How Much Is The Recovery Rebate Credit 2024 If you didn t get the full amount of the first and second Economic Impact Payment you may be eligible to claim the 2020 Recovery Rebate Credit and must file a 2020 tax return even if you don t usually file taxes to claim it

The fastest way to get your tax refund is to file electronically and have it direct deposited contactless and free into your financial account You can have your refund direct deposited into your bank account prepaid debit card or mobile app and will need to provide routing and account numbers If you re one of the many who are owed stimulus money you may be able to claim the amount as a recovery rebate tax credit on your 2020 or 2021 federal tax return Featured Partner Offers

How Much Is The Recovery Rebate Credit 2024

How Much Is The Recovery Rebate Credit 2024

https://i0.wp.com/southernmarylandchronicle.com/wp-content/uploads/2021/04/Recovery-Rebate-Credit.png?fit=1200%2C675&ssl=1

Recovery Rebate Credit Here s How You Can Qualify For 1 400 Payments Marca

https://phantom-marca.unidadeditorial.es/d6b6bb8dde4d78d0f51f6bbc03766e1e/resize/1320/f/jpg/assets/multimedia/imagenes/2022/01/31/16436644359926.jpg

2023 Tax Rebate Credit Tax Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/how-to-claim-recovery-rebate-credit-turbotax-romainedesign-3.png?fit=633%2C623&ssl=1

Sign up This helps eligible Americans who either didn t receive a third stimulus check or didn t get the full amount And in some cases even a person who received the 1 400 third round payment Before claiming a Recovery Rebate Credit you would have had to first determine whether you were due one For 2023 taxes filed in 2024 the Child Tax Credit is 2 000 for children under age 17

If you did not receive the full amount of EIP3 before December 31 2021 claim the 2021 Recovery Rebate Credit RRC on your 2021 Form 1040 U S Individual Income Tax Return or Form 1040 SR U S Income Tax Return for Seniors The 2021 RRC amount was 1 400 or 2 800 in the case of a joint return plus an additional 1 400 per each The 2020 Recovery Rebate Credit is part of the Coronavirus Aid Relief and Economic Security CARES Act that was signed into law in March of 2020 The initial stimulus payment provided up to 1 200 per qualifying adult and up to 500 per qualifying dependent Most of these payments went out to recipients in mid 2020

Download How Much Is The Recovery Rebate Credit 2024

More picture related to How Much Is The Recovery Rebate Credit 2024

Recovery Rebate Credit 2023 2024 Credits Zrivo

https://www.zrivo.com/wp-content/uploads/2022/05/Recovery-Rebate-Credit-zrivo-1.jpg

Form 1040 Recovery Rebate Credit Instructions Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/01/irs-recovery-rebate-credit-worksheet-pdf-irsyaqu-5.png?fit=530%2C696&ssl=1

Does A Tax Credit Give You Money Leia Aqui Do You Get Money From Tax Credit

https://img.money.com/2022/03/News-Recovery-Rebate-Credit.jpg

To calculate the Recovery Rebate Credit Open the Recovery Rebate Credit Worksheet You can find this by pressing F6 to bring up Open Forms Type Recov and press Enter or locate Recov Rebate Cr in the list and double click to open it Scroll down to line 13 of the worksheet The Recovery Rebate Credit is back for our 2022 tax season In this article find out what it is how it works and how to get it January 08 2024 This tax season we want to make sure you receive every dollar you deserve That s why we re sharing tax filing resources that are 100 FREE Browse our guide to master tax time and make it

Eligible claimants will receive up to 1 400 for each qualifying dependent claimed on their return even including older relatives like college students adults with disabilities parents and Here s a practical plain English guide to how the electric vehicle tax credit will work in 2024 including why you may also consider leasing a car What s new for 2024 instant rebate

2022 Irs Recovery Rebate Credit Worksheet Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2022/11/who-could-qualify-for-2nd-stimulus.jpeg

IRS Letter Needed To Claim Stimulus Check With Recovery Rebate Credit

https://www.gannett-cdn.com/presto/2022/01/31/PDTF/b7acf011-8827-427c-87dd-1b4ac9c5ff02-extra.jpg?crop=2015,1134,x0,y75&width=2015&height=1134&format=pjpg&auto=webp

