How Much Property Tax In Houston Texas The Tax Office accepts both full and partial payment of property taxes Property taxes may be paid online in person by mail or by phone There is a 30 administrative charge for incorrect information entered or payments dishonored by your financial institution or rejected by your service provider Paying Prior Year Taxes

The median property tax in Harris County Texas is 3 040 per year for a home worth the median value of 131 700 Harris County collects on average 2 31 of a property s assessed fair market value as property tax The median property tax also known as real estate tax in Harris County is 3 040 00 per year based on a median home value of 131 700 00 and a median effective property tax rate of 2 31 of property value

How Much Property Tax In Houston Texas

How Much Property Tax In Houston Texas

https://newventureescrow.com/wp-content/uploads/2021/06/HOW-TO-CALCULATE-PROPERTY-TAX-EVERYTHING-YOU-NEED-TO-KNOW-1024x538-1.png

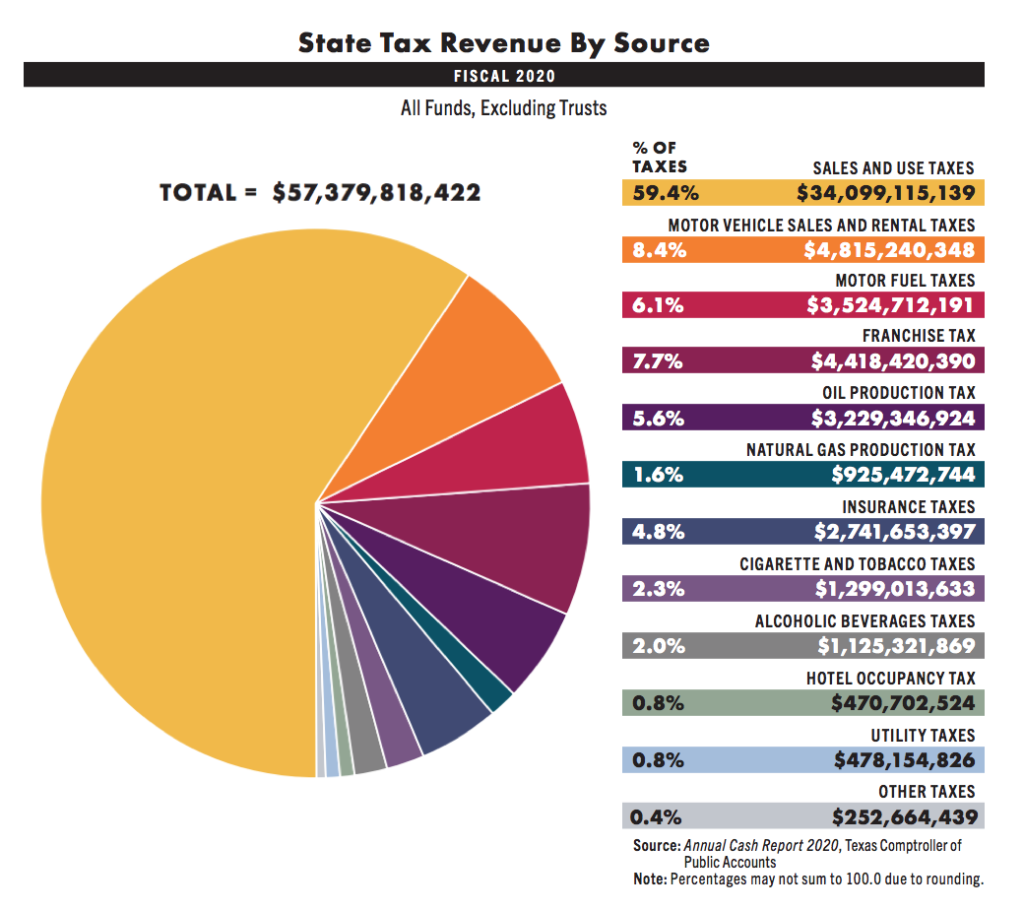

What Are The Tax Rates In Texas Texapedia

https://www.honestaustin.com/wp-content/uploads/2020/02/Texas-Tax-Revenue-by-Source-2020-1024x911.png

