How Much Ltcg Is Tax Free In India The rate of LTCG tax in India varies based on the type of asset For listed equities and equity oriented mutual funds the rate is ten percent if the gain exceeds

In India for example the LTCG tax on equities mutual funds and stocks is 10 if the profits reach Rs 1 lakh in a fiscal year The LTCG tax rate is 20 with an indexation The ClearTax LTCG Calculator will show you the long term capital gains tax on the purchase and sale of equity oriented funds and shares in a matter of seconds You get a birds eye view of the actual

How Much Ltcg Is Tax Free In India

How Much Ltcg Is Tax Free In India

https://images.moneycontrol.com/static-mcnews/2018/01/tax1-770x433.jpg?impolicy=website&width=770&height=431

Taxability On Mutual Funds 3 Ways To Save LTCG Tax Inventiva

https://m.economictimes.com/thumb/msid-74592107,width-1200,height-900,resizemode-4,imgsize-327558/16.jpg

Claim Rs 1 Lakh Exemption In LTCG In ITR 2021 22 Rs 1 Lakh

https://i.ytimg.com/vi/XspuKodcLEo/maxresdefault.jpg

Long term capital gain tax is applicable at 20 except on the sale of equity shares and the units of equity oriented funds Long term capital gains are 10 over and above Rs 1 lakh on the sales of equity Gains of up to Rs 1 lakh in a year are tax free Only gains above that limit will be taxed He went to explain Suppose you invest Rs 2 lakh in stocks or equity

LTCG up to Rs 1 lakh per person in a financial year will be exempt Thus if your net LTCG after setting of any eligible losses from selling of equity shares and Long Term Capital Gains LTCG on shares and equity oriented mutual funds in India are taxed at a 10 rate plus surcharge and cess if they reach Rs 1 lakh in a fiscal year

Download How Much Ltcg Is Tax Free In India

More picture related to How Much Ltcg Is Tax Free In India

Does The Cost Of Living Payment Affect Universal Credit What The CoL

https://wp.inews.co.uk/wp-content/uploads/2022/09/PRI_220569912-2-e1664375368912.jpg

How To Claim Exemptions From Long Term Capital Gains

https://kmgcollp.com/wp-content/uploads/2022/02/Long-Term-Capital-Gains-tax-exemptions-sec-54-54ec-54f-on-sale-of-land-or-residential-property-LTCG-2-years.jpg

LTCG Tax How To Invest In The New LTCG Tax Regime

https://img.etimg.com/thumb/msid-62860042,width-1070,height-580,imgsize-65202,overlay-etwealth/photo.jpg

Long term capital gains upto Rs 1 lakh are exempted from tax However if the LTCG exceeds this threshold then such gains are taxable at a 10 plus surcharge Holding stocks certain mutual funds and business trust units for more than a year before selling long term capital gains gets you a lower tax rate of 10 on profits

LTCG tax rate on Mutual Funds is 20 after indexation Indexation is done through the Cost Inflation Index CII which involves factoring in inflation in the cost of acquisition It helps What are the tax implications on LTCGs arising from selling shares As per the Union budget 2018 a 10 tax will be levied on long term capital gains over 1 lakh

How Much Tax Paid On The Profit Earned While Selling Residential

https://malayalam.goodreturns.in/img/2023/08/tax13-1690872166.jpg

LTCG Tax How LTCG Tax Will Be Calculated On Shares Where STT Is Not

https://img.etimg.com/thumb/msid-67318247,width-1070,height-580,imgsize-63204,overlay-etwealth/photo.jpg

https://www.forbesindia.com/article/explainers/...

The rate of LTCG tax in India varies based on the type of asset For listed equities and equity oriented mutual funds the rate is ten percent if the gain exceeds

https://groww.in/p/long-term-capital-gains-tax

In India for example the LTCG tax on equities mutual funds and stocks is 10 if the profits reach Rs 1 lakh in a fiscal year The LTCG tax rate is 20 with an indexation

