How Much Is The Disability Tax Credit For A Child 9 428 disability amount 5 500 supplement for children 14 928 How to claim the DTC on your tax return To claim the credit for the current tax year you must enter the disability amount on your tax return Any unused amount may be transferred to a supporting family member

The child disability benefit CDB is a tax free monthly payment made to families who care for a child under age 18 with a severe and prolonged impairment in physical or mental functions Eligibility To get the CDB EITC for parents of children with disabilities You may qualify for this credit if your qualifying child is permanently and totally disabled regardless of age as long as you meet the other requirements

How Much Is The Disability Tax Credit For A Child

How Much Is The Disability Tax Credit For A Child

https://www.debt.ca/wp-content/uploads/2022/01/disability-tax-credit.jpg

How To Use The Disability Tax Credit For Type 1 Diabetes Connected In

https://www.connectedinmotion.ca/wp-content/uploads/2022/09/CIM-Blog-DisabilityTaxCredit-05734.jpg

How To Use The Disability Tax Credit For Type 1 Diabetes Connected In

https://www.connectedinmotion.ca/wp-content/uploads/2022/09/CIM-Blog-DisabilityTaxCredit-00670-1536x1024.jpg

Child tax credit CTC The 2023 child tax credit is available for all parents who meet the income requirements and have a qualifying child including children with disabilities The maximum credit is worth up to 2 000 per child Child Disability Tax Credit Calculation The Disability Tax Credit qualified individual will get both the Base Amount and the Supplemental Amount if after the tax year he or she is under the age of 18

You may be eligible for the Child Disability Benefit CDB if you are already eligible and a recipient of the Canada Child Benefit CCB and are eligible to receive the Disability Tax Credit for your child If your child is eligible for the disability tax credit you may also be eligible for the child disability benefit For the period of July 2024 to June 2025 you could get up to 3 322 276 83 per month for each child who is eligible for the disability tax credit Go to Child disability benefit

Download How Much Is The Disability Tax Credit For A Child

More picture related to How Much Is The Disability Tax Credit For A Child

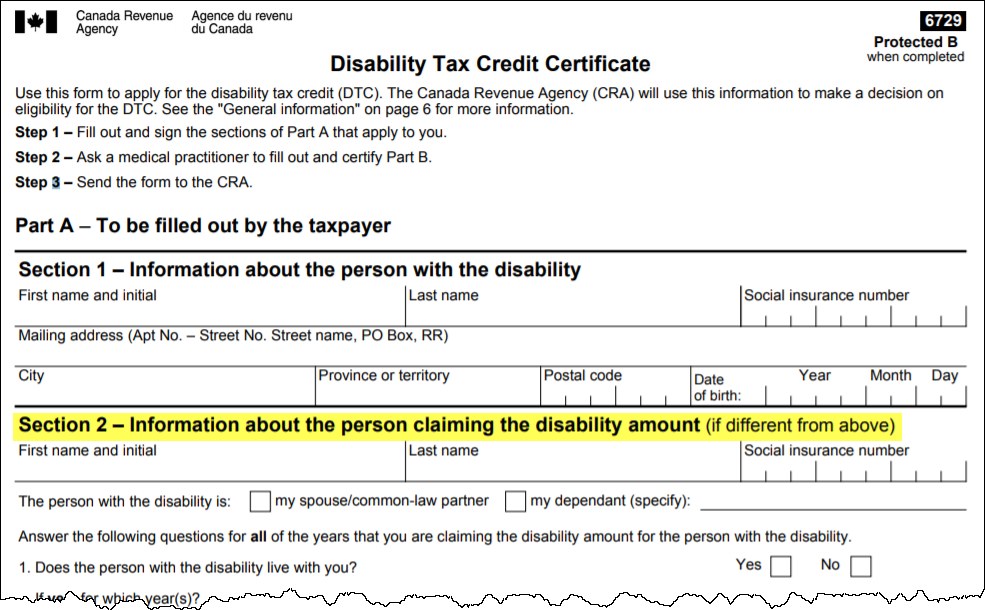

The Disability Tax Credit Your Online Guide For 2023

https://www.resolutelegal.ca/wp-content/uploads/2022/11/the-disability-tax-credit2.jpg

Disability Discrimination In The Workplace Mayo Wynne Baxter

https://www.mayowynnebaxter.co.uk/uploads/blog/2017/06/Disability.jpg

How Much Is The Disability Tax Credit By Province MoneyGenius

https://cms.moneygenius.ca/wp-content/uploads/2023/01/how-much-is-the-disability-tax-credit-by-province.jpg

