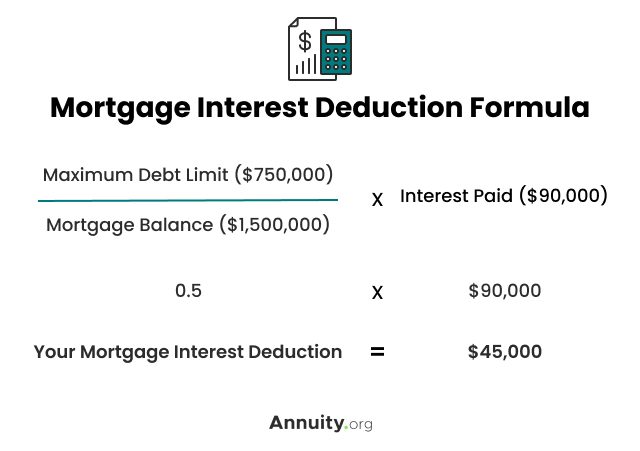

How Much Of My Home Loan Interest Is Tax Deductible The mortgage interest deduction allows you to deduct the interest you paid on the first 750 000 of your mortgage debt during the tax year

The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on home loans up to 750 000 For taxpayers who use married filing separate status Eligible homeowners can claim the mortgage interest tax deduction on Schedule A of their annual tax returns Schedule A accompanies Form 1040 or 1040 SR a simplified 1040 for seniors

How Much Of My Home Loan Interest Is Tax Deductible

How Much Of My Home Loan Interest Is Tax Deductible

https://www.consolidatedcreditcanada.ca/wp-content/uploads/2021/08/Is-interest-on-student-loan-debt-tax-deductible.jpg

Mortgage Interest Tax Relief Calculator DermotHilary

https://www.annuity.org/wp-content/uploads/mortgage-interest-deduction-formula-640x0-c-default.jpg

Is Student Loan Interest Tax Deductible RapidTax

http://blog.priortax.com/wp-content/uploads/2014/02/Student-Loan-Interest-Deduction-20131.jpg

Is mortgage interest tax deductible What is the mortgage interest deduction How much mortgage interest can be deducted What qualifies as mortgage interest What types of home loans Yes mortgage interest is tax deductible in 2024 up to a loan limit of 750 000 for individuals filing as single married filing jointly or head of household

The mortgage interest deduction allows homeowners to deduct the interest they pay on their home mortgage from their taxable income This can help homeowners lower tax bills by The Tax Cuts and Jobs Act TCJA of 2017 changed individual income tax by lowering the mortgage deduction limit and limiting how much you can deduct from your taxable income Before the TCJA the mortgage interest deduction limit was on loans up to 1 million Now the loan limit is 750 000

Download How Much Of My Home Loan Interest Is Tax Deductible

More picture related to How Much Of My Home Loan Interest Is Tax Deductible

Student Loan Interest Deduction 2013 PriorTax Blog

https://www.blog.priortax.com/wp-content/uploads/2014/02/Student-Loan-Interest-Deduction-2013-1024x576.jpg

Tax Benefits On Home Loan Know More At Taxhelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2021/11/Tax-Saving-Benefits-of-having-property-through-Home-Loan-1.png

Compare Home Mortgage Interest Rates By Decade INFOGRAPHIC Denver

https://www.thepeak.com/wp-content/uploads/2021/02/20210219-MEM.png

The home mortgage interest deduction is a rule that allows homeowners to deduct the interest paid on a home loan in a given tax year lowering their total taxable income Taxpayers can deduct the interest paid on mortgages secured by their primary residence and a second home if applicable for loans used to buy build or substantially improve For example if you owe 600 000 on your main home and 800 000 on a vacation home you cannot deduct the interest you pay that relates to the excess 400 000 In some cases the excess interest may qualify for a deduction if it relates to a home equity loan

If you re questioning How much mortgage interest can I deduct on my taxes you can fully deduct the home mortgage interest you pay on acquisition debt as long as the debt isn t more than the following amounts within a tax year 750 000 of mortgage debt if the loan was finalized after Dec 15 2017 If you closed on your mortgage after December 15 2017 you can deduct interest paid on loan amounts up to 750 000 for single and joint tax filers and 375 000 for those married filing

How Much Of My Income Should Go Towards A Mortgage Payment

https://assurancemortgage.com/wp-content/uploads/2022/04/iStock-473687780.jpg.webp

Claiming The Student Loan Interest Deduction

https://www.taxdefensenetwork.com/wp-content/uploads/2022/04/student-loan-interest-deduction-worksheet-1-2048x1352.jpg

https://www.nerdwallet.com/article/taxes/mortgage...

The mortgage interest deduction allows you to deduct the interest you paid on the first 750 000 of your mortgage debt during the tax year

https://www.bankrate.com/mortgages/mortgage-tax...

The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on home loans up to 750 000 For taxpayers who use married filing separate status

Is Personal Loan Interest Tax Deductible

How Much Of My Income Should Go Towards A Mortgage Payment

Investment Expenses What s Tax Deductible Retirement Plan Services

Is HELOC Interest Tax Deductible Can You Write Off The Interest You

Is Home Equity Loan Interest Tax Deductible For Rental Property

Is Your Business Loan Tax Deductible

Is Your Business Loan Tax Deductible

Debt Recovery Interest Calculator HussanRomano

Is Your Interest Tax Deductible ShineWing TY TEOH

Tax Deductions The New Rules INFOGRAPHIC Alloy Silverstein

How Much Of My Home Loan Interest Is Tax Deductible - The mortgage interest deduction allows homeowners to deduct the interest they pay on their home mortgage from their taxable income This can help homeowners lower tax bills by