How Much Lic Premium Is Tax Deductible Verkko 5 kes 228 k 2023 nbsp 0183 32 If a premium of INR 20 000 is paid INR 15 000 would be allowed as a deduction while the remaining INR 5000 would be a part of your taxable income If the

Verkko 23 kes 228 k 2018 nbsp 0183 32 The investment in life insurance can be deducted up to Rs 1 50 000 Rs 1 Lakh upto A Y 2014 15 It a common perception that Premium Paid on all Life Insurance Policies qualifies for deduction Verkko Is LIC premium tax deductible A The taxpayer can claim deduction under section 80C in respect of premium on life insurance policy paid by him during the year

How Much Lic Premium Is Tax Deductible

How Much Lic Premium Is Tax Deductible

http://static1.squarespace.com/static/623b48a3293e2847ebe155cc/625e95a79c5ec522c5f3c38d/628632b30484eb3b330be95b/1654612213254/are-health-insurance-premiums-tax-deductible.png?format=1500w

Donations To Charities Are Still Tax Deductible Charitable

https://i.pinimg.com/originals/cd/2e/96/cd2e960802d4b9bb0af533e8140cfd9d.gif

LIC Premium Payment Methods Online And Offline Insurance Funda

https://i2.wp.com/www.insurancefunda.in/wp-content/uploads/2016/03/LIC-premium-is-Due.png?resize=800%2C445

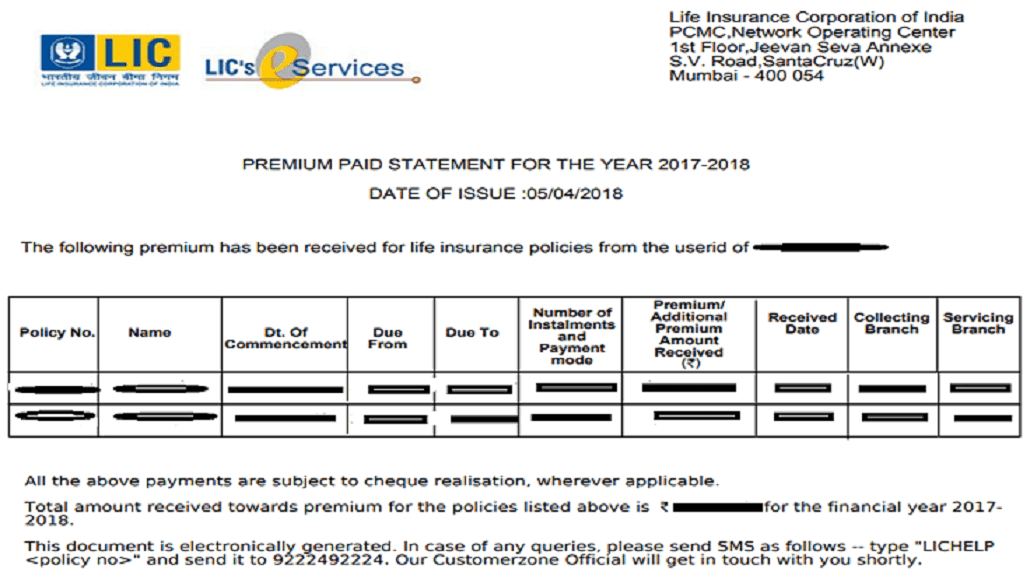

Verkko The first way to determine your installment premium without tax is through the premium receipt For example The information regarding the total premium amount and the Verkko Up to 20 of the actual sum assured is tax deductible for policies issued on or after 1st April 2013 Up to 10 of the actual sum assured is tax deductible for policies issued

Verkko In the policy bond the premium amount and the tax amount are mentioned separately where the customer can check the LIC premium amount without the tax LIC Verkko 3 huhtik 2023 nbsp 0183 32 Income received from insurance policies issued on or after 1 April 2023 other than unit linked policies having a premium or aggregate of premium

