How Much Is The Child Care Tax Credit For 2021 A1 For tax year 2021 the Child Tax Credit increased from 2 000 per qualifying child to 3 600 for children ages 5 and under at the end of 2021 and 3 000 for children ages 6 through 17 at the end of 2021 Note The 500 nonrefundable Credit for Other Dependents amount has not changed

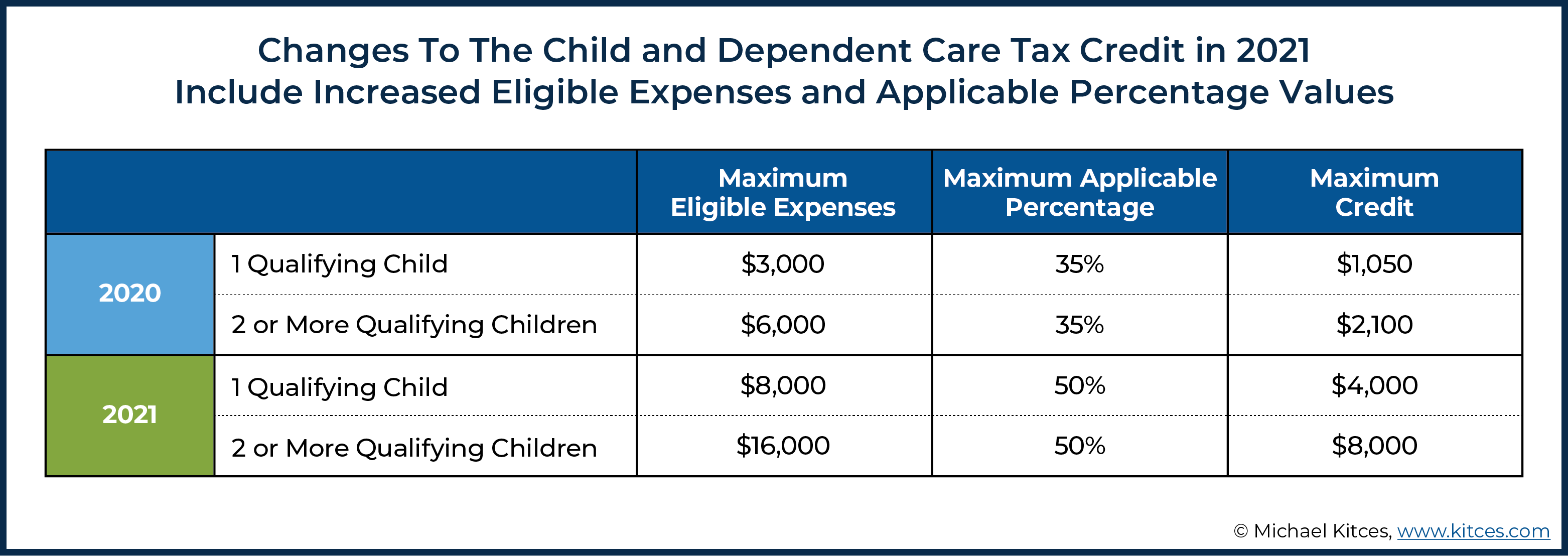

For tax year 2021 the maximum eligible expense for this credit is 8 000 for one child and 16 000 for two or more Depending on their income taxpayers could write off up to 50 of these expenses For the purposes of this credit the IRS defines a qualifying person as A taxpayer s dependent who is under age 13 when the care is provided Take advantage of the 2021 child care credit and receive a refundable tax credit of up to 8 000 This tax season an often overlooked tax credit could put up to 8 000 back in families

