How Much Mortgage Interest Deduction Calculator In most cases you can deduct all of your home mortgage interest How much you can deduct depends on the date of the mortgage the amount of the mortgage and how you use the mortgage proceeds

The home mortgage interest deduction HMID allows homeowners who itemize on their tax returns to deduct mortgage interest paid on up to 750 000 worth of their loan principal The HMID is one Mortgage Interest Tax Deduction Calculator to calculate how much tax you can deduct from your monthly mortgage payments The mortgage interest deduction calculator

How Much Mortgage Interest Deduction Calculator

How Much Mortgage Interest Deduction Calculator

https://www.annuity.org/wp-content/uploads/mortgage-interest-deduction-formula-640x0-c-default.jpg

Mortgage Interest Tax Deduction 2020 Calculator JunaidKaleah

https://blog.turbotax.intuit.com/wp-content/uploads/2020/05/You-can-deduct-student-loan-interest-if-you-meet-the-following-qualifications.jpg?w=580

39 Mortgage Interest Deduction Calculator OonaghNyall

https://www.mortgagecalculators.info/images/couple-calculating-bills-together.jpg

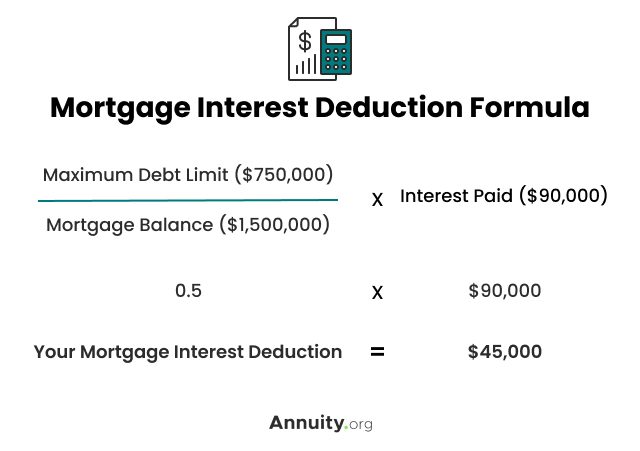

Mortgage Tax Benefits Calculator One of the advantages of real estate investment is that some homeowners may qualify to deduct mortgage interest payments from their income when filing their taxes This The mortgage interest deduction allows you to deduct the interest you paid on the first 750 000 of your mortgage debt during the tax year

Mortgage Interest Tax Deduction Limit How Much Can I Deduct The Tax Cuts and Jobs Act TCJA of 2017 changed individual income tax by lowering the mortgage deduction limit and limiting how much you can You can use Bankrate s mortgage interest deduction calculator to estimate the type of savings you can expect when you file What is the mortgage interest deduction

Download How Much Mortgage Interest Deduction Calculator

More picture related to How Much Mortgage Interest Deduction Calculator

Deductible Home Mortgage Interest Calculator Economy Diva

https://aws.wideinfo.org/economydiva.com/wp-content/uploads/2022/07/14053956/mortgage-interest-deduction-for-owning-a-Spring-Texas-home.jpg

UNDERSTANDING THE MORTGAGE INTEREST DEDUCTION AFTER THE TAX CUTS AND

https://media.licdn.com/dms/image/C4E12AQFd0ZMhMoHjMQ/article-cover_image-shrink_720_1280/0/1539099769588?e=2147483647&v=beta&t=Yo-H4VSLFXeL-9ecQFA0O9ZyX00yzawP-17i9k73Chw

Mortgage Interest Deduction On Your Taxes What It Is Who Qualifies

https://image.cnbcfm.com/api/v1/image/107059537-1652287238617-gettyimages-1024531896-2018-05-1100-06-57bradius8smoothing4-edit.jpeg?v=1704303235&w=1920&h=1080

Homeowners can deduct mortgage interest from their income with the mortgage interest deduction Learn what qualifies for this deduction and how you can benefit Use a mortgage calculator designed specifically to tell you about the interest paid during a loan This will calculate just how much is being paid that can then be used as a tax

Calculate your mortgage interest deduction You will need to calculate your deduction by figuring how much interest will qualify for the deduction Remember the rules above for what kinds of interest Use the mortgage tax savings calculator to determine how much your mortgage payments could reduce your income taxes The interest paid on a mortgage

10 Tax Credits Deductions You Need To Know About Brigit Blog

https://www.hellobrigit.com/wp-content/uploads/2022/09/iStock-1344766725-scaled.jpg

How To Estimate Mortgage Interest Deduction In 2023

https://earthnworld.com/wp-content/uploads/2022/02/Mortgage-Interest-Amounts.jpg

https://www.irs.gov/publications/p936

In most cases you can deduct all of your home mortgage interest How much you can deduct depends on the date of the mortgage the amount of the mortgage and how you use the mortgage proceeds

https://www.investopedia.com/articles/…

The home mortgage interest deduction HMID allows homeowners who itemize on their tax returns to deduct mortgage interest paid on up to 750 000 worth of their loan principal The HMID is one

Is The Mortgage Interest Deduction In Play B Logics

10 Tax Credits Deductions You Need To Know About Brigit Blog

Mortgage Interest Tax Deduction Calculator Ownerly

Should I Itemize Or Take The Standard Deduction Calculators By

How To Calculate Interest Home Loan Haiper

39 Mortgage Interest Deduction Calculator OonaghNyall

39 Mortgage Interest Deduction Calculator OonaghNyall

Vincere Tax Who Qualifies For The 2023 Mortgage Interest Rate Deduction

Can I Claim The Mortgage Interest Deduction Mortgage Interest Tax

Mortgage Calculator 1 2 Million AlannaAvaMay

How Much Mortgage Interest Deduction Calculator - The mortgage interest deduction allows you to deduct the interest you paid on the first 750 000 of your mortgage debt during the tax year