How Much State Tax Do You Pay On 401k Withdrawal The minimum age when you can withdraw money from a 401 k is 59 5 Withdrawing money before that age typically results in a 10 penalty on the amount you withdraw This is in addition to the federal and state income taxes you pay on this withdrawal There are exceptions to this early withdrawal penalty though

When you make a withdrawal from a 401 k account the amount of tax you pay depends on your tax bracket in the year when the withdrawal is made For example if you fall in the 12 tax bracket rate you can expect to pay up to 22 in taxes including a 10 early withdrawal penalty if you are below 59 Hassle free tax filing is 50 for all tax situations no hidden costs or fees Maximum refund guaranteed Get every dollar you deserve when you file with this tax product powered by

How Much State Tax Do You Pay On 401k Withdrawal

How Much State Tax Do You Pay On 401k Withdrawal

https://www.personalfinanceclub.com/wp-content/uploads/2022/03/2022-03-26-Tax-advantage-401k.png

Owe State Taxes But Not Federal Ola Willett

https://www.irs.gov/pub/image/870Refunds.jpg

How Much Tax Do You Pay On Overtime In South Africa Greater Good SA

https://gg.myggsa.co.za/1661758842261.png

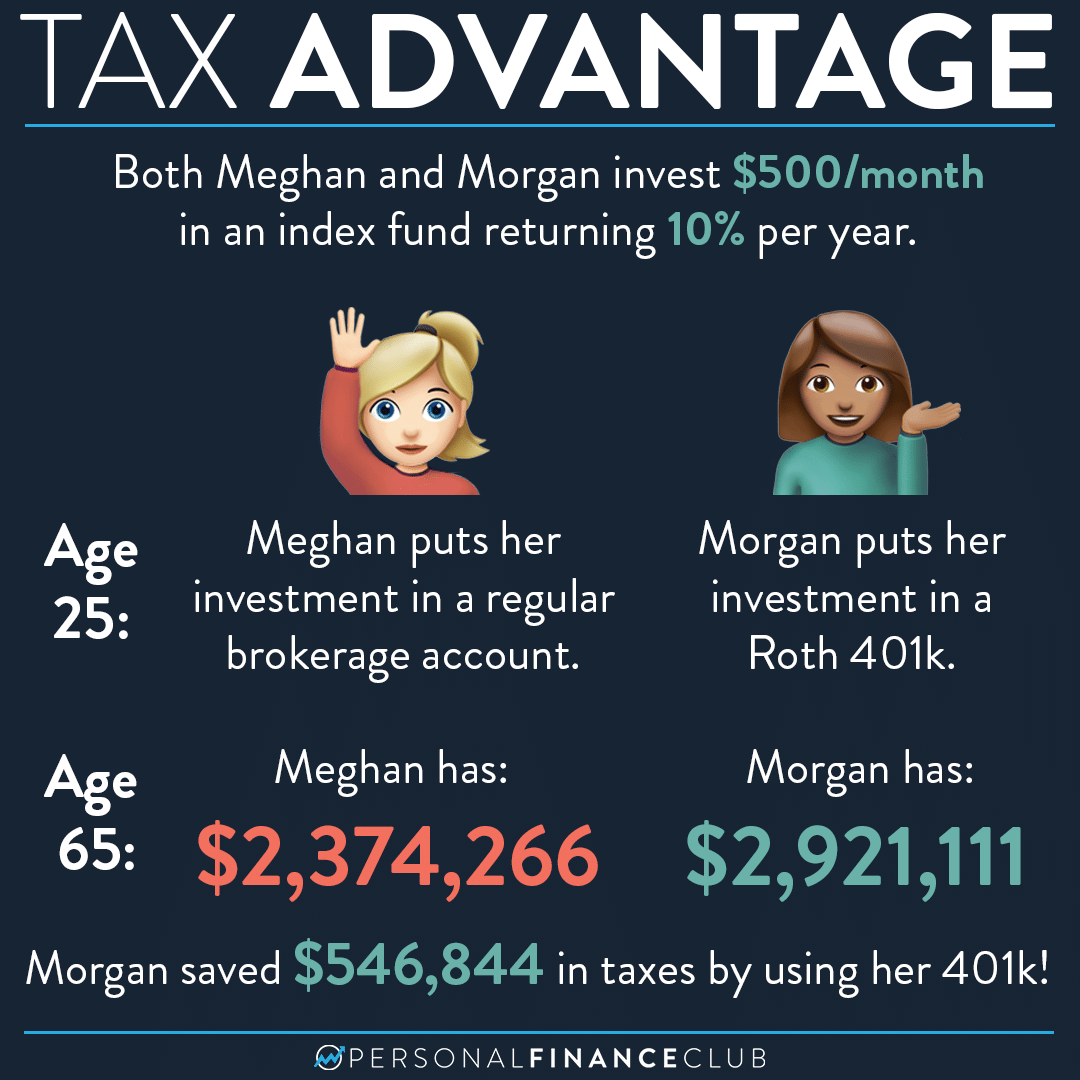

Traditional 401 k withdrawals are taxed at an individual s current income tax rate In general Roth 401 k withdrawals are not taxable provided the account was opened at least five years Generally speaking the only penalty assessed on early withdrawals from a traditional 401 k retirement plan is the 10 additional tax levied by the Internal Revenue Service IRS though there

There is no way to take a distribution from a 401 k without owing income taxes at the rate you re paying the year you take the distribution Except in special cases you can t take a distribution from your plan at all until you ve reached age 59 5 State Income Tax Withholding Information for Individual Retirement Accounts This general information is provided to help you understand state income tax withholding requirements for Individual Retirement Account distributions

Download How Much State Tax Do You Pay On 401k Withdrawal

More picture related to How Much State Tax Do You Pay On 401k Withdrawal

Pin On Retirement

https://i.pinimg.com/originals/3b/14/9e/3b149e888331b86e9624120f6414770a.png

How Much Tax Do I Pay On 401k Withdrawal YouTube

https://i.ytimg.com/vi/SPer0vMC4Ao/maxresdefault.jpg

How Much Tax Will I Pay On My 401k Retirement News Daily

https://www.retirementnewsdailypress.com/wp-content/uploads/2021/12/How-much-tax-will-I-pay-on-my-401k.jpeg

