How Much Tax On Lump Sum Payment Web 13 Jan 2020 nbsp 0183 32 To make planning easier we have produced this quick tool to allow you to see how much of any bonus you get to keep and how

Web Your tax for your lump sum would therefore be 33 000 10 000 times 33 percent 3 300 times 10 equals 33 000 To determine whether 10 Web 7 Dez 2022 nbsp 0183 32 You would avoid the highest federal income tax bracket of 37 for single people with incomes greater than 539 900 in 2022 and 578 125 in 2023 or 647 850

How Much Tax On Lump Sum Payment

How Much Tax On Lump Sum Payment

https://s3.studylib.net/store/data/007948853_1-78b0e63c5349a926675054b774da6d26-768x994.png

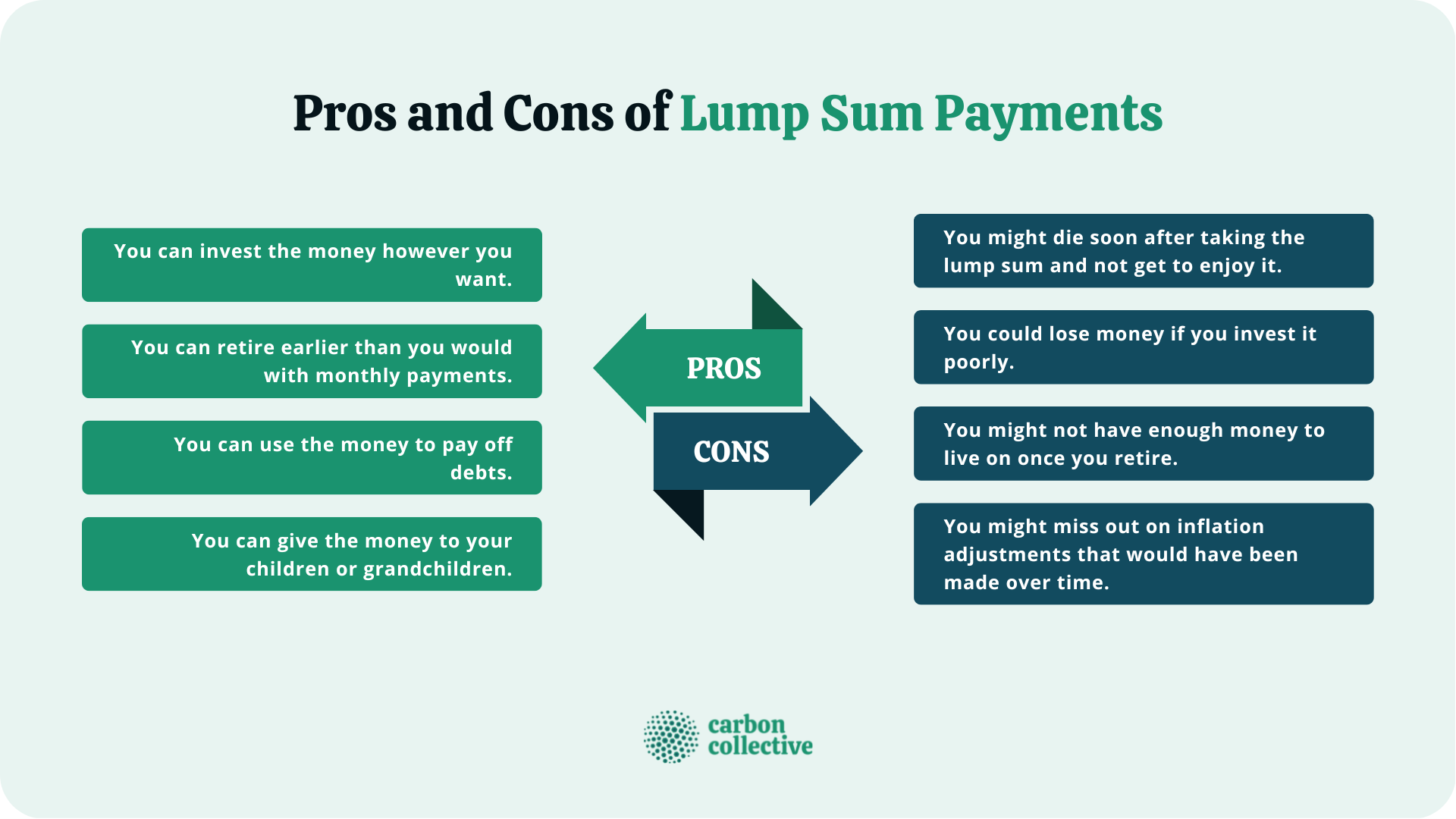

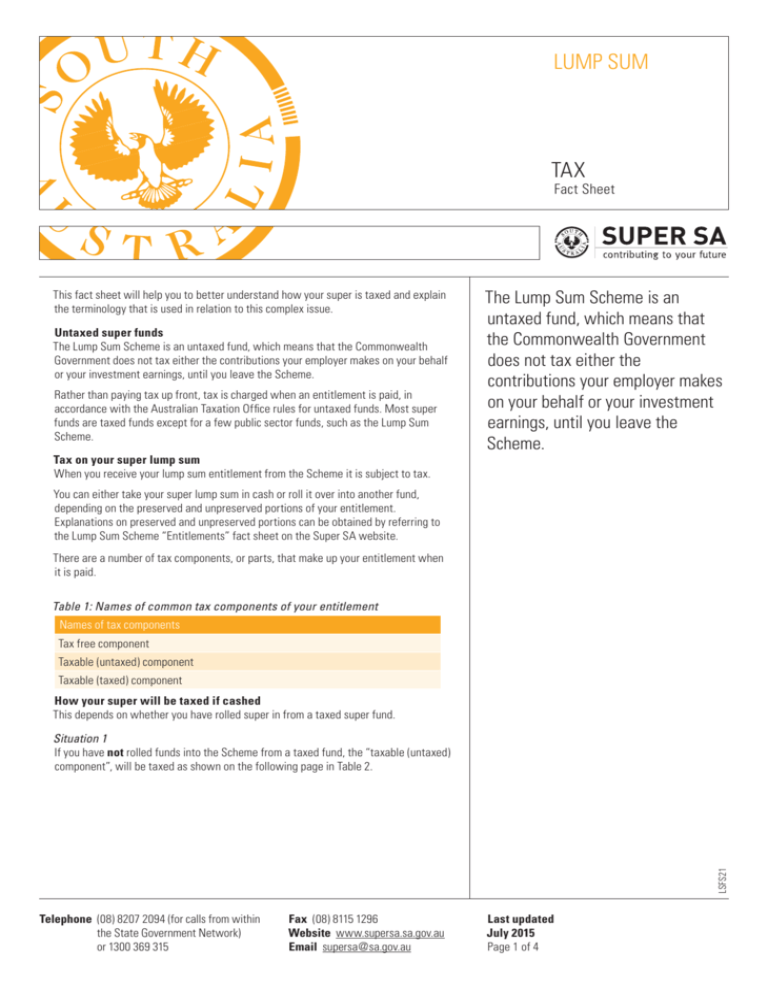

Lump Sum Payment What It Is How It Works Pros Cons

https://www.carboncollective.co/hubfs/Lump-Sum_Payment_-_FI.png

DB Tax Free Lump Sum T mobile

https://tmipensions.co.uk/wp-content/uploads/2019/08/Img001.jpg

Web Key Takeaways Government levies the Lump sum taxes at a fixed rate irrespective of an individual s income and therefore falls under a regressive tax system This taxation is based on anticipated living costs instead of Web Mandatory income tax withholding of 20 applies to most taxable distributions paid directly to you in a lump sum from employer retirement plans even if you plan to roll over the

Web 14 Nov 2023 nbsp 0183 32 If your state has income tax and you take a lump sum before age 59 1 2 thereby triggering the 10 early withdrawal penalty you might face a total tax rate of Web A mandatory income tax withholding of 20 is required on most taxable distributions received directly from an employer s retirement plan in a lump payment even if they

Download How Much Tax On Lump Sum Payment

More picture related to How Much Tax On Lump Sum Payment

Lump Sum Tax Calculator CallanReeve

https://scrn-cdn.omnicalculator.com/finance/[email protected]

Lump Sum Payment Definition Finance Strategists

https://learn.financestrategists.com/wp-content/uploads/Benefits-of-Lump-Sum-Payments.png

Lump Sum Tax Quiz Lump Sum Tax The City Government Is Considering

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/32204036a5e9f07b88f423a1d4244b6f/thumb_1200_1553.png