Calculate how much you might be able to receive by getting approved for the disability tax credit The disability tax calculator considers factors such as when your condition first began and the province you reside in The child and dependent care credit is worth up to 1 050 for one qualifying dependent The maximum credit is 2 100 for two or more qualifying dependents Benefits of an ABLE account ABLE

Child disability benefit CDB A tax free monthly payment for parents of a child under 18 who qualifies for the DTC and who also qualifies for the Canada child benefit The Child Tax Credit CTC is available for parents who meet the income requirements and have a qualifying child including children with disabilities Take note that the child needs to be under 17 even if they are disabled to claim the CTC

How Does The Disability Tax Credit Work GroupEnroll ca

https://groupenroll.ca/wp-content/uploads/2022/07/disability-tax-credit.jpg

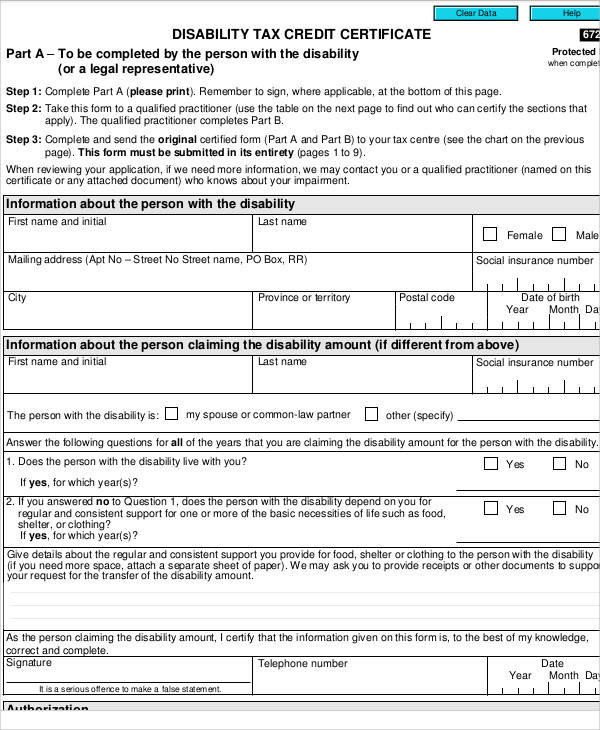

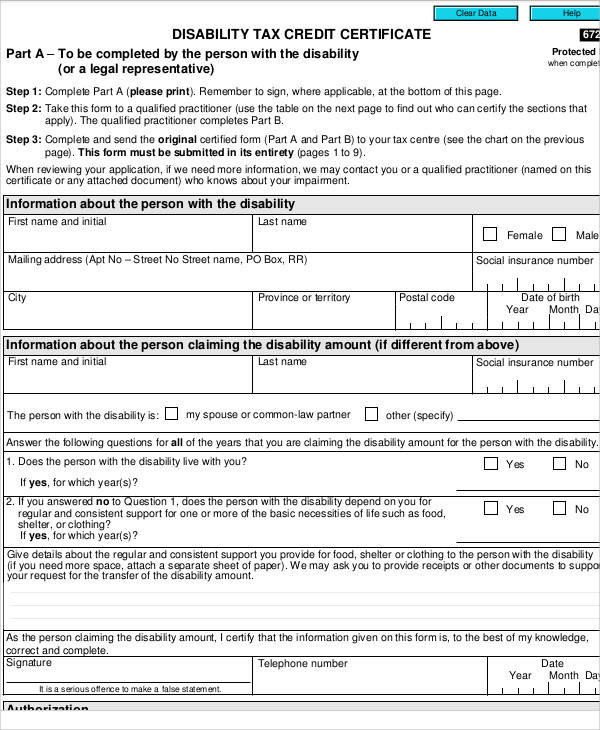

2008 Form Canada T2201 E Fill Online Printable Fillable Blank

https://www.pdffiller.com/preview/47/411/47411796/large.png

https://www.canada.ca/.../disability-tax-credit/claiming-dtc.html

9 428 disability amount 5 500 supplement for children 14 928 How to claim the DTC on your tax return To claim the credit for the current tax year you must enter the disability amount on your tax return Any unused amount may be transferred to a supporting family member

https://www.canada.ca/en/revenue-agency/services/...