Download How Much Lic Premium Is Tax Deductible

More picture related to How Much Lic Premium Is Tax Deductible

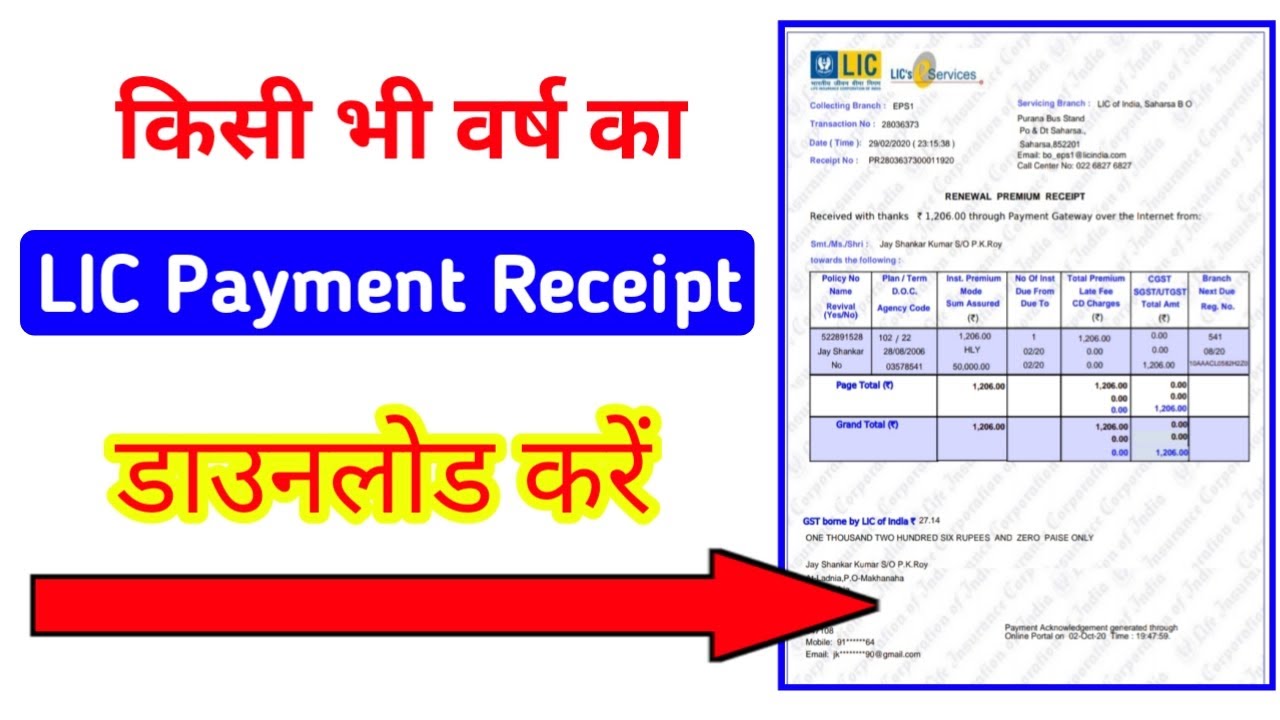

How To Download Lic Premium Receipt Lic Receipt Download Online Lic

https://i.ytimg.com/vi/LrG1--ej-mQ/maxresdefault.jpg

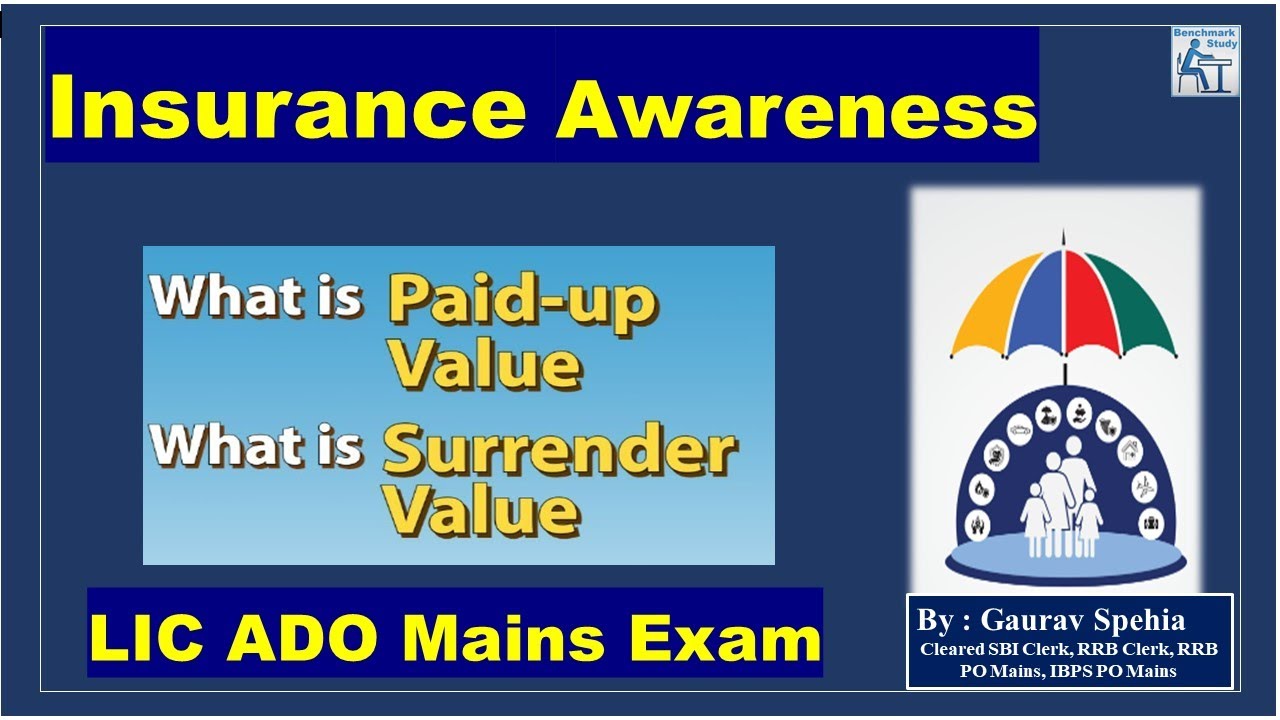

Paid Up Value Surrender Value Deductible Premium Sum Assured

https://i.ytimg.com/vi/hdC80ApqW-U/maxresdefault.jpg

Know How Much LIC s IPO Listed Gain Can Be LIC IPO Listing Price

https://i.ytimg.com/vi/a7o19eWAyCs/maxresdefault.jpg

Verkko 12 toukok 2023 nbsp 0183 32 Why Invest Last Updated on 05 12 2023 Discover the tax benefits of LIC insurance plans Maximize your savings with comprehensive policies that offer Verkko 19 tammik 2019 nbsp 0183 32 The benefit I guess is that the LIC can make future gains pay zero tax and distribute to you or simply reinvest into new holdings The NTA will be higher than

Verkko Is GST applicable on LIC premium Yes the indirect tax laws dictate the applicability of GST on LIC premiums in India How much GST is levied on LIC premium The levy Verkko 18 syysk 2023 nbsp 0183 32 If your employer pays for a life insurance the premium paid on policy amounts above 50 000 is considered part of your taxable income Interest generated

