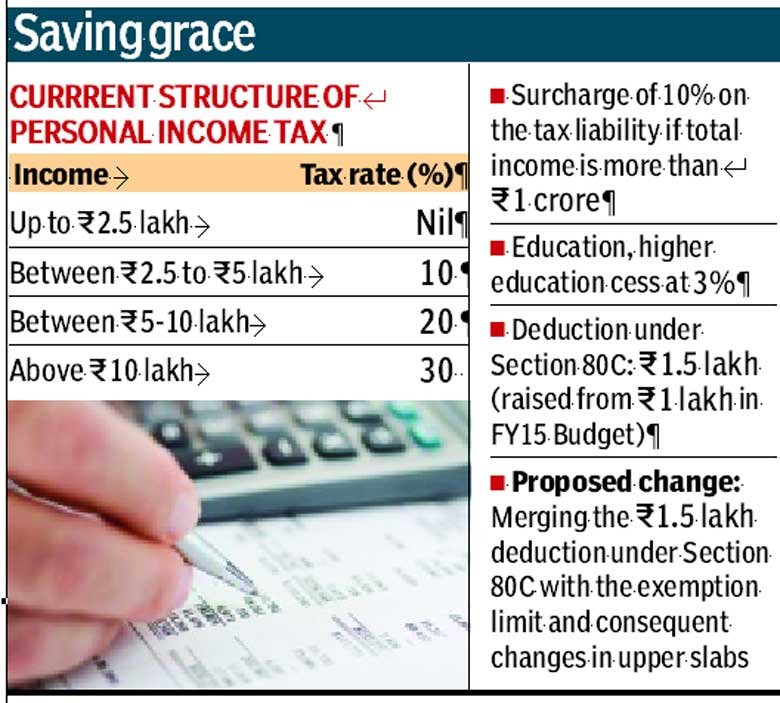

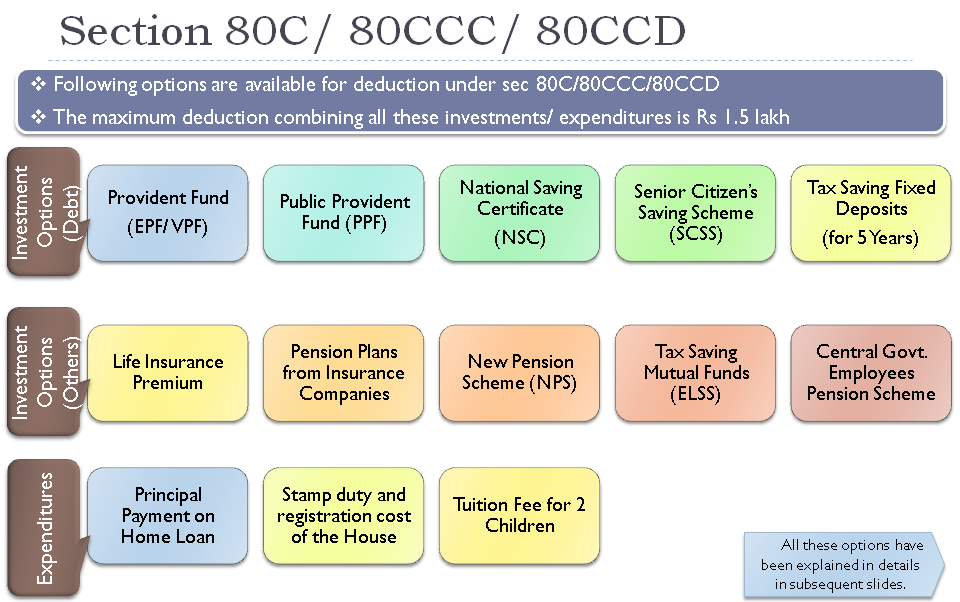

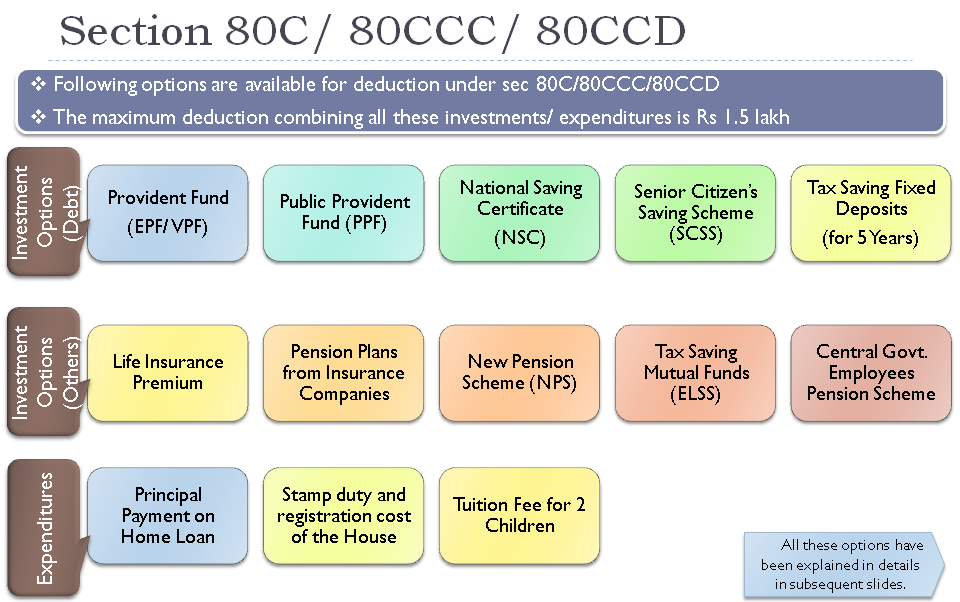

How Much Tax Exemption Under 80c For section 80C The amount of eligible investment or expenditure as specified is fully allowed for deduction subject to the limit of Rs 1 5 lakh The limit of Rs

Maximum Limit Rs 1 50 lakh every financial year Please note that the aggregate deduction amount under Sections 80C 80CCC and 80CCD is restricted to Section 80C of the Income Tax Act of India is a clause that points to various expenditures and investments that are exempted from Income Tax It allows for a maximum

