How Much Tax Do You Pay If You Take Out Rrsp When you withdraw funds from an RRSP your financial institution withholds the tax The rates depend on your residency and the amount you withdraw For

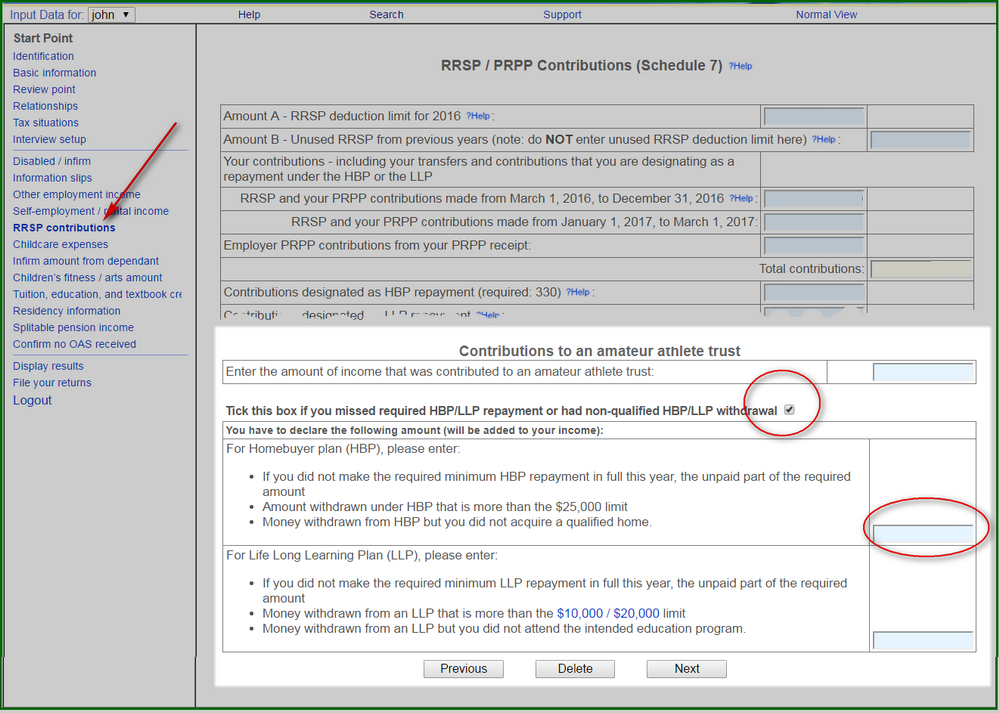

RRSP withholding tax is charged when you withdraw funds from your RRSP before retirement The current rate of RRSP withholding tax is 10 for withdrawals up to If you are enrolled in college university or another post secondary training program or your spouse is you can take out up to 20 000 without paying tax on it You can take out

How Much Tax Do You Pay If You Take Out Rrsp

How Much Tax Do You Pay If You Take Out Rrsp

https://dyernews.com/wp-content/uploads/taxmap-1.png

How Much Tax Do You Pay On A UK Pension In France Complete France

https://www.completefrance.com/wp-content/uploads/2022/04/how-much-tax-do-you-pay-on-uk-.jpg

How Much Tax Do You Pay On A Life Insurance Payout Life Settlement

https://www.lsa-llc.com/wp-content/uploads/2022/06/How-Much-Tax-Do-You-Pay-on-a-Life-Insurance-Payout-1536x1024.jpg

When withdrawing from your RRSP before it matures age 71 the financial institution automatically puts aside a percentage for taxes The rate of tax depends on how much you withdraw 10 is held back How much income tax do you pay on RRSP withdrawals RRSP withholding tax isn t the only payment you might have to make The gross amount that you withdraw

You pay income tax Your withdrawals must be reported on your tax return as income If your current income is higher than your retirement income you ll pay more taxes now Withdrawing from your RRSP at 55 can result in immediate tax costs For example if you withdraw 10 000 you d be looking at a withholding tax of up to 20

Download How Much Tax Do You Pay If You Take Out Rrsp

More picture related to How Much Tax Do You Pay If You Take Out Rrsp

How Much Tax Do You Pay On Buy To Let Property Property Investing UK

https://i.ytimg.com/vi/9BuupuadmeU/maxresdefault.jpg

Payroll Tax Estimator GeorgeAnmoal

https://www.patriotsoftware.com/wp-content/uploads/2021/08/how_much_employer_pays_payroll_tax-01.png

RRSP Minimum Repayment

https://www.taxchopper.ca/t1help/Q_deduction/rrspRepay.png

Any income you earn in the RRSP is usually exempt from tax as long as the funds remain in the plan However you generally have to pay tax when you cash in What is the RRSP withdrawal withholding tax and how much tax do you have to pay The withholding tax is the amount of funds taken directly by your financial institution and

You can take money out of your RRSP before you retire For example you might tap into your RRSP to cover costs of an emergency situation But you will pay an TurboTax s free RRSP tax calculator Estimate your 2023 income tax savings your RRSP contribution generates in each Canadian province and territory

How Much TAX Do You Pay UK Income Tax Explained In shorts YouTube

https://i.ytimg.com/vi/TVvQNWTj9f0/maxresdefault.jpg

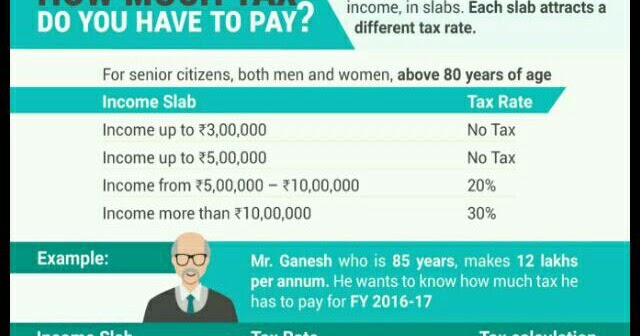

Nrinvestments How Much Tax Do You Have To Pay

https://3.bp.blogspot.com/-GbqZzj5p_D8/WIMGYBDBbbI/AAAAAAAAAGw/zJH3WWEf9DwYEpcdY4mTQHrRJJXrT5i-gCLcB/w1200-h630-p-k-no-nu/WhatsApp%2BImage%2B2017-01-21%2Bat%2B12.23.08%2BPM.jpeg

https://www.canada.ca/en/revenue-agency/services/...

When you withdraw funds from an RRSP your financial institution withholds the tax The rates depend on your residency and the amount you withdraw For

https://www.wealthsimple.com/en-ca/learn/rrsp-withholding-tax

RRSP withholding tax is charged when you withdraw funds from your RRSP before retirement The current rate of RRSP withholding tax is 10 for withdrawals up to

How Much Tax Do You Have To Pay On An ABN OpenLegal

How Much TAX Do You Pay UK Income Tax Explained In shorts YouTube

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FMENQYIIVBCKDIIIWAAPXQI5RM.png)

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

Understanding Your Forms W 2 Wage Tax Statement Tax Tax Refund

Taxes Rake In The WSOP How Much Tax Do You Pay On Winnings

How Much Tax Do I Pay Find The Resources You Need

How Much Tax Do I Pay Find The Resources You Need

Best Tax Breaks 12 Most Overlooked Tax Breaks Deductions 2021

Low Interest Rates Save You Money Here s How Much

Calculate My Income Tax SuellenGiorgio

How Much Tax Do You Pay If You Take Out Rrsp - How much income tax do you pay on RRSP withdrawals RRSP withholding tax isn t the only payment you might have to make The gross amount that you withdraw