How Much Tax Deduction For Student Loan Interest How Much Student Loan Interest Is Tax Deductible You can deduct either 2 500 in student loan interest or the actual amount of loan interest you paid during the

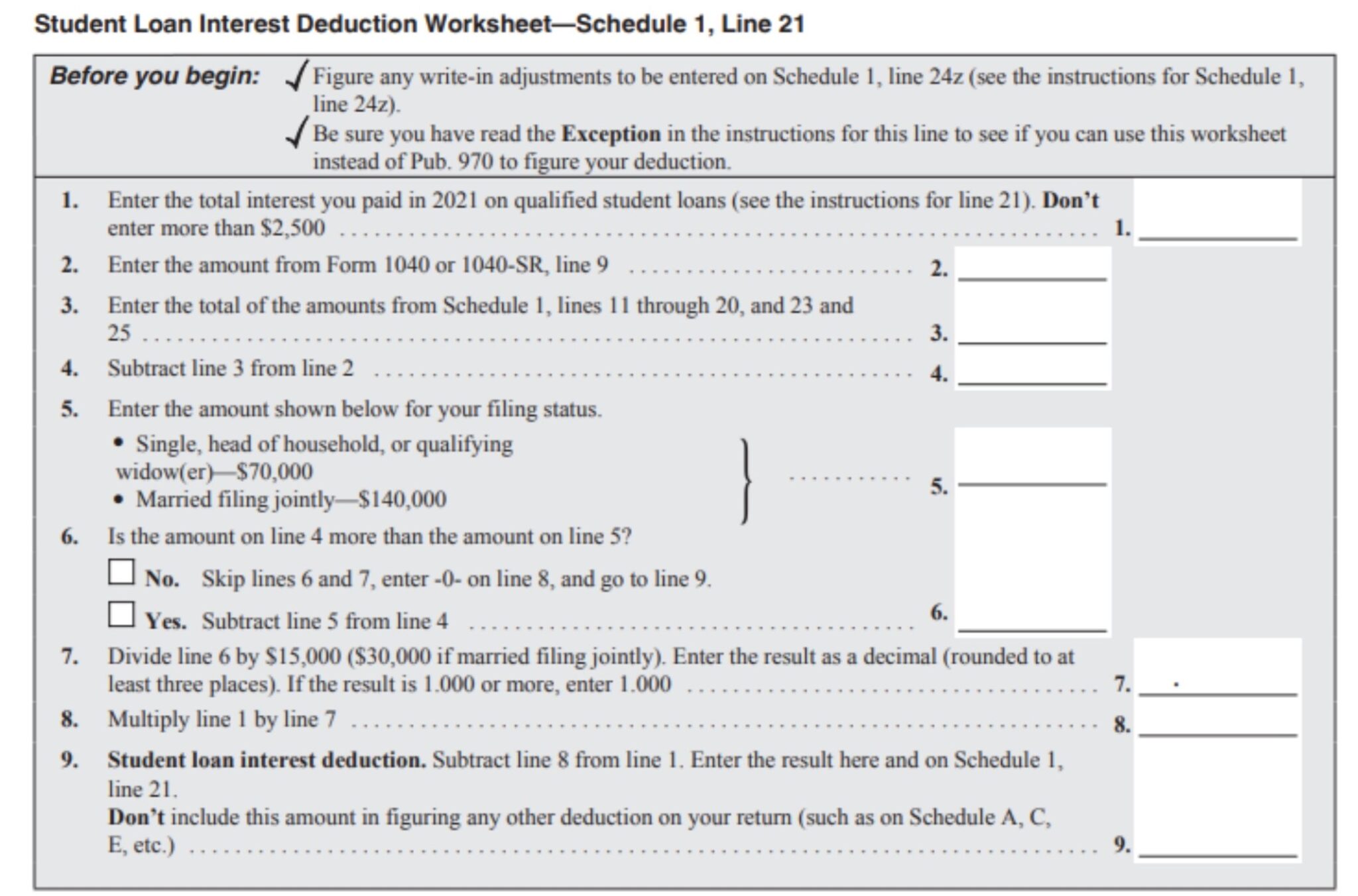

Taxpayers can deduct student loan interest up to 2 500 in 2023 The deduction can be claimed as an adjustment to income Here s what you need to know 900 x 73 000 70 000 15 000 180 Reducing the deduction you can claim by 180 means you can deduct 720 on your