Lic Authorisation Letter Fill Online Printable Fillable Blank

https://www.pdffiller.com/preview/448/374/448374132/large.png

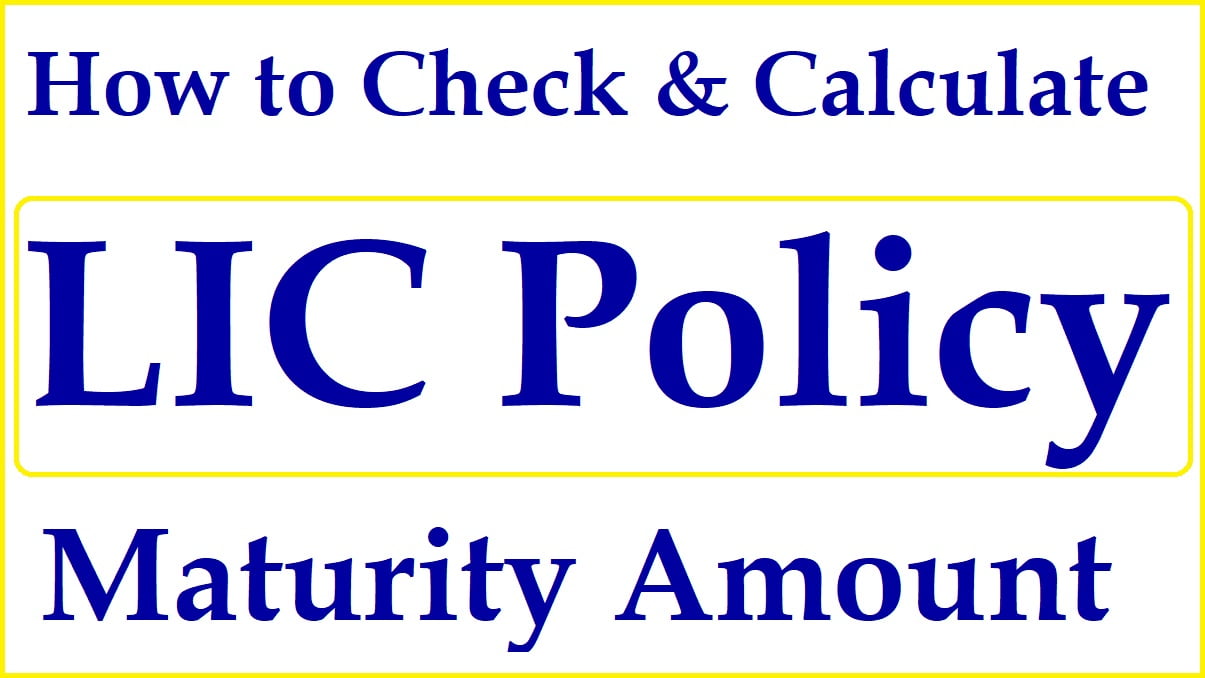

LIC Maturity Calculator How To Check LIC Policy Maturity Amount

https://howtofill.com/wp-content/uploads/2021/11/LIC-Maturity-Calculator-How-to-check-LIC-Policy-Maturity-Amount.jpg

https://www.turtlemint.com/lic-premium-tax-deductions

Verkko 5 kes 228 k 2023 nbsp 0183 32 If a premium of INR 20 000 is paid INR 15 000 would be allowed as a deduction while the remaining INR 5000 would be a part of your taxable income If the

https://taxguru.in/income-tax/insurance-premi…

Verkko 23 kes 228 k 2018 nbsp 0183 32 The investment in life insurance can be deducted up to Rs 1 50 000 Rs 1 Lakh upto A Y 2014 15 It a common perception that Premium Paid on all Life Insurance Policies qualifies for deduction

How To Download LIC Premium Paid Certificate Online For IT Returns

Lic Authorisation Letter Fill Online Printable Fillable Blank

Lic Jeevan Labh Policy Calculator Archives Nrmsc Hot Sex Picture

How To Get Your LIC Premium Receipt Through Official Website Of LIC

Tax Deductions The New Rules INFOGRAPHIC Alloy Silverstein

How To Check My LIC Installment Premium Without Tax Quora

How To Check My LIC Installment Premium Without Tax Quora

Download LIC Premium Payment Receipt Online E filing Of Income Tax Return

How To Download LIC Premium Paid Receipt Online How To Download

Tax Deductible Bricks R Us

How Much Lic Premium Is Tax Deductible - Verkko Rebate of Income Tax Section 87A A resident individual whose total taxable income does not exceed Rs 5 00 000 shall be entitled to a deduction from the amount of