How Much Tax Deduction For Mileage To take the deduction taxpayers must meet use requirements and may have to itemize on their returns if claiming

17 rowsThe standard mileage rates for 2023 are Self employed and business 65 5 For the 2022 tax year taxes filed in 2023 the IRS standard mileage rates are 65 5 cents per mile for business 14 cents per mile for charity 22 cents per mile for medical purposes or moving purposes for qualified active duty members of the armed forces

How Much Tax Deduction For Mileage

How Much Tax Deduction For Mileage

https://tlwastoria.com/wp-content/uploads/2022/03/mileage-for-tax-deduction-1024x597.jpg

13 Proven Mileage Tax Deduction Tips The Handy Tax Guy

https://www.handytaxguy.com/wp-content/uploads/2015/12/road-908176_640.jpg

Business Mileage Deduction 101 How To Calculate For Taxes

https://www.patriotsoftware.com/wp-content/uploads/2019/04/mileage_reimbursement-03.png

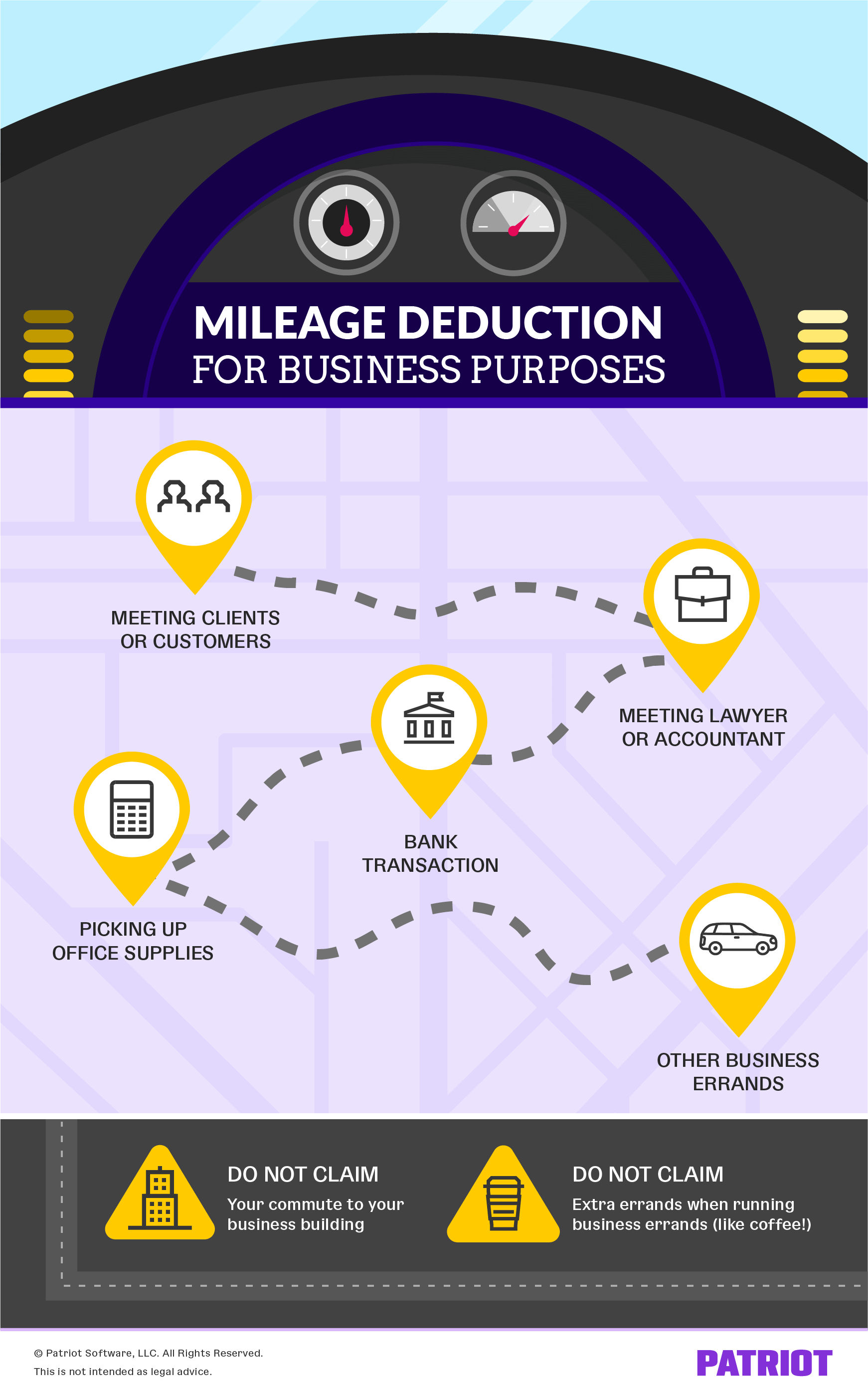

The IRS mileage rate determines how much money you can write off when using your vehicle for business purposes The IRS increases the mileage reimbursement rate each year to keep pace with inflation For many businesses mileage is the largest deductible Key Takeaways The IRS annually publishes three standard rates used to calculate deductions for mileage driven for business medical moving and charitable purposes The rates for

