How Much Should An Employer Pay For Mileage If your employees are using their personal vehicles for work you should reimburse them accordingly Here s how to quickly calculate mileage reimbursement

As of July 2022 the standard mileage rate is 0 625 per mile For trips in 2022 that occurred from January to July the rate was 0 585 per mile Many employers If your employees use their personal vehicles for work related tasks you may be required to reimburse them for their mileage Let s look at six frequently asked questions about mileage reimbursement

How Much Should An Employer Pay For Mileage

How Much Should An Employer Pay For Mileage

https://www.peoplekeep.com/hubfs/How-much-do-employers-pay-for-health-insurance_fb.jpg#keepProtocol

What Nurse Practitioner Expenses Should An Employer Pay For YouTube

https://i.ytimg.com/vi/RAeYzgYodxM/maxresdefault.jpg

How Much Super Does An Employer Pay In 2023

https://takeatumble.com.au/wp-content/uploads/2022/08/How-Much-Super-Does-an-Employer-Pay-1.png

Employers are not required to reimburse employees for mileage unless the mileage expenses cause their wages to drop below the federal minimum wage However many businesses reimburse employees for Employee mileage reimbursement is when employers pay employees for expenses associated with driving their personal vehicles on behalf of the business These payments aim to cover the cost of fuel

Employee mileage reimbursement pays employees for work related travel made in their personal vehicles Calculate pay with a free calculator The IRS has set the 2022 rate as 58 5 cents per mile driven for business use up 2 5 cents from the rate for 2021 While many businesses use the IRS rate as a base it is not a legal requirement

Download How Much Should An Employer Pay For Mileage

More picture related to How Much Should An Employer Pay For Mileage

Indiana Paycheck Taxes

https://www.patriotsoftware.com/wp-content/uploads/2021/08/how_much_employer_pays_payroll_tax-01.png

Does My Employer Have To Pay Me Mileage 45p Per Mile

https://smallbusinessowneradvice.co.uk/wp-content/uploads/2022/06/Does-My-Employer-Have-to-Pay-Me-Mileage-768x515.jpg

How Does An Employer Pay For Health Insurance PlanCover Small

https://www.plancover.com/insurance/wp-content/uploads/2021/12/How-Does-An-Employer-Pay-For-Health-Insurance.png

For employers mileage reimbursements given to employees are usually deductible as business expenses This allows employers to reduce taxable income and ensure fair In 2024 it means that companies can issue tax free reimbursements at the maximum rate of 67 cents per mile Any vehicle reimbursement higher than that is considered taxable

Tax rates per business mile Your employee travels 12 000 business miles in their car the approved amount for the year would be 5 000 10 000 x 45p plus 2 000 x 25p It does Under the FAVR approach to reimbursing employees an employer is required to pay a combination of mileage reimbursement payments and a monthly

How Much Does An Employer Pay In Payroll Taxes Tax Rate

https://www.patriotsoftware.com/wp-content/uploads/2021/08/employers-pay-in-taxes-3.jpg

How Much Should An Online Article Cost Infographic Copywriting

https://i.pinimg.com/originals/15/8b/fd/158bfd0f45569dc22f7b5d718cffb85d.jpg

https://www.fool.com/the-ascent/small-business/...

If your employees are using their personal vehicles for work you should reimburse them accordingly Here s how to quickly calculate mileage reimbursement

https://www.businessnewsdaily.com/15891-mileage...

As of July 2022 the standard mileage rate is 0 625 per mile For trips in 2022 that occurred from January to July the rate was 0 585 per mile Many employers

