How Much Is The Child Care Tax Credit For 2022 The child and dependent care credit is a tax credit that may help you pay for the care of eligible children and other dependents qualifying persons The credit is

The child and dependent care credit is generally worth 20 to 35 of up to 3 000 for one qualifying dependent or 6 000 for two or more qualifying dependents Introduction This publication explains the tests you must meet to claim the credit for child and dependent care expenses It explains how to figure and claim the credit You may

How Much Is The Child Care Tax Credit For 2022

How Much Is The Child Care Tax Credit For 2022

https://i0.wp.com/zobuz.com/wp-content/uploads/2020/05/The-Child-Tax-Credit.jpg

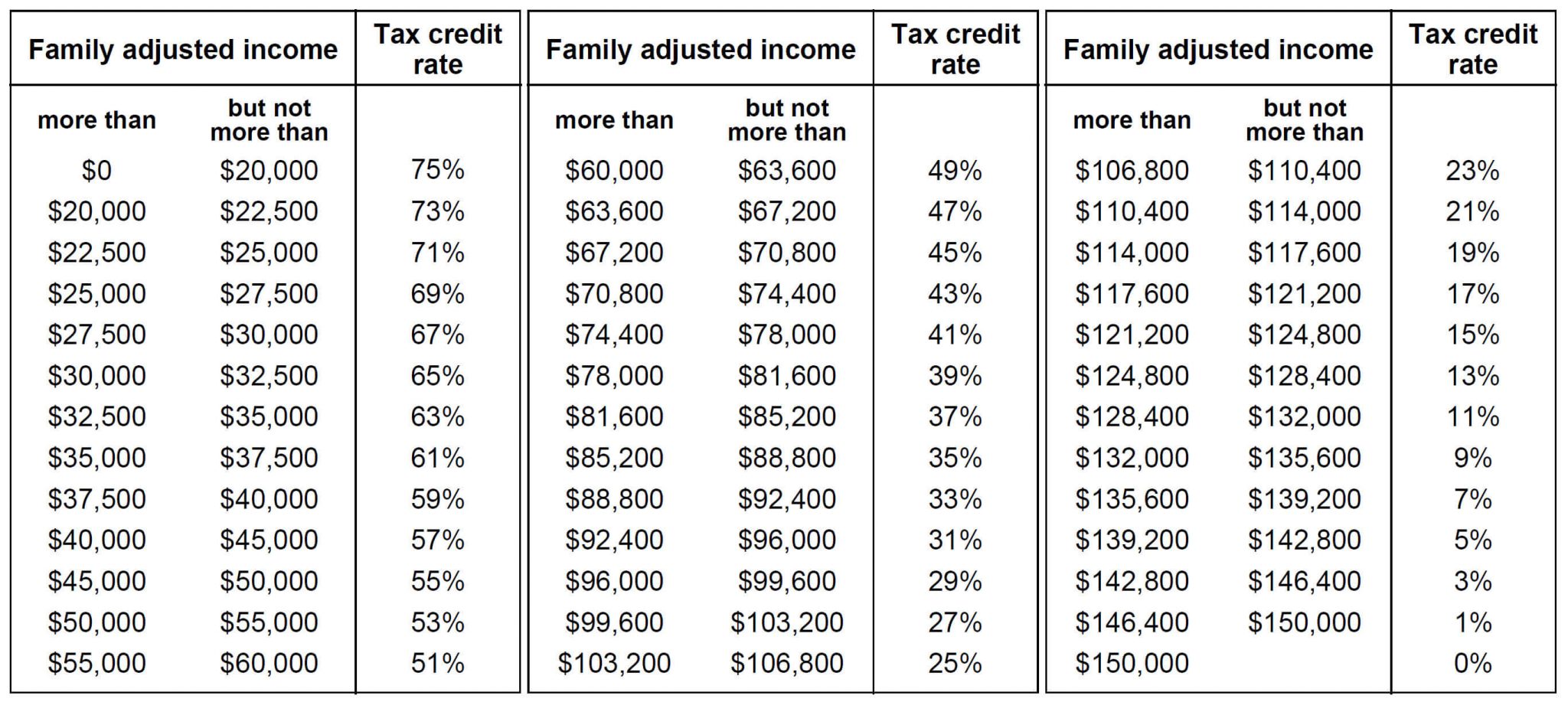

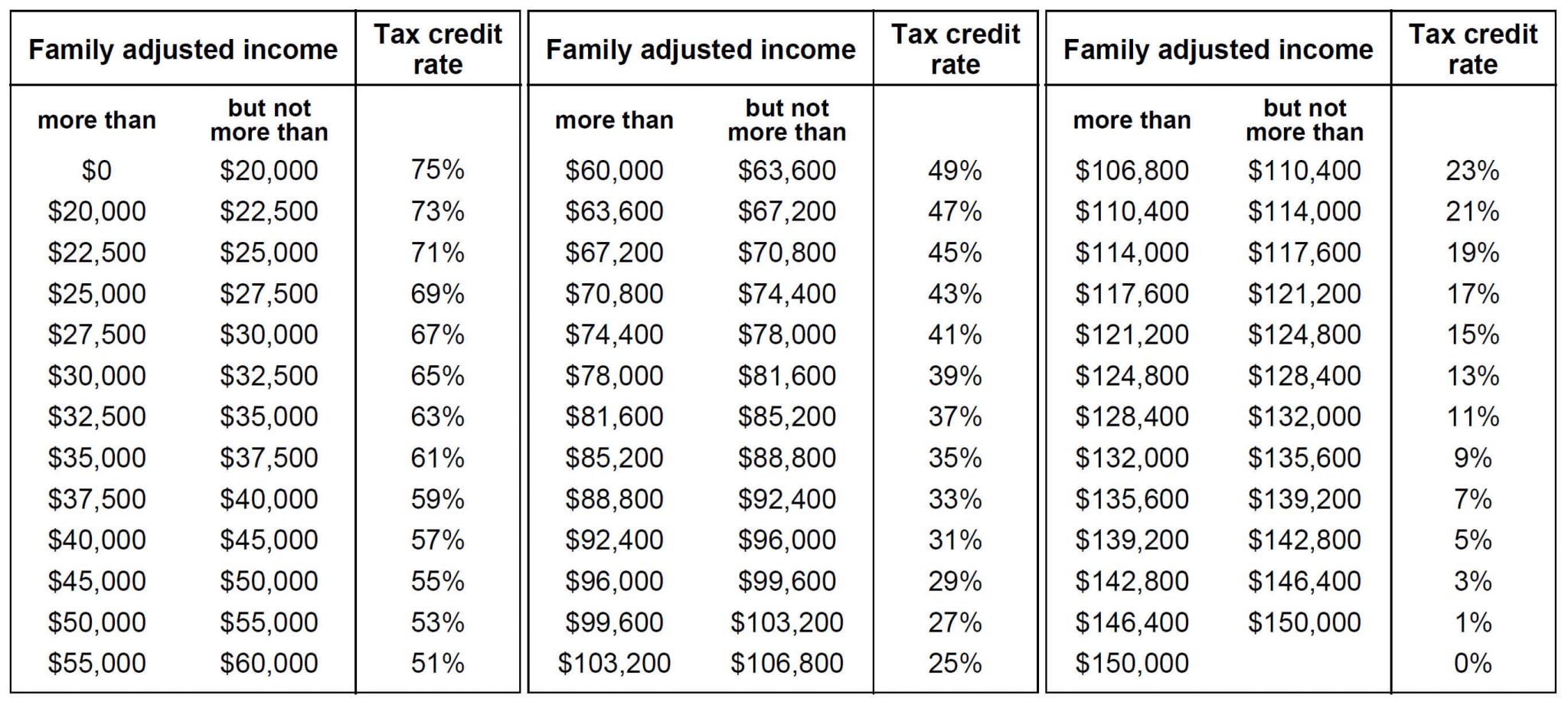

Ontario Childcare Tax Credit Refundable Tax Credit For Low income

https://cdn.taxory.com/wp-content/uploads/2021/01/childcare-access-and-relief-from-expenses-tax-credit-2048x917.jpg