How To Calculate Mileage Deductions on Your Tax Return You have options for deducting business miles on your tax return Learn the IRS mileage rate and tips to keep track of your How much you can deduct for mileage depends on the type of driving you did Business mileage is most common but you can also deduct mileage accrued for charitable purposes or for

Download How Much Tax Deduction For Mileage

More picture related to How Much Tax Deduction For Mileage

Mileage Tax Deductions Can Increase Your Refund Check Amount Doing

https://i.pinimg.com/736x/05/59/ed/0559ed6f7090fc54e464cbf7bf541538.jpg

Tax Tips Mileage Deduction GOFAR

https://www.gofar.co/wp-content/uploads/2018/12/featured-image-tax-tip-mileage-deduction.jpg

Tax Deduction Tracker Printable Tax Deduction Log Business Etsy

https://i.etsystatic.com/34842725/r/il/d7a013/4058712943/il_fullxfull.4058712943_8i57.jpg

Rates are reviewed regularly The rate is 88 cents per kilometre for 2024 25 85 cents per kilometre for 2023 24 78 cents per kilometre for 2022 23 72 cents per kilometre for 2020 21 and 2021 22 68 cents per kilometre for 2018 19 and The standard mileage rate is the fixed amount an employer can deduct as a business cost per mile The IRS has set this rate in 2022 at 62 5 cents for July December and 58 5 cents for January June

For 2023 the federal tax deduction for mileage is 65 5 cents per mile for business use 22 cents per mile for medical purposes and if you re claiming moving expenses as an active The IRS mileage rate generally increases each year to account for changes in fuel prices maintenance costs and other expenses related to driving This rate is used to calculate deductions for business medical or moving expenses when you use your

Tax Deductions You Can Deduct What Napkin Finance

https://napkinfinance.com/wp-content/uploads/2020/12/NapkinFinance-TaxDeductions-Napkin-10-13-20-v05-1.jpg

Easily Calculate Your Business Mileage Tax Deduction YouTube

https://i.ytimg.com/vi/_01WGdnfbNs/maxresdefault.jpg

https://www.nerdwallet.com/article/t…

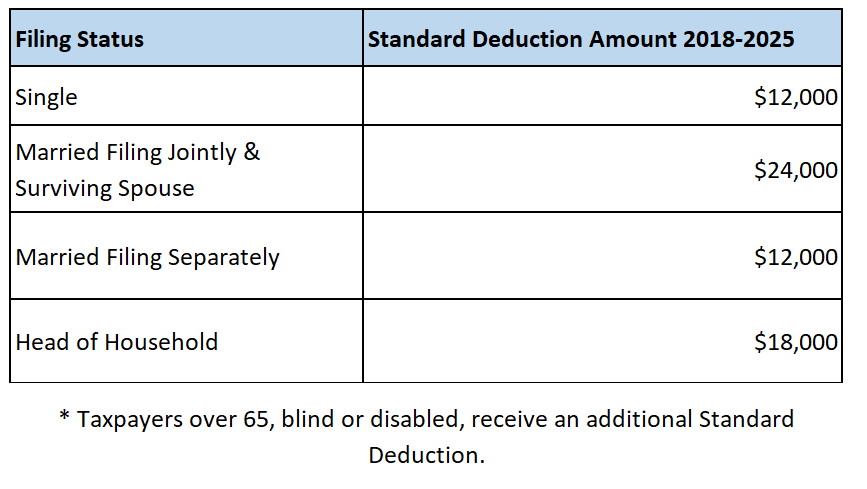

To take the deduction taxpayers must meet use requirements and may have to itemize on their returns if claiming

https://www.irs.gov/tax-professionals/standard-mileage-rates

17 rowsThe standard mileage rates for 2023 are Self employed and business 65 5

Standard Deduction 2020 Self Employed Standard Deduction 2021

Tax Deductions You Can Deduct What Napkin Finance

100 Tax Deduction On Your Donation In Malaysia Jul 26 2021 Johor

Mileage Deduction Rules How To Deduct Mileage

About That Property Tax Deduction For Vets NJMoneyHelp

Standard Deduction 2020 Age 65 Standard Deduction 2021

Standard Deduction 2020 Age 65 Standard Deduction 2021

How Do I Get A Tax Deduction For My Car Repayments Costs One Car Group

Summary Of Income Tax Deduction Under Chapter VI A CA Rajput

Standard Deduction How Much Is It And How Do You Take It India

How Much Tax Deduction For Mileage - The IRS mileage rate determines how much money you can write off when using your vehicle for business purposes The IRS increases the mileage reimbursement rate each year to keep pace with inflation For many businesses mileage is the largest deductible