How Much Tax Deduction For Student Loan Interest

How Much Tax Deduction For Student Loan Interest

https://millikenperkins.com/wp-content/uploads/2021/12/12_21_21_1224502855_ITB_560x292.jpg

Isaacson Bill Would Create Tax Deduction For Student Loan Interest

https://i.ytimg.com/vi/Rnxj46P0GNg/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AH-CYAC0AWKAgwIABABGHIgTShCMA8=&rs=AOn4CLA2IHHfd7UtzTRiiJlCsP1Jz59TjA

How To Claim The Student Loan Interest Deduction Tomcaligist

https://d32ijn7u0aqfv4.cloudfront.net/wp/wp-content/uploads/raw/Deducting-Student-Loan-Interest-1.png

It allows you to deduct up to 2 500 in interest paid from your taxable income Payments on federal student loans were paused from March 2020 until October 2023 If Our student loan interest tax deduction calculator is fully updated for the 2023 tax year ready for filing by April 2024 Most borrowers had zero interest for most of 2023 but the

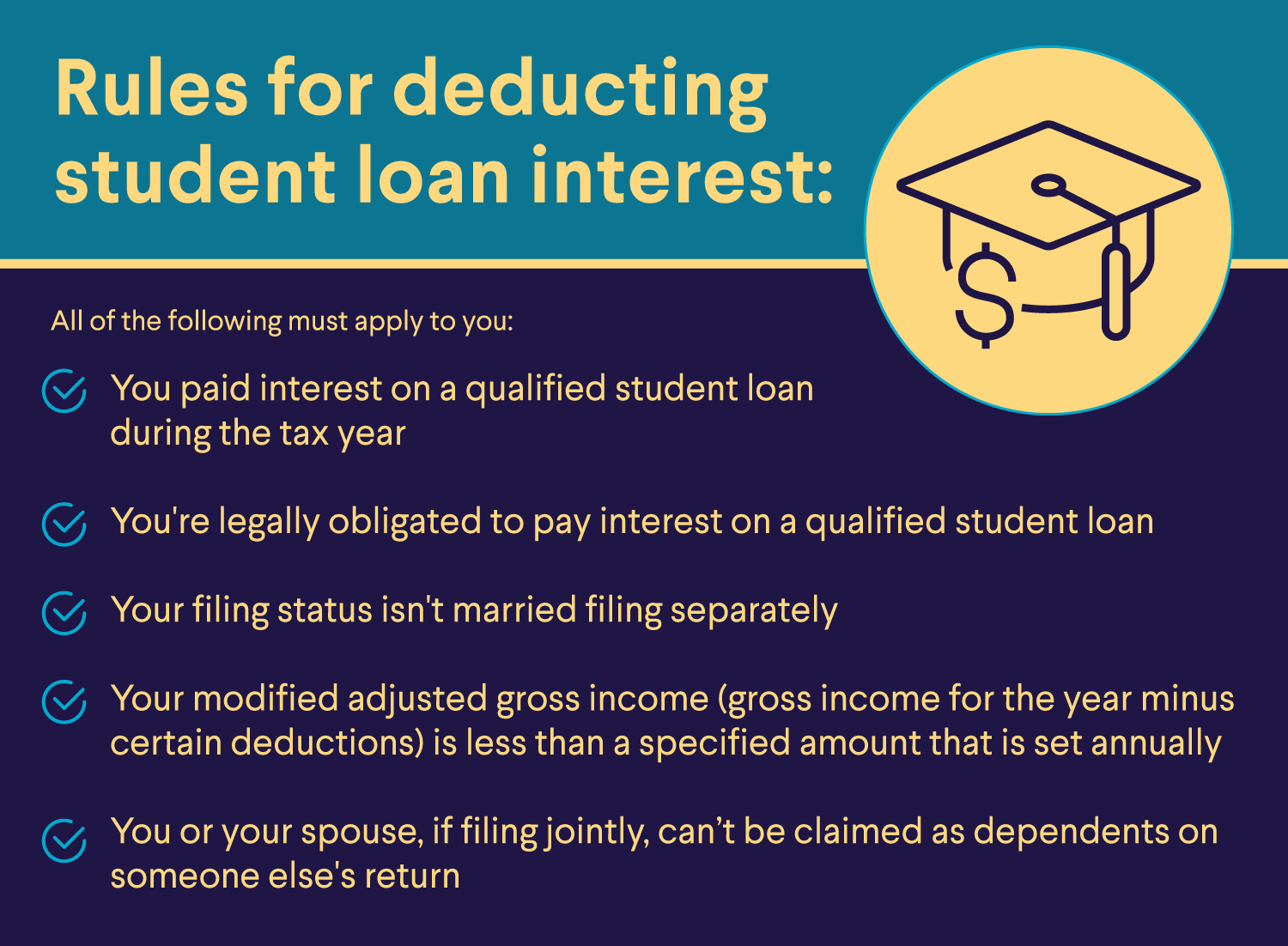

The Student Loan Interest Deduction is a tax deduction that may allow you to reduce your taxable income by the amount you paid in student loan interest up to If you paid 600 or more in interest to a federal loan servicer during the tax year you ll receive at least one 1098 E

Download How Much Tax Deduction For Student Loan Interest

More picture related to How Much Tax Deduction For Student Loan Interest

Is Student Loan Interest Tax Deductible RapidTax

http://blog.priortax.com/wp-content/uploads/2014/02/Student-Loan-Interest-Deduction-20131.jpg

Student Loan Interest Deduction Who s Eligible And How To Apply For A

https://phantom-marca.unidadeditorial.es/b9d9e750c88f4c28889d6c6e55172bb0/resize/1320/f/jpg/assets/multimedia/imagenes/2022/03/23/16480644606624.jpg

Claiming The Student Loan Interest Deduction

https://www.taxdefensenetwork.com/wp-content/uploads/2022/04/student-loan-interest-deduction-worksheet-1-2048x1352.jpg