How Much Is The Child Care Tax Credit For 2021

How Much Is The Child Care Tax Credit For 2021

https://vadogwood.com/wp-content/uploads/sites/12/2021/07/Child-Tax-Credit1.jpg

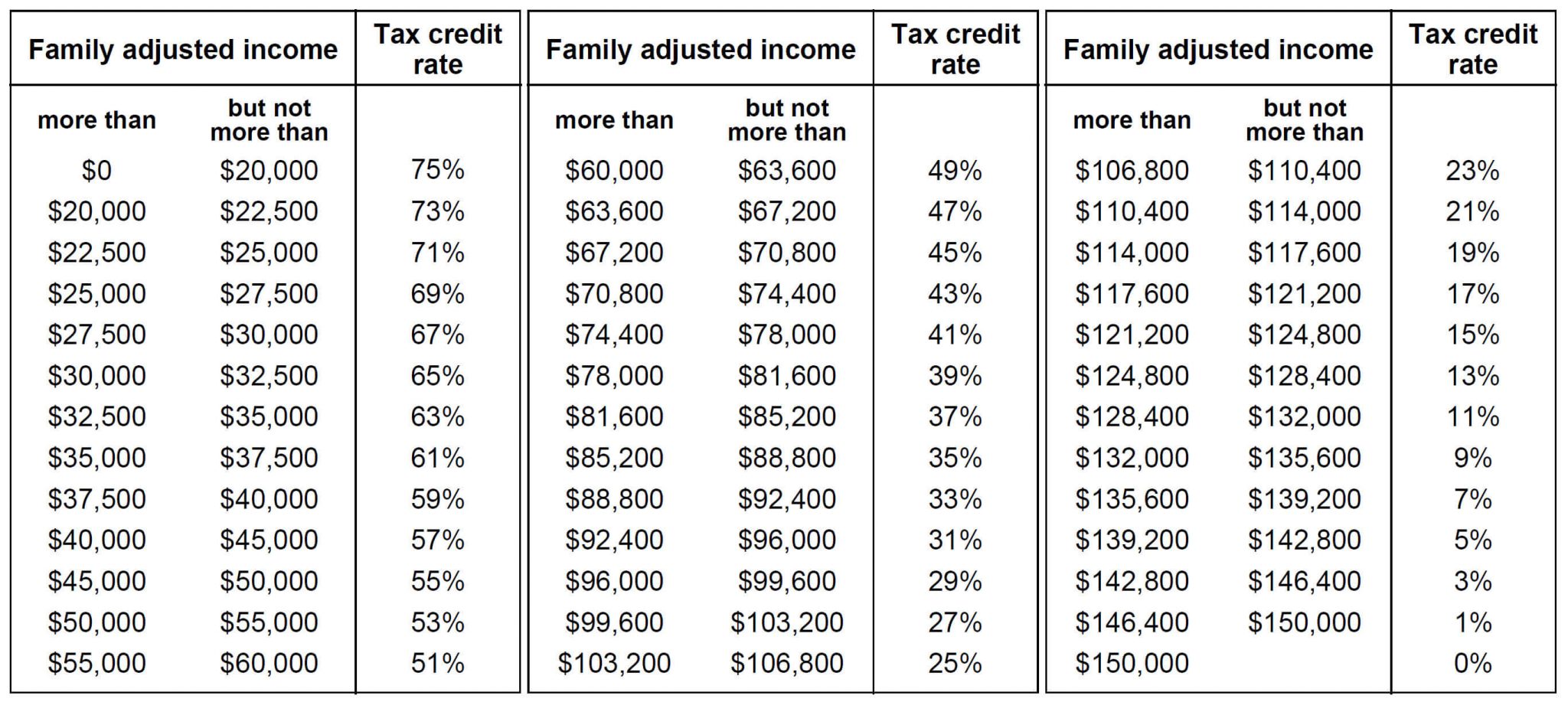

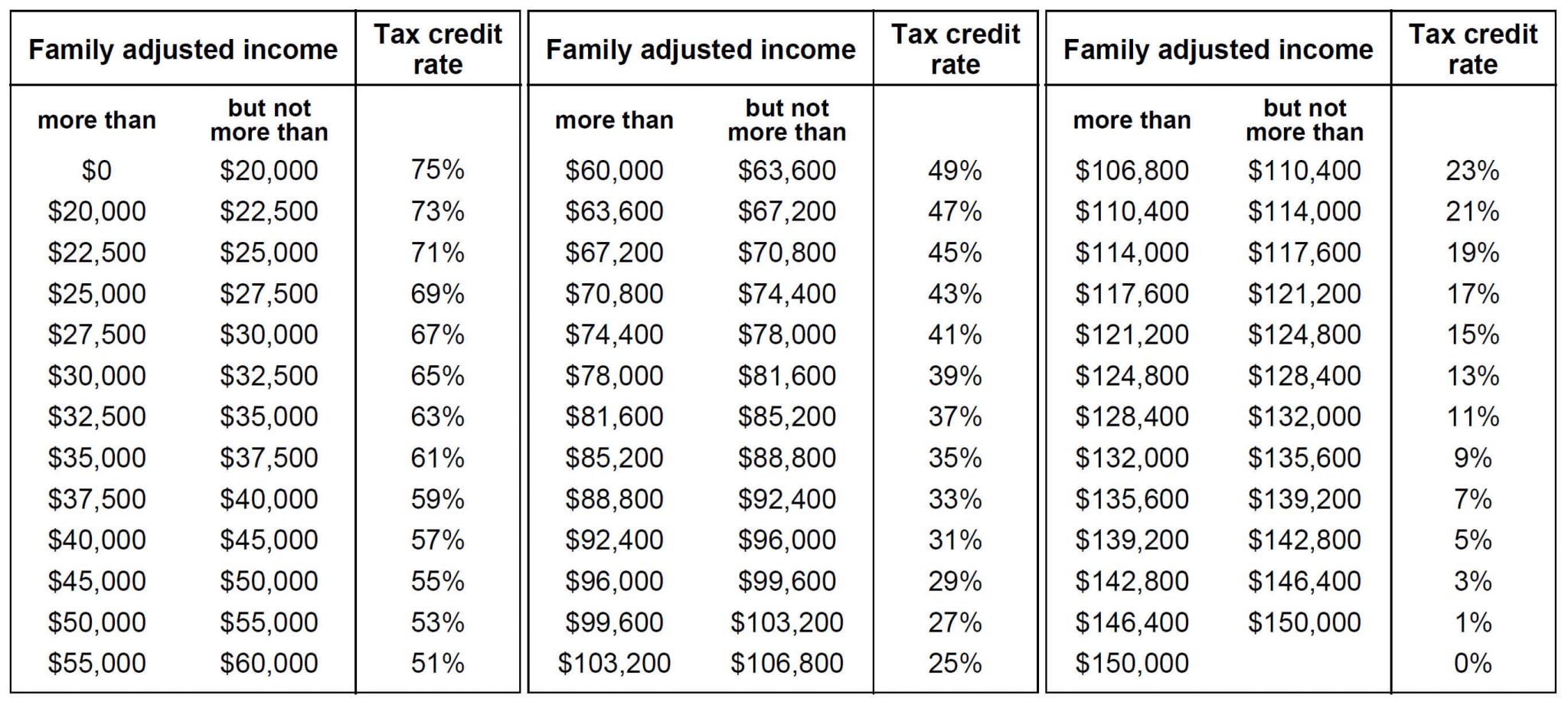

Ontario Childcare Tax Credit Refundable Tax Credit For Low income

https://cdn.taxory.com/wp-content/uploads/2021/01/childcare-access-and-relief-from-expenses-tax-credit-2048x917.jpg

What Is The Child Care Tax Credit And How Do You Claim It

https://andersonadvisors.com/wp-content/uploads/2021/09/child-care-tax-credit-1080x675.jpeg

For tax year 2021 the taxes you file in 2022 The amount of qualifying expenses increases from 3 000 to 8 000 for one qualifying person and from 6 000 to 16 000 for two or more qualifying individuals The percentage of qualifying expenses eligible for the credit increases from 35 to 50 In about three weeks millions of American families will receive the first of six monthly payments of up to 300 per child from the federal government thanks to an expanded child tax