LTCG Tax Here s How Much Tax You Have To Pay On Your Mutual Fund Gains

How Much Tax Paid On The Profit Earned While Selling Residential

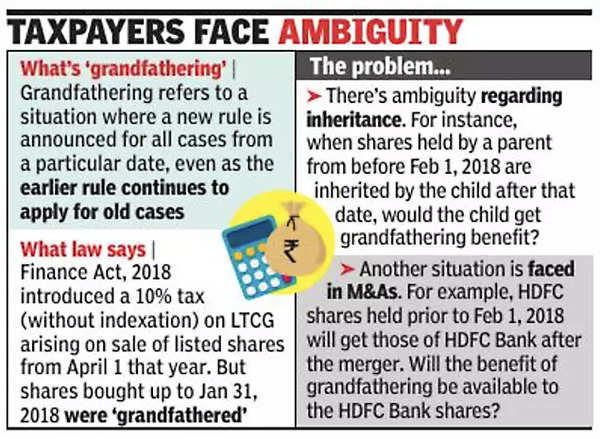

Govt May Tweak Rules For Long term Cap Gains Tax Times Of India

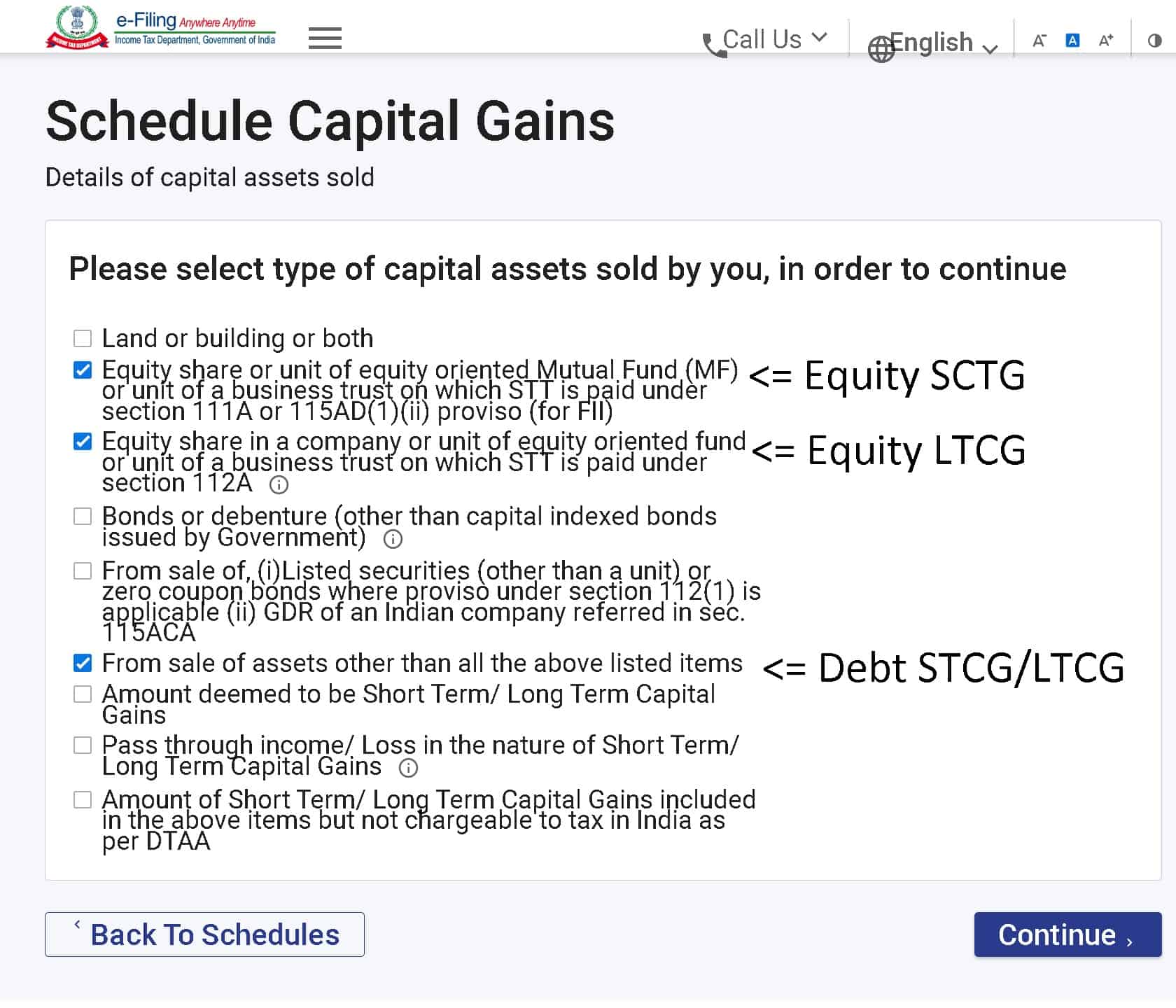

How To Enter Mutual Fund And Share Capital Gains In ITR2 or ITR3

Managing The LTCG Tax For Your Mutual Funds Livemint

LTCG Tax Other Budget Proposals To Kick In From April 1 Times Of India

LTCG Tax Other Budget Proposals To Kick In From April 1 Times Of India

LTCG Tax How To Save Tax On Property Equity Mutual Funds

How To Calculate Your 2023 Taxes PELAJARAN

104 Years Of The Income Tax Then And Now Americans For Tax Reform

How Much Ltcg Is Tax Free In India - Long term capital gain tax is applicable at 20 except on the sale of equity shares and the units of equity oriented funds Long term capital gains are 10 over and above Rs 1 lakh on the sales of equity