How Much Maximum Pf Can Be Deducted From Salary How can I calculate PF deduction from salary in compliance with relevant laws and regulations The PF account receives 12 of the base salary and dearness allowance from both the employer and the employee

Employees whose monthly salary basic wage dearness allowances is 15000 or below are eligible for the EPF scheme For employees whose salary is above 15000 then the The maximum amount that can be deducted towards EPF contribution is 12 of the basic salary plus dearness allowance and the maximum amount that can be contributed by the employer is 12 of the basic salary plus dearness

How Much Maximum Pf Can Be Deducted From Salary

How Much Maximum Pf Can Be Deducted From Salary

https://btechgeeks.com/wp-content/uploads/2021/12/Java-Program-to-Calculate-Tax-to-be-Deducted-from-Salary-1024x576.jpg

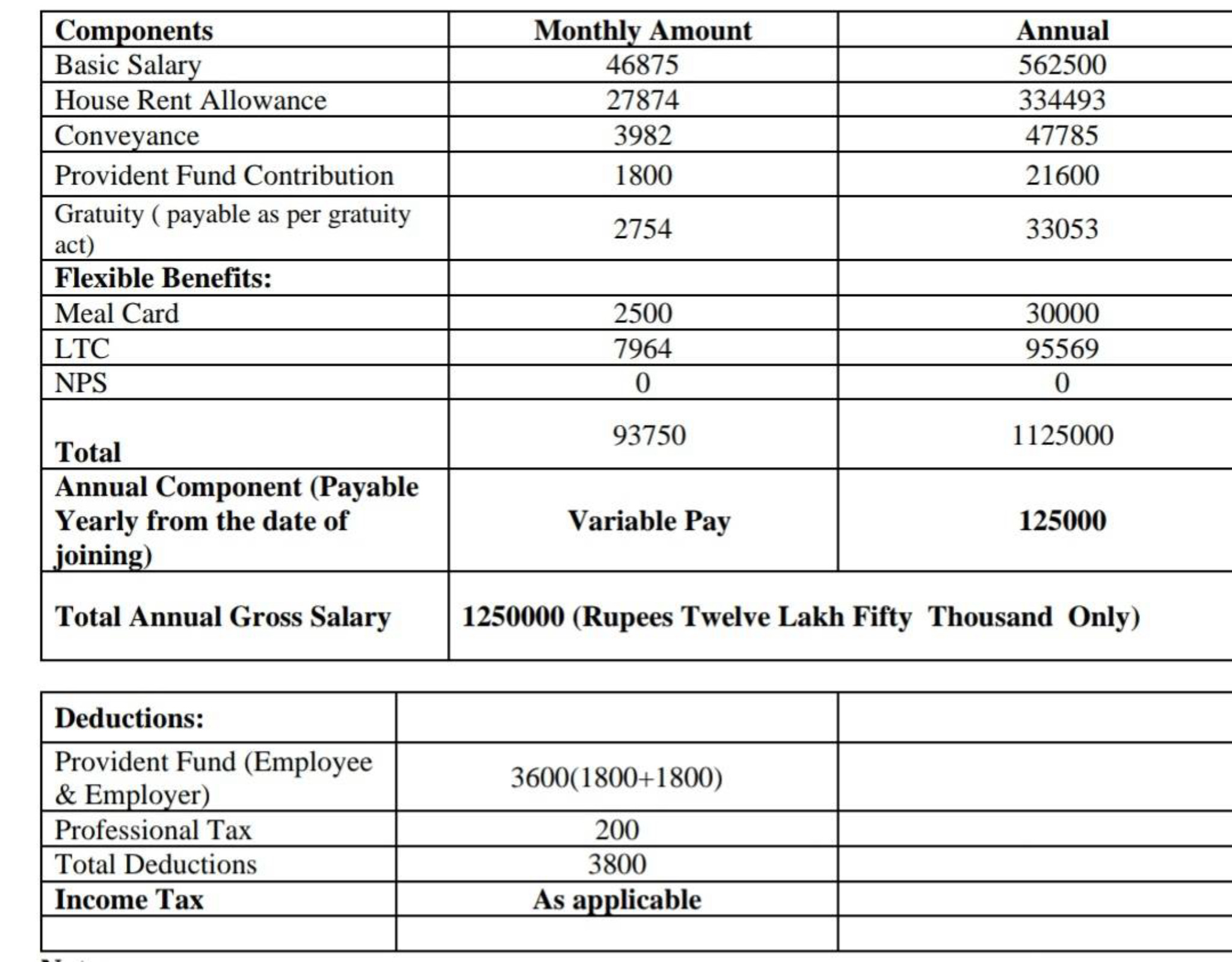

How Much Tax Is Deducted From My Monthly Salary Fishbowl

https://dslntlv9vhjr4.cloudfront.net/posts_images/fIUjzl6VNs2HG.jpg

Request Letter To Stop Deduction From Salary Request Letter For Stop

https://i.ytimg.com/vi/T2IaPwOvIX4/maxresdefault.jpg

Irrespective of the last drawn salary the maximum salary considered for this calculation is Rs 15 000 Therefore if your last drawn salary is Rs 42 000 and you have worked for eight consecutive years the EPS amount you can withdraw is How much EPF is deducted 12 of employee basic wage dearness allowances will be paid as a monthly contribution towards PF and at the same time employer will also pay another 12 PF contribution In which 3 67 goes

Learn PF deduction from salary calculation and ensure accurate EPF contributions with our free tool for seamless compliance PF is deducted by taking 12 of employee s basic salary and dearness allowance which is employee s contribution Are PF withdrawals taxed After 5 years of continuous

Download How Much Maximum Pf Can Be Deducted From Salary

More picture related to How Much Maximum Pf Can Be Deducted From Salary

Request Letter To Start PF Deduction From Salary Sample Letter

