How Much Tax Rebate Will I Get Self Employed Verkko The Tax refund calculator helps you estimate a rebate for a number of different circumstances You are self employed if you have a UTR number You are employed under PAYE For construction workers where a CIS Tax return is needed Uniform Tax rebates General Tax overpayments

Verkko 5 huhtik 2017 nbsp 0183 32 If you re self employed the self employed ready reckoner tool can help you budget for your tax bill You may be able to claim a refund if you ve paid too much tax Start now Verkko 12 lokak 2022 nbsp 0183 32 Tax reliefs and allowances for businesses employers and the self employed Find out about tax reliefs and allowances available from HMRC if you run a business employ people or are self employed

How Much Tax Rebate Will I Get Self Employed

How Much Tax Rebate Will I Get Self Employed

https://blog.freetaxfiler.com/wp-content/uploads/2022/09/Tax-Rebate-1.jpg

Oregon Kicker Taxpayers Set To Get A 1 9 Billion Rebate Next Year

https://www.oregonlive.com/resizer/1VgMAk6GAxQnRp-CzJgLgoh_1i0=/1280x0/smart/cloudfront-us-east-1.images.arcpublishing.com/advancelocal/O4F2UKMB6FDJNMNU4OUVWXC67M.png

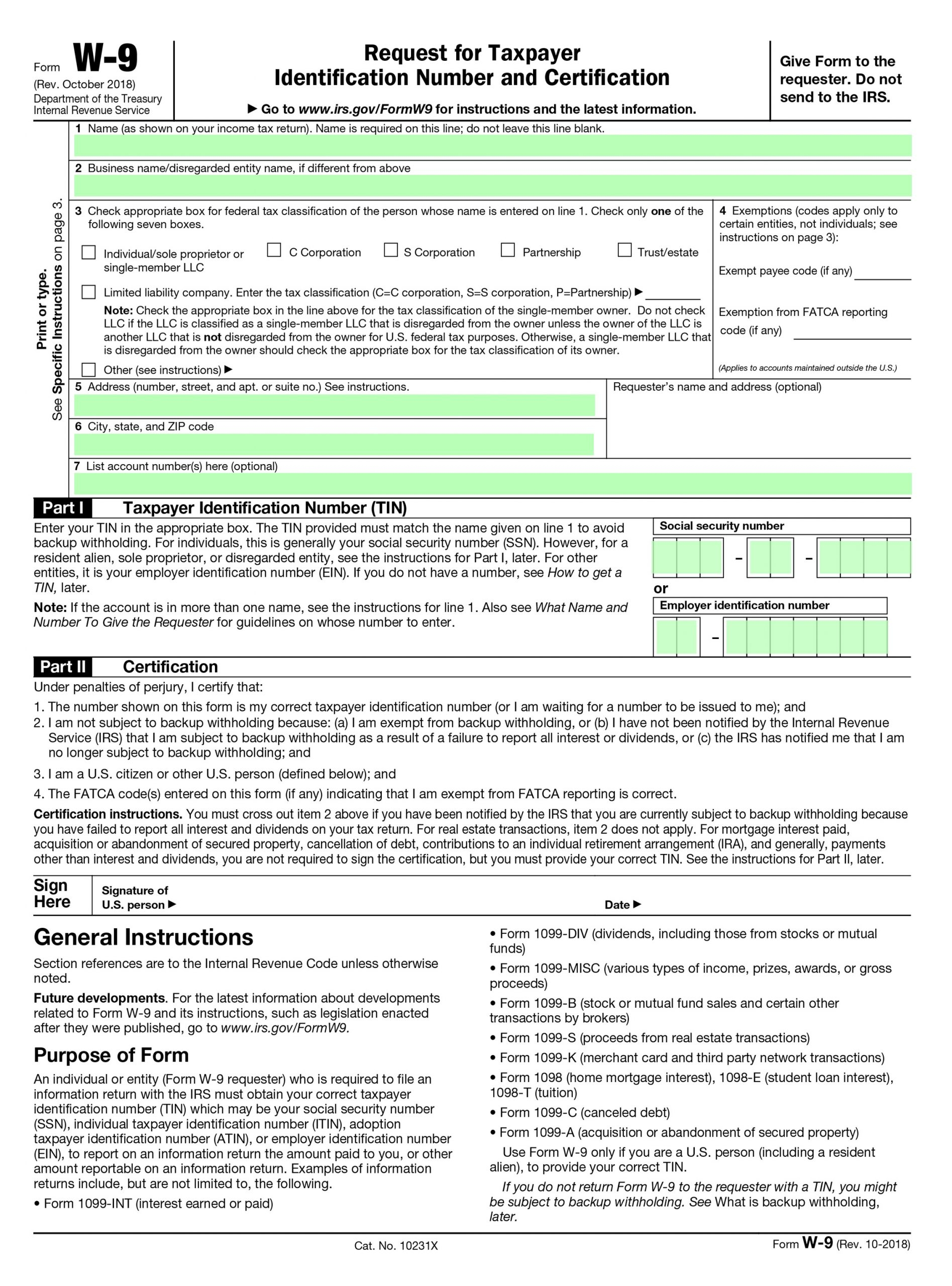

Self Employment Tax Forms 2022 Employment Form

https://www.employementform.com/wp-content/uploads/2022/08/self-employment-tax-forms-2022.jpg