Where Do My Greater Houston Metro Area Property Taxes Go

https://www.hometaxsolutions.com/wp-content/uploads/2020/04/Houston-property-tax-loans-.png

In the Greater Houston area property tax rates vary by county and play a crucial role in the local real estate market As a resident learning about the different property tax rates is important for accurate budgeting and financial planning Your local property tax database will be updated regularly during August and September as local elected officials propose and adopt the property tax rates that will determine how much you pay in property taxes

The Harris County Tax Assessor Collector s Office Property Tax Division maintains approximately 1 5 million tax accounts and collects property taxes for 70 taxing entities including Harris County How Property Tax is Determined What s the Houston property tax rate How do you pay property taxes in Houston How can you lower your property tax bill We have answers to these and more

Download How Much Property Tax In Houston Texas

More picture related to How Much Property Tax In Houston Texas

How To Reduce Property Tax In Houston There Is No Wonder Flickr

https://live.staticflickr.com/65535/50707496311_835a9e2b0e_z.jpg

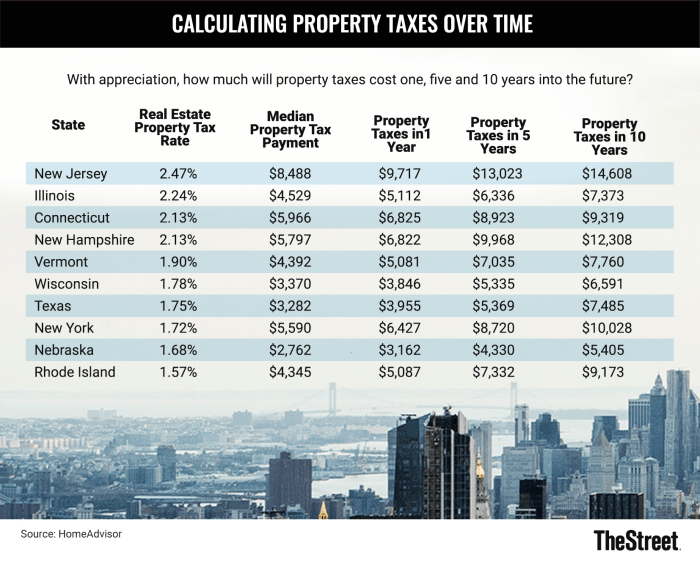

These States Have The Highest Property Tax Rates TheStreet

https://www.thestreet.com/.image/c_limit%2Ccs_srgb%2Cq_auto:good%2Cw_700/MTkzMTM5Mzg2MDIyNDM4MjQ0/table-property-taxes-101922.png