How Much Tax Exemption Under 80c

How Much Tax Exemption Under 80c

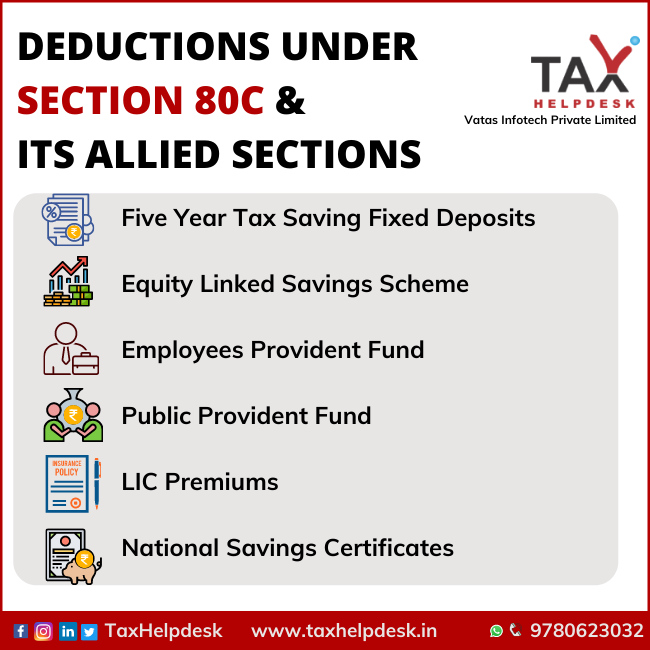

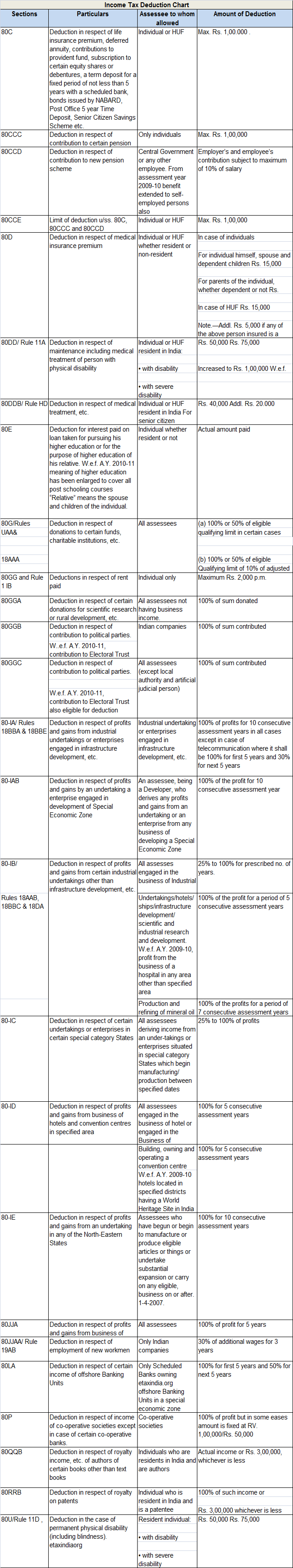

https://www.taxhelpdesk.in/wp-content/uploads/2021/08/Deductions-under-Section-80C-its-allied-sections.png

