapter-image-uploads.s3.amazonaws.com/image.pennlive.com/home/penn-media/width2048/img/opinion/photo/shutterstock-73723585jpg-d16c80d4865485e6.jpg

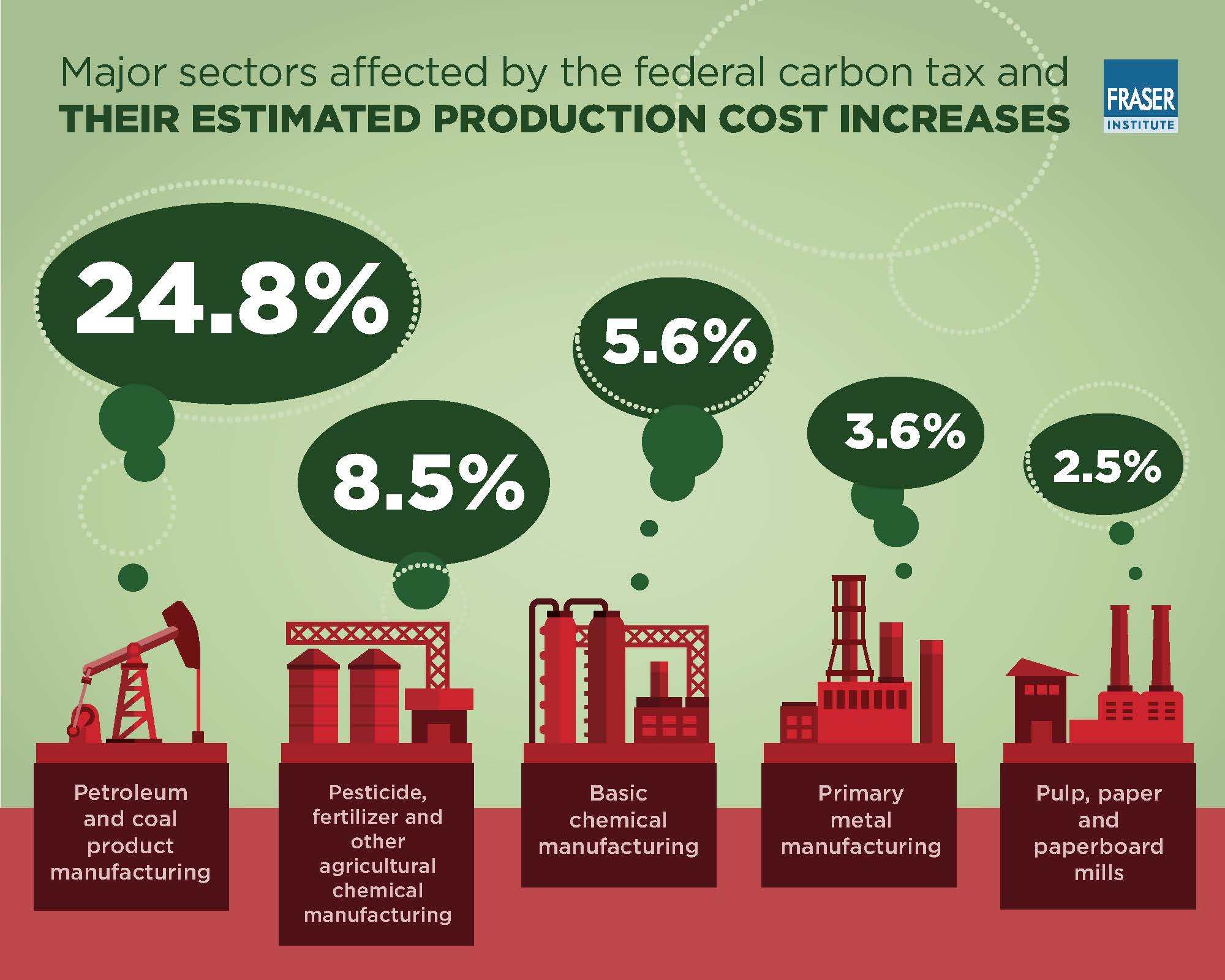

Carbon Taxes What Do They Mean For Your Business Folkestone Works

https://folkestone.works/wp-content/uploads/2021/06/carbon-tax-scaled.jpg

On April 1 2024 B C s carbon tax rate rose from 65 to 80 per tCO2e To protect affordability revenues generated by the new carbon tax increases will be directed to carbon tax relief for British Columbians through enhancements to the Climate Action Tax Credit Starting in 2024 25 rural Canadians would receive a 20 per cent top up to the base Canada Carbon Rebate in recognition of their higher energy needs and more limited access to cleaner transportation options In order to receive their Canada Carbon Rebate Canadians need to file their annual tax return

