How Much Medical Bills Can You Claim On Taxes You can only deduct unreimbursed medical expenses that exceed 7 5 of your adjusted gross income AGI found on line 11 of your 2023 Form 1040

If you or your dependents have been in the hospital or had other costly medical or dental expenses keep those receipts they could help cut your tax bill Here s a look at how the medical This interview will help you determine if your medical and dental expenses are deductible Information you ll need Filing status Type and amount of expenses paid The year in which the expenses were paid Your adjusted gross income If you were reimbursed or if expenses were paid out of a Health Savings Account or an Archer Medical Savings

How Much Medical Bills Can You Claim On Taxes

How Much Medical Bills Can You Claim On Taxes

https://hp-prod-wp-data.s3.us-west-1.amazonaws.com/content/uploads/02x.jpeg

How To Lower Your Hospital Bill Plantforce21

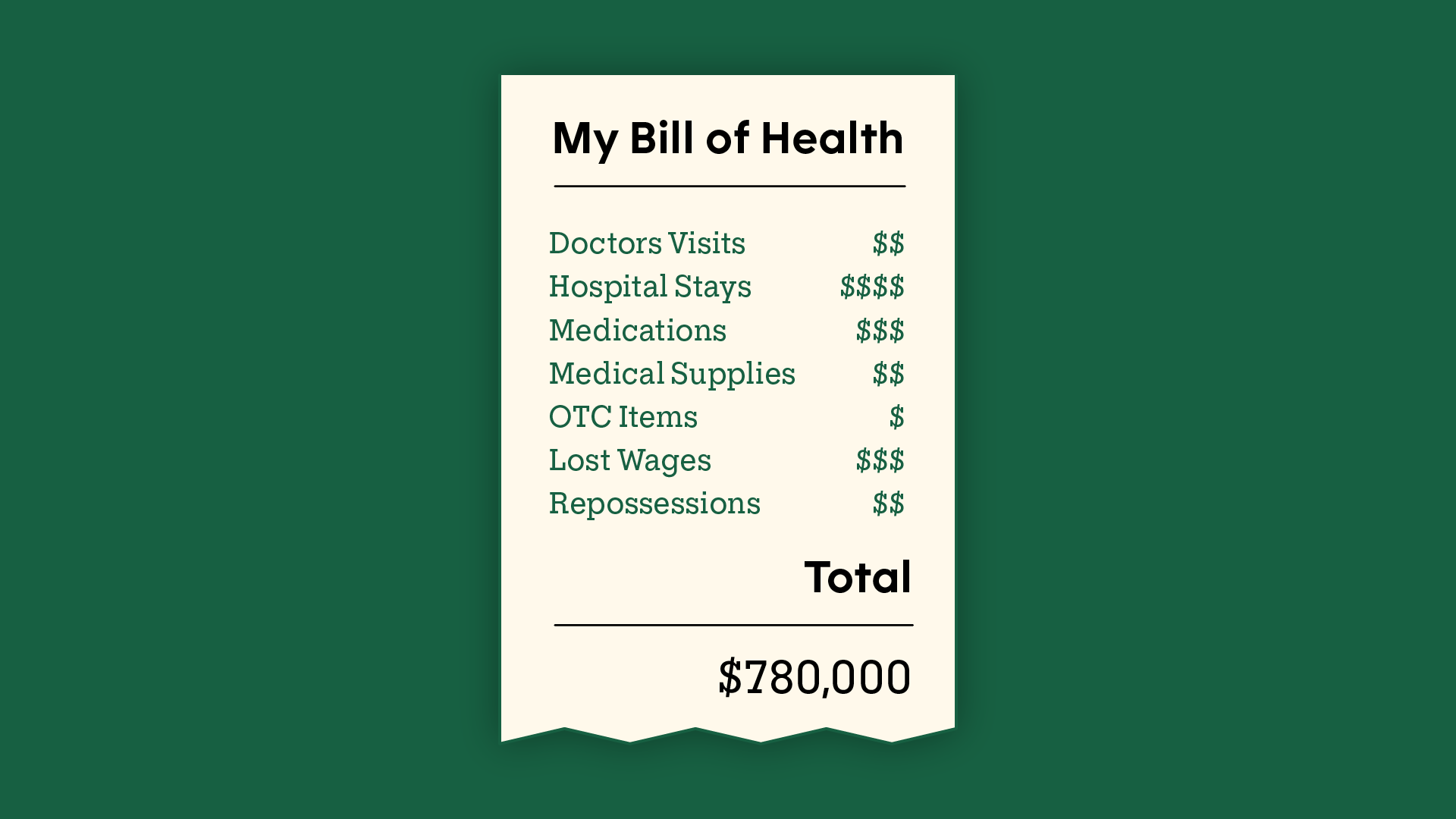

https://images.ctfassets.net/4f3rgqwzdznj/6nkNZ8MEpJ1V3ggiilpgGO/8d442a94cf03c27dc8e8205ba8671161/GRxH_bill_of_health_GFX-01.png

How Many Kids Can You Claim On Taxes YouTube

https://i.ytimg.com/vi/5ZlHu2_Btog/maxres2.jpg?sqp=-oaymwEoCIAKENAF8quKqQMcGADwAQH4Ac4FgAKACooCDAgAEAEYZSBlKGUwDw==&rs=AOn4CLAUVfOUGX38VyHK3nGlEwomCKi1-g

Most forms of medical spending from insurance premiums to treatment are tax deductible if you meet the IRS requirements To claim this deduction you must take itemized deductions rather than the standard deduction and must have spent more than 7 5 of your income on qualified medical bills There are plenty of qualifying medical expenses that you can claim on your taxes However you can only deduct expenses that exceed 7 5 of your adjusted gross income And if your total itemized deductions don t exceed the new higher standard deduction then you won t take the deduction

If you re itemizing deductions the IRS generally allows you a medical expenses deduction if you have unreimbursed expenses that are more than 7 5 of your Adjusted Gross Income You can deduct the cost of care from several types of Medical care expenses include payments for the diagnosis cure mitigation treatment or prevention of disease or payments for treatments affecting any structure or function of the body