The child disability benefit CDB is a tax free monthly payment made to families who care for a child under age 18 with a severe and prolonged impairment in physical or mental functions Eligibility To get the CDB

How Supplemental Disability Insurance Works For Doctors

How Does The Disability Tax Credit Work GroupEnroll ca

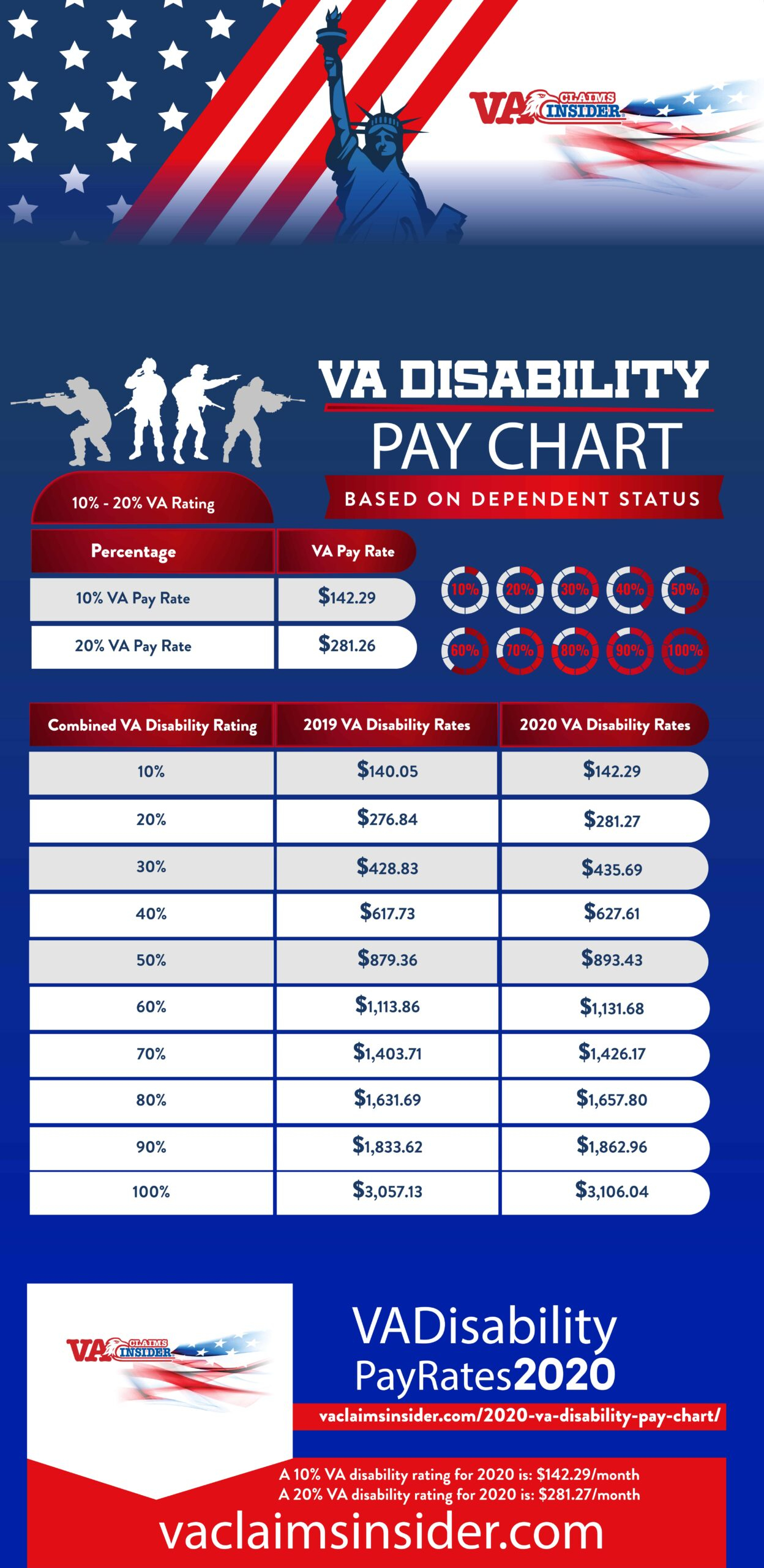

2023 VA Disability Pay Chart Official Guide

Do I Qualify For The CRA Disability Tax Credit Blueprint Accounting

What Is Disability Tax Credit And Who Is Eligible Empireone Credit

Are Taxes Taken Out Of Disability Disability Talk