As of April 2023 the maximum Climate Action Tax Credit British Columbian adults can claim will increase from 193 50 to 447 per year A four person family will be able to claim up to Single people in B C who make under a net income of 61 465 annually are eligible for up to 447 this year an increase of 250 from 2022 And a family of four that makes less than 89 270

Download How Much Is The Carbon Tax Rebate In Bc

More picture related to How Much Is The Carbon Tax Rebate In Bc

Carbon Tax Rebate Available To Alberta Farmers Fulcrum Group

https://www.fulcrumgroup.ca/wp-content/uploads/2022/03/fulcrum-group-accountant-grande-prairie-carbon-tax-rebate-farmers.png

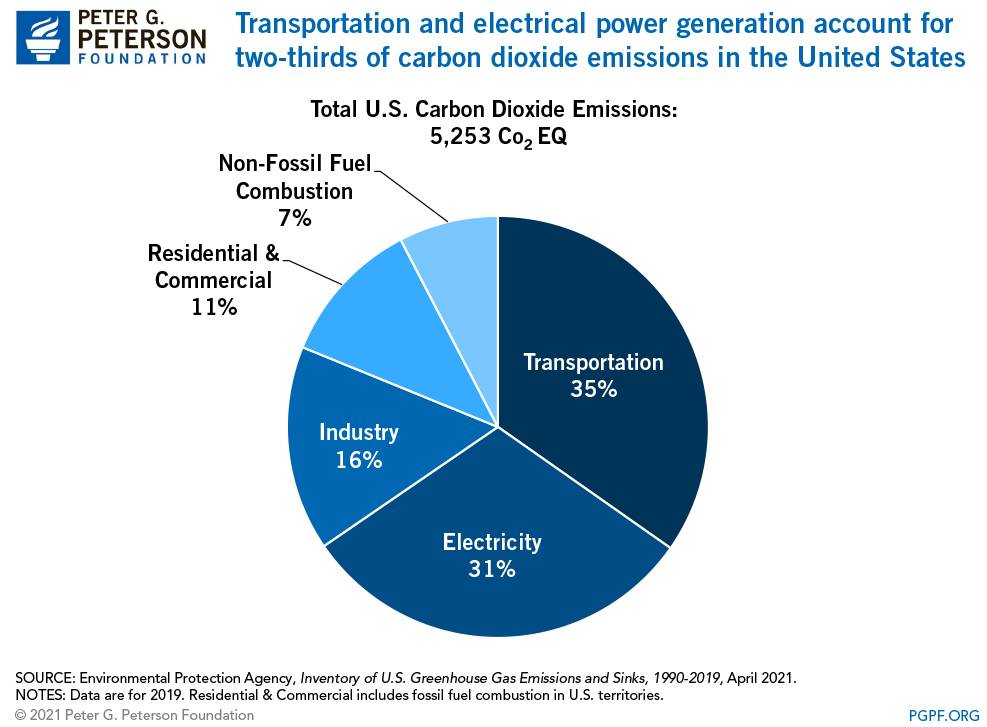

What Is A Carbon Tax How Would It Affect The Economy

https://www.pgpf.org/sites/default/files/what-is-a-carbon-tax-chart-1.jpg

How Would Gov Jay Inslee s Proposed Carbon Tax Work Washington

https://washingtonstatewire.com/wp-content/uploads/2017/01/carbon-tax-revenue-breakdown-e1484254891918.png

The amount of carbon tax paid by British Columbians will vary depending on family consumption and household use of taxable fuels for heating cooking and transportation To improve affordability the government has increased the Climate Action Tax Credit for households The Canada Carbon Rebate CCR is a tax free amount paid to help individuals and families in Alberta Saskatchewan Manitoba and Ontario to offset the cost of the federal pollution pricing Learn about payments and who is eligible

The annual carbon tax increases will raise the price of a litre of gasoline by 26 cents by the end of the decade which the NDP government says will be offset by rebates and credits If you qualify for the BC climate action tax credit you receive payments quarterly along with the GST HST credit in July October January and April You need to file a tax return every year to get your BC climate action tax credit even if

Your Cheat Sheet To Carbon Pricing In Canada Delphi

https://delphi.ca/wp-content/uploads/2018/10/carbon-pricing-canada-map.png

What You Need To Know About The Carbon Tax Rebate In N S And N B

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA1dxVaa.img?w=1024&h=683&m=4&q=88

https://vancouversun.com/news/as-b-c-carbon-tax...

