How Much Tax Deduction Can You Get For Donating A Car If the charity sells your car sells for 500 or less you can deduct 500 or your car s fair market value whichever is less For example if your car is valued at 650 but sells for 350 you can deduct 500 Charities are typically required to report the sales price of your car to you on Form 1098 C Step 2 Determine the car s fair market value

If the charity sells the car for 500 or less you can deduct 500 or your car s fair value whichever is lower If your car is valued at 600 and the charity sells it for 400 you can deduct 500 Once your vehicle is sold the selling price determines the amount of your donation If your vehicle sells for more than 500 you may deduct the full selling price If your vehicle sells for 500 or less you can deduct the fair market value of your vehicle up to 500

How Much Tax Deduction Can You Get For Donating A Car

How Much Tax Deduction Can You Get For Donating A Car

https://wealthfit-staging.cdn.prismic.io/wealthfit-staging/412c54c56299372c10093120ad811293a9e703bd_02-maximize-charitable-deductions.jpg

How Do Tax Deductions For Donating A Car Actually Work

https://i0.wp.com/automarketwatch.com/wp-content/uploads/2021/02/How-Do-Tax-Deductions-for-Donating-A-Car-Actually-Work.png?w=1000&ssl=1

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

Federal Income Tax Deduction Chart My XXX Hot Girl

https://www.investopedia.com/thmb/JjB8KxvTErLB2ZgozO3H_wkKoNA=/2338x2338/smart/filters:no_upscale()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg

In most cases donated vehicles that sell for less than 500 are able to be claimed at the fair market value up to 500 without filling out any extra paperwork If your donated car sells for more than 500 you will be able to claim the exact amount for which your vehicle sold with a 1098 c form or a 8283 form Generally limits the deduction to the actual sales prices of the vehicle when sold by the donee charity and requires donors to get a timely acknowledgment from the charity to claim the deduction Donors may claim a deduction of the vehicle s fair market value under the following circumstances

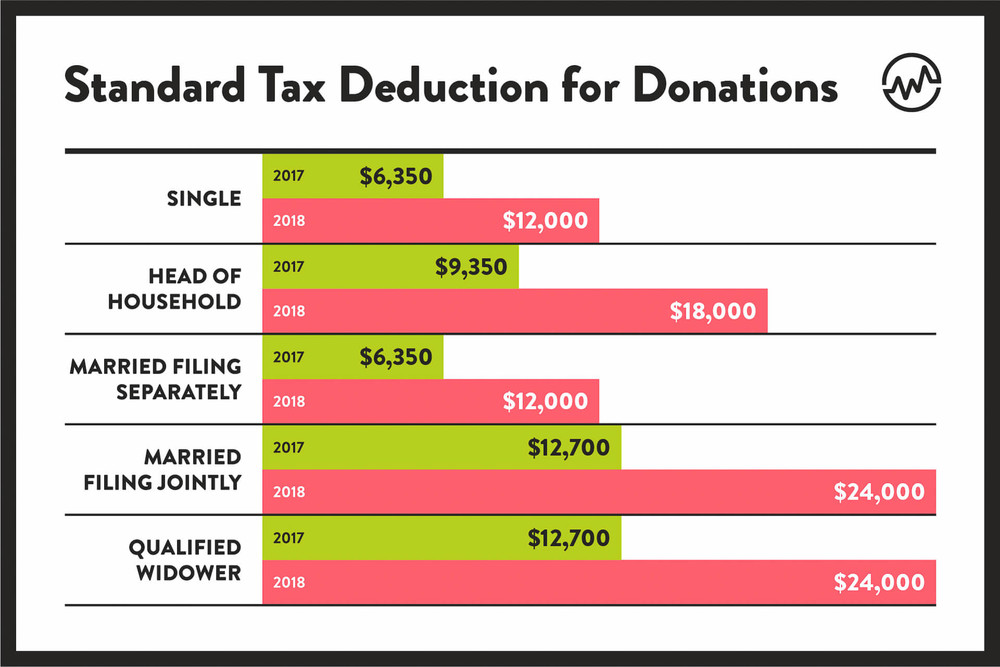

In general you can deduct up to 60 of your adjusted gross income via charitable donations but you may be limited to 20 30 or 50 depending on the type of contribution and the October 25 2022 Donating your car or vehicle to charity can be a great way to get a 2022 federal tax deduction and Rawhide Youth Services makes it free and easy Start by simply filling out this online form or calling 1 800 RAWHIDE Our friendly donor service representatives and vehicle technicians are here to ensure you get more for your

Download How Much Tax Deduction Can You Get For Donating A Car

More picture related to How Much Tax Deduction Can You Get For Donating A Car

Receive A Tax Deduction For Donating A Car

https://toprateddealers.com/wp-content/uploads/2020/11/Receive-a-Tax-Deduction-for-Donating-a-Car.jpg

How To Calculate Taxes With Standard Deduction Dollar Keg

https://dollarkeg.com/wp-content/uploads/2023/01/how-to-calculate-taxes-with-standard-deduction.png

Solved Please Note That This Is Based On Philippine Tax System Please

https://www.coursehero.com/qa/attachment/19096880/

For a tax deduction of more than 5000 the IRS will need IRS Form 8283 signed by an official of the charity Form 1098 C or a legal substitute like the receipt from the charity You can claim your tax deduction in the year that you donated your car Be sure to include all the needed documentation as shown above with your federal income tax The deductible amount is 20 if the contribution is 40 and the FMV of the T shirt is 20 Donated Goods and FMV Charitable contribution deductions are allowed for donations of goods such as

[desc-10] [desc-11]

Standard Deduction U s 16 ia For Ay 2021 22 Standard Deduction 2021

https://standard-deduction.com/wp-content/uploads/2020/10/latest-income-tax-slab-rates-fy-2020-21-ay-2021-22-3-768x432.jpg

Tax Deductions For Businesses BUCHBINDER TUNICK CO

http://www.buchbinder.com/wp-content/uploads/2016/02/deduction.jpg

https://turbotax.intuit.com/tax-tips/charitable-contributions/how...

If the charity sells your car sells for 500 or less you can deduct 500 or your car s fair market value whichever is less For example if your car is valued at 650 but sells for 350 you can deduct 500 Charities are typically required to report the sales price of your car to you on Form 1098 C Step 2 Determine the car s fair market value

https://www.aarp.org/money/taxes/info-2022/car-donation-deduction...

If the charity sells the car for 500 or less you can deduct 500 or your car s fair value whichever is lower If your car is valued at 600 and the charity sells it for 400 you can deduct 500

Tax Deductions You Can Deduct What Napkin Finance

Standard Deduction U s 16 ia For Ay 2021 22 Standard Deduction 2021

ITR Filing How Much Deduction Can You Get For Stamp Duty And Property

Teacher Tax Deductions Teacher Organization Teaching

2022 Car Donation Tax Deduction Donate Junk Car Tax Deduction

If I Donate My Car To Charity How Much Tax Deduction Can I Take YouTube

If I Donate My Car To Charity How Much Tax Deduction Can I Take YouTube

6 Signs Donation Is Right For You Newgate School

Tax Deductions Write Offs To Save You Money Financial Gym

Donate Car Tax Deduction Donate Car For Tax Credit YouTube

How Much Tax Deduction Can You Get For Donating A Car - [desc-12]