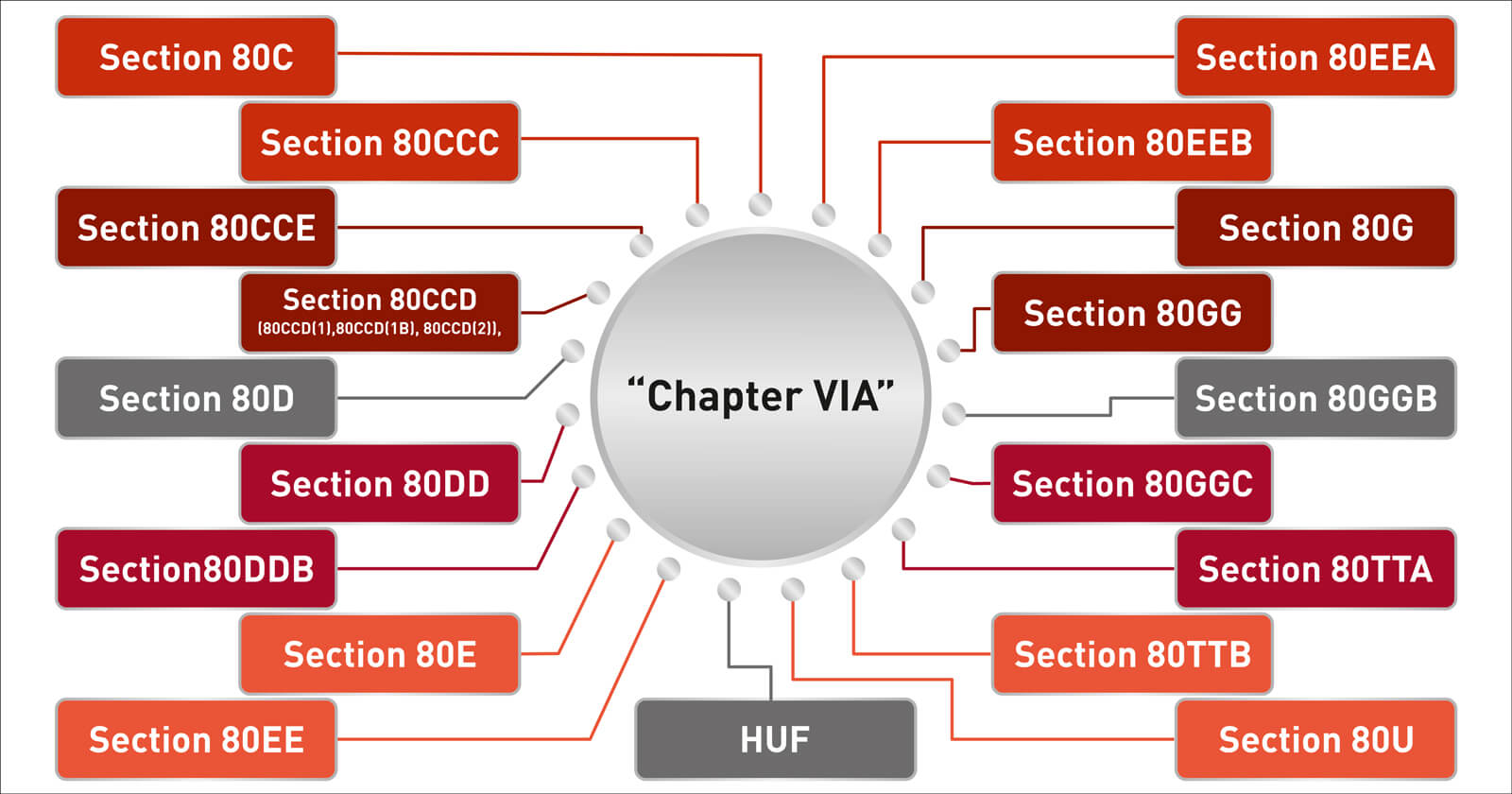

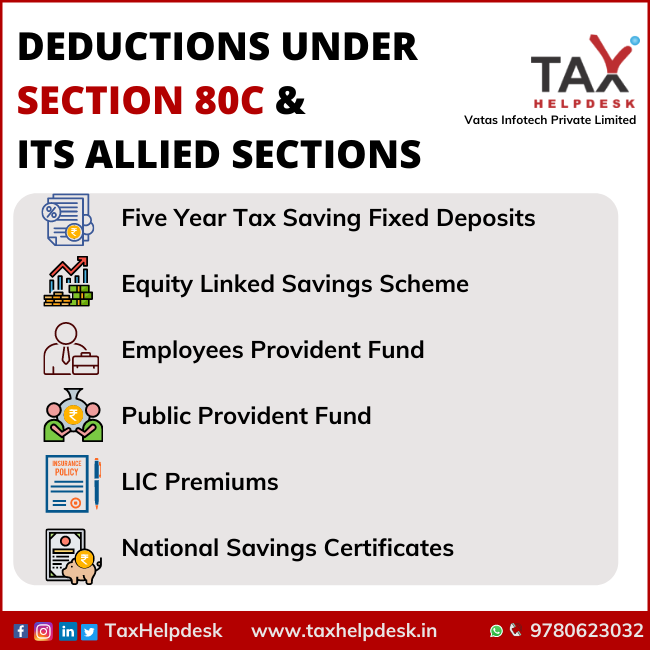

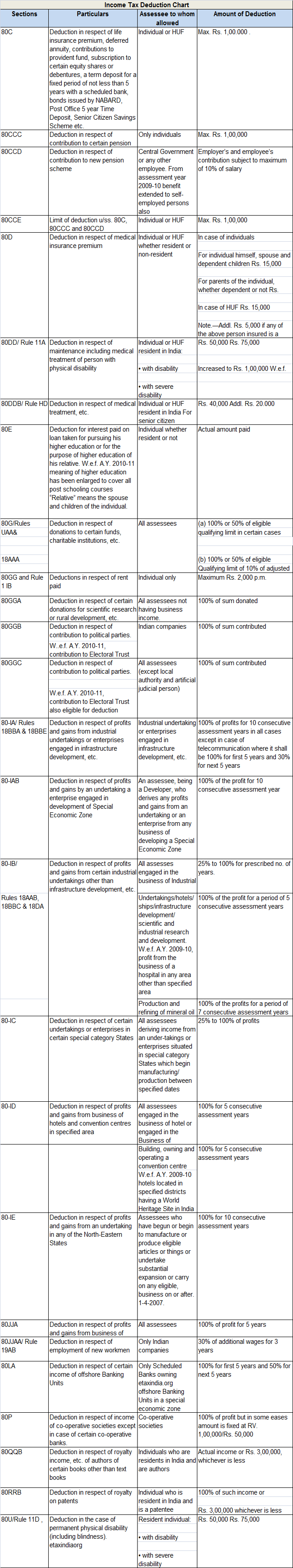

Deductions Under Chapter VIA

https://life.futuregenerali.in/media/5utfvrlk/chapter-via-section.jpg

How Much Amount Can Be Claimed For Tax Exemption Under Section 80C

https://i.ytimg.com/vi/R_QRngBP5Rk/maxresdefault.jpg

Section 80C of the Income Tax Act is the most popular income tax deduction for tax saving 80C deduction limit for the current FY 2023 24 AY 2024 25 is Here s step by step guidance on how to use the calculator Select the assessment year AY for which you want your taxes to be calculated if you have invested in the year

80C 80CCD 1 80CCD 2 Upto 1 50 000 80CCD 1B Upto 50 000 Total Maximum deduction Upto 2 00 000 Important Note The date for making various 3 Tax benefit of 46 800 is calculated at the highest tax slab rate of 31 2 including Cess excluding surcharge on life insurance premium under Section 80C of 1 50 000

Download How Much Tax Exemption Under 80c

More picture related to How Much Tax Exemption Under 80c

Exemption In Lieu Of 80C Tax Benefits

https://geod.in/wp-content/uploads/2015/02/Saving-tax.jpg

Section 80C Of Income Tax Act Tax Deduction AY 2023 24

https://cdn-scripbox-wordpress.scripbox.com/wp-content/uploads/2020/01/section-80c.jpg

Section 80C Deductions Save Up To 1 5 Lakhs On Taxes

https://life.futuregenerali.in/media/2zjhyg5j/section-80c-deductions.jpg

10 of the Sum Assured 2 Employee s Contribution to Recognized Provident Fund 1 Employee s Contribution to approved provident fund is eligible for tax deduction u s 80C The admissible deduction shall be the least of the following a Rs 5 000 per month b 25 of the adjusted total income or c Rent paid less than 10 of total

Pension Funds Section 80CCC This section Sec 80CCC stipulates that an investment in pension funds is eligible for deduction from your income Section Under Section 80C a taxpayer can claim an exemption for the investments made and expenses incurred up to Rs 1 5 lakh in a financial year The