Web 4 Apr 2017 nbsp 0183 32 Example John s deferred annuity has a current cash value of 110 000 to which a surrender charge of 10 000 applies His investment in the contract is 100 000 Web 9 Jan 2023 nbsp 0183 32 The amount of a lump sum payment has an inverse relationship to interest rates in general as interest rates rise lump sum values will decline If you don t roll the

Web Use the following lump sum withholding rates to deduct income tax 10 5 for Quebec on amounts up to and including 5 000 20 10 for Quebec on amounts over Web 29 Aug 2023 nbsp 0183 32 The agency says that mandatory income tax withholding of 20 applies to the majority of lump sum distributions from employer retirement plans However this

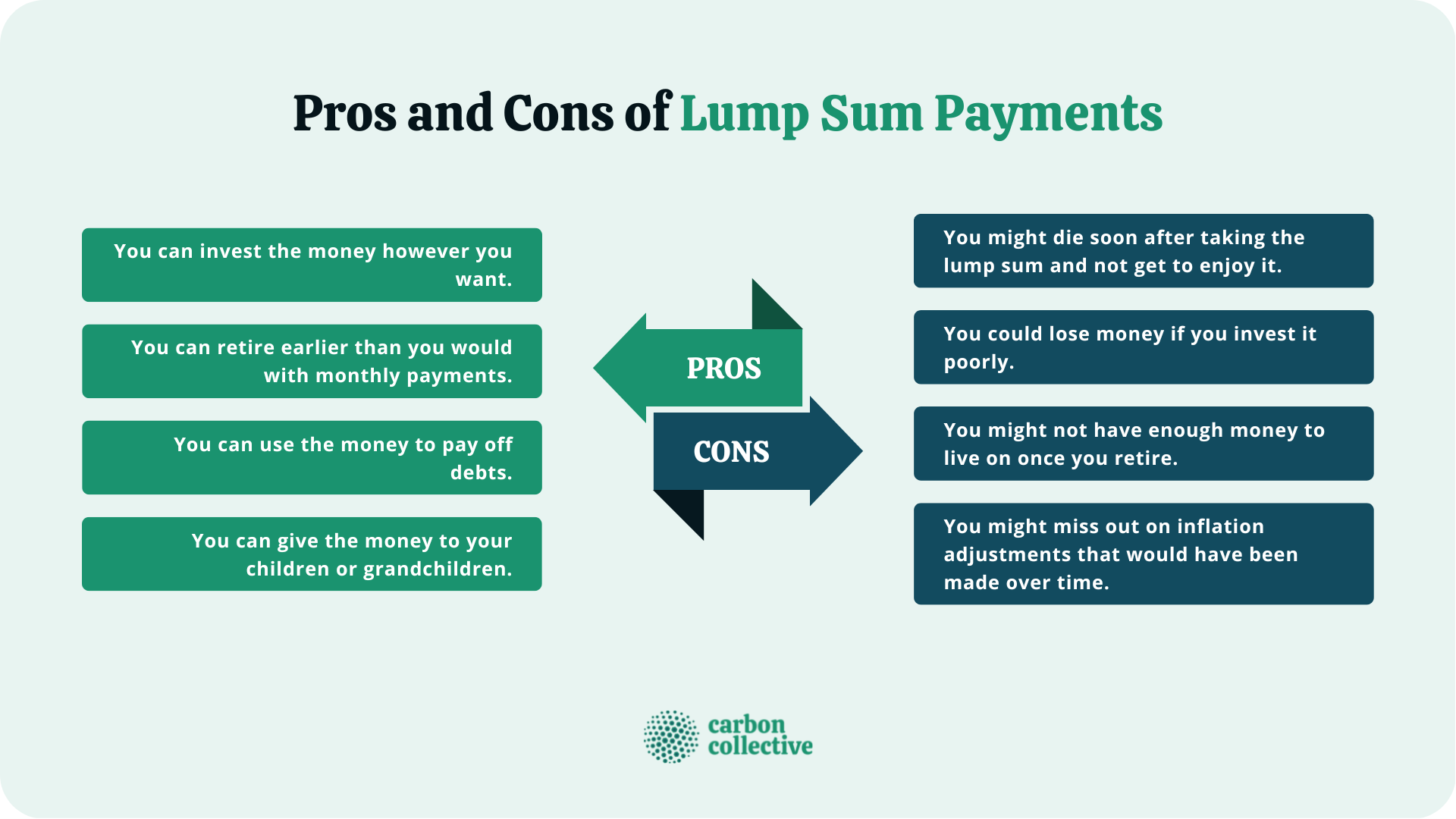

Lump Sum Payment What It Is How It Works Pros Cons

https://www.carboncollective.co/hs-fs/hubfs/Pros_and_Cons_of_Lump_Sum_Payments.png?width=1920&name=Pros_and_Cons_of_Lump_Sum_Payments.png