Download How Much Medical Bills Can You Claim On Taxes

More picture related to How Much Medical Bills Can You Claim On Taxes

Can t Pay For Medical Bills Or Prescriptions Doctors Take Note Bloomberg

https://assets.bwbx.io/images/users/iqjWHBFdfxIU/iJ4Q8iJLJQu4/v0/1200x800.jpg

How Many Kids Can You Claim On Taxes Hanfincal

https://hanfincal.com/wp-content/uploads/2022/01/how-many-kids-can-you-claim-on-taxes-hanfincal.jpg

How Much Medical Expense Can You Claim On Taxes 27F Chilean Way

https://www.27fchileanway.cl/wp-content/uploads/2023/05/how-much-medical-expense-can-you-claim-on-taxes.jpg

You can deduct on Schedule A Form 1040 only the part of your medical and dental expenses that is more than 7 5 of your adjusted gross income AGI This publication also explains how to treat impairment related work expenses and health insurance premiums if you are self employed If your unreimbursed out of pocket medical bills in 2020 exceeded 7 5 percent of your adjusted gross income AGI you may be able to deduct them on your taxes

How Much in Medical Expenses Can You Claim on Your Taxes If you meet the two qualification there s no cap on the amount of medical expenses you can claim Take people with big medical bills Itemizers can claim medical expenses not reimbursed by insurance for themselves their spouse and dependents The cost must be incurred primarily

Do You Have To Pay Your Medical Bills From A Personal Injury Settlement

https://www.injurylawrights.com/wp-content/uploads/2020/04/medical-bill-from-personal-injury-settlement.jpg

What Happens If You Don t Pay Your Taxes A Complete Guide All

https://www.allthingsfinance.net/wp-content/uploads/2020/04/image1-56-1536x1086.jpg

https://turbotax.intuit.com › tax-tips › health-care › ...

You can only deduct unreimbursed medical expenses that exceed 7 5 of your adjusted gross income AGI found on line 11 of your 2023 Form 1040

https://www.nerdwallet.com › article › taxes › medical...