Are Taxes Taken Out Of Disability Disability Talk

VA Disability Payment Increase VA Disability Rates 2021

Cra Tax Forms 2023 Printable Printable Forms Free Online

What Is The Disability Tax Credit RightFit Advisors

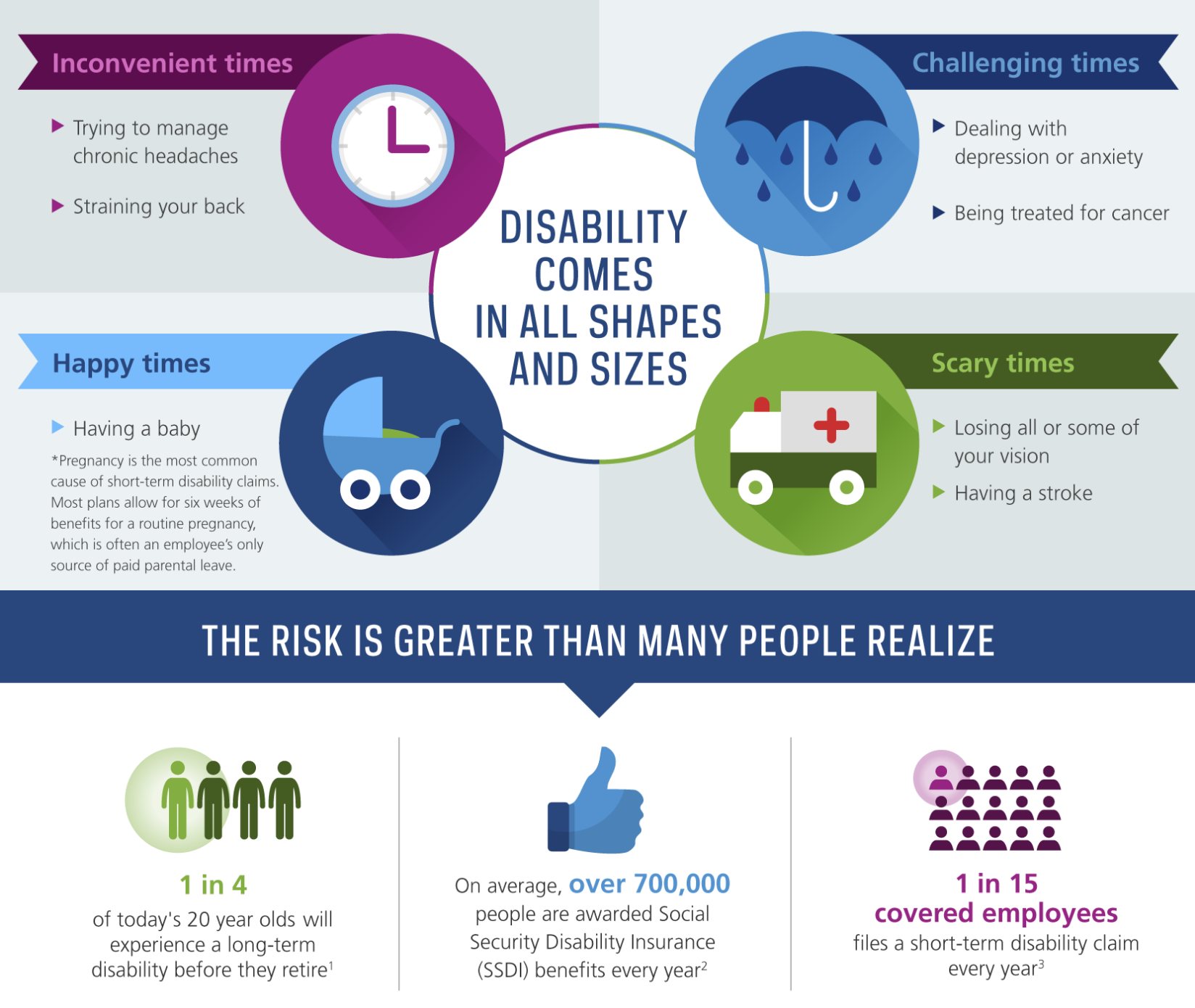

How Much Is The Disability Tax Credit For A Child - The Child With Disability Tax Credit is a tax benefit offered by the government to help families who have children with mental or physical impairments This credit helps to offset some of the additional expenses associated with caring for a child with a disability The credit amount varies depending on the severity of the disability