How Much Savings Bank Interest Is Tax Free The IRS treats interest earned on money in a savings account as taxable income Your financial institution issues a 1099 form if you earned at least 10 in

Depending on how much money you make you can expect to pay between 10 to 37 on savings account interest in taxes These are the federal income tax rates and tax brackets for 2023 If you earn less than 18 570 in income and savings interest combined you can get all interest paid tax free Read MoneySavingExpert s guide to understand your allowance

How Much Savings Bank Interest Is Tax Free

How Much Savings Bank Interest Is Tax Free

https://cdn.gobankingrates.com/wp-content/uploads/2015/11/why_banks_wont_increase_savings_account_rates.jpg

TD Bank Savings Account Interest Rates November 2023

https://www.usatoday.com/money/blueprint/images/uploads/2023/08/08055948/bank-savings-account-interest-rates-e1691488818154.jpg

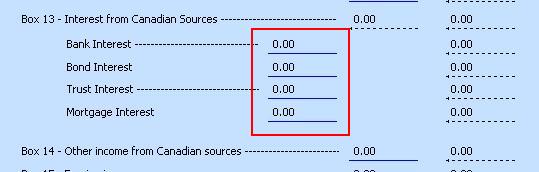

MyTaxExpress And T2Express FAQs How To Enter Bank Interest From Slip

http://www.mytaxexpress.com/images/mtxp_bankinterest.jpg

If your savings account has 10 000 and earns 0 2 interest you are only taxed on the 20 interest the bank pays you You can t avoid federal income tax on high yield savings account interest if you earn more than 10 but it is possible to avoid tax on other types of savings accounts

The personal savings allowance PSA lets most people earn up to 1 000 in interest without paying tax on it At current savings rates basic rate taxpayers need just over 19 000 in the top easy access savings The personal savings allowance allows you to earn up to 1 000 of interest tax free on top of the starting rate for savers The allowance varies depending on your income tax bracket Basic rate taxpayers 1 000

Download How Much Savings Bank Interest Is Tax Free

More picture related to How Much Savings Bank Interest Is Tax Free

How Much Savings Should You Have Saved By Now Hotcash

https://hotcash.com/wp-content/uploads/2022/08/2696234.jpg

How Much Savings Should I Have Accumulated By Age Personal Wealth

https://i2.wp.com/financialsamurai.com/wp-content/uploads/2022/11/financial-freedom-saving-rate-retire-early-chart.png?fit=1456,9999

Tax On Savings Interest KNNLLP

http://www.knnllp.co.uk/wp-content/uploads/2018/11/2017-03-23-391386.jpg

How much interest on savings is tax free All of the interest you make from a savings account is taxable from as little as one cent up to a million dollars You are required to report any amount you make Are there tax free savings accounts You can earn tax free interest with any savings account so long as you don t exceed your annual personal savings allowance

Most people are eligible for a certain amount of tax free savings before they have to pay tax on the interest they earn Basic rate taxpayers can earn up to 1 000 in savings interest before paying tax on it whilst Savings in a 529 or Coverdell education savings account are withdrawn tax free if they re used for qualified education expenses The 529 was expanded to cover K 12 education

How Much Savings Interest Is Tax free UK Lucky Transport Company

https://luckytransport.com.au/wp-content/uploads/2023/06/how-much-savings-interest-is-tax-free-uk.jpg

3 Ways To Calculate Bank Interest On Savings WikiHow

http://www.wikihow.com/images/5/5a/Calculate-Bank-Interest-on-Savings-Step-14-Version-2.jpg

https://www.usnews.com/banking/articles/do-you-pay...

The IRS treats interest earned on money in a savings account as taxable income Your financial institution issues a 1099 form if you earned at least 10 in

https://www.forbes.com/advisor/bankin…

Depending on how much money you make you can expect to pay between 10 to 37 on savings account interest in taxes These are the federal income tax rates and tax brackets for 2023

Maximum Interest On Financial Savings Accounts

How Much Savings Interest Is Tax free UK Lucky Transport Company

10 Banks Which Pay High Interest Rates On Savings Accounts YouTube

Bank Liable To Pay Income Tax On Interest On Sticky Loans NPAs On

Income Tax On Savings Bank Interest Saving Account FD RD Fincash

Tax On Bank Interest TaxAssist Accountants

Tax On Bank Interest TaxAssist Accountants

Savings Bank Account Becomes Tax Efficient Budget 2012

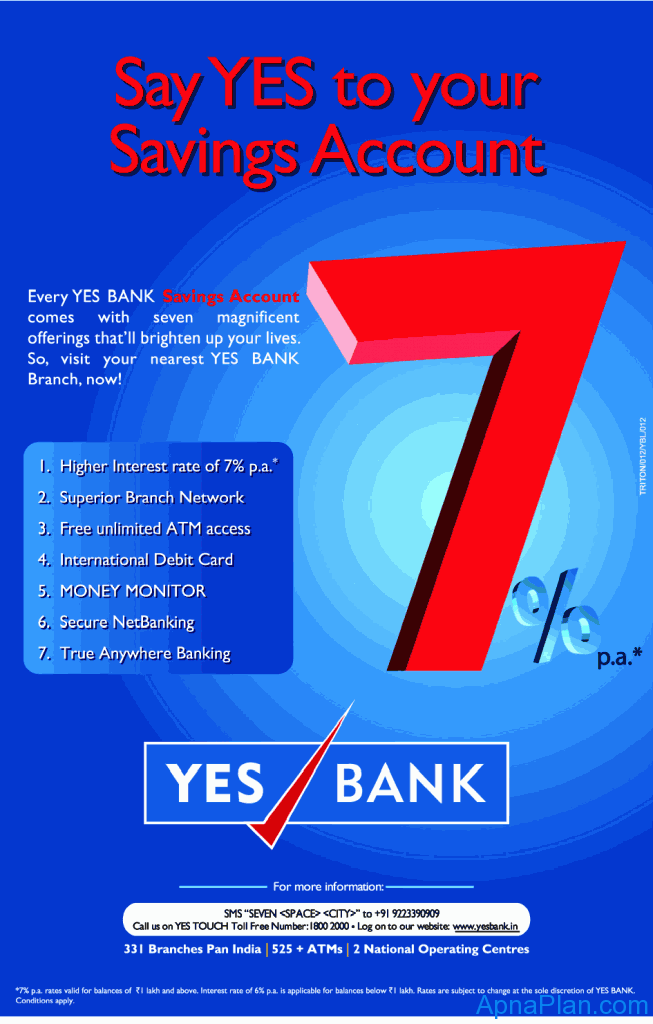

Savings Account Interest Rates Of Small Finance Banks Yadnya

How To Save Tax On The Interest Income With Your Savings Bank Account

How Much Savings Bank Interest Is Tax Free - If your savings account has 10 000 and earns 0 2 interest you are only taxed on the 20 interest the bank pays you