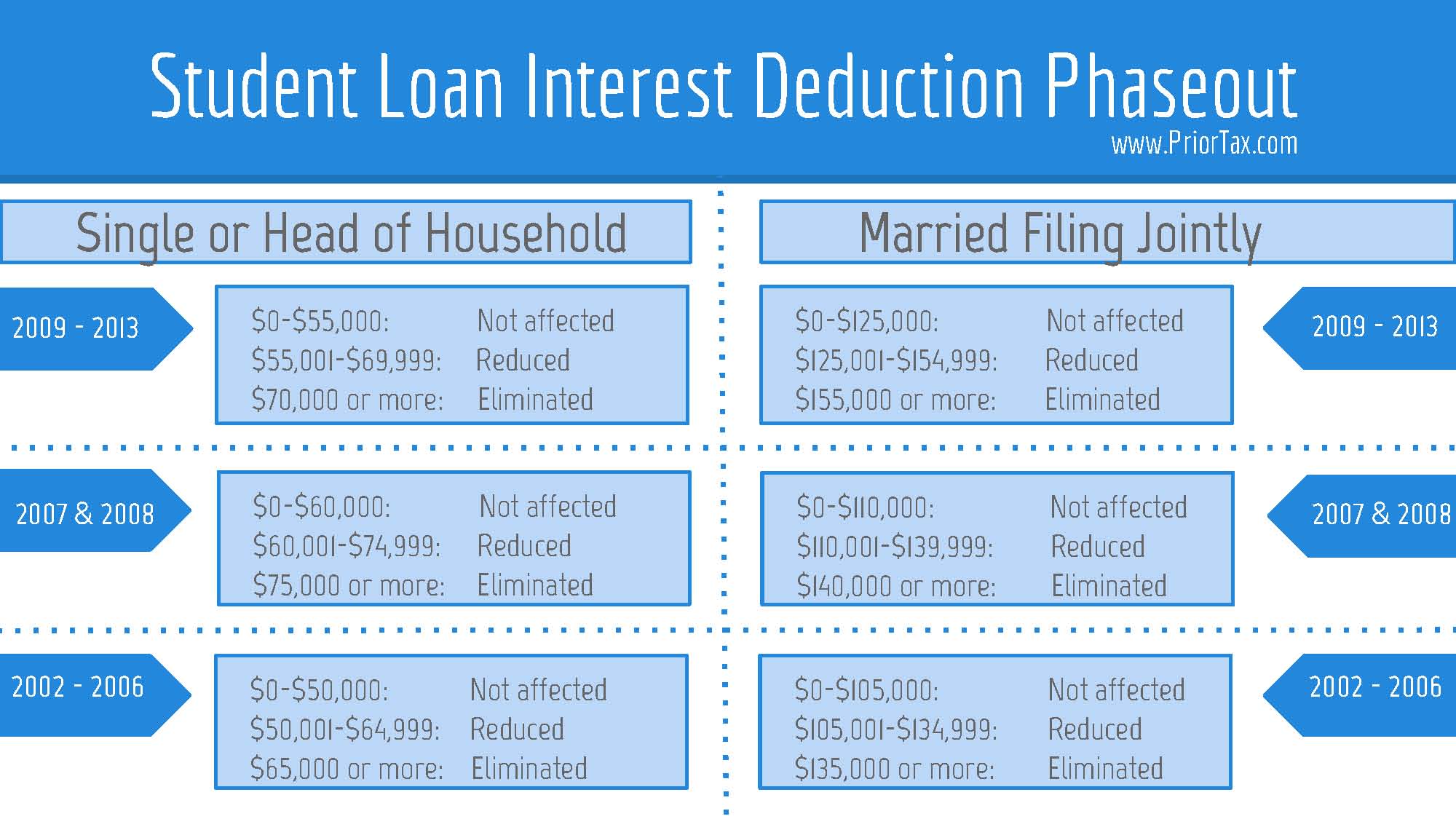

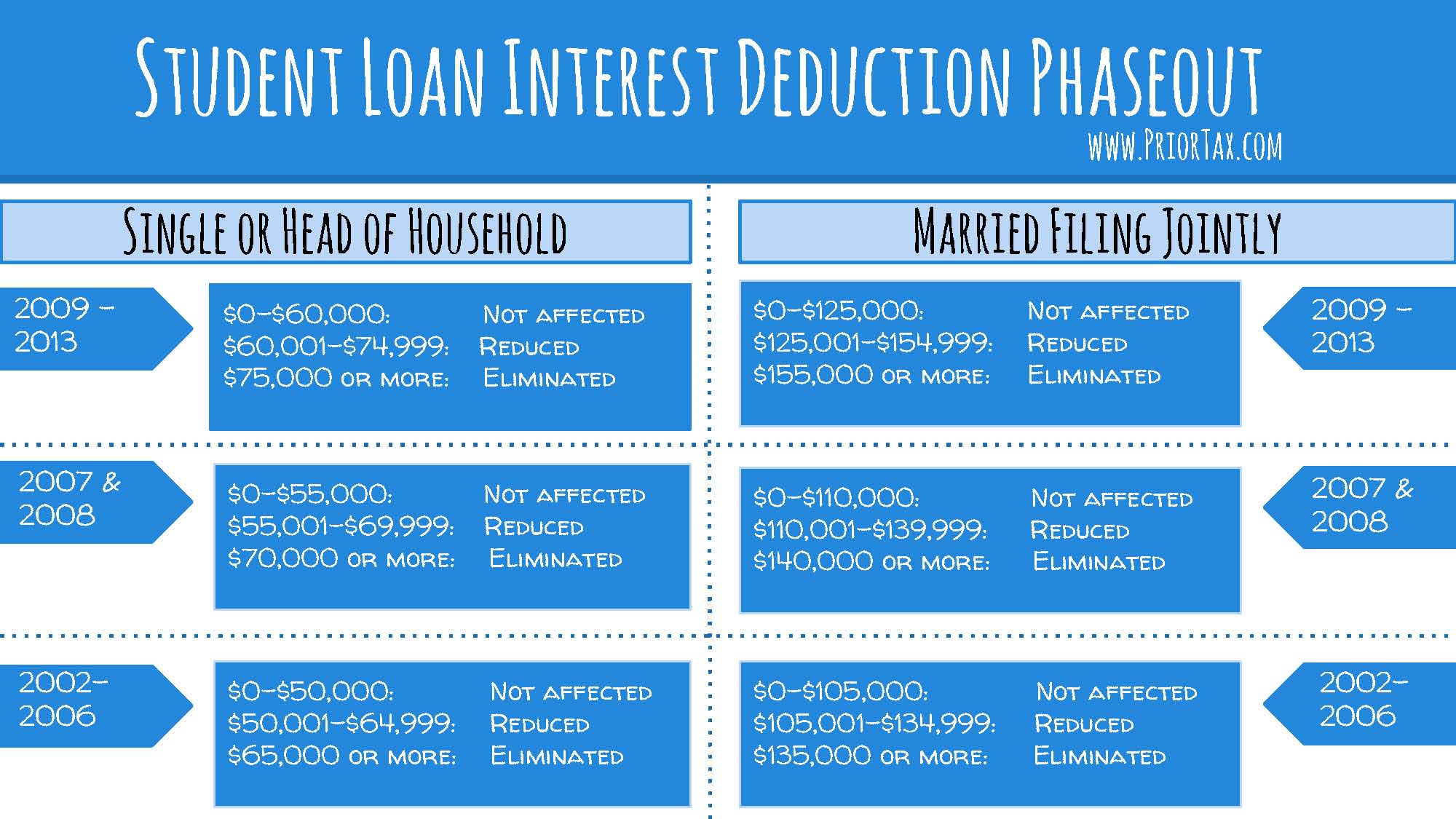

To calculate your interest deduction you take the total amount you paid in student loan interest for the tax year from January 1 to December 31 for most people Student loan interest deduction For 2023 the amount of your student loan interest deduction is gradually reduced phased out if your MAGI is between 75 000 and 90 000 155 000 and 185 000 if you file a

If you paid student loan interest last year you could qualify for a tax deduction worth up to 2 500 You won t receive that money back as a refund since the This tax break can help you write off as much as 2 500 of your taxable income Who qualifies for the student loan interest deduction You need to meet the

What Is The Student Loan Tax Deduction Tax Deductions Student Loans

https://i.pinimg.com/originals/af/ef/2e/afef2e568b2baba1c9194a5699785dc2.jpg

2023 Student Loan Interest Deduction Who Qualifies And How Much Can

https://texasbreaking.com/wp-content/uploads/2023/03/3GWFIVWP2BEZTFQBD5PQ5KVZEY.jpg

https://www. forbes.com /advisor/taxes/student-loan...

How Much Student Loan Interest Is Tax Deductible You can deduct either 2 500 in student loan interest or the actual amount of loan interest you paid during the

https:// smartasset.com /taxes/student-lo…

Taxpayers can deduct student loan interest up to 2 500 in 2023 The deduction can be claimed as an adjustment to income Here s what you need to know

How To Get The Student Loan Interest Deduction NerdWallet

What Is The Student Loan Tax Deduction Tax Deductions Student Loans

Student Loan Interest Deduction 2013 PriorTax Blog

Can I Claim A Deduction For Student Loan Interest Callinterview

Your Guide To The Student Loan Interest Tax Deduction

Understanding The Student Loan Interest Tax Deduction

Understanding The Student Loan Interest Tax Deduction

Student Loan Interest Deduction What You Need To Know

Tax Deduction For Student Computers Proposed

Salary Deduction Letter To Employee For Loan Dollar Keg

How Much Tax Deduction For Student Loan Interest - If you qualify you can deduct up to 2 500 of student loan interest per year When your modified adjusted gross income MAGI reaches the yearly limit for your tax