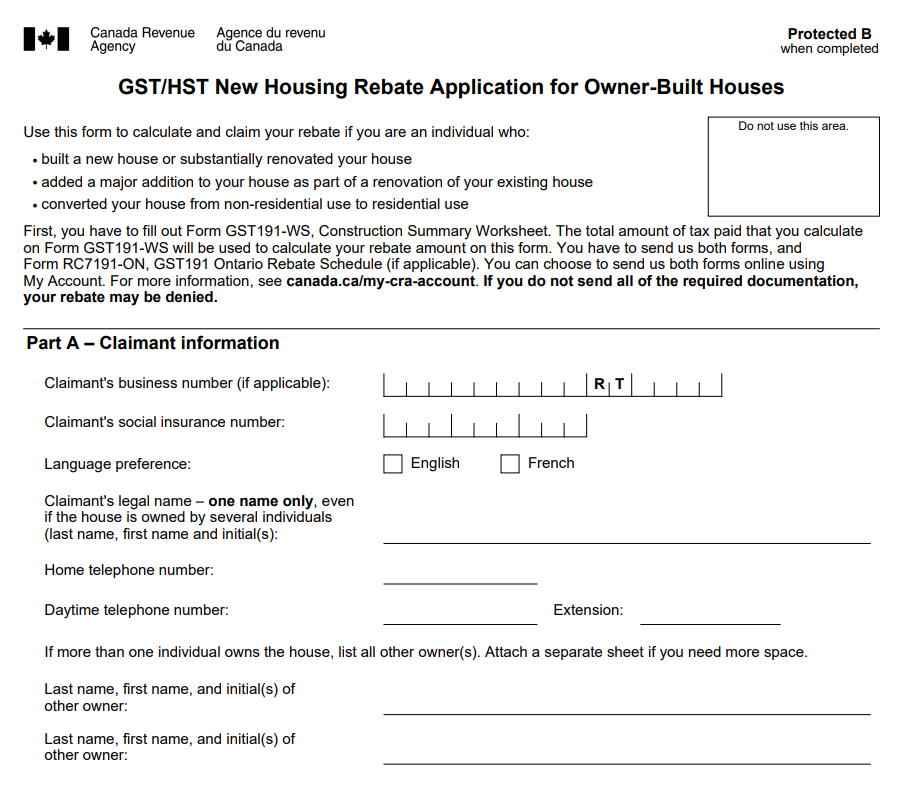

How Much Is The New Housing Rebate Verkko This will determine the amount of tax paid that you will use to calculate your rebate amount on Form GST191 GST HST New Housing Rebate Application for Owner Built Houses and if you are entitled to claim the Ontario new housing rebate on Form RC7191 ON GST191 Ontario Rebate Schedule

Verkko 11 toukok 2020 nbsp 0183 32 While the rebate is often used by first time home buyers it s available to everyone First the new housing rebate equals 36 of the GST that all buyers need to pay when buying a new home in Canada This rebate is up to 6 300 and valid on homes with a fair market value of 350 000 or less Verkko 26 elok 2021 nbsp 0183 32 The maximum amount you can receive is 450 000 in Ontario The only catch is you have to apply for the refund so you aren t necessarily entitled to get any money back and the amount you do receive back might not

How Much Is The New Housing Rebate

How Much Is The New Housing Rebate

https://i.ytimg.com/vi/WnG23WfOQqc/maxresdefault.jpg

GST HST Filings And Rebates NBG Chartered Professional Accountant

https://www.nbgcpa.ca/wp-content/uploads/2022/09/Housing-rebate-ontario.png

November Is The Month To Travel discount For 1 4 Million People

https://img.sbs.co.kr/newimg/news/20211109/201607892_1280.jpg

Verkko For houses located in Ontario you may be eligible to claim the Ontario new housing rebate if you are not eligible to claim the new housing rebate for some of the federal part of the HST only because the fair market value of the housing exceeds 450 000 Verkko 27 helmik 2023 nbsp 0183 32 So the maximum new housing rebate amount available in Ontario is 6 of 400 000 which amounts to 24 000 While the purchase price of homes should be less than 450 000 in order to qualify for the Federal rebate for homes valued above 450 000 homebuyers may still apply for the provincial rebates