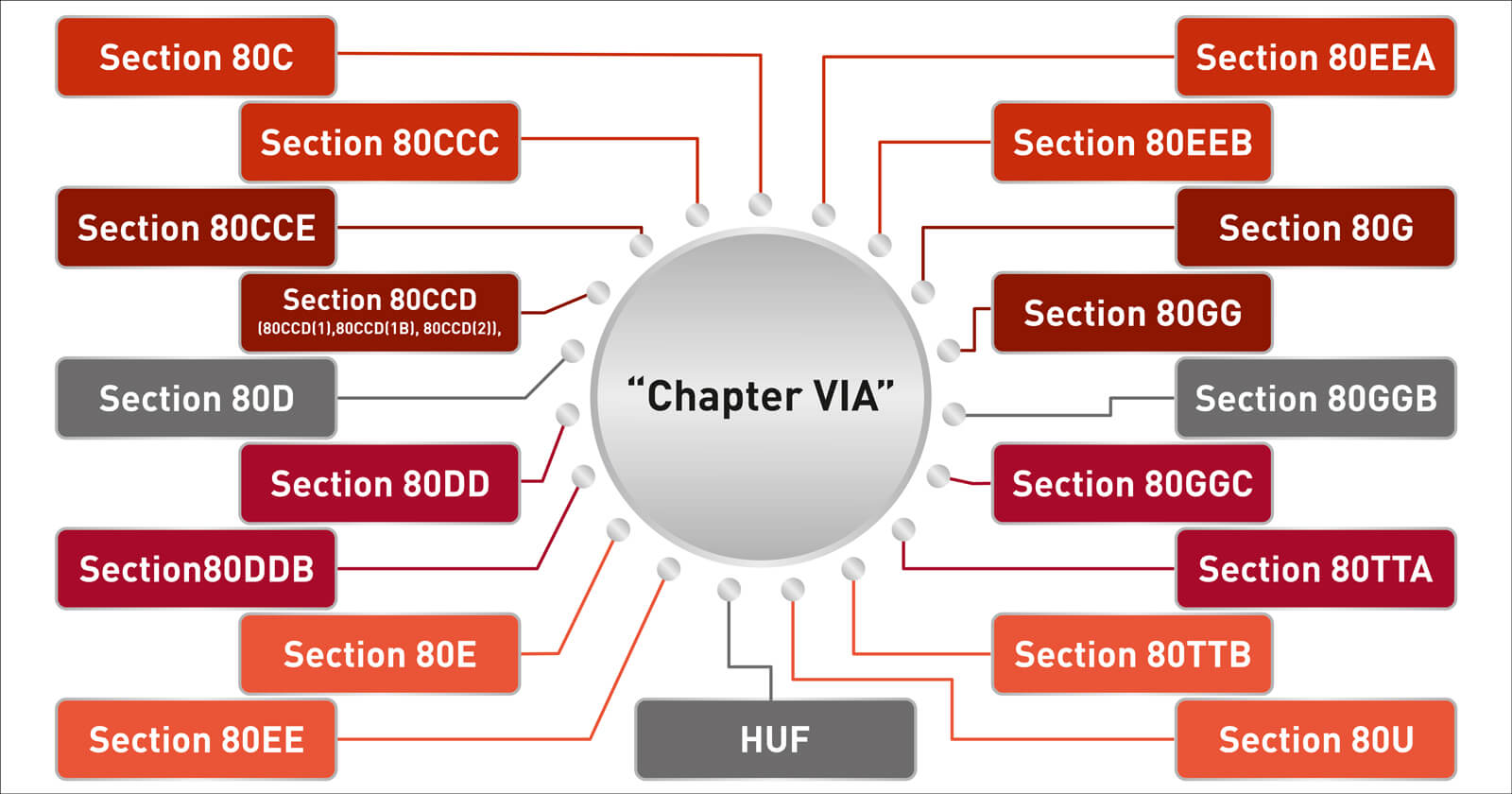

INCOME TAX DEDUCTION UNDER SECTION 80C TO 80U PDF

https://moneyexcel.com/images/incometaxchart.png

How To Save Tax Under Section 80c In Income Tax Here s All About It

https://okcredit-blog-images-prod.storage.googleapis.com/2021/04/Save-Tax-under-80C1--1-.jpeg

https://cleartax.in/s/80C-Deductions

For section 80C The amount of eligible investment or expenditure as specified is fully allowed for deduction subject to the limit of Rs 1 5 lakh The limit of Rs

https://cleartax.in/s/tuition-fees-deduction-under-section-80c

Maximum Limit Rs 1 50 lakh every financial year Please note that the aggregate deduction amount under Sections 80C 80CCC and 80CCD is restricted to

Section 80C Deductions List To Save Income Tax FinCalC Blog

INCOME TAX DEDUCTION UNDER SECTION 80C TO 80U PDF

Section 80C Deduction Under Section 80C In India Paisabazaar

Section 80d Sec 80d Deduction In Income Tax Deduction Under 80c

Tax Savings Deductions Under Chapter VI A Learn By Quicko

Budget 2014 Impact On Money Taxes And Savings

Budget 2014 Impact On Money Taxes And Savings

How To Claim Tax Exemptions Here s Your 101 Guide

Epf Contribution Table For Age Above 60 2019 Frank Lyman

How To Save Tax Using 80C Options Scripbox

How Much Tax Exemption Under 80c - Section 80C of the Income Tax Act is the most popular income tax deduction for tax saving 80C deduction limit for the current FY 2023 24 AY 2024 25 is