How Much Is The First Time Homebuyer Credit Go to our First Time Homebuyer Credit account look up to receive Balance of your First Time Homebuyer Credit Amount you paid back to date Total amount of the credit you received Annual installment repayment amount

The Biden First Time Homebuyer Act of 2021 is a bill that would provide a refundable tax credit of up to 15 000 for first time home buyers The proposed law seeks to revive and update a 2008 The first time home buyer credit was created to incentivize Americans to buy homes after the Great Recession Is it time to bring it back

How Much Is The First Time Homebuyer Credit

How Much Is The First Time Homebuyer Credit

https://homeownershipmatters.realtor/wp-content/uploads/2020/08/Homebuyer_Pandemic-1200.png

Help For First Time Homebuyers With Bad Credit AavaizEllidh

https://i.pinimg.com/originals/8b/ef/6b/8bef6b2f2fc5f84c4cf02fd2f0504c57.jpg

The First Time Homebuyer Tax Credit Explained Jeanine Hemingway CPA

http://www.austinaccountingservices.com/wp-content/uploads/2022/06/First-time-home-buyer-2.jpg

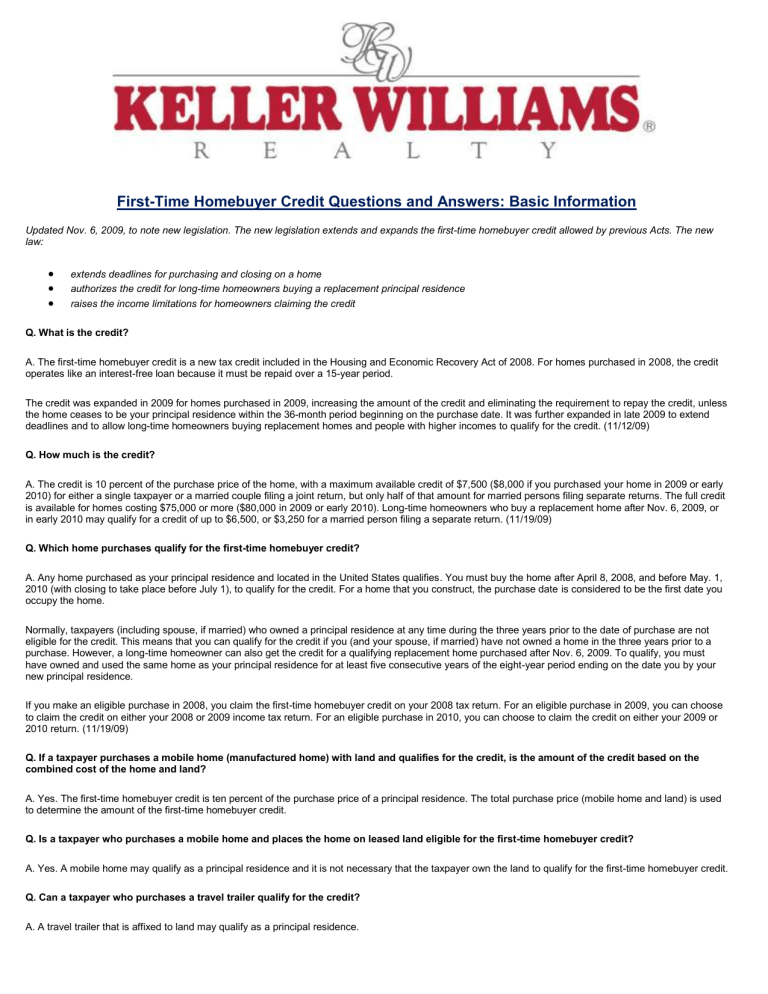

The first time homebuyer tax credit was an Obama era tax credit that no longer exists Here s what it did and which tax benefits homeowners can still use Providing a tax rebate on income taxes owed it allowed a credit of up to 10 of the purchase price on a principal residence to a maximum of 8 000 The IRS

So for people who received the maximum 7 500 credit this averaged out to 500 per year beginning with their 2010 tax returns source IRS For most people the credit repayment uses IRS form 5405 Repayment of Qualifying first time home buyers can take out up to 10 000 of distributions penalty free to buy build or reconstruct a first home For the purposes of this section of the tax code a first time

Download How Much Is The First Time Homebuyer Credit

More picture related to How Much Is The First Time Homebuyer Credit

What Is The First Time Homebuyer Tax Credit SoFi

https://d32ijn7u0aqfv4.cloudfront.net/wp/wp-content/uploads/raw/SOHL1121063_1560x880_desktop.jpg

First time home buyer book cover The Stacking Benjamins Show

https://www.stackingbenjamins.com/wp-content/uploads/first-time-home-buyer-book-cover.png