Verkko 26 lokak 2022 nbsp 0183 32 The amount of rebate you can receive for the GST Portion is 36 of the GST tax amount up to a maximum of 6 300 Check GST rebate for new homes in Canada Also find out about HST or province rebate on new homes in Ontario British Columbia and Nova Scotia Verkko 17 toukok 2023 nbsp 0183 32 The new housing rebate allows you to receive 36 of your house s GST for up to 6 300 Builders can apply for the new housing rebate on behalf of the new homeowners Some provinces like Ontario and Nova Scotia also offer HST rebates on the provincial portion of the tax Table of Contents Show

Download How Much Is The New Housing Rebate

More picture related to How Much Is The New Housing Rebate

Affordable Housing In Kenya Big 4 Agenda Kenya Homes

https://kenyahomes.co.ke/blog/wp-content/uploads/2019/02/Affordable-Housing.jpg

Ontario New Housing Rebate Form By State Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/09/Ontario-New-Housing-Rebate-Form-768x715.png

Gst New Housing Rebate Application Form Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/02/Housing-Rebate-Form-2023.jpg

Verkko GST New Home Rebate Calculation 36 of 17 500 5 GST 6 300 GST After Rebate 17 500 6 300 11 200 Purchase Price GST GST Rebate 361 200 Partial GST Rebate example The Partial G S T New Housing Rebate calculation is Full GST Rebate of 6 300 x 450 000 qualifying purchase price 100 000 Verkko How Much Is The GST HST New Housing Rebate The GST HST New Housing Rebate is equal to 36 of the GST that individuals are paying on their brand new home It is capped at 6 300 on homes with a fair market value equal to or less than 350 000 The maximum allowable limit could be higher depending on the exact GST HST rate

Verkko 13 lokak 2020 nbsp 0183 32 Next let s calculate the value of the rebate that can be claimed In this case it s 36 x 20 000 7 200 for the GST portion of the HST and 75 x 32 000 24 000 for the provincial portion of the HST which equals up to 31 200 In Quebec an additional rebate is available of 4 9875 of the purchase price 50 of the 9 975 Verkko New home buyers can apply for a 36 rebate of the federal portion of HST applicable to the purchase price to a maximum of 6 300 for homes costing 350 000 or less New homes priced between 350 000 and 450 000 the rebate on the federal share of the HST rebate would be decreased proportionally

How To Calculate The GST HST New Housing Rebate Sproule Associates

https://my-rebate.ca/wp-content/uploads/2021/03/shutterstock_745359235-1-768x509.jpg

GST HST New Housing Rebate And New Residential Rental Property Rebate

https://sqicpa.com/wp-content/uploads/2018/09/GST-HST-Rebate-1-e1537821386125.png

https://www.canada.ca/en/revenue-agency/services/forms-publications...

Verkko This will determine the amount of tax paid that you will use to calculate your rebate amount on Form GST191 GST HST New Housing Rebate Application for Owner Built Houses and if you are entitled to claim the Ontario new housing rebate on Form RC7191 ON GST191 Ontario Rebate Schedule

https://www.ratehub.ca/blog/what-is-the-gsthst-new-housing-rebate-and...

Verkko 11 toukok 2020 nbsp 0183 32 While the rebate is often used by first time home buyers it s available to everyone First the new housing rebate equals 36 of the GST that all buyers need to pay when buying a new home in Canada This rebate is up to 6 300 and valid on homes with a fair market value of 350 000 or less