Verkko 31 hein 228 k 2017 nbsp 0183 32 Employed and Self Employed uses tax information from the tax year 2023 2024 to show you take home pay See what happens when you are both employed and self employed at the same time with UK income tax National Insurance student loan and pension deductions More information about the Verkko Self employed Full time PAYE Results Select your employment status How much does your CIS rebate really cost Keep more of your money TaxScouts charge a 163 149 flat fee no matter how big your rebate With other providers you can pay as much as 163 500 in accounting fees Fee You receive TaxScouts 163 149 163 124 VAT 163 3 986 Biggest refund

Verkko Using our free tax rebate calculator instantly gives you an estimate of how much of a tax refund you could be owed from HMRC with the average being 163 3 000 Tax Year You re Claiming For 22 23 21 22 20 21 19 20 Gross Income 163 Tax Paid 163 Other Business Expenses 163 Verkko 11 jouluk 2023 nbsp 0183 32 If you earn more than the 163 12 570 personal tax free allowance you will start paying income tax But it s not just income from employment that counts as personal income Everything from pension payments income from life annuities and even interest on investments is considered earned income

Download How Much Tax Rebate Will I Get Self Employed

More picture related to How Much Tax Rebate Will I Get Self Employed

Recovery Rebate Credit Form Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2021/07/Recovery-Rebate-Credit-Form-2021-768x767.jpg

Joint Home Loan Declaration Form For Income Tax Savings And Non

https://lh3.googleusercontent.com/-m3Y3HavWnbc/YgqSD7tknxI/AAAAAAAAYdw/PRErS72JdeIE0B2a37gG1CvGAfWFlQvHwCNcBGAsYHQ/w1200-h630-p-k-no-nu/1644859917358770-0.png

How To Calulate Rebate FY 2019 20 AY 2020 21 Chapter 4 Income Tax

https://d77da31580fbc8944c00-52b01ccbcfe56047120eec75d9cb2cbd.ssl.cf6.rackcdn.com/4f3e8d40-1fcf-4c08-b717-2df0bca83a73/rebate-1.png

Verkko Which age group you are in affects your tax free allowance and whether or not you pay National Insurance For the 2023 24 tax year this is your age on 6th April 2023 Married Blind No NI Married people over the age of 75 get a tax rebate Verkko Calculators 2022 Here are some helpful calculators to help you estimate your self employment tax and eliminate any surprises Estimate your refund or what you ll owe with TaxCaster Know how much to set aside for 2022 taxes by answering questions about your life and income Apply business expenses and see how much they save

Verkko 18 huhtik 2023 nbsp 0183 32 If your net earnings exceed 400 from self employment income you re required to pay self employment tax Church employees must pay self employment taxes if their income is more Verkko 25 elok 2023 nbsp 0183 32 If you re self employed you ll pay income tax in a different way to employed workers as it s charged on your profits rather than your gross income via a self assessment tax return To work out the correct figure you need to deduct your business expenses from your income this includes both business expenses and

How Much Tax Will I Pay On 41000 Update New Countrymusicstop

https://i.ytimg.com/vi/ieA-bmoFk3k/maxresdefault.jpg

Pa 1000 2021 2024 Form Fill Out And Sign Printable PDF Template

https://www.signnow.com/preview/585/571/585571881/large.png

https://www.quickrebates.co.uk/tax-rebate-calculator

Verkko The Tax refund calculator helps you estimate a rebate for a number of different circumstances You are self employed if you have a UTR number You are employed under PAYE For construction workers where a CIS Tax return is needed Uniform Tax rebates General Tax overpayments

https://www.gov.uk/estimate-income-tax

Verkko 5 huhtik 2017 nbsp 0183 32 If you re self employed the self employed ready reckoner tool can help you budget for your tax bill You may be able to claim a refund if you ve paid too much tax Start now

Tax Credits Save You More Than Deductions Here Are The Best Ones

How Much Tax Will I Pay On 41000 Update New Countrymusicstop

Hmrc Tax Return Self Assessment Form PrintableRebateForm

Property Tax Rebate Checks Are Coming Here s How Much Money You re Due

How To Calculate Self Employment Tax YouTube

Amazon Flex Take Out Taxes Augustine Register

Amazon Flex Take Out Taxes Augustine Register

Do Tax Rebates Get Paid Automatically Tax Banana

Get Your 20 000 Instant Asset Write off FENCiT

Self Employed Tax Preparation Printables Instant Download Etsy In

How Much Tax Rebate Will I Get Self Employed - Verkko 2 kes 228 k 2023 nbsp 0183 32 You can claim a tax credit for the lesser of 200 per day or 67 of your average daily self employment income for the year per day How do I calculate and claim these tax credits quot Average daily self employment income quot is calculated as your net earnings from self employment during the tax year divided by 260