On Monday B C raised its carbon tax by 23 per cent to 80 a tonne from 65 a tonne an amount that the B C NDP government said represents an increase of about three cents a litre

https://www.cbc.ca/news/canada/british-columbia/bc...

Changes to income thresholds in the 2023 B C budget boosted what a single person can receive to a maximum of 447 per year For a family of four the maximum amount is 893 50 The new

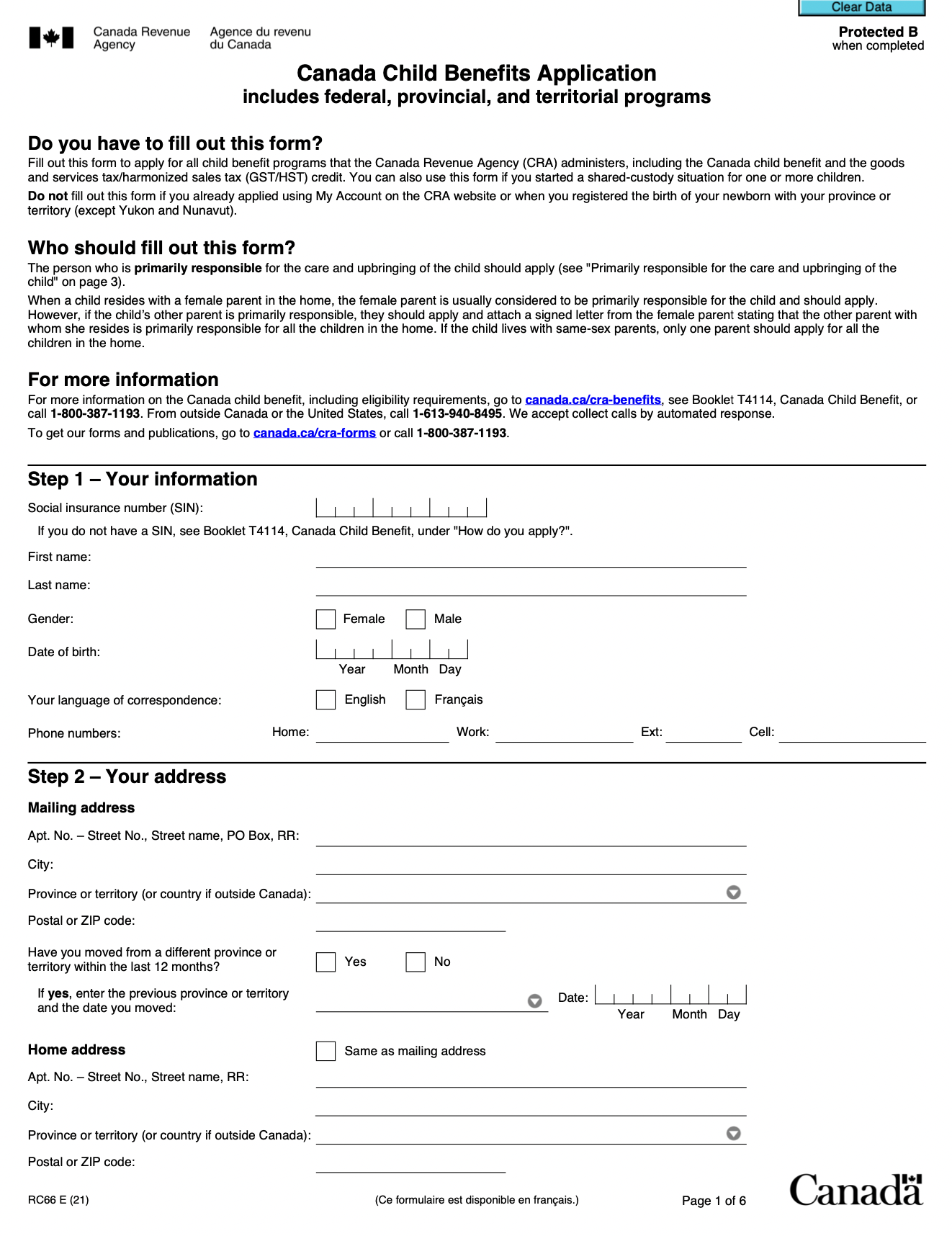

Carbon Tax Rebate Form Printable Rebate Form

Your Cheat Sheet To Carbon Pricing In Canada Delphi

Is The 1 January 2019 Implementation Date For Carbon Tax Possible

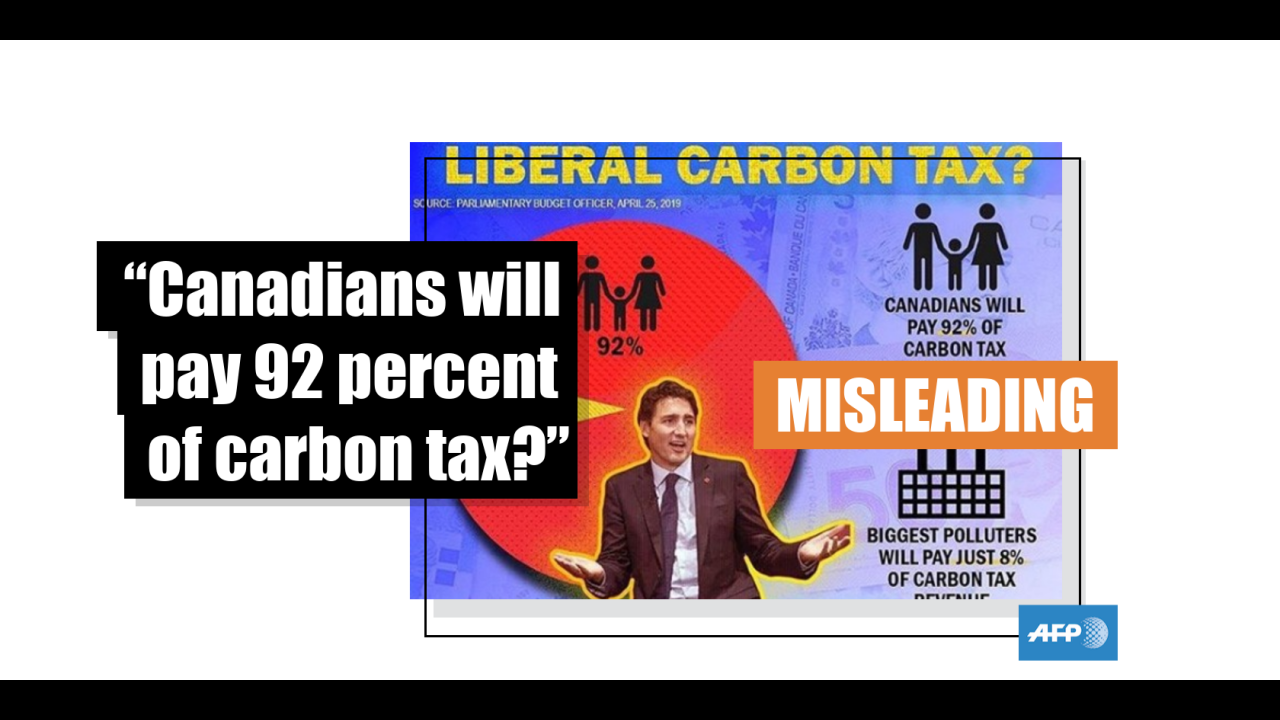

Canada s Carbon Tax Misleading Claims Fail To Mention Rebates Fact Check

The Carbon Tax Rebate In New Brunswick This Is New Brunswick

Carbon Tax Canada All You Need To Know About Bc S Carbon Tax Shift In

Carbon Tax Canada All You Need To Know About Bc S Carbon Tax Shift In

Explainer Which Countries Have Introduced A Carbon Tax World

How To Use Your Carbon Tax Rebate To Lower Your Taxes and Save The

Tax Credits Save You More Than Deductions Here Are The Best Ones

How Much Is The Carbon Tax Rebate In Bc - The Canada Carbon Rebate is a tax free payment created to help Canadian households offset the cost of federal pollution pricing at gas pumps According to the Canadian government eight in