https://www.lettersinenglish.com/wp-content/uploads/Request-Letter-to-Start-PF-Deduction-from-Salary-Sample-Letter-Requesting-for-Provident-Fund-Deduction-from-Salary.jpg

PF Deduction In Salary Excel Formula YouTube

https://i.ytimg.com/vi/kWNoBdSAGD0/maxresdefault.jpg

EPF Calculator How To Calculate PF Amount For Salaried Employers

https://epfindia.net/wp-content/uploads/2019/02/calculate-epf-768x408.jpg

An employer can contribute 0 5 of the salary paid to the employee for their EPF When does an employee become eligible for EPF contribution An employee becomes eligible for EPF If your basic pay is less than 6 500 PF is calculated based on your gross salary But if your basic pay is more than 6 500 PF is calculated on your basic pay Employee

Employee s contribution to the EPF is eligible for a tax deduction under Section 80C of the Income Tax Act subject to the maximum limit of Rs 1 50 000 Employer s Contribution to the EPF is not included in the An employee whose actual basic pay is Rs 35000 pm but his PF is being deducted on 15000 i e Rs 1800 pm according to the proportion of number of payable days

How Is Provident Fund Calculated On Salary

https://khatabook-assets.s3.amazonaws.com/media/post/2022-06-08_140737.0718440000.webp

:max_bytes(150000):strip_icc()/what-is-my-legal-obligation-to-pay-employees-397929-final-updated2020-a91daa5d21be4818bf0ab5eeb7a20a42.png)

What Are The Laws Against Not Paying Employees

https://www.thebalancemoney.com/thmb/JEsl_olT1w3Hdr8FBuak7QiIVOQ=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/what-is-my-legal-obligation-to-pay-employees-397929-final-updated2020-a91daa5d21be4818bf0ab5eeb7a20a42.png

https://fi.money › guides › personal-finance …

How can I calculate PF deduction from salary in compliance with relevant laws and regulations The PF account receives 12 of the base salary and dearness allowance from both the employer and the employee

https://www.hrcabin.com

Employees whose monthly salary basic wage dearness allowances is 15000 or below are eligible for the EPF scheme For employees whose salary is above 15000 then the