Ontario New Housing Rebate Form 2023 Printable Rebate Form

How To Calculate The GST HST New Housing Rebate Sproule Associates

Affordable Housing Project Coming To Section Of GVSU

New Housing Rebate On GST HST In Canada AADCPA

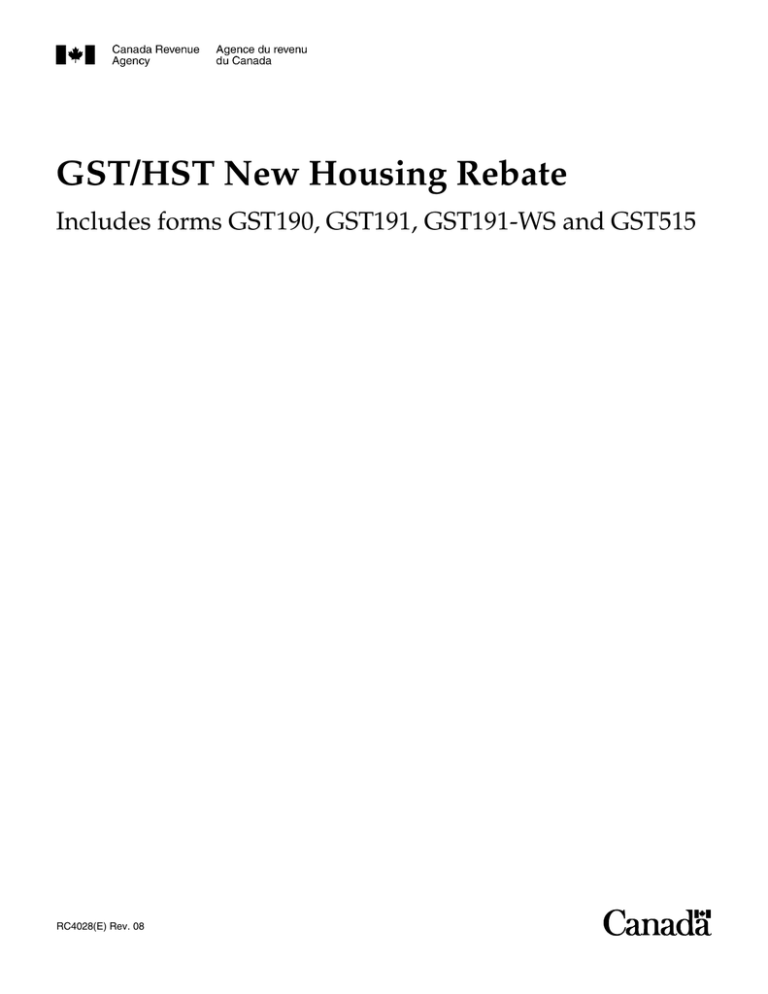

GST HST New Housing Rebate

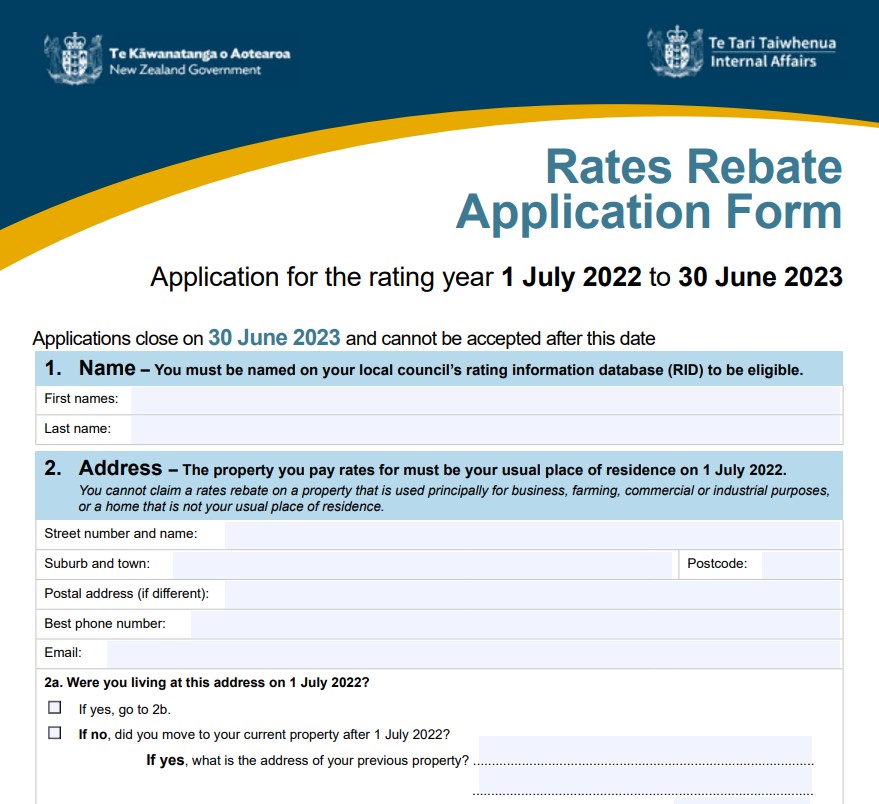

Form For Renters Rebate RentersRebate

Form For Renters Rebate RentersRebate

Home Buyer Rebates 2 5 Cash Back Of Total Purchase Price

GST HST New Housing Rebate

HST GST New Home Rebate Ontario Ontario New Housing HST Rebate

How Much Is The New Housing Rebate - Verkko For houses located in Ontario you may be eligible to claim the Ontario new housing rebate if you are not eligible to claim the new housing rebate for some of the federal part of the HST only because the fair market value of the housing exceeds 450 000