How Much Is The Income Tax In The Philippines 2023 Use this income tax in the Philippines calculator to help you quickly determine your income tax as a Filipino citizen your benefits contributions and your net pay after tax and deductions

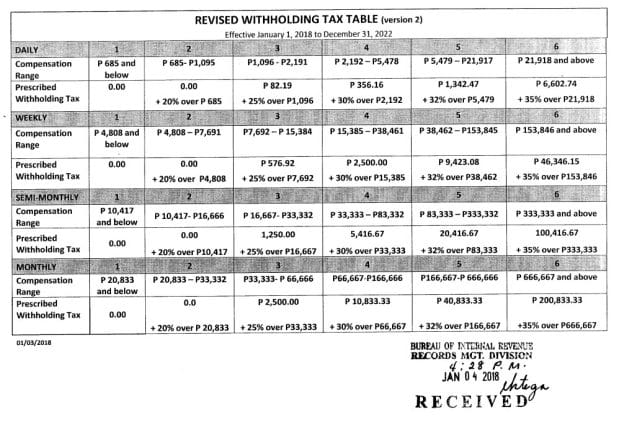

The act stated two schedule of new income tax rate as follows a Effective January 1 2018 to December 31 2022 b Effective January 1 2023 and onward Because of this change on income tax rate withholding tax rate You can calculate your income tax independently whether you re curious about how your employer computes it or you need to file and pay your tax by yourself Here s a

How Much Is The Income Tax In The Philippines 2023

How Much Is The Income Tax In The Philippines 2023

https://i0.wp.com/lifeguide.ph/wp-content/uploads/2023/01/Income-Tax-Table-2023-Philippines-Life-Guide-PH.png?w=768&ssl=1

How To Find Out If You Owe Irs Informationwave17

https://i.insider.com/5f721b9074fe5b0018a8dc86?width=1000&format=jpeg&auto=webp

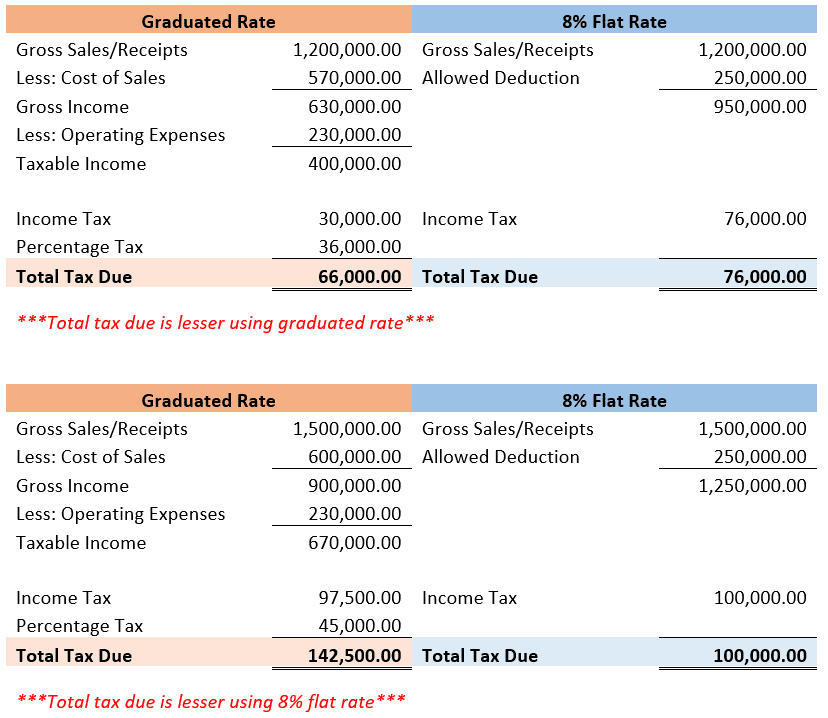

Solved Please Note That This Is Based On Philippine Tax System Please

https://www.coursehero.com/qa/attachment/19096880/

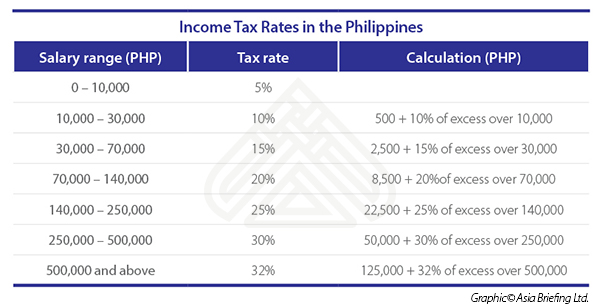

TRAIN Law increases take home pay in the new Income Tax Table for 2023 Good news arrives for Filipino employees as the Tax Reform for Acceleration and Inclusion TRAIN Law has implemented an increased take Enforced under the TRAIN or the Tax Reform for Acceleration and Inclusion Law individuals with taxable earnings of less than P8 million yearly will have a 15 to 30 tax rate starting January 1 2023 depending on the tax