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-e-calculating-the-2021-recovery-rebate-credit

If you didn t get the full amount of the first and second Economic Impact Payment you may be eligible to claim the 2020 Recovery Rebate Credit and must file a 2020 tax return even if you don t usually file taxes to claim it

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-a-general-information

The fastest way to get your tax refund is to file electronically and have it direct deposited contactless and free into your financial account You can have your refund direct deposited into your bank account prepaid debit card or mobile app and will need to provide routing and account numbers

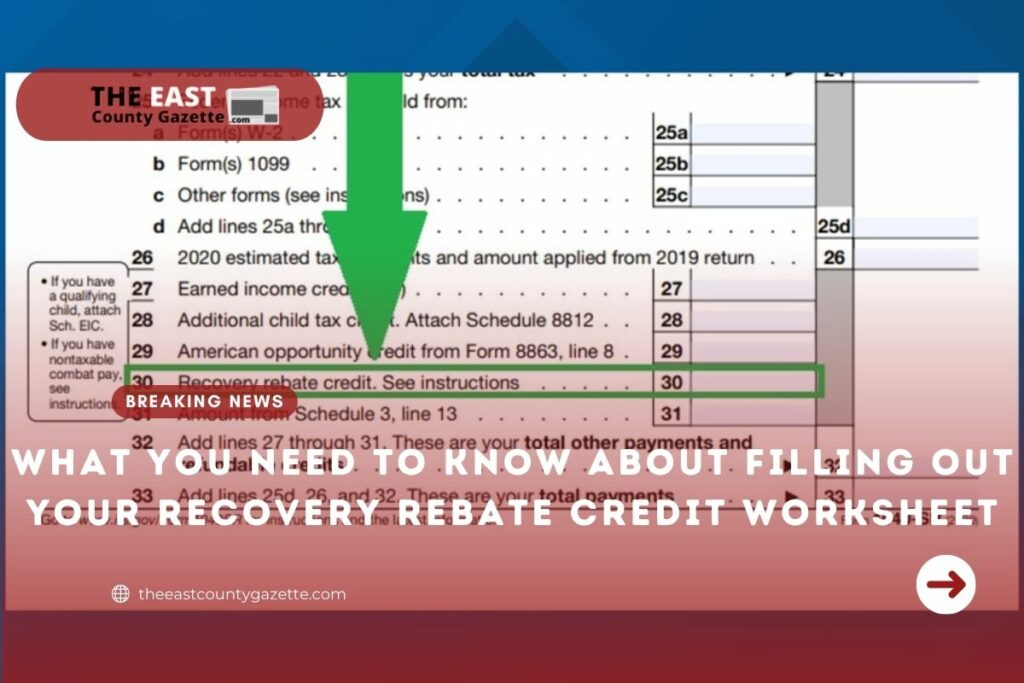

What You Need To Know About Filling Out Your Recovery Rebate Credit Worksheet The East County

2022 Irs Recovery Rebate Credit Worksheet Recovery Rebate

Recovery Rebate Credit Stimulus Check 2022 Turbotax Recovery Rebate

IRS Updates Info On Recovery Rebate Credit And Pandemic Response Scott M Aber CPA PC

The Recovery Rebate Credit Explained Expat US Tax

The Recovery Rebate Credit Calculator MollieAilie

The Recovery Rebate Credit Calculator MollieAilie

What Is The Recovery Rebate Credit 2023 Detailed Information

How To Claim Recovery Rebate Credit With No Income Recovery Rebate

Can I Claim Recovery Rebate Credit In 2023 Recovery Rebate

How Much Is The Recovery Rebate Credit 2024 - If you did not receive the full amount of EIP3 before December 31 2021 claim the 2021 Recovery Rebate Credit RRC on your 2021 Form 1040 U S Individual Income Tax Return or Form 1040 SR U S Income Tax Return for Seniors The 2021 RRC amount was 1 400 or 2 800 in the case of a joint return plus an additional 1 400 per each