How Much Tax Credit For Health Insurance The premium tax credit also known as PTC is a refundable credit that helps eligible individuals and families cover the premiums for their health insurance purchased

The premium tax credit is a refundable credit that helps lower the cost of your monthly health insurance premium You must meet the requirements and file a specific form with your tax return to qualify for it A tax credit for health insurance lowers the amount you pay on your federal income taxes based on your health insurance costs You must purchase your

How Much Tax Credit For Health Insurance

How Much Tax Credit For Health Insurance

https://www.letsbegamechangers.com/wp-content/uploads/2020/01/load-image-2020-01-24T030638.645-1536x1024.jpeg

Tution Tax Credit For Students NCS CA

https://www.ncscorp.ca/wp-content/uploads/2022/03/Untitled-design-12-e1648708763193.png

Don t Forget The Healthy Homes Tax Credit Safe Home

https://safeathomewindsor.ca/wp/wp-content/uploads/2015/04/HHTCgentleman1.jpg

A tax credit you can use to lower your monthly insurance payment called your premium when you enroll in a plan through the Health Insurance Marketplace Your tax credit is A tax credit you can use to lower your monthly insurance payment called your premium when you enroll in a plan through the Health Insurance Marketplace Your tax credit

To be eligible for the premium tax credit your household income must be at least 100 percent and for years other than 2021 and 2022 no more than 400 percent of the Premium tax credits are available to people who buy Marketplace coverage and whose income is at least as high as the federal poverty level For an individual that means an

Download How Much Tax Credit For Health Insurance

More picture related to How Much Tax Credit For Health Insurance

How Do I Get A Tax Credit For Health Insurance Tax Walls

https://s.marketwatch.com/public/resources/images/MW-HV858_groovy_NS_20191124102401.png

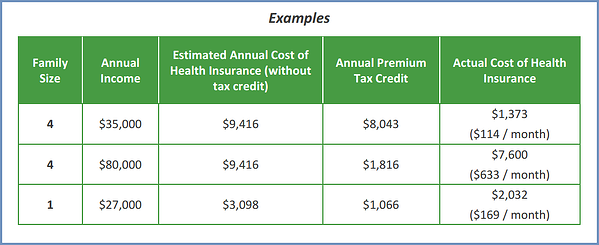

FAQs Health Insurance Premium Tax Credits

https://www.peoplekeep.com/hs-fs/hub/149308/file-2078678351-png/examples.png?width=601&name=examples.png

EU built Electric Vehicle Tax Credit Approval Will Face Internal And

https://s1.cdn.autoevolution.com/images/news/approval-of-tax-credit-for-union-built-evs-will-face-internal-and-foreign-disputes-173073_1.jpg

The premium tax credit is a refundable tax credit that helps cover the cost of health insurance premiums It s available to taxpayers who have purchased a health insurance plan from the Here s how to avoid any tax time surprises with the health insurance premium credit The premium tax credit helps lower income Americans pay for health insurance but if you re not careful

If your estimated income falls between 100 and 400 of the federal poverty level for a household of your size and you purchase health insurance through the national Health Insurance Marketplace See if you re eligible for the Affordable Care Act s premium tax credits premium subsidies how subsidies are calculated and why they are more robust than

Historic Tax Benefit For Union Workers Championed By UDW Signed Into

https://udwa.org/wp-content/uploads/TaxCredit.png

Pandemic Tax Credit Gets A Boost IndustryWeek

https://img.industryweek.com/files/base/ebm/industryweek/image/2021/03/tax_credit.60501bbf38caa.png?auto=format,compress&fit=crop&h=556&w=1000&q=45

https://www.irs.gov/affordable-care-act/...

The premium tax credit also known as PTC is a refundable credit that helps eligible individuals and families cover the premiums for their health insurance purchased

https://www.thebalancemoney.com/do-i-qua…

The premium tax credit is a refundable credit that helps lower the cost of your monthly health insurance premium You must meet the requirements and file a specific form with your tax return to qualify for it