To get the full enhanced CTC which amounts to 3 600 for children under 6 years old and 3 000 for kids ages 6 to 17 years old single taxpayers must earn less than 75 000 and joint filers When combined with the 50 maximum credit percentage that puts the highest credit amount available for the 2021 tax year at 4 000 if you have just one child and 8 000 for two or more children

Download How Much Is The Child Care Tax Credit For 2021

More picture related to How Much Is The Child Care Tax Credit For 2021

Is There A Refundable Child Tax Credit For 2023 Leia Aqui How Much Is

https://cdn.mos.cms.futurecdn.net/atBAeA95EXm3hifrNbAKPV.jpg

Do You Have To Pay Back The Child Tax Credit In 2022 Leia Aqui Will

https://static01.nyt.com/images/2022/12/14/upshot/14up-child-tax-credit-promo-promo/14up-child-tax-credit-promo-promo-mediumSquareAt3X.png

Who Gets Tax Credits Leia Aqui Who Gets Federal Tax Credits

https://cdn.newswire.com/files/x/32/c9/0bc29c33e2af4d42f581fad9e660.png

For 2021 only ARPA increased the limit on expenses that can be claimed to 8 000 for one qualifying person and 16 000 for two or more qualifying persons The maximum credit amount was raised to 50 percent For the first time in 2021 the credit became potentially refundable If you paid for babysitting day care or even a summer camp you might be eligible to receive up to 8 000 in credits during this year s tax season depending on how many dependents you have and

The child and dependent care credit CDCC is a tax credit for parents or caregivers to help cover the cost of qualified care expenses for a child under 13 a spouse or parent unable to care In brief for the 2021 tax year you could get up to 4 000 back for one child and 8 000 back for care of two or more In prior years the maximum return for the credit was 1 050 for

Tax Opportunities Expanded Individual Tax Credits In New Law Blog

https://mfiworks.com/wp-content/uploads/2021/05/the-child-tax-credit-and-the-dependent-care-credit.jpg

What Families Need To Know About The CTC In 2022 CLASP

https://www.clasp.org/wp-content/uploads/2022/04/CTC20_f202220Infographic_final_crop.png

https://www.irs.gov/credits-deductions/2021-child...

A1 For tax year 2021 the Child Tax Credit increased from 2 000 per qualifying child to 3 600 for children ages 5 and under at the end of 2021 and 3 000 for children ages 6 through 17 at the end of 2021 Note The 500 nonrefundable Credit for Other Dependents amount has not changed

https://www.irs.gov/newsroom/understanding-the...

For tax year 2021 the maximum eligible expense for this credit is 8 000 for one child and 16 000 for two or more Depending on their income taxpayers could write off up to 50 of these expenses For the purposes of this credit the IRS defines a qualifying person as A taxpayer s dependent who is under age 13 when the care is provided

Is The Child Tax Credit A Good Thing Leia Aqui How Helpful Is The

Tax Opportunities Expanded Individual Tax Credits In New Law Blog

How Many Monthly Child Tax Credit Payments Were There Leia Aqui How

Great News Child Care Tax Credit Expanded For 2021 Brady Martz

Big Changes To The Child And Dependent Care Tax Credits FSAs In 2021

Care Credit Printable Application Printable Word Searches

Care Credit Printable Application Printable Word Searches

Child Tax Credit Payments 06 28 2021 News Affordable Housing

American Rescue Plan 2021 Tax Credit Stimulus Check Rules

Big Changes To The Child And Dependent Care Tax Credits FSAs In 2021

How Much Is The Child Care Tax Credit For 2021 - For tax year 2021 the taxes you file in 2022 The amount of qualifying expenses increases from 3 000 to 8 000 for one qualifying person and from 6 000 to 16 000 for two or more qualifying individuals The percentage of qualifying expenses eligible for the credit increases from 35 to 50