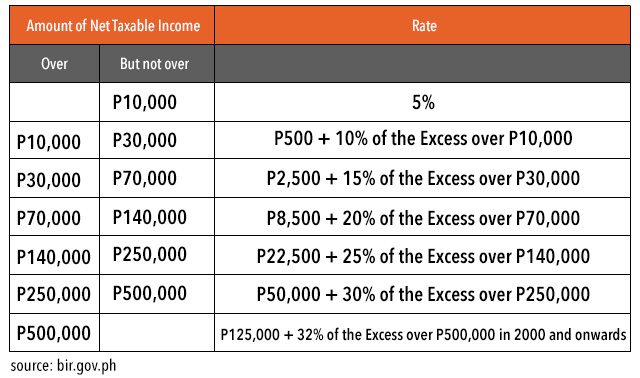

The free online 2023 Income Tax Calculator for Philippines Learn how to estimate your income tax with easy steps focusing on taxable income and understanding the results Under the TRAIN tax table in the Philippines taxpayers earning below 250 000 per year are still exempted from paying personal income tax in 2023 and onwards Those who have an annual income of more than

Download How Much Is The Income Tax In The Philippines 2023

More picture related to How Much Is The Income Tax In The Philippines 2023

2 Introduction To Income Tax INTRODUCTION TO INCOME TAXATION INCOME

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/2ccb7bafc57b051282caa4e482655bd7/thumb_1200_1553.png

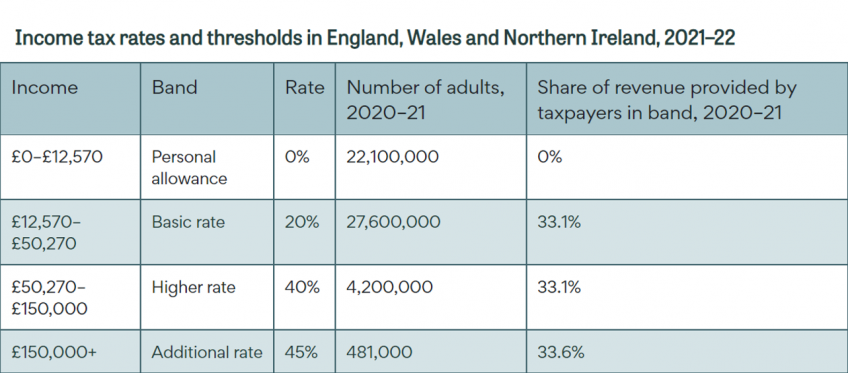

Income Tax Explained IFS Taxlab

https://ifs.org.uk/sites/default/files/styles/wysiwyg_full_width_desktop/public/2021-06/Income tax rates and thresholds in England%2C Wales and Northern Ireland%2C 2021–22_0.png?itok=sAe2JxBC

Withholding Tax Table 2018 Philippines Brokeasshome

https://www.accountable.ph/static/276b3166512016d65cc1abece011fc8b/8efc2/tax.png

The Philippine Bureau of Internal Revenue Dec 28 clarified income tax rates for 2023 The clarification explains 1 the annual taxable income below 250 000 Philippine pesos The revised tax schedule beginning January 1 2023 reduces personal income taxes for those earning PHP8 000 000 and below compared to the initial tax cuts for January

The updated income tax table in the Philippines provides relief for low and middle income earners while reducing labor costs for employers This can have a positive impact on How Much is the Income Tax in the Philippines Compared to the previous two years the personal income tax rates in the Philippines have faced a significant reduction due

Income Tax Rate Malaysia 2023 Calculator Printable Forms Free Online

https://i2.wp.com/d3q48uqppez4lq.cloudfront.net/wp-content/uploads/2019/03/malaysia-income-tax-rates-2013-2018.png

The Income Tax In 1913 A Way To Soak The Rich PBS News

https://d3i6fh83elv35t.cloudfront.net/static/2013/04/ms_1.jpg

https://www.omnicalculator.com › finance › i…

Use this income tax in the Philippines calculator to help you quickly determine your income tax as a Filipino citizen your benefits contributions and your net pay after tax and deductions

https://mpm.ph

The act stated two schedule of new income tax rate as follows a Effective January 1 2018 to December 31 2022 b Effective January 1 2023 and onward Because of this change on income tax rate withholding tax rate

Income Tax Act 1 3 Notes On Law Of Taxation PART THE INCOME

Income Tax Rate Malaysia 2023 Calculator Printable Forms Free Online

Budget 2022 Different Types Of Taxable Incomes Income Tax Slab Rates

Types Of Income Tax In The Philippines Search Bovenmen Shop

How To Compute Income Tax In The Philippines Free Calculator APAC

Individual Taxpayers To Have Lower Income Tax Rates In 2023 Tutubi

Individual Taxpayers To Have Lower Income Tax Rates In 2023 Tutubi

Cherish Childhood Memories Quotes

Key Steps Toward Genuine Tax Reform In PH Inquirer Business

Why PH Has 2nd Highest Income Tax In ASEAN

How Much Is The Income Tax In The Philippines 2023 - Below is the new tax table effective starting January 1 2023 and onwards Under the adjusted tax rates individuals with an annual taxable income of 250 000 Below will still