How Much Is The Head Of Household Tax Credit 2023 Head of Household filers can have a lower taxable income and greater potential refund than when using the single filing status The Head of Household filing

Filing as Single Head of Household or Widowed Filing as Married Filing Jointly Zero 17 640 24 210 One 46 560 53 120 Two 52 918 59 478 Three The maximum Earned Income Tax Credit EITC in 2023 for single and joint filers is 560 if the filer has no children Table 5 The maximum credit is 3 995 for one

How Much Is The Head Of Household Tax Credit 2023

How Much Is The Head Of Household Tax Credit 2023

https://i.ytimg.com/vi/tUerJqpbbsQ/maxresdefault.jpg

Head Of Household Tax Filing Status Claim It If You Can The Motley Fool

https://g.foolcdn.com/editorial/images/517112/mother-child-gettyimages-108359432.jpg

Overview Of The Head Of Household Tax Filing Status finance

https://i.ytimg.com/vi/CzyqS3h59sY/maxres2.jpg?sqp=-oaymwEoCIAKENAF8quKqQMcGADwAQH4Ac4FgAKACooCDAgAEAEYZSBTKEcwDw==&rs=AOn4CLB7TbSRJ9rd-jEQiOWK17AcWpxSvA

You can qualify for Head of Household if you Were unmarried as of December 31 2023 and Paid more than half the cost to run your or a qualifying parent s home this year Transparent pricing Hassle free tax filing is 50 for all tax situations no hidden costs or fees Maximum refund guaranteed Get every dollar you deserve when you file with this

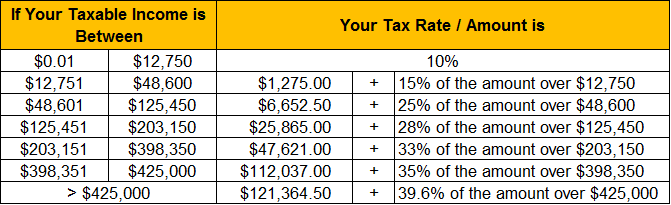

If you file head of household however you can earn between 15 700 and 59 850 before surpassing the 12 tax bracket Head of household filers also benefit from a higher standard deduction The 2023 standard deduction for couples married filing jointly is 27 700 up 1 800 from 25 900 in tax year 2022 For those filing head of household the standard

Download How Much Is The Head Of Household Tax Credit 2023

More picture related to How Much Is The Head Of Household Tax Credit 2023

2022 Tax Rates Standard Deduction Amounts To Be Prepared In 2023

https://thumbor.forbes.com/thumbor/960x0/https://specials-images.forbesimg.com/imageserve/618c2bcb9a71897404eafb0f/Head-of-Household-tax-rates-2022/960x0.jpg%3Ffit%3Dscale

Who Qualifies For head Of Household Tax Filing Status Suttle

https://www.suttlecpas.com/wp-content/uploads/2021/05/download.jpg

Can I Claim Head Of Household If I m Still Legally Married But Not

https://img-aws.ehowcdn.com/600x600p/photos.demandstudios.com/114/133/fotolia_7076255_XS.jpg

The 2023 tax year meaning the return you ll file in 2024 will have the same seven federal income tax brackets as the last few seasons 10 12 22 24 32 35 and 37 Your filing Adoption credit For the 2023 tax year this covers up to 15 950 in adoption costs per child The credit begins to phase out at 239 230 of modified adjusted gross

Tax Year 2023 Income Limits and Range of EITC Number of Qualifying Children For Single Head of Household or Qualifying Surviving Spouse or Married Single or Head of Household Blind 1 850 1 950 Single or Head of Household 65 or older 1 850 1 950 Single or Head of Household Blind AND 65 or

Filing Head Of Household To IRS Negotiate Your Tax Debt

http://negotiateyourtaxdebt.com/wp-content/uploads/2014/01/head-of-household.jpg

Taxes Head Of Household Explained YouTube

https://i.ytimg.com/vi/L3BWsDLCk_I/maxresdefault.jpg

https://turbotax.intuit.com/tax-tips/family/guide...

Head of Household filers can have a lower taxable income and greater potential refund than when using the single filing status The Head of Household filing

https://www.irs.gov/credits-deductions/individuals...

Filing as Single Head of Household or Widowed Filing as Married Filing Jointly Zero 17 640 24 210 One 46 560 53 120 Two 52 918 59 478 Three

Head Of Household Qualifications Tax Brackets And Deductions TheStreet

Filing Head Of Household To IRS Negotiate Your Tax Debt

Head Of Household Definition Filing Requirements And Advantages

Who Qualifies For head Of Household Tax Filing Status

Head Of Household Vs Single Top Differences Infographics

When To File Head Of Household Tax Benefits And Tips The Knowledge Hub

When To File Head Of Household Tax Benefits And Tips The Knowledge Hub

Some Taxpayers Qualify For More Favorable Head Of Household Tax

Complete Tax Brackets Tables And Income Tax Rates Tax Calculator

Head Of Household Vs Single How Should You File Your Taxes

How Much Is The Head Of Household Tax Credit 2023 - Under the expansion a family can receive up to 1 800 of the remainder for the 2023 tax year By 2025 families would be able to receive the full tax credit as a