How To Build Your Employer Brand Pamunications

How Much Does An Employer Pay In Payroll Taxes Tax Rate

Pin On Proposal Templates

Average Cost Of Employer Sponsored Health Insurance 2022 What

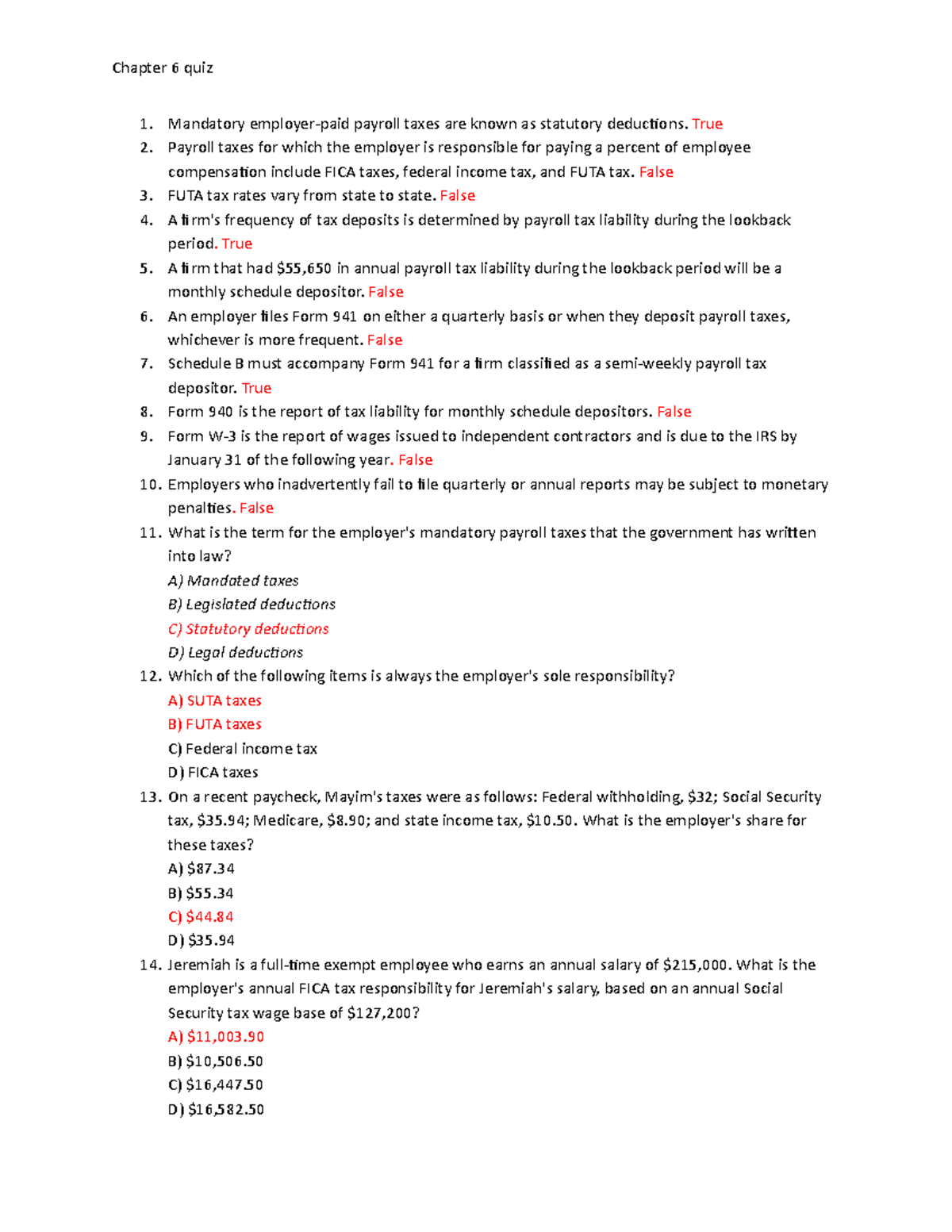

Chapter 6 Quiz Employer Payroll Taxes And Labor Planning Mandatory

Printable Mileage Reimbursement Form Printable Forms Free Online

Printable Mileage Reimbursement Form Printable Forms Free Online

How Much Does Lululemon Pay Their Employees Insurance

What Are Payroll Taxes An Employer s Guide Wrapbook

12 Employer Branding Metrics For HR To Track AIHR

How Much Should An Employer Pay For Mileage - Employee mileage reimbursement pays employees for work related travel made in their personal vehicles Calculate pay with a free calculator