Another Way To Save New Tax Credit For Plan Participants

Historic Tax Benefit For Union Workers Championed By UDW Signed Into

Premium Tax Credit Calculator For Health Insurance Tax Refund YouTube

IL Health Insurance Reform Questions Answers IL Health Insurance

Tax Credit Bill For Rural Physicians Passes House Committee

A Comprehensive Guide On The Affordable Care Act ACA

A Comprehensive Guide On The Affordable Care Act ACA

How To Get Insurance Companies To Pay Your Claims Kiplinger

Health Insurance Plan In India Health Insurance By TULSI WEALTH

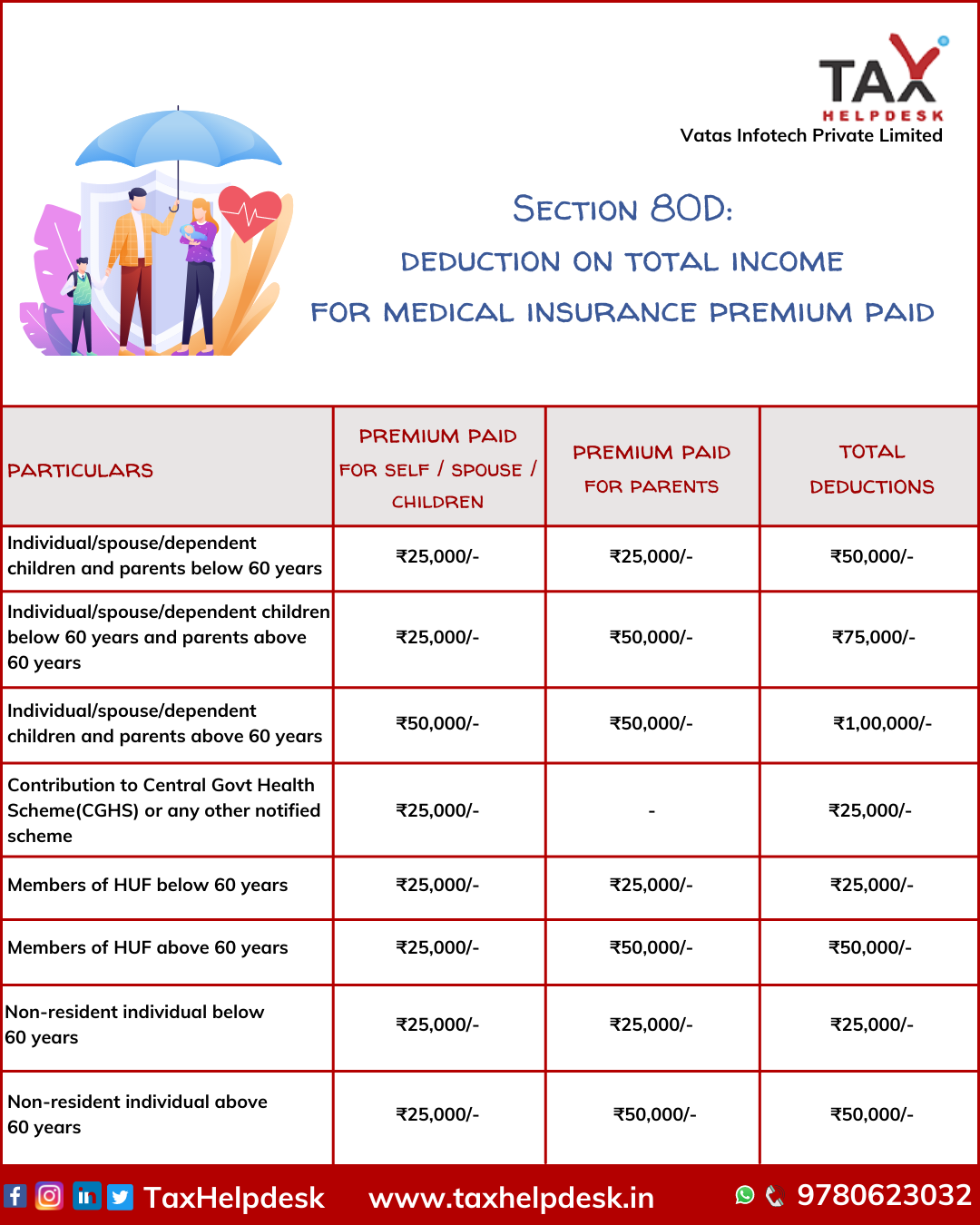

Know Tax Benefits On Health Insurance And Medical Expenditure TaxHelpdesk

How Much Tax Credit For Health Insurance - A tax credit you can use to lower your monthly insurance payment called your premium when you enroll in a plan through the Health Insurance Marketplace Your tax credit is