What Is The Child Care Tax Credit And How Do You Claim It

https://andersonadvisors.com/wp-content/uploads/2021/09/child-care-tax-credit-1080x675.jpeg

The Child and Dependent Care Credit was supercharged through the 2021 American Rescue Plan with the pandemic aid bill boosting how much parents can claim The American Rescue Plan increased the amount of the Child Tax Credit from 2 000 to 3 600 for qualifying children under age 6 and 3 000 for other qualifying children under

For 2024 taxes filed in 2025 the child tax credit will be worth 2 000 per qualifying dependent child if your MAGI is 400 000 or below married filing jointly or For your 2021 tax return the cap on expenses eligible for the child and dependent care tax credit is 8 000 for one child up from 3 000 or 16 000 up from

Download How Much Is The Child Care Tax Credit For 2022

More picture related to How Much Is The Child Care Tax Credit For 2022

Can I Opt Out Of The Child Tax Credit Payments Here s The Answer Dogwood

https://vadogwood.com/wp-content/uploads/sites/12/2021/07/Child-Tax-Credit1.jpg

Is There A Refundable Child Tax Credit For 2023 Leia Aqui How Much Is

https://cdn.mos.cms.futurecdn.net/atBAeA95EXm3hifrNbAKPV.jpg

Do You Have To Pay Back The Child Tax Credit In 2022 Leia Aqui Will

https://static01.nyt.com/images/2022/12/14/upshot/14up-child-tax-credit-promo-promo/14up-child-tax-credit-promo-promo-mediumSquareAt3X.png

Thanks to a temporary change codified in the American Rescue Plan parents or guardians can now claim a maximum credit of 4 000 50 of 8 000 in Your 2022 Child and Dependent Care Tax Credit ranges from 20 to 35 of what you spent on daycare up to 3 000 for one dependent or up to 6 000 for two or

You can claim from 20 to 35 of your care expenses up to a maximum of 3 000 for one person or 6 000 for two or more people tax year 2023 Benefits of the For tax year 2022 the child tax credit is 2 000 per child under 17 who s claimed on your tax return as a dependent Last year the credit was bumped up to

2022 Education Tax Credits Are You Eligible

https://www.taxdefensenetwork.com/wp-content/uploads/2022/11/2022-Education-Credits-Comparison-scaled.jpg

Child Care Tax Credit 2021 2022 Requirements What It Is Sittercity

https://www.sittercity.com/wp-content/uploads/2020/02/GettyImages-1180592592-1-scaled-e1581105297103.jpg

https://www.irs.gov/newsroom/child-and-dependent-care-credit-faqs

The child and dependent care credit is a tax credit that may help you pay for the care of eligible children and other dependents qualifying persons The credit is

https://www.nerdwallet.com/article/taxes/child-and...

The child and dependent care credit is generally worth 20 to 35 of up to 3 000 for one qualifying dependent or 6 000 for two or more qualifying dependents

Who Gets Tax Credits Leia Aqui Who Gets Federal Tax Credits

2022 Education Tax Credits Are You Eligible

CHILD CARE TAX Statement Form Daycare Or Childcare Printable Etsy

What Families Need To Know About The CTC In 2022 CLASP

Tax Opportunities Expanded Individual Tax Credits In New Law Blog

Is The Child Tax Credit A Good Thing Leia Aqui How Helpful Is The

Is The Child Tax Credit A Good Thing Leia Aqui How Helpful Is The

Tax Credit Or FSA For Child Care Expenses Which Is Better

FSA Or Tax Credit Which Is Best To Save On Child Care

How Many Monthly Child Tax Credit Payments Were There Leia Aqui How

How Much Is The Child Care Tax Credit For 2022 - For 2024 taxes filed in 2025 the child tax credit will be worth 2 000 per qualifying dependent child if your MAGI is 400 000 or below married filing jointly or