How Much Is The Value Added Tax In Philippines Learn about Value Added Tax VAT in the Philippines a 12 tax applied to most goods services and properties including imports Find out how to register file returns claim

Value Added Tax DESCRIPTION WHO ARE REQUIRED TO FILE VAT RETURNS OPTIONAL FILING AND PAYMENT OF MONTHLY VAT RETURNS BIR FORM NO 2550M FOR VAT Philippines has a national Value added tax VAT of 12 as of 2024 administered by the Department of Finance s Bureau of Internal Revenue Visit this page for an executive

How Much Is The Value Added Tax In Philippines

How Much Is The Value Added Tax In Philippines

https://imgv2-2-f.scribdassets.com/img/document/465587328/original/501265f5f6/1665411469?v=1

Value Added Tax In Nigeria An Overview MakeMoney ng

https://www.makemoney.ng/wp-content/uploads/2022/11/Value-Added-Tax.jpg

VAT Chapter 8 TAX Just Tax CHAPTER 8 VALUE ADDED TAX VAT Tax On

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/0b8c8facd09cb0055a109878eb885895/thumb_1200_1698.png

VAT Value Added Tax is a sales tax imposed on goods services and imports in the Philippines Learn who are required to be VAT registered what are the types and rates of VAT and how to The topic of Value Added Tax VAT under the National Internal Revenue Code of 1997 NIRC as amended by the TRAIN Law Republic Act No 10963 and the Ease of

Learn how VAT works in the Philippines a 12 tax on most goods and services Find out the exemptions zero rated transactions registration invoicing and reporting Learn about the VAT scope rates exemptions registration declaration and recovery in the Philippines Find out how the COVID 19 pandemic and the CREATE Act affect