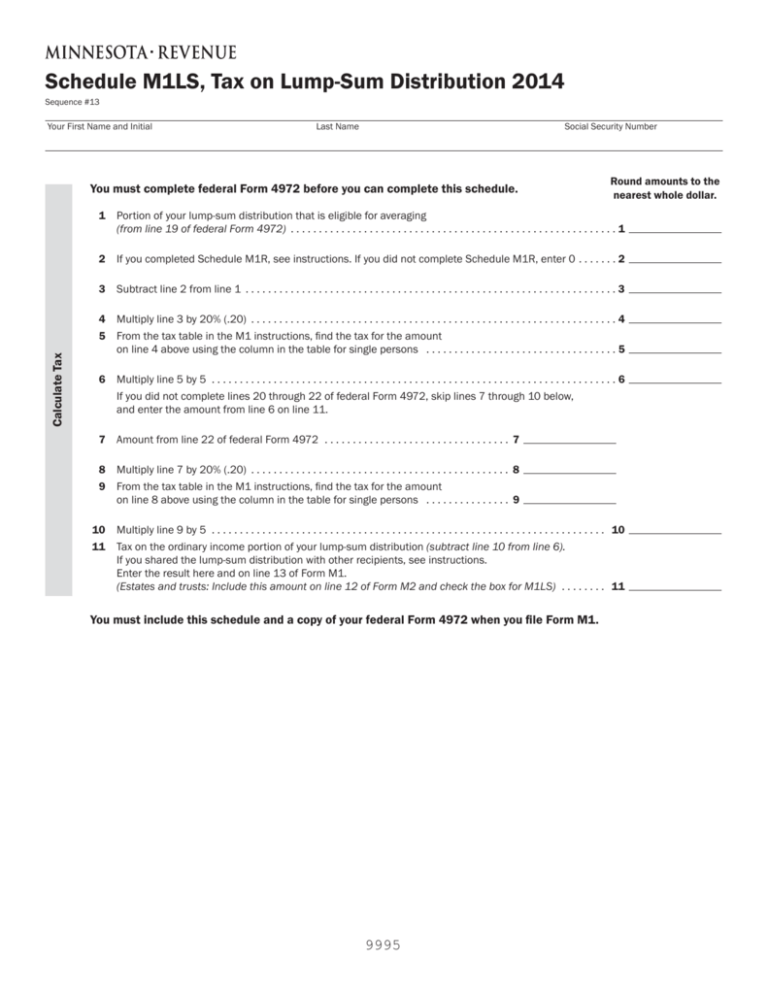

2014 Tax On Lump Sum Distribution

https://s3.studylib.net/store/data/008921204_1-f620303fd066c0fe14aa9e3da0e44541-768x994.png

https://www.uktaxcalculators.co.uk/tax-guides…

Web 13 Jan 2020 nbsp 0183 32 To make planning easier we have produced this quick tool to allow you to see how much of any bonus you get to keep and how

https://www.sapling.com/12079944/calculate …

Web Your tax for your lump sum would therefore be 33 000 10 000 times 33 percent 3 300 times 10 equals 33 000 To determine whether 10

Lump Sum Tax What Is It Formula Calculation Example

Lump Sum Payment What It Is How It Works Pros Cons

Claim For An Annual Lump Sum Payment Of Family Tax Benefit

Comparing Lump Sum Versus Payments Personal Finance Advice For Real

Form 4972 Tax On Lump Sum Distributions Stock Photo Image Of Checking

Should I Pay Income Tax In Installment Or Lump Sum Prudent Dreamer

Should I Pay Income Tax In Installment Or Lump Sum Prudent Dreamer

Lump Sum Payment Definition Example Tax Implications

Lump Sum Versus Payments The Best Kind Of Loan Personal Finance

Lump Sum Payments And Significantly Higher Organic Payment Rates Premium

How Much Tax On Lump Sum Payment - Web Amount of lump sum R Use our fund benefit calculator to work out the tax payable on lump sum payments from Pension funds Provident funds and or Retirement Annuity