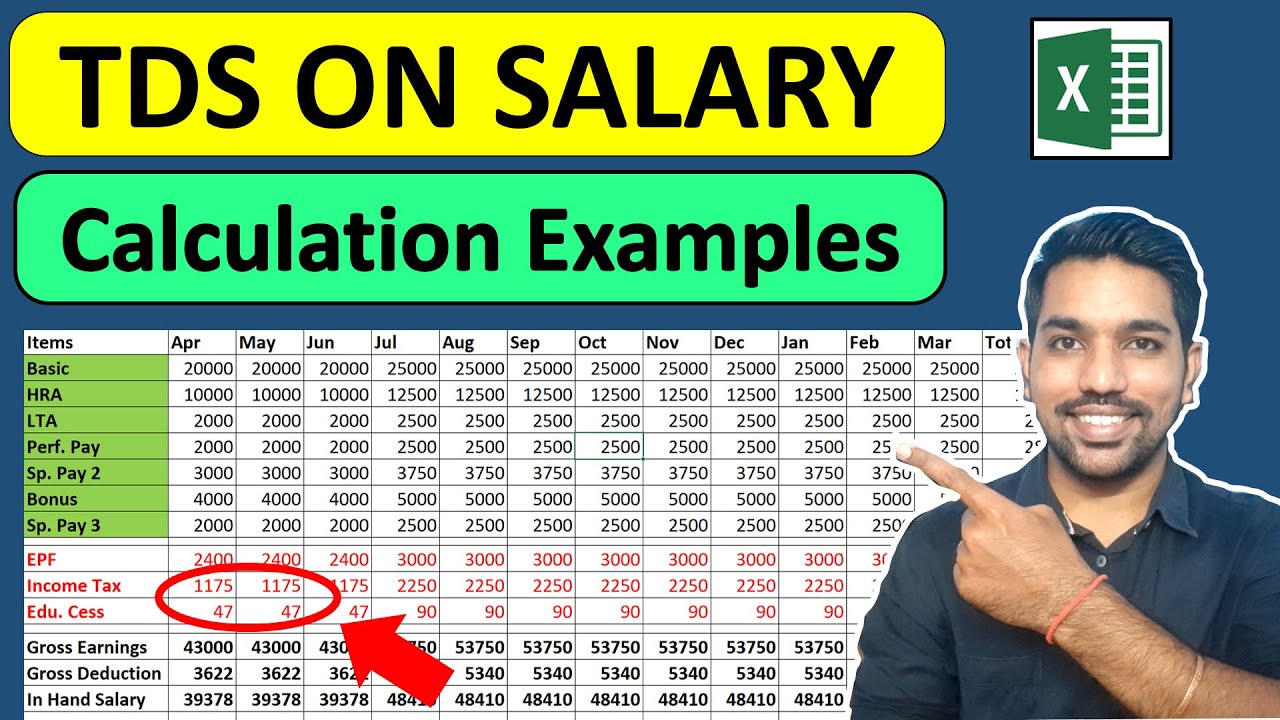

TDS On Salary Calculation Tax Deduction On Salary FinCalC

How Is Provident Fund Calculated On Salary

Mandatory Government Deductions From Salary SSS Philhealth Pag Ibig

Guide On Reading And Understanding Your First Payslip In 2022 UpGrad

C mo Calcular PF Y ESI Con Ejemplo En 2018

Salary Deduction Letter Due To Employee s Poor Performance

Salary Deduction Letter Due To Employee s Poor Performance

Us Salary Slip Format Kerahut

TDS Deduction On PF Account And EPF Saving Tips

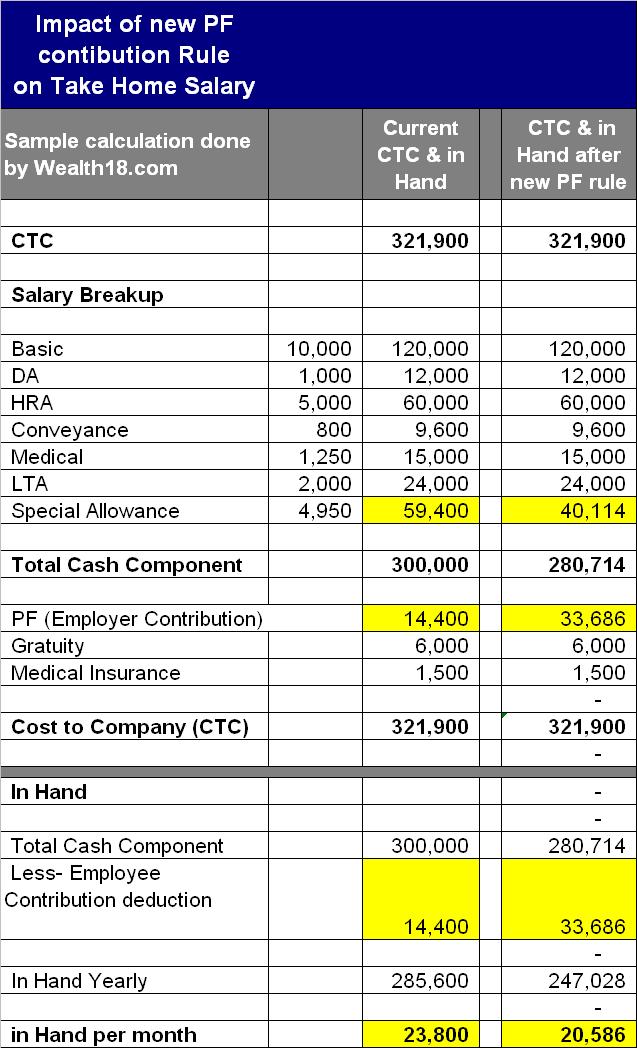

New PF Contribution Rule May Reduce Your Take Home Salary Wealth18

How Much Maximum Pf Can Be Deducted From Salary - PF is deducted by taking 12 of employee s basic salary and dearness allowance which is employee s contribution Are PF withdrawals taxed After 5 years of continuous