Download How Much Is The Value Added Tax In Philippines

More picture related to How Much Is The Value Added Tax In Philippines

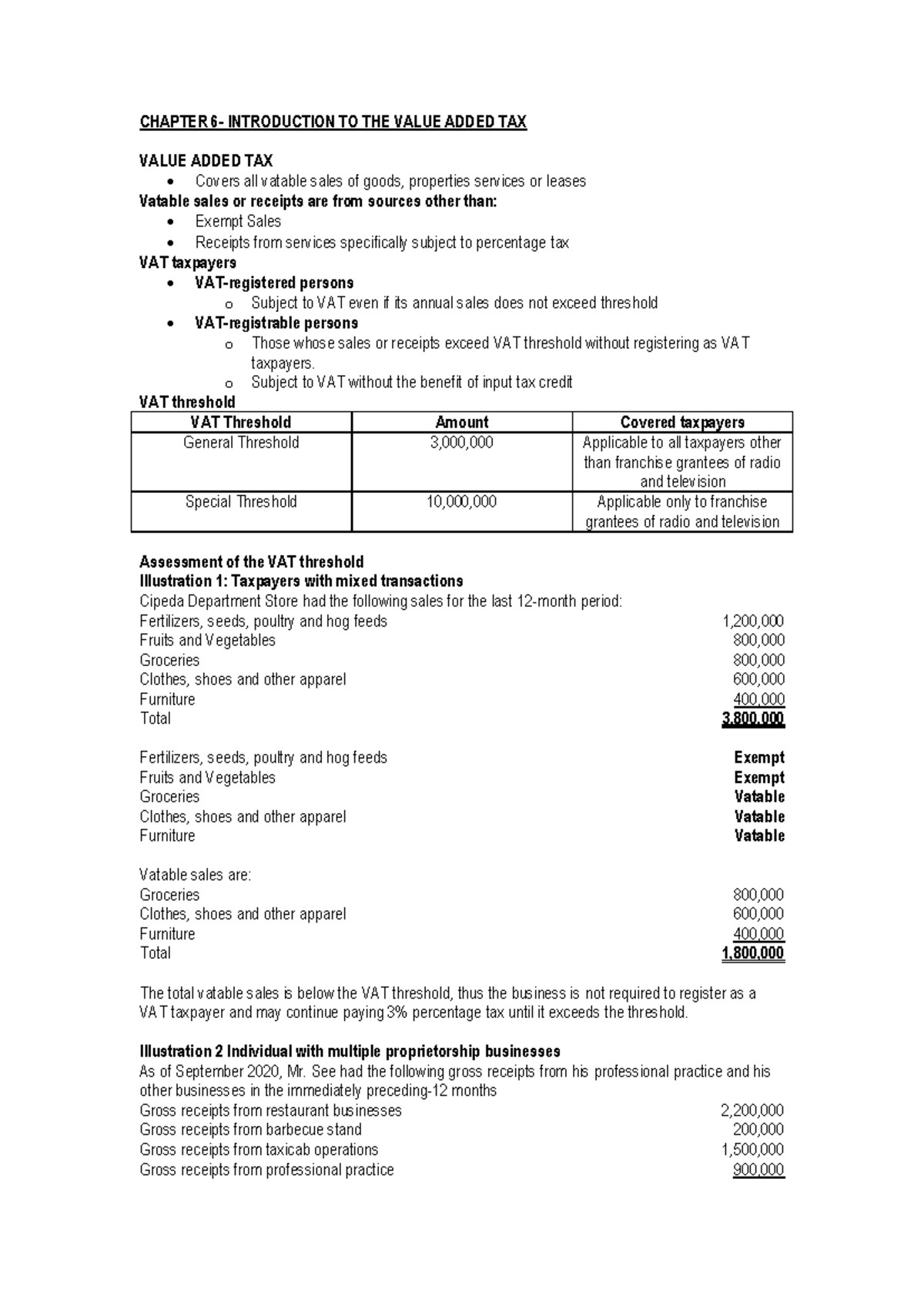

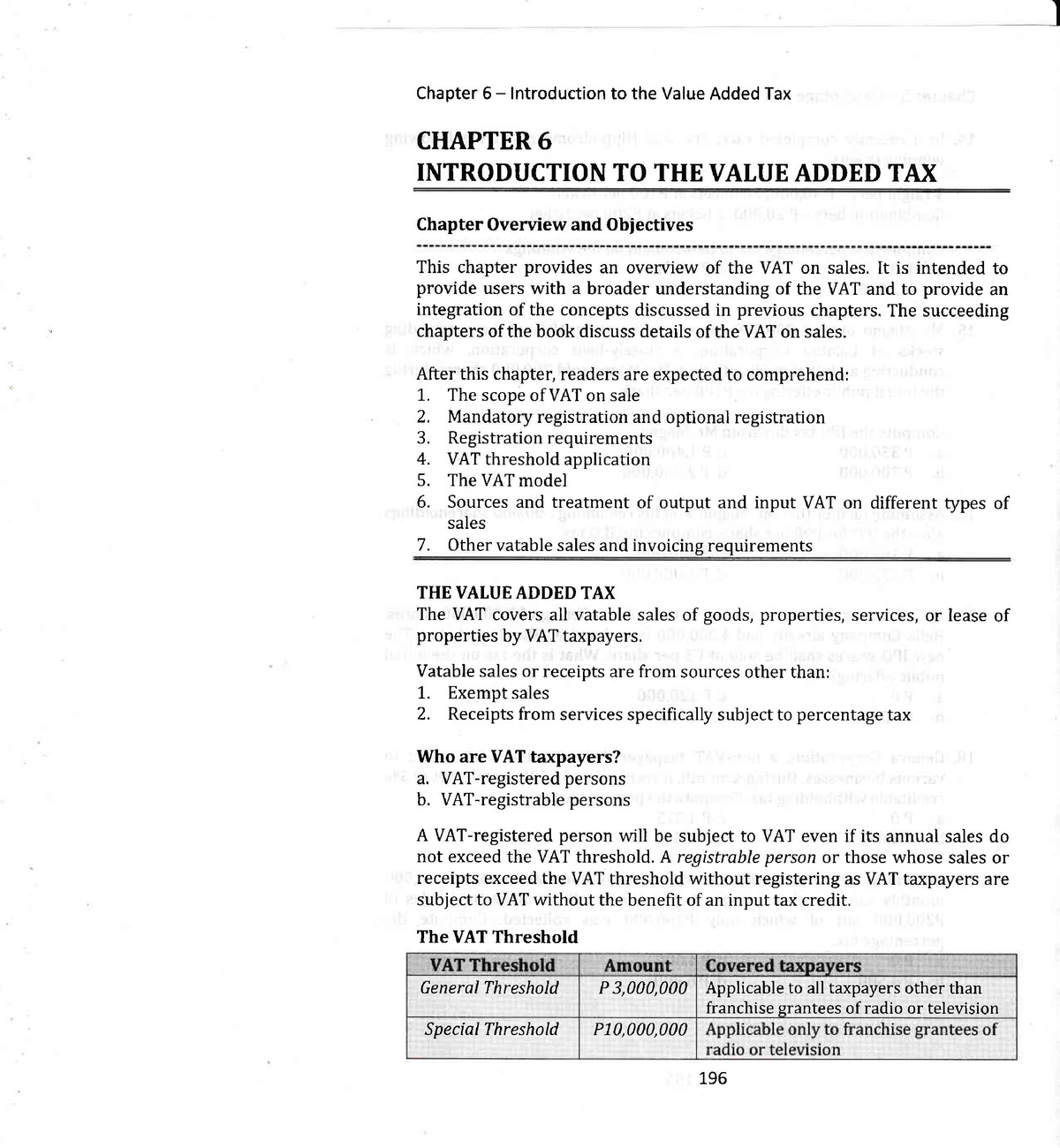

6 Tax INTRODUCTION TO THE VALUE ADDED TAX THE VALUE ADDED TAX The

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/dc50378dfb0509e7486752c37313879b/thumb_1200_1553.png