Estimate your marginal state income tax rate your tax bracket based on your current earnings including the amount of the cash withdrawal from your retirement plan 55 or older If you left your employer in or after the year in which you turned 55 you are not subject to the 10 additional tax Rate of Return If you withdraw money from your 401 k before you re 59 the IRS usually assesses a 10 tax as an early distribution penalty That could mean giving the government 1 000 or 10 of a

Key Takeaways One of the easiest ways to lower the amount of taxes you have to pay on 401 k withdrawals is to convert to a Roth IRA or Roth 401 k Withdrawals from Roth accounts are not taxed The short answer is that they get taxed at the time of withdrawal Many 401 k plans require a 20 mandatory withholding on 401 k distributions If you withdraw from your 401 k before the age of 59 5 also known as an early distribution you will have to pay a 10 penalty on the early withdrawal

How To Pay Less Taxes On 401k Withdrawal shorts YouTube

https://i.ytimg.com/vi/GwJGSKeaADA/maxresdefault.jpg

How Much Tax Will I Pay On 41000 Update New Countrymusicstop

https://i.ytimg.com/vi/ieA-bmoFk3k/maxresdefault.jpg

https://smartasset.com/retirement/401k-tax

The minimum age when you can withdraw money from a 401 k is 59 5 Withdrawing money before that age typically results in a 10 penalty on the amount you withdraw This is in addition to the federal and state income taxes you pay on this withdrawal There are exceptions to this early withdrawal penalty though

https://meetbeagle.com/resources/post/how-much-tax...

When you make a withdrawal from a 401 k account the amount of tax you pay depends on your tax bracket in the year when the withdrawal is made For example if you fall in the 12 tax bracket rate you can expect to pay up to 22 in taxes including a 10 early withdrawal penalty if you are below 59

When Can You File Taxes In 2023 Kiplinger

How To Pay Less Taxes On 401k Withdrawal shorts YouTube

Solved 5 How Much State Tax Is Withheld From 36 200 If The Tax Rate

How Much Tax Do You Pay On A 457 B Withdrawal Vanessa Benedict

How Much Tax Do You Pay On Dividends Business Advice

Sales Tax By State Here s How Much You re Really Paying Sales Tax

Sales Tax By State Here s How Much You re Really Paying Sales Tax

6 Things To Know About Roth 401 k Withdrawals The Motley Fool

When Can I Get My 401k Without Paying Taxes Retirement News Daily

How To Avoid Penalty On 401k Withdrawal TM

How Much State Tax Do You Pay On 401k Withdrawal - State Income Tax Withholding Information for Individual Retirement Accounts This general information is provided to help you understand state income tax withholding requirements for Individual Retirement Account distributions