If you or your dependents have been in the hospital or had other costly medical or dental expenses keep those receipts they could help cut your tax bill Here s a look at how the medical

How Many Kids Can You Claim On Taxes Hanfincal

Do You Have To Pay Your Medical Bills From A Personal Injury Settlement

What Can You Claim On Taxes In 2020 Perth Mobile Tax

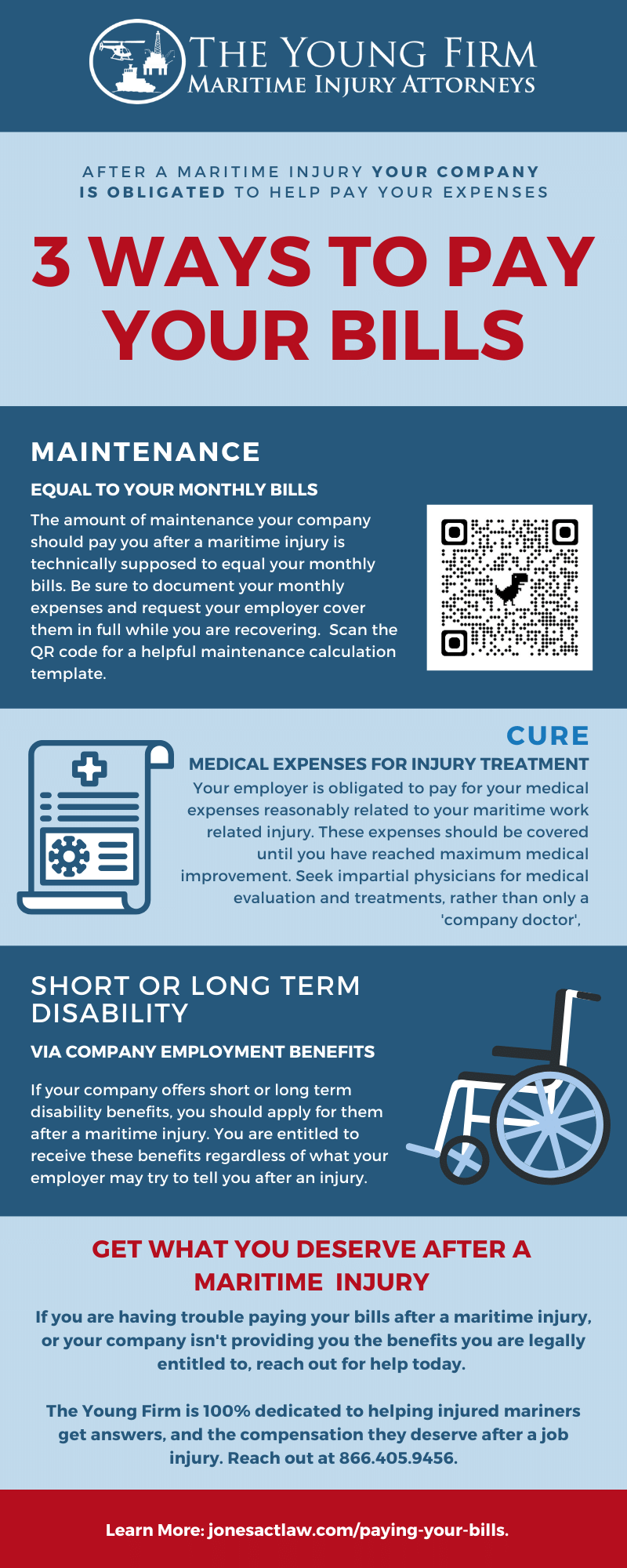

Paying Your Bills After A Maritime Injury The Young Firm

Can I Claim Medical Expenses On My Taxes TMD Accounting

Medical Bills Bankruptcy Acworth GA Law Offices Of Roger Ghai

Medical Bills Bankruptcy Acworth GA Law Offices Of Roger Ghai

Can I Write Off Medical Expenses Canada 27F Chilean Way

The Deductions You Can Claim Hra Tax Vrogue

Do Medical Bills Affect Your Credit Score They Can Self

How Much Medical Bills Can You Claim On Taxes - If you re itemizing deductions the IRS generally allows you a medical expenses deduction if you have unreimbursed expenses that are more than 7 5 of your Adjusted Gross Income You can deduct the cost of care from several types of