Value Added Tax Act KPMG Bulgaria

https://assets.kpmg.com/is/image/kpmg/bg-vat-training-1024x:cq5dam.web.1400.350

Value Added Tax Semi Finals Value Added Tax A Is An Indirect

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/85351f1e7b66a3fbea88c19bc1f6699b/thumb_1200_1553.png

Learn what Value Added Tax VAT is how it applies to different transactions and how to register and issue VAT invoices in the Philippines Find out the standard zero and Learn about VAT Value Added Tax in the Philippines a 12 tax on most sales transactions Find out who pays VAT who is exempt how to file VAT returns and more

Value Added Tax Also called VAT this tax is imposed on the sale of goods and services It is levied on the value added to a product or service at each stage in its production Learn about the value added tax VAT rate of 12 and the excise tax rates for various products and services in the Philippines Find out the latest amendments and rulings

Chapter 6 Introduction TO THE Value Added TAX CHAPTER 6

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/07c7dff97b38fad929fb5308c0d21757/thumb_1200_1696.png

VAT Value Added Tax In The Philippines YouTube

https://i.ytimg.com/vi/qXWsmXG8MIY/maxresdefault.jpg

https://incometaxcalculator.ph/value-added-tax-philippines

Learn about Value Added Tax VAT in the Philippines a 12 tax applied to most goods services and properties including imports Find out how to register file returns claim

https://www.bir.gov.ph/value-addedtax

Value Added Tax DESCRIPTION WHO ARE REQUIRED TO FILE VAT RETURNS OPTIONAL FILING AND PAYMENT OF MONTHLY VAT RETURNS BIR FORM NO 2550M FOR VAT