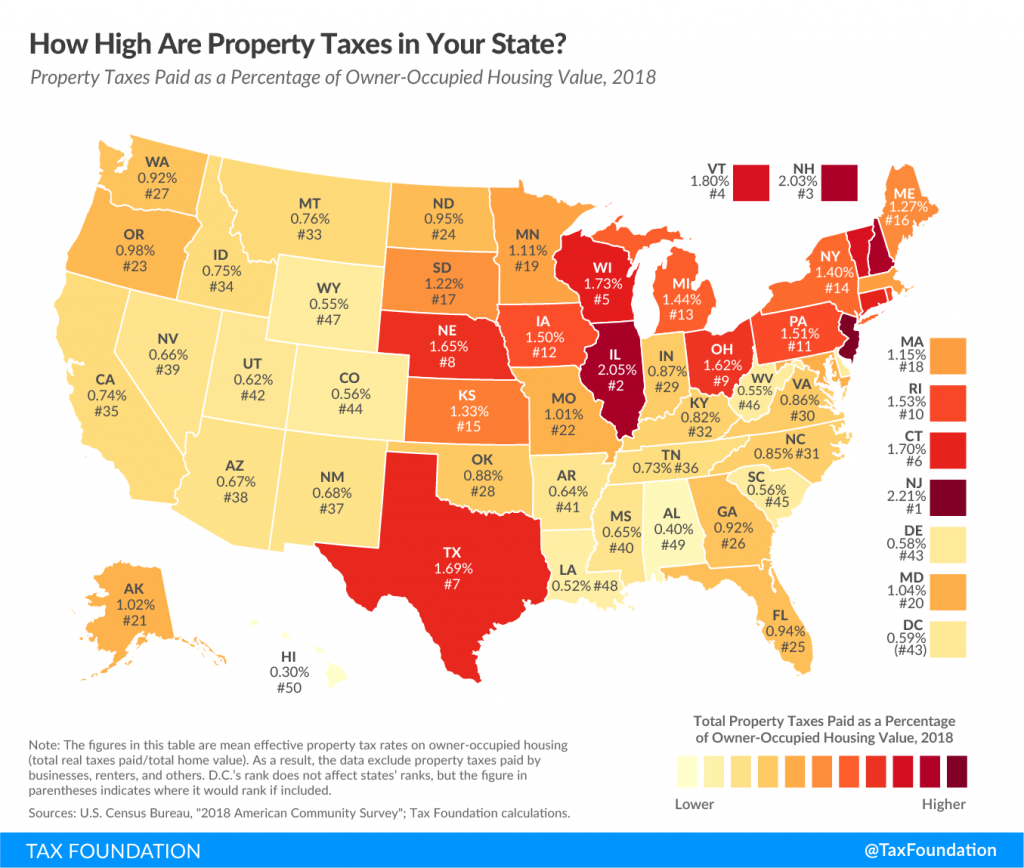

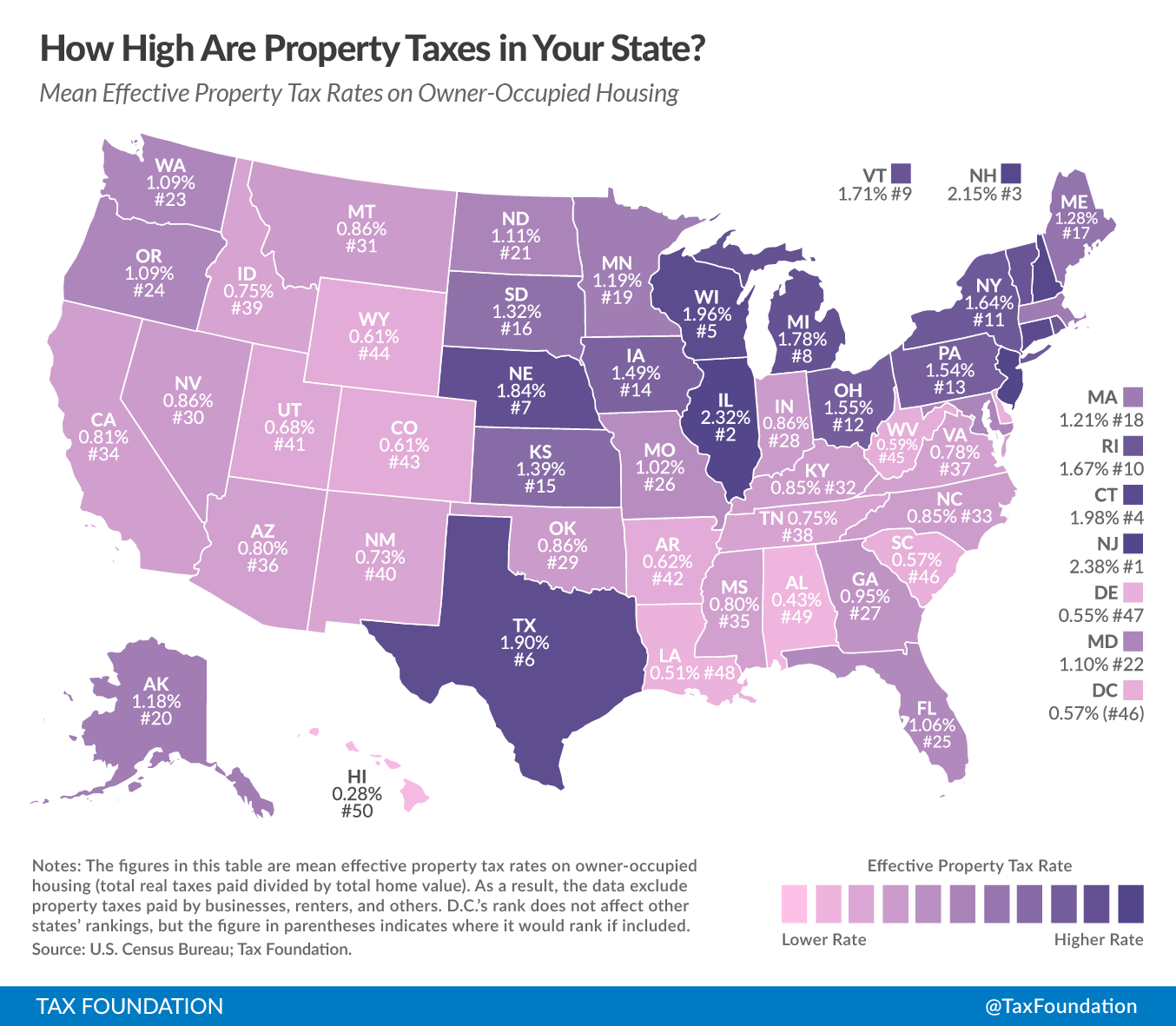

How High Are Property Taxes In Your State American Property Owners

https://propertyownersalliance.org/wp-content/uploads/2020/10/property-taxes-by-state-2020-FV-01-1024x868-1.png

Understanding how property taxes are calculated is crucial for home buyers In Houston property tax rates are expressed in terms of tax rates per 100 of assessed value The formula for calculating property taxes in Houston is as follows Property Tax Assessed Value x Tax Rate 100 Here s what you should know about each component 1 Use the Houston Property Tax Calculator to quickly and accurately estimate your property tax liability Learn how this tool works and discover its benefits

Our Harris County Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in Texas and across the entire United States Calculate how much you ll pay in property taxes on your home given your location and assessed home value Compare your rate to the Texas and U S average Menu burger