Programs For First Time Homebuyers Down Payment Assistance And More

https://www.credible.com/blog/wp-content/uploads/2020/05/programs-for-first-time-buyers.png

Introduced in the House of Representatives in April by Rep Earl Blumenauer and Rep Jimmy Panetta the First Time Homebuyer Act would establish a refundable tax credit of 10 of a home s purchase The first time home buyer tax credit was a refundable 8 000 credit people could claim on their federal income tax returns in 2008 2009 and 2010 By using the tax credit new homeowners could reduce the amount of federal taxes they owed after buying their first house

The credit is for up to 20 of the purchase price up to a maximum of 15 000 The dollar amount would be adjusted for inflation beginning in 2025 Your tax basis in the home is reduced by the amount Every first time homebuyer is eligible to take up to 10 000 of portfolio earnings out of a traditional IRA or Roth IRA without paying the 10 penalty for early

First Time Home Buyer Programs Single Mothers Bad Credit GayatriAimen

https://homebuyer.com/wp-content/uploads/2022/02/first-time-home-buyer-programs.jpg

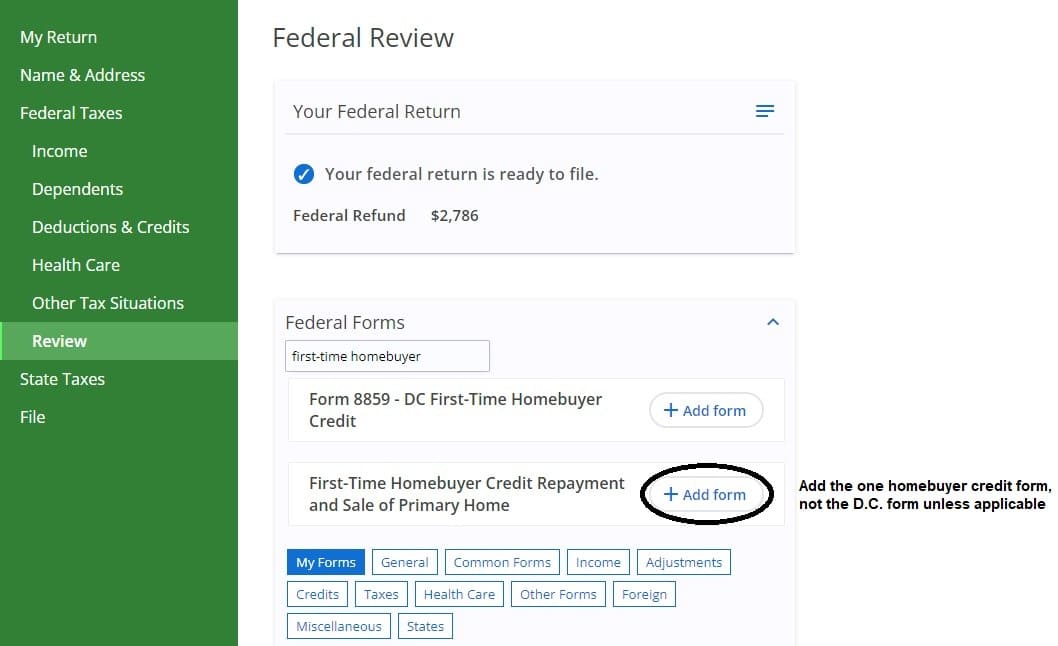

Add IRS Form 5405 To Repay First Time Homebuyer Credit

https://www.efile.com/image/ef0073_homebuyer_1.jpg

https://www.irs.gov/credits-deductions/indi…

Go to our First Time Homebuyer Credit account look up to receive Balance of your First Time Homebuyer Credit Amount you paid back to date Total amount of the credit you received Annual installment repayment amount

https://themortgagereports.com/106765

The Biden First Time Homebuyer Act of 2021 is a bill that would provide a refundable tax credit of up to 15 000 for first time home buyers The proposed law seeks to revive and update a 2008

Financial Literacy

First Time Home Buyer Programs Single Mothers Bad Credit GayatriAimen

First time Homebuyer Credit Could Bring 9 3M Renters Into The Market

THE ULTIMATE GUIDE FOR THE FIRST TIME HOMEBUYER DOWNLOADABLE Buying

For The First time Homebuyer 10 Financial Mistakes To Avoid Chicago

Confessions Of A First Time Homebuyer

Confessions Of A First Time Homebuyer

Form 5405 Repayment Of The First Time Homebuyer Credit Editorial Stock

First Time Homebuyer Credit Questions And Answers Basic

Bill Proposes Pandemic Savings For First Time Home Buyers

How Much Is The First Time Homebuyer Credit - Qualifying first time home buyers can take out up to 10 000 of distributions penalty free to buy build or reconstruct a first home For the purposes of this section of the tax code a first time