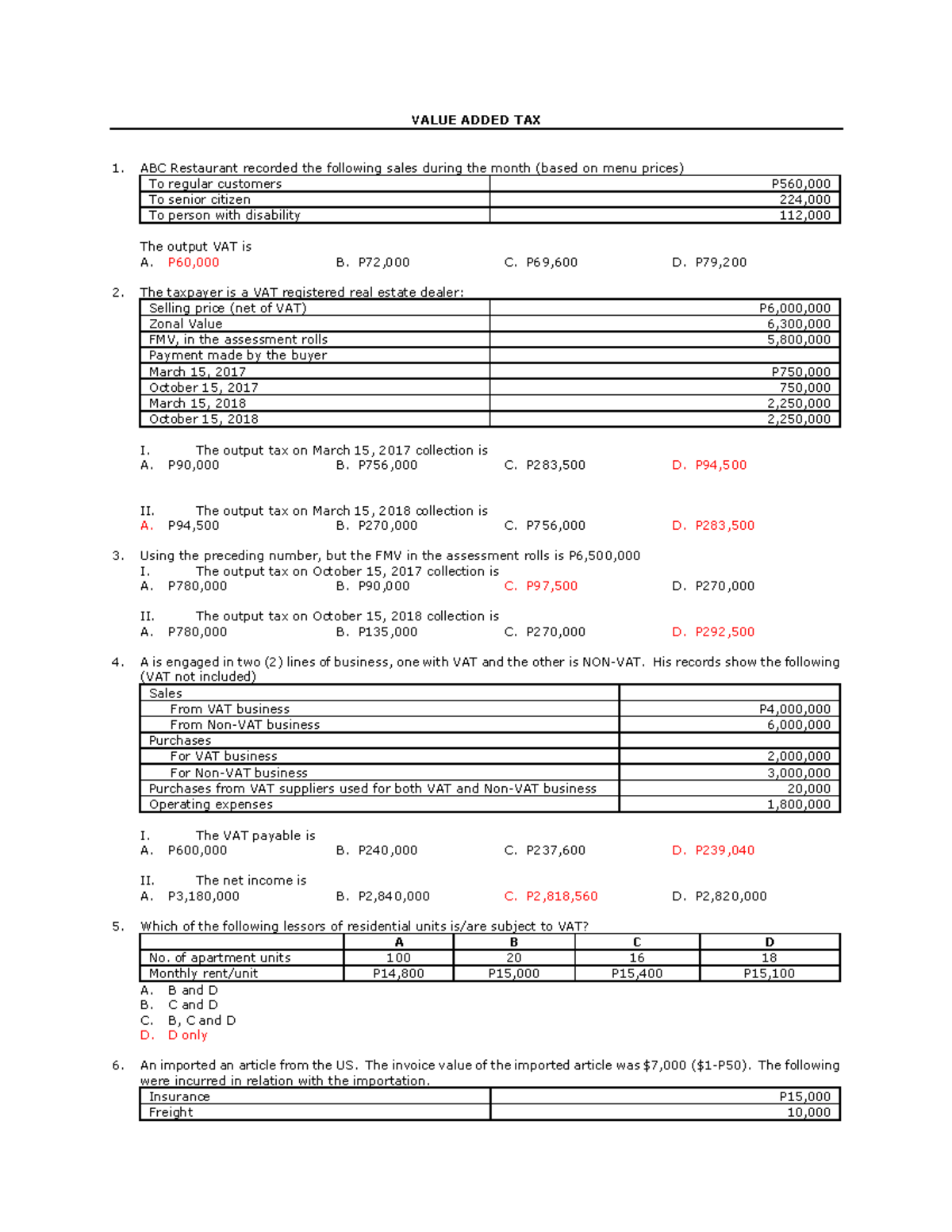

87 13 Value Added Tax Oct 28 VALUE ADDED TAX ABC Restaurant

Chapter 6 Introduction TO THE Value Added TAX CHAPTER 6

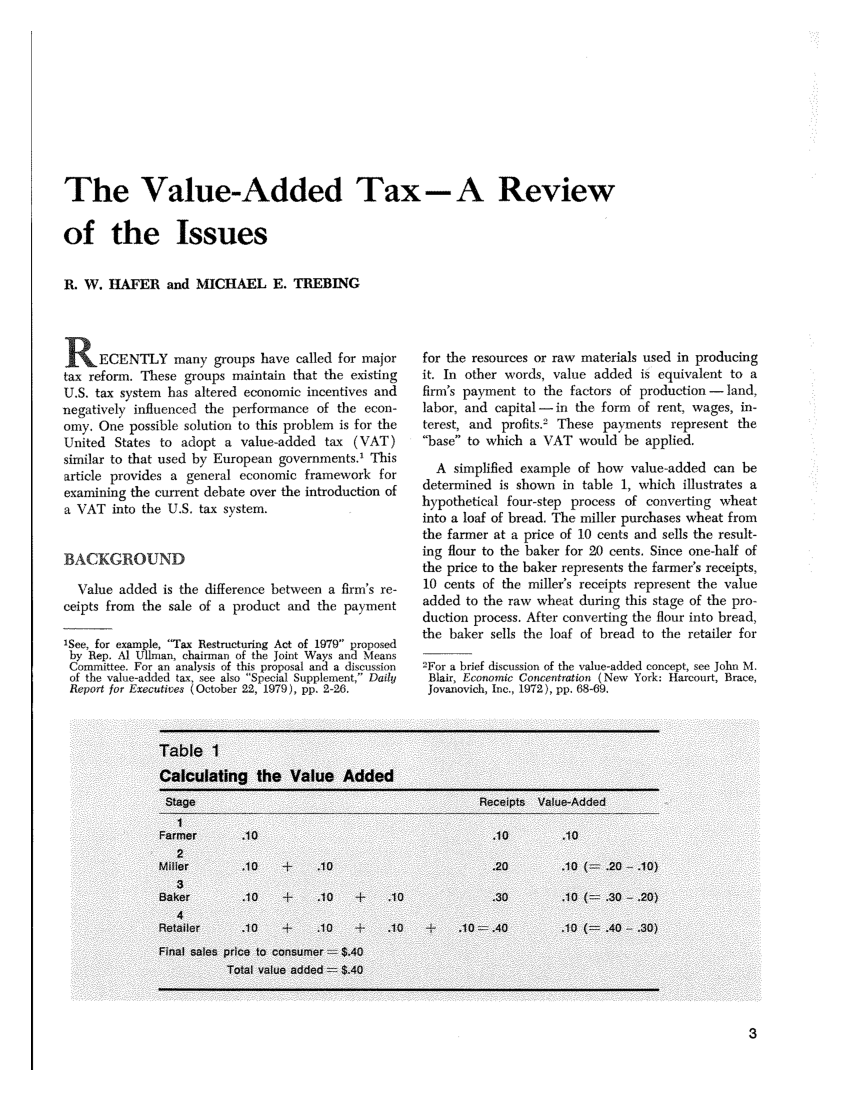

PDF The Value Added Tax A Review Of The Issues

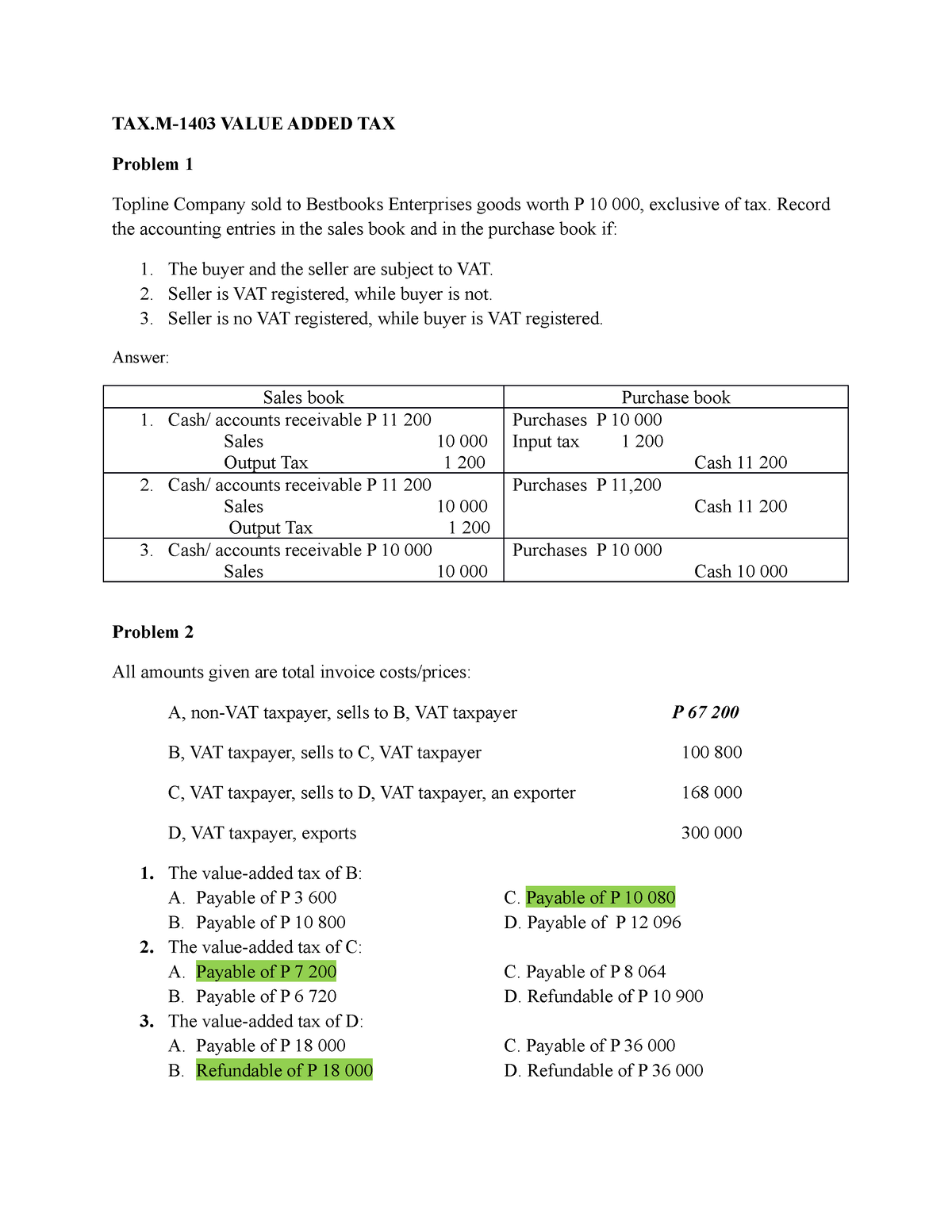

Value Added Tax TAX 1403 VALUE ADDED TAX Problem 1 Topline Company

PDF VALUE ADDED TAX LAW The Lebanese Ministry Of Finance Portal

Vad Value Added Distributor Concept With Big Word Or Text And Team

Vad Value Added Distributor Concept With Big Word Or Text And Team

What Are The VAT Exempt Goods And Services Condo Living

Understanding The VAT Law In The UAE ITC Accounting And Tax Consultancy

TAX232 Intro TO VAT N A L Chapter 5 Lntroduction To The Value

How Much Is The Value Added Tax In Philippines - Learn about Value Added Tax VAT in the Philippines a business tax imposed on sales of goods and services Find out the current VAT rates exemptions zero rating input VAT output VAT