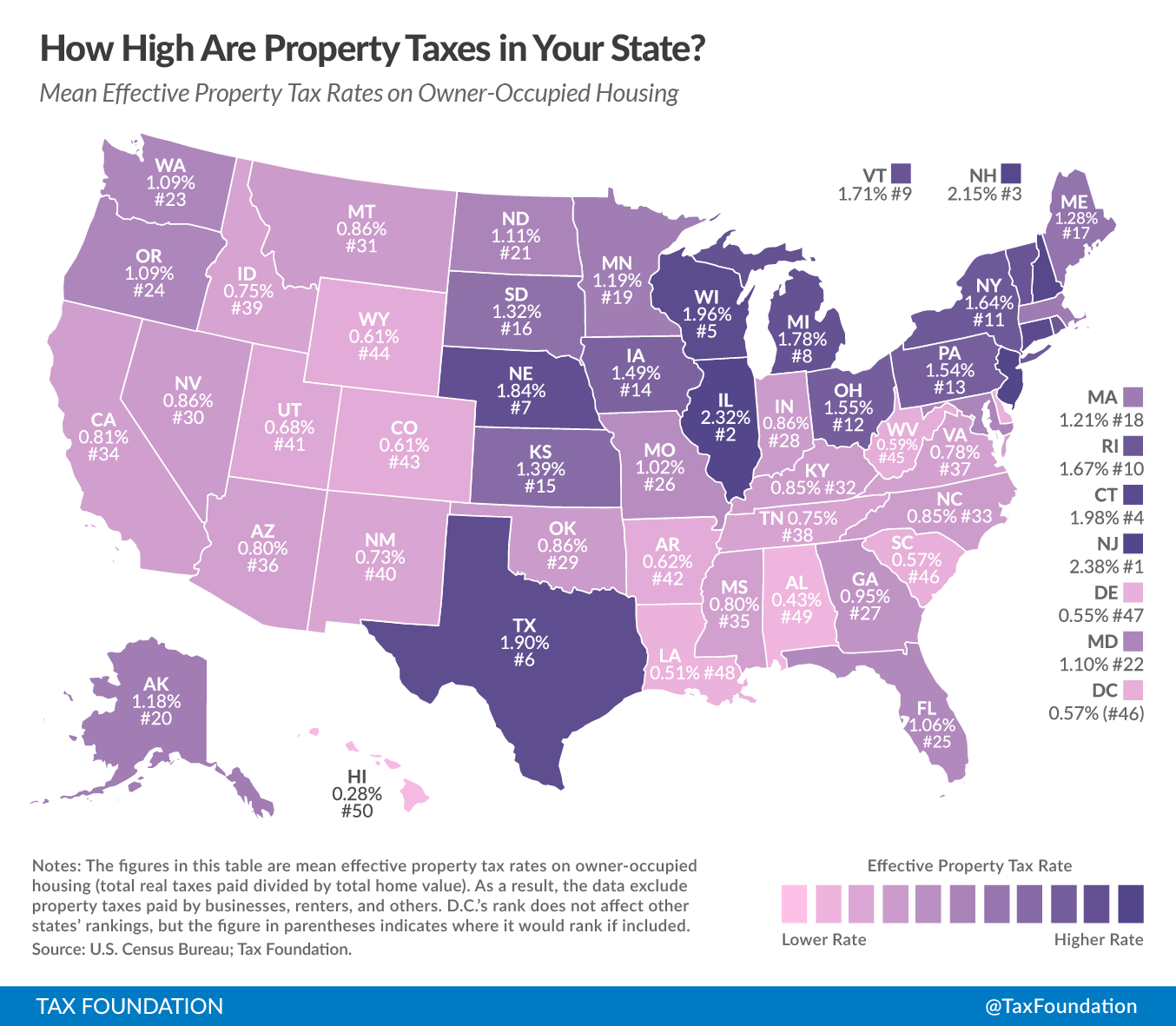

How High Are Property Taxes In Your State Tax Foundation

https://files.taxfoundation.org/20170110101027/PropertyTax.png

Houston Tax Attorney Charged Billionaire Rats On Houston Attorney

https://i1.wp.com/www.houston-criminalattorney.com/wp-content/uploads/2020/06/content-img-min.jpg

https://www.hctax.net › Property › PropertyTax

The Tax Office accepts both full and partial payment of property taxes Property taxes may be paid online in person by mail or by phone There is a 30 administrative charge for incorrect information entered or payments dishonored by your financial institution or rejected by your service provider Paying Prior Year Taxes

https://www.tax-rates.org › texas › harris_county_property_tax

The median property tax in Harris County Texas is 3 040 per year for a home worth the median value of 131 700 Harris County collects on average 2 31 of a property s assessed fair market value as property tax

Houston Property Tax Guide How To Lower Houston Property Tax

How High Are Property Taxes In Your State Tax Foundation

Texas Has The Fifth Highest Property Taxes In The Nation But Do We Get

Houston Property Tax Rates

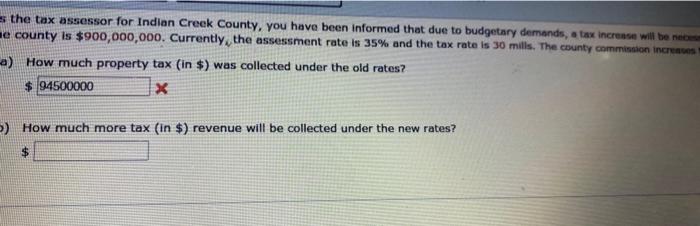

How Much Property Tax Will I Pay In Kansas Kansas Bank Blog

Tax Assessor Houston County

Tax Assessor Houston County

Solved As The Tax Assessor For Indian Creek County You Have Chegg

Houston area Property Tax Rates By County

Why Are Texas Property Taxes So High Home Tax Solutions

How Much Property Tax In Houston Texas - The tax break usually equates to a small discount on your property taxes When shopping for your next home in the Houston area you shouldn t pass on a house because the tax rate is 3 7 versus 3 2