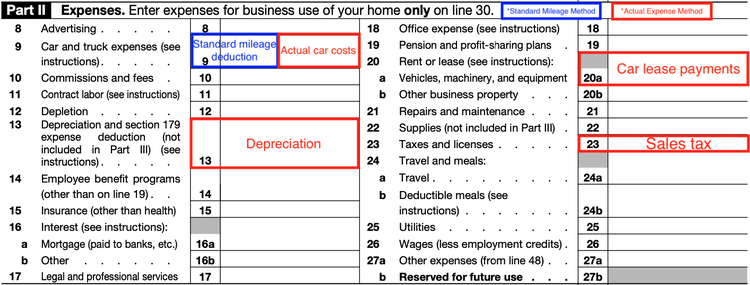

How Much Tax Deduction For New Car You can enter the sales tax you paid for the car you purchased in 2023 by going to Federal Deductions and Credits Estimates and Other Taxes Paid Sales Tax You will be

For example let s say you spent 20 000 on a new car for your business in June 2024 You use the car for business purposes 75 of the For the current tax year the maximum deduction limit is 1 050 000 To qualify for the Section 179 deduction the vehicle must be used for business at least 50 of the time However there

How Much Tax Deduction For New Car

How Much Tax Deduction For New Car

https://i.ytimg.com/vi/X-YJc2vswGk/maxresdefault.jpg

New Tax Deduction For Business Angels Konieczny Wierzbicki Law Firm

https://koniecznywierzbicki.pl/wp-content/uploads/2021/12/LI_ulgi-podatkowe_06.12-scaled.jpg

How Do Tax Deductions For Donating A Car Actually Work

https://i0.wp.com/automarketwatch.com/wp-content/uploads/2021/02/How-Do-Tax-Deductions-for-Donating-A-Car-Actually-Work.png?w=1000&ssl=1

New vehicles or simply new to you used more than 50 of the time can be used for the Section 179 deduction in both 2022 and 2023 during their first year of use Taxes can A SUV or Truck over 6 000 pounds can be a legitimate business expense Learn the basics of automobile tax deduction rules before buying

One of the many deductions that people miss is the sales tax that was paid on a new or used car This is a tricky deduction however You can claim sales tax paid or state income tax withheld but not both on your income tax return 101 rowsSection 179 is a deduction it reduces your taxable income rather than providing a dollar for dollar reduction of your actual tax bill Vehicles that meet the 6 000 lb threshold don t

Download How Much Tax Deduction For New Car

More picture related to How Much Tax Deduction For New Car

13 Car Expenses Worksheet Worksheeto

https://www.worksheeto.com/postpic/2010/10/tax-deduction-worksheet_449321.png

Tax Deduction Letter Sign Templates Jotform

https://files.jotform.com/jotformapps/tax-deduction-letter-ba34c1cde26cab2d0fb9bbcbf35ce8d5_og.png

Where To Donate Vehicles For Tax Deductions Places To Donate Cars

https://i.imgur.com/2mX5gwy.jpg

Taxpayers cannot take a write off for the full price of a new vehicle but the IRS allows businesses and individuals to deduct several vehicle costs Your auto expense deductions depend on how Title and lien fees are never deductible Sales tax is deductible if you itemize your deductions and if you choose to deduct sales tax instead of state income tax Registration fees

This deduction depends on the vehicle and the percentage of time you drive it for your business and there are several exceptions Find out if your work vehicle qualifies for a business vehicle The Which guide to car tax also known as vehicle excise duty VED reveals how much you ll pay the car tax breaks available on electric and alternative fuel cars rules on

Tax Deductions You Can Deduct What Napkin Finance

https://napkinfinance.com/wp-content/uploads/2020/12/NapkinFinance-TaxDeductions-Napkin-10-13-20-v05-1.jpg

Tax Deduction Tracker Printable Tax Deduction Log Business Etsy

https://i.etsystatic.com/34842725/r/il/d7a013/4058712943/il_fullxfull.4058712943_8i57.jpg

https://ttlc.intuit.com › community › tax-credits...

You can enter the sales tax you paid for the car you purchased in 2023 by going to Federal Deductions and Credits Estimates and Other Taxes Paid Sales Tax You will be

https://www.thebalancemoney.com

For example let s say you spent 20 000 on a new car for your business in June 2024 You use the car for business purposes 75 of the

Car Tax Deduction

Tax Deductions You Can Deduct What Napkin Finance

About That Property Tax Deduction For Vets NJMoneyHelp

Tax Rates Absolute Accounting Services

Car Lease Tax Deduction Calculator Have A Large Ejournal Lightbox

Standard Deduction U s 16 ia For Ay 2021 22 Standard Deduction 2021

Standard Deduction U s 16 ia For Ay 2021 22 Standard Deduction 2021

Claiming A Tax Deduction For Motor Vehicle And Fuel Expenses Roberts

Business Tax Deductions Cheat Sheet Excel In PINK Tax Etsy

How To Donate Real estate And Get A Tax Deduction By I Believe World

How Much Tax Deduction For New Car - 101 rowsSection 179 is a deduction it reduces your taxable income rather than providing a dollar for dollar reduction of your actual tax bill Vehicles that